Posting here from TF

https://twitter.com/EricBalchunas/status/1504088105321705473?s=20&t=keI4FFTk_b8X4JOc-HiLMA

Could you ask Marie to point you to the relevant OFAC restriction?

Spoke with someone at UBS Investment bank, specifically their “Unique Liquidity” ATS (Alternative Trading System) department. He was unable to confirm that RSX is still trading within their ATS (OTC), however, did confirm that if I was able to find a source for RSX shares that my broker could facilitate an exchange of the shares through “normal means” despite the halt. Basically purchasing them in an OTC transaction.

I then called TD and was abruptly told that they would not facilitate any such trade. Not that they couldn’t, but that they would refuse to given the current sanctions.

I then asked if I were to secure shares privately, if they’d accept a transfer of them, they did acknowledge that I am free to transfer privately acquired shares into my TD account, but that the chances of the transactions clearing before expiration are slim to none. This also counts for transferring the options out of the account to a brokerage that would allow exercising.

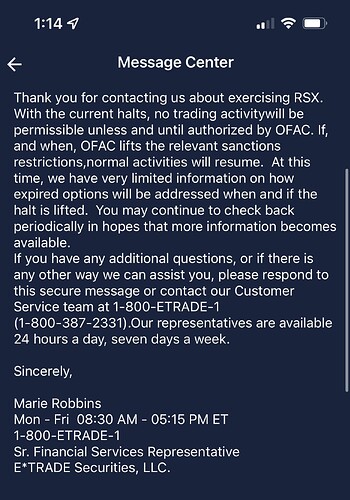

She seems unaware of the specifics surrounding RSX then

so no relevant OFAC restriction then. thanks Marie

Is she confusing RSX with an actual Russian stock? Sounds like it at least. And yay, add another institution being passed the buck

This is probably just the narrative they’re using to avoid explaining further and divulging there’s no real reason for the halt on RSX.

Now the server that handles the messaging is conveniently down…

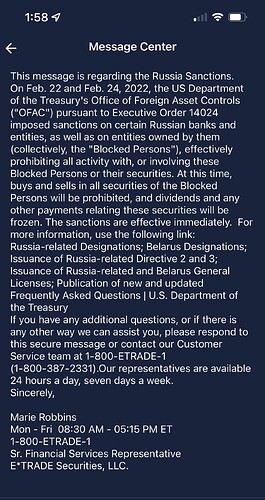

Yes, it appears they are all going to hide behind “sanctions” bc the underlying securities are sanctioned. So they are going to make the claim that if the underlying are sanctioned then the ETF can’t be traded either bc of the association. It will be easy for them to hide behind the sanction excuse.

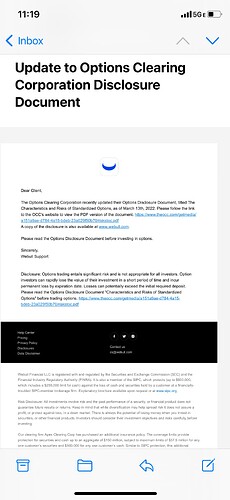

Received this email from WeBull today.

Here is the link it shares: https://www.theocc.com/getmedia/a151a9ae-d784-4a15-bdeb-23a029f50b70/riskstoc.pdf

Scroll down to the “risk” section. In particular, the bottom of page 61 into page 62. I wonder if this risk was noted in prior versions of this document. Will look into it tonight, if nobody beats me to it.

that part is not really relevant here IMO. OCC did not implement exercise restrictioins and that section also sepcifies that if they did, restriction should be lifted latest on business open on expiration day.

Yeah someone else said the same thing. My thought was that is sounds like a catch-all. I haven’t had a chance to look through this disclosure in detail, but wonder if changes were made to reflect the RSX situation in any way.

The risks outlined here are about exercising which is all the OCC is responsible for. They don’t have anything to do with the trading of the contracts. They also seem to cover themselves by stating there could be regulatory risks that could “have the effect of restricting exercising of an option” which is what they would likely say is going on here.

This is not on the OCC because:

- The OCC has no control over the trading of the contracts. That is solely within the CBOE’s power and they are not allowing it.

- The OCC has no control over VanEck liquidating the ETF and can’t do anything related to cash settlement until VanEck announces a liquidation.

- The CBOE is responsible for the halt and is using “sanctions” as the justification and will stick with that excuse as long as they want so they can’t be accused of violating the sanctions. As asinine as that is, that is what is happening. The only way this would continue to trade would be if some official in the State Department said the ETF is not under sanctions and can continue to trade. That ain’t happening.

- VanEck won’t announce liquidation for whatever reason. They have liquidated but they aren’t saying they are ending the fund. And because of how slowly the gears of government grind, they probably won’t have to announce their plans for a while.

For me, I think what this shows is that there needs to be written rules about how option holders are treated when a security is halted and they shouldn’t have to assume all of the risk that an exchange can indefinitely halt a security with very little oversight and have zero recourse for challenging the halt and for the contracts expiring worthless.

I think you might have a better case suing VanEck for failing to disclose material information in a timely manner about their liquidation.

To sue Van Eck for that, though, you might need to be an RSX shareholder. I’m not aware of whether you could have a claim against a fund manager for required disclosure violations involving a security you don’t own. Putting my lawyer hat on, it seems that you’d lack privity with Van Eck. The SEC might still be able to go after them, however.

I am not a lawyer and this is not legal advice. I have no idea if you would have standing to sue if you weren’t a holder of the stock. But I would think you could make a case that you are still an injured party.

I spoke with a recently retired corporate securities partner at a well know Silicon Valley law firm who is a family friend. His take on this is we need to make it as uncomfortable for the CBOE and COO as possible and that they won’t do anything unless there is negative press that shines the light on them and as big a class action suit as possible. My arguement with him is that the options are a mark to market situation so there should be a a price based on real time events and performance of the underlying stock. He agreed and his view is that RSX and options associated with it should be trading and that the reality is the stocks that make up the ETF is near worthless and at this point in time and that price discovery for that should be evident if it was allowed to trade. In other words if investors value RSX at $0 than that is the accurate market value of the ETF. Unfortunately, both Van Eck and the regulatroy bodies are going to hide behind Force Majere, unforseeable acts of “God”.

He said Van Eck has a real stance which protects them on Force Majere as it is in their prospectus risk factors. In other words, suing Van Eck is not productive. It is the exchanges and regulatory bodies that he suggest we focus our attension on. They hate negative press and they are set up to protect both sides of the transaction. In practice they don’t do it and side with those who make the most noise and influence. Saying that it doesn’t look good for them if a lot of individual investors are harmed by their decision/non action as individual investor protection is a siginifiant PR issue with the financial regulatory bodies. All of us in the options need to be part of the class action suit that Matchetphil and Conq has mentioned.

Excellent post, thanks.

I’m continuing to email CBOE but have nothing new to report that hasn’t been reported last week.

Ready and willing to join any class action lawsuit if that’s the path we’re taking