This article is from Feb 28. A week after they halted it! So it doesn’t really mean anything

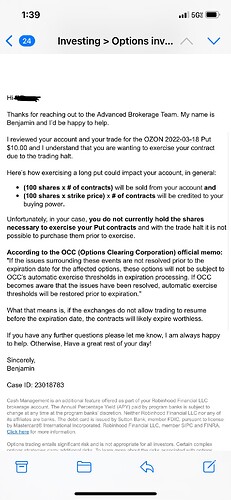

So Ozon is a lost case as well.

Stop.

BBarna informed me that the halt pop up warnings are disabled on the weekend and outside trading hours. Sorry for the scare everyone

saw this on a twitter thread

Wow. Just a few days before they halted it and fucked thousands of people. Ridiculous…

Here’s a very good summary of what transpired with LongFin regulatory halt: “You Have to Understand”: The Saga of Longfin Corp. Reveals the Danger of Trading Halts Imposed by Self-Regulating Exchanges | Hastings Law Journal

There is definitely a case against Self-Regulating Orgs (Exchanges like Nasdaq, CBOE) having supreme power to halt regardless of ramifications. In the Longfin saga, tens of millions from put holders over two monthlies were wiped.

As demonstrated by the story of Longfin, regulatory halts can have

devastating effects, making otherwise profitable trades into total losses. In

discussing the use of regulatory halts by the SEC, the Supreme Court stated that

“the power to summarily suspend trading in a security even for 10 days, without

any notice, opportunity to be heard, or findings based upon a record, is an

awesome power with a potentially devastating impact on the issuer, its

shareholders, and other investors.” With this almost reverential respect for the

power of regulatory halts in mind, it seems incongruous that exchanges can not

only emplace their own halts, but can do so indefinitely, with no or minimal

outside scrutiny, and without any mechanism by which traders and investors can

overcome them

The article advocates setting a halt limit of up to certain period like SEC’s regulatory halt having max 10 days. I have no idea why exchanges are spared and have complete leeway and immunity while the SEC doesn’t.

I am sorry if this doesn’t help us in our current predicament but this is what my rabbit hole trip yielded.

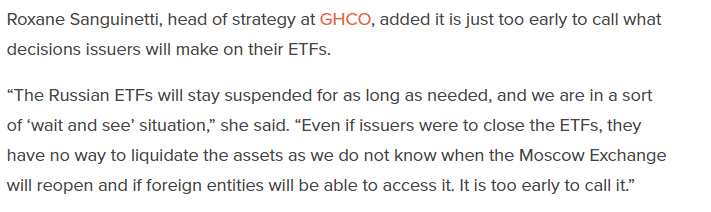

Options Traders Who Bet Against Russia Can’t Unwind Positions as Markets Halted - Bloomberg

Link to the article about @thots_and_prayers

To save on space - I also have it here for those that get blocked by the paywall:

RSX Bloomberg Article - Thots is Famous! - Community - Valhalla (ascendedtrading.com)

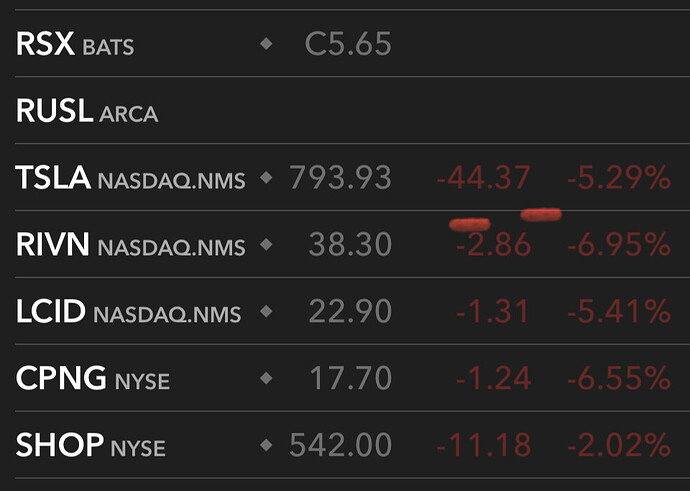

Daily ETF Movement Tracking and Trend Tables.

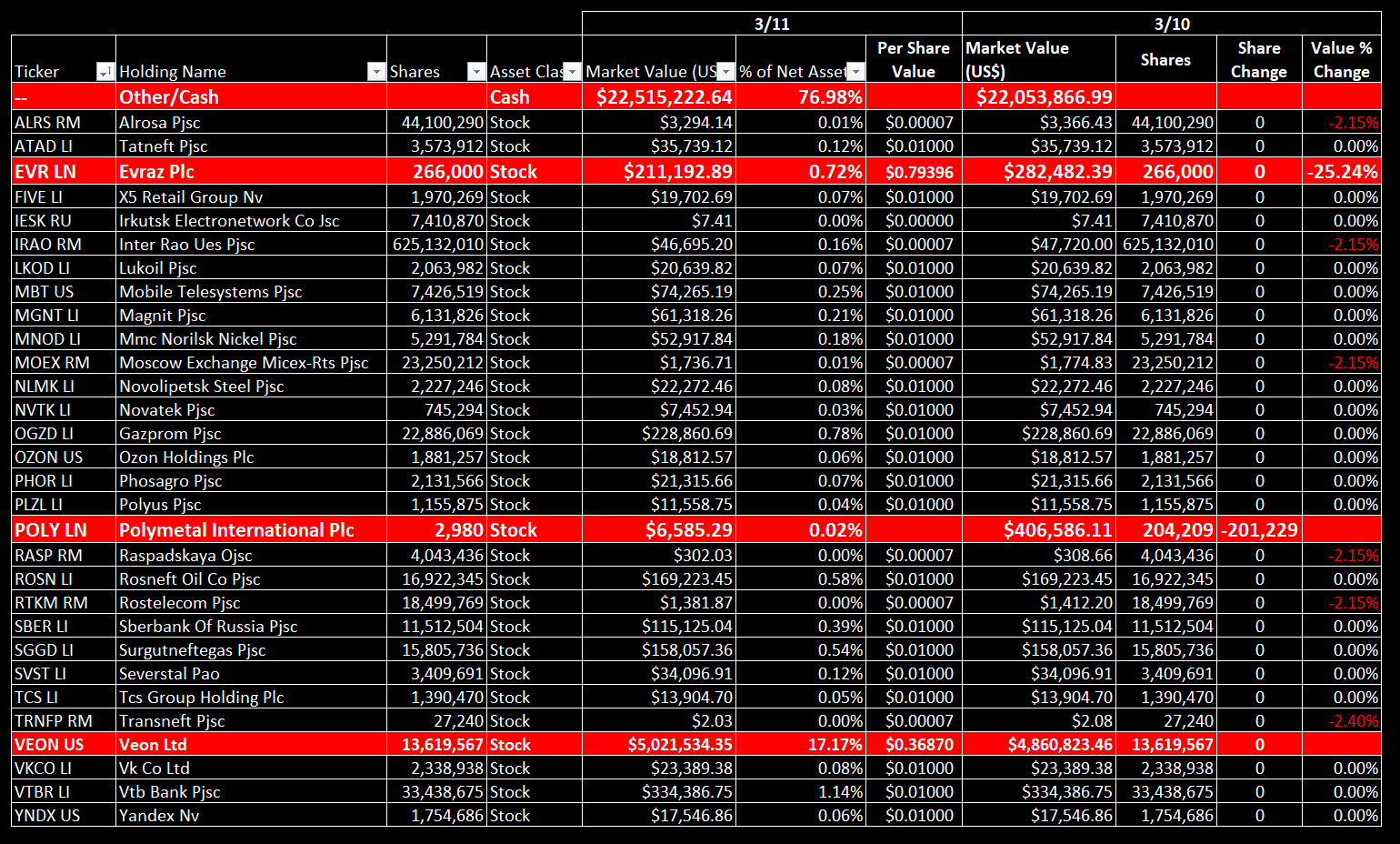

So they continue to sell off their position in POLY down to 2,980 shares. Mind you it was 5,699,331 just a day before things were halted on 3/3/22.

Few of the other stocks were downgraded another ~2%ish.

All they have left of assets they could sell now are the remaining 2,980 shares of POLY, 266k shares of EVR and 13.6mil shares of VEON. I would venture a guess that they won’t sell VEON but I could definitely see more shares of POLY and EVR being sold off in the next few days if not by today.

let me preface this by saying that the legal minds here on Valhalla deserve our utmost support and respect for any possible future litigation against CBOE, OCC, and Vaneck.

that being said, this journal article highlighted for me the very steep uphill battle that’s about to be climbed. while this is a dense legal journal article, i found it extremely informative. thanks to greydoge for finding this and hopefully any future litigants can use the references in here to pierce the unjust immunity armour that surrounds CBOE and OCC.

edit: i want to reiterate that any type of legal action is definitely aided by a helpful mindset of the litigants. showing resiliency and encouraging your advocate while staying fully informed on the legal issues at hand will only benefit a cause of action

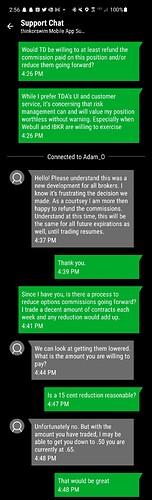

For those of you that have TD, I was able to use this situation to get my commissions reduced. Better than nothing.

I tried to get Webull to lower the 300% liquidity requirement to 100%, but even after “reviewing the situation” they said they would not.

I like how he told you he couldn’t do what you asked for and then proceeded to give you the number you wanted ![]()

https://www.reddit.com/r/options/comments/teslp7/bloomberg_options_traders_who_correctly_bet/

I got a post on /r/options to stick.

Just some updates on my end:

- Made some tweets trying to push more in the direction of calling out the more nefarious looking bits of this.

- Spoke with TD and they confirmed that RSX puts are still unable to be exercised, I have an appointment to speak with one of their risk team heads about getting clarification on TD’s relationship with the market maker that sold me the puts I’m holding. I also got clarification that short share availability is not a concern and that they’re purely not letting me exercise because of the perceived risk exercising on a halted stock (which is a restatement from last week).

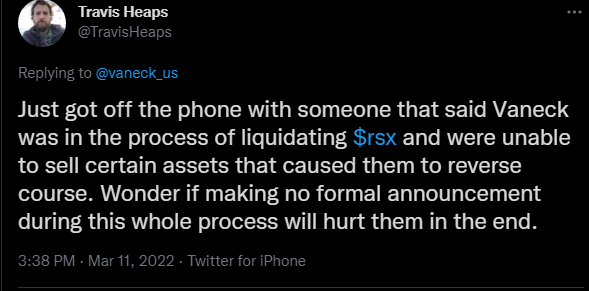

- VanEck is basically useless at this moment, they refuse to comment on liquidation or anything further.

- CBOE is apparently legally justified to halt a stock for whatever reason they see fit for as long as they’d like. However, the fact that they’ve halted this for “Regulatory Concern” while the RSX press release indicates that they would’ve been under pressure from Market Participants (market makers for CBOE) to halt the stock may open a case for something. Currently seeing pressuring CBOE to unhalt as more likely than pressuring VanEck to delist.

- OCC is fuck all useless. They essentially exist as a puppet and are almost entirely uninterested in taking action on their own. They are a reactive entity in the chain.

I’m going to take another wack at scaring CBOE before Friday. Doesn’t hurt to try.

The OCC posted today with this week’s trading halt update. Spoiler: Nothing new has changed. RSX and OZON are both listed as removed from automatic Ex by Ex, meaning no automatic exercising.

Interested to hear what comes from your chat with TD. I wouldn’t mind exercising my 7p, if possible.