Is this new information that we found?

Shocker, nothing but pushback on Reddit from a well-researched opinion.

I have called and left numerous messages with the SEC about being robbed, they seem more interested than everyone else I have tried to take my frustrations out on.

Half of the people on r/options were selling cash secured puts on RSX hoping this would happen, and now feel smug that they were correct. Not to mention that this was a massive stroke of luck for them (in previous instances of an underlying stock exchange being halted, such as in Greece, the ETFs on American exchanges and their associated option contracts continued to trade) and if it’s a fund on the other side of the trade they might actually end up getting assigned.

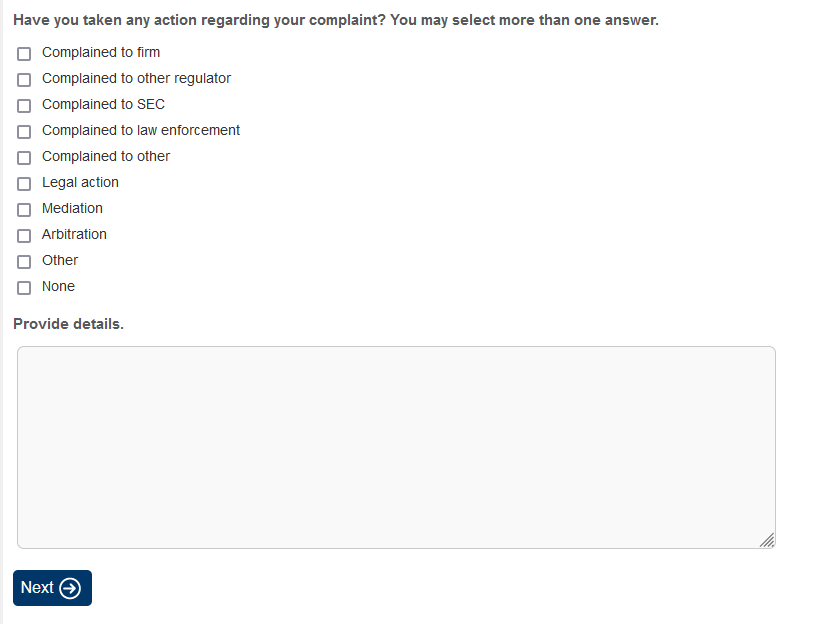

I just received a phone call back from my local representative and they said that you can make a complaint with the SEC and with the Office of the Comptroller of the Currency and if they cannot get to your complaint in a timely fashion to reach back out to the local representative and they can open an inquiry. So that is what I am going to do.

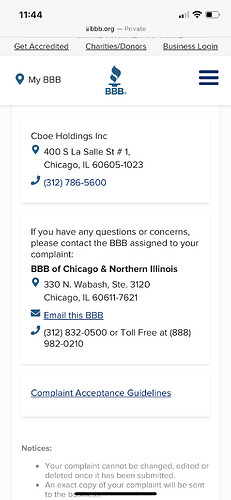

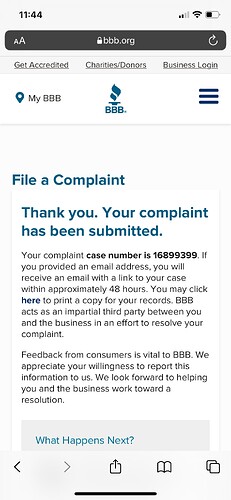

I have attached a link to file complaints with the SEC. I think we all should file official complaints against CBOE, VanEck and the market makers about what is happening with the RSX halt. I for one will file a complain.

https://tcr.sec.gov/TcrExternalWeb/faces/pages/disclaimer.jspx

Not a bad idea, might be helpful to put a guide up since there quite a few options - I think if we all use one voice it might carry a bit more weight

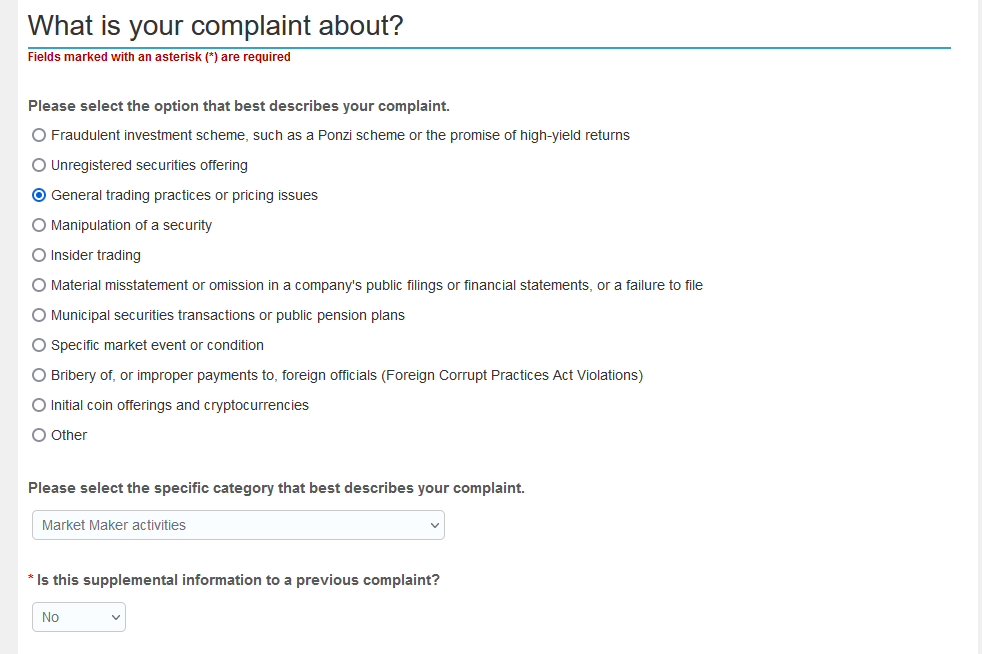

That’s a good idea. However it seems like a lot of categories match what the hell has been going on. I was thinking of filing a complain as follows:

If anyone can provide a format or detail, especially some of the team members that have been constantly reaching out to the different brokers/dealers, I think that would help with having a unified front when filing these complaints.

I have called a few times when bored they are very helpful when I say they robbed me it was there and then disappeared

I selected specific market event. I believe that it falls under a few.

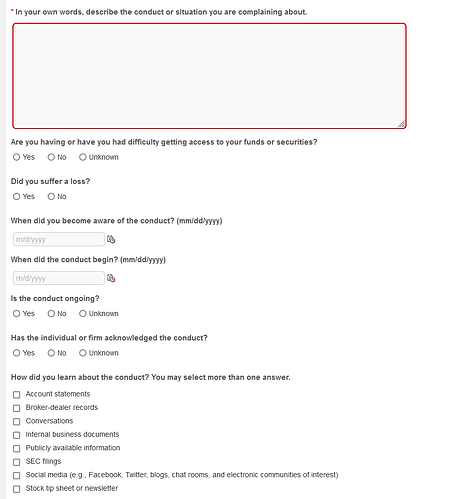

I wrote out the following for my complaint. Feel free to put this sentiment in your own words.

"I believe Vaneck, who manages an ETF by the name of RSX, has been fraudulent in their refusal to announce liquidation of said ETF. I believe they have been pressured to not announce liquidation, even though that is exactly what has happened. Every day since the CBOE halted trading on RSX, Vaneck has been selling off massive amounts of the underlying positions owned by the ETF. The fund now has a vast majority position (77%) in cash. They’ve sold just about every stock that could be sold.

I believe the CBOE has halted RSX under pressure from market makers. They have said it is under a regulatory hold, but they refuse to provide further information on why it has been halted or what can be done to remedy the situation.

I have put contracts for RSX expiring Friday. Even though they are in the money, they will expire worthless because the stock isn’t trading. It hasn’t traded since 3/4/22 and there have been no updates or reasons given. This is fraud.

The amount listed below is the total value of the put contracts if RSX had announced liquidation. RSX is liquidating. They have not announced for reasons that must be determined. CBOE has refused to unhalt the security for reasons that must be determined.

Thanks"

I wonder if the ‘Manipulation of a Security’ or ’ Material Misstatement or Omission…’ would be better categories to submit under than General Pricing. Though then again the Manipulation section is probably flooded with meme stock stuff. Still, I’ll fill one out, it’s insanity there’s still no word on this

This is not new information. But they still have to conduct a review of the halt on a regular basis and determine whether the halt should remain in place, be terminated or modified “in the interests of a fair and orderly market and to protect investors”. There is still no evidence that they ever conducted this review or are conducting this review on a regular basis. They have to follow the regulations they set.

They’re not required to share their findings publicly though and announce the results of their reviews, are they?

I filed my complain with the SEC as well. It’s a waiting game at this point. Also, nothing new from TD, I spoke to their risk department this morning, and they still will not allow me to exercise my options, i was told to call them Friday after market open to see if there are any updates. But unless there is anything new from CBOE and/or VanEck, I don’t think there is anything these brokers can do if they do not have the shares.

I don’t think there is anything these brokers can do if they do not have the shares.

That isn’t the issue, TD already admitted to Conq that they have shares available to lend - they simply don’t want to accept the risk. Hold their feet to the fire, tell them other brokers ARE letting their customers exercise their puts and that TD should as well unless they want to be considered a second-tier brokerage.

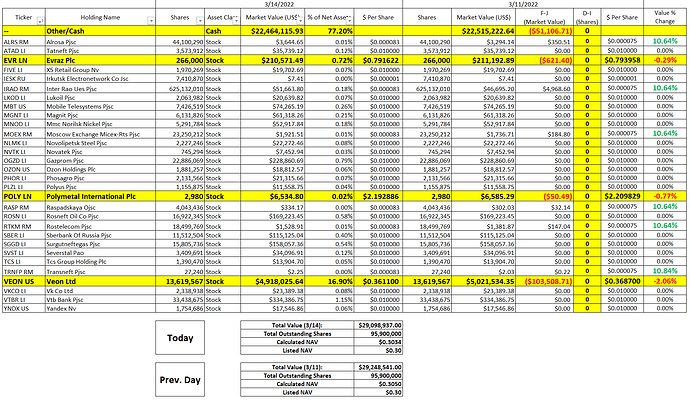

Not much changed for today for 3/14/22 data.

1). No shares sold for any holdings.

2). Valuation for few halted stocks went up by 10%.

3). Cash decreased by $51.1k from $22.515mil to $22.464mil. This was the only thing that really popped up to me. Why did their cash holdings decrease when they did not purchase anything?

4). NAV remains at $0.30

This is what I submitted to the SEC.

On March 4, 2022 VanEck Securities published a press release that their ETF (ticket RSX) would continue to trade despite several underlying securities being in Russian companies. The price of RSX was very out of sync with their NAV and had traded much higher than it should be trading (closing share price of $5.65 vs a NAV of approximately $0.30). At close of trading on March 4th the CBOE halted trading on this ticker. Shortly thereafter VanEck began to liquidate the holdings of the ETF and now the ETF is approximately 76% cash. By definition of an ETF they should no longer qualify as an investment company (cash is not an investment) nor are they able to issue or create investment units. It seems clear that VanEck is liquidating this ETF, however they have refused to announce the liquidation.

The CBOE has not allowed RSX to trade since March 4 and on March 11 a substantial number of option contracts expired without being able to be fairly valued or traded. Several brokers refused to even allow the contracts to be exercised. I suffered a financial loss due to the capricious and arbitrary nature of the halt which has not yet been explained. A even larger number of contracts are set to expire on March 18th and if the halt is not lifted, or VanEck does not announce liquidation so cash settlement can proceed, hundred of millions of dollars in option premium will be transferred from individual investors to the pockets of market makers. I have no proof that any collusion has taken place, but because of the arbitrary and unexplained reason for the halt, and the general lack of oversight of exchanges and broker-dealers my only recourse is to assume that market makers are only too glad to have the halt continue, and the CBOE is only too glad to make them happy.

According to the CBOE’s own guidelines, any halt must undergo an evaluation after 2 days and this evaluation must continue every 2 days to maintain the halt. To my knowledge, no information has been provided as to if that evaluation was ever performed and under what circumstances a determination was made to keep the halt in place. At no point, has the CBOE (nor the OCC) provided any additional information as to why the halt has remained in place, or provided any timeline as to when it might be removed. At no point has VanEck made any public disclosures of the very relevant information that they have liquidated 76% of their holdings in this ETF and therefore RSX should no longer qualify as a “a registered open-end management investment company (i) that issues and redeems creation units to (and from) Authorized Participants (defined below) in exchange for a basket and a cash balancing amount if any; and (ii) whose shares are listed on a national securities exchange and traded at market-determined prices.” according to rule 6c-11 in paragraph (a)(1).

By what logic can the CBOE claim to provide a fair and orderly market if they refuse to provide a market at all for this security. By what logic, can the ETF still be an ETF if it has liquidated the vast majority of it’s assets and no longer issues investment units. I therefore implore you to investigate this matter with the upmost urgency, and force a disclosure of why the halt took place, have the halt removed, and find the ETF no longer qualifies as a security (under rule 6c-11) and liquidation has taken place so cash settlement can commence. Failure to do so is to abandon the role the SEC should be playing in overseeing the investment and security markets.

I also implore you to codify a fair and equitable process for unwinding option contracts when an exchange halts the trading of a security. The current actions of the exchanges and clearing houses under a halt-event to refuse to compensate contract holders is nothing short of theft. This cannot be described as a fair and orderly market because it isn’t a market at all.

I like this one a lot.

Sorry if I’ve missed it, but is there any guidance on what we can do to help? I’ve lost out on last week’s puts and am expecting the same on my 4/1 puts.

I appreciate everyone’s effort in trying to right the wrong.