Valhalla,

I’ve seen a lot of people in the discord scalping options on SPY and the Q’s.

Whilst these 0DTE options are obviously the most profitable if the trade goes your way i want to quickly show another way i trade SPY and QQQ price action.

For SPY I trade the MES (soonest expiry) whilst watching SPY price action, i just take the trade on the MES.

this, for a couple of reasons. As a trader you want to take high probability setups so that over thousands of trades you average more winners than losers, in turn making you a profitable trader.

In my opinion to be consistently profitable is only possible if you manage your risk.

Hard stops, consistent profit taking and the most important one: standardising your risk.

Trading soon expiring options makes for hard risk management. When price consolidates and let’s say SPY comes back to your entry price it will be worth less due to Theta. Options also make it easier to average down in a trade that is going against you because you don’t run a hard stop.

For this reason, I trade futures.

-

I’m able to run a hard stop in premarket and after hours

-

there is no theta decay.

-

as for some traders these should also be beneficial: low margin requirement, no PDT and better tax benefits (not a US citizen but that’s what i heard.)

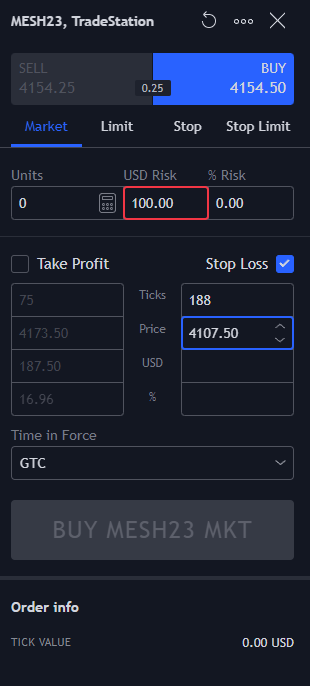

I trade through trade station and link that with Tradingview (also works with IBKR and some other brokers)

For the next example, if you don’t use Tradingview or your broker doesn’t have a build in tool to standardise your risk you can also manually calculate it using your $ risk amount.

for now, I risk 100 dollars per trade.

As an example a trade i took yesterday:

I watched as SPY opened and fall into Mondays lows; buyers stepped in right at the wick low from Monday. Since at open we are in a high volatile environment I’ll watch for a setup on the 1 min.

double bottom with a decrease in volume on the move down. in real time i’m watching for market buying to step in for confirmation at the lows.

Now for the risk management part:

So, I took the trade on the MES (hard stop, no theta decay etc)

in the strategy I need to be able to get a 1:1 return on my risk before the next resistance. Which was at that point HOD and that premarket swing low.

So, I put in my standard risk amount, and take a quarter off at 1:1 which was just before HOD.

Don’t remember but with 100 dollars of risk it were probably like 5 or 6 contracts i was able to take.

Move my stop to break even (something you can hardly do with 0DTE options) and watch for a breakout. the key thing is that this is what should help to be consistently profitable, you manage your risk and take profit into resistance.

Took more profit (25%) into the next area of resistance. I got profit stopped out on the remainder at break-even which is fine. i managed my risk and took profit into resistance.

Now 0DTE options fine if you just want to quickly scalp high volatile environments for the gamma increase, but most traders in this discord use it for almost everything.

Just something to consider, made this just before market open so it’s probably fucked grammatically.

Brummel