As we know RIVN is on the decline trading lower and lower each day, and I’m here to convince you that Friday is the day that all hell breaks loose and the stock drills to the center of the Earth.

THE RUNUP

Buy! Buy! Buy! Buy. Buy. Buy?

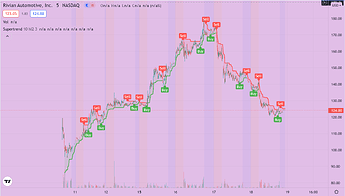

RIVN had an IPO starting price of 74-76 dollars, and has since experienced the “EV craze”. The price rocketed upward to a high of $179.47, valuing the company at a whopping 150 billion dollars give or take a few. This is an absurd amount, and it can be explained by the EV craze happening as more investors pile in. Now though, the stock has cooled down a little bit and this brings me into the next section.

THE PEAK

All this run-up has to stop sometime, but when?

As you can see by the graph above, the days following the peak have been grim for the stock, but I believe that the lemon isn’t quite squeezed just yet. There is an opportunity for us to make some money here! But what makes you say that? I see something in this graph that reflects myself. I used to be a degenerate TSLA yolo master, but I wasn’t quite a master at gaining money, but quite the contrary. Being a master of losing money was a skill that I had developed which I know praise for being able to see eye to eye with all of the RIVN bag holders.

THE PROFIT

SELL SELL SELL FUD SELL

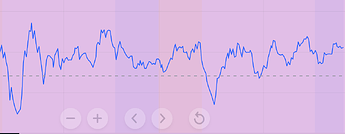

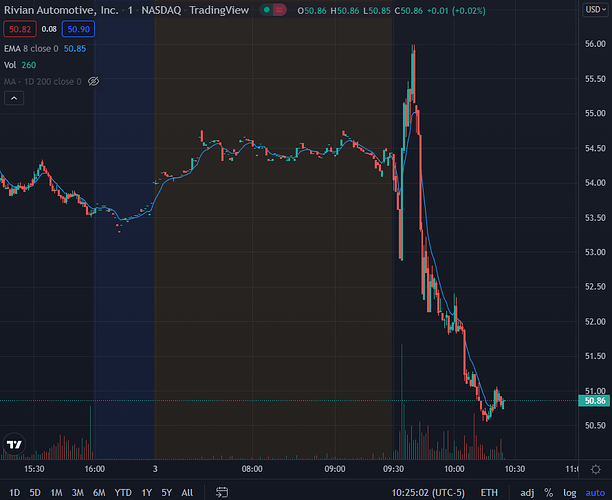

This brings me to the last section before I give all of the delicious charts and all the pies you could ever eat. What do you see that I don’t? I see an opportunity here to reap the benefits of the dump that will happen on Friday. What will cause the dump? Call Options. Specifically the monthly expirations that everybody bought this week and hasn’t sold. All of these calls are going to expire worthless. As you may or may not know, during the TSLA runup and then eventual drop because of Elon’s Tweet, the Friday before he tweeted, the stock took a big dip and I lost a lot selling it mere minutes before expiration. There is going to be a lot of panic and FUD on Rivian, and although we could see a resurgence at open, people will panic and people will sell. Not only this but people are going to continue locking in profits with the momentum already dead. According to the image below which represents the momentum of the stock, the stock is abruptly getting dumped at open and coming back a little bit just to trade sideways for the whole day, but like I said, this is Friday and all the Calls are expiring. We could see a large dump at open and as for the rest of the day, I will be honestly, but I do not know what will happen as it is so unpredictable.

Now for the data and my proposition:

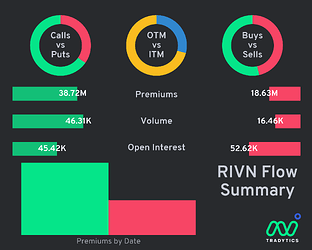

This one shows the amount of calls vs puts and how many of them are OTM. It also shows that more people are still buying than selling and that people are starting to catch on as the sell Volume rises and the short position increases. Data unavailable for shorts. Institutions could sell as well, and correct me if I am wrong, but Amazon could sell their position and still get the trucks with a nice bonus of tens of billions of dollars. Also unless I am getting it wrong and Ford cannot close their position, Ford could be another seller and cash in on this cash cow.

My proposition: to buy put options expiring late December. I already have December monthly puts that are up a good bit, and my suggestion is to give yourself time because this is going to be a slow bleed. Hopefully by expiration your puts should be in the money and Friday should help with that. In the case of IV crush, there is a lot of time for the stock to drop, or you can just take profits in the end of power hour.

Stay safe and have a good rest of your week.

TL DR;

Rivian is insanely overvalued and buying put options tomorrow morning will gain you profit for the next few weeks , but most importantly this Friday having all of the Calls expire worthless netting you profit.