I thought I would eMail Robin Hood based on the new “theocc” memo - there reply is below -

Hi ----------,

Thanks for reaching out to the Advanced Brokerage Team. My name is Robert and I am more than willing to assist you today.

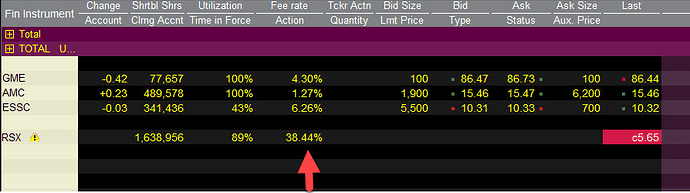

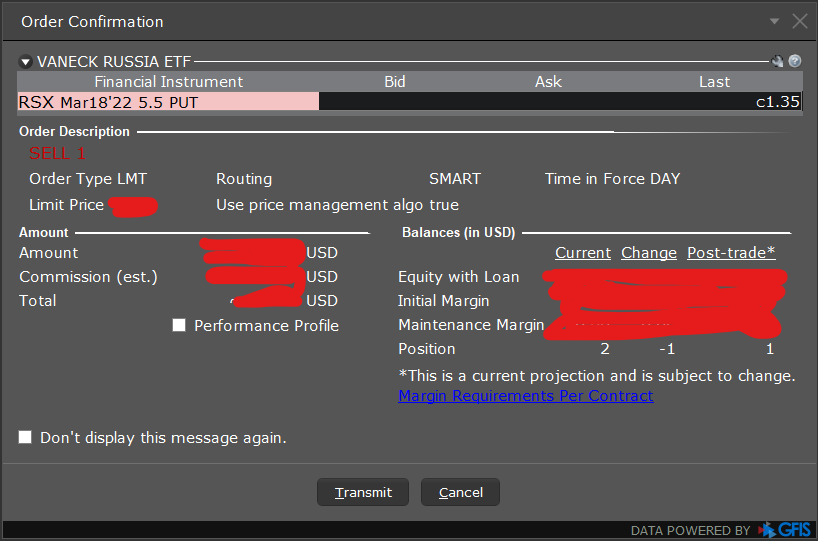

I understand it can be very concerning with options contracts that deal with the unprecedented events taking place in Russia, but I can help clarify what is going to happen with the RSX 2022-03-18 Put $5.50 contracts.

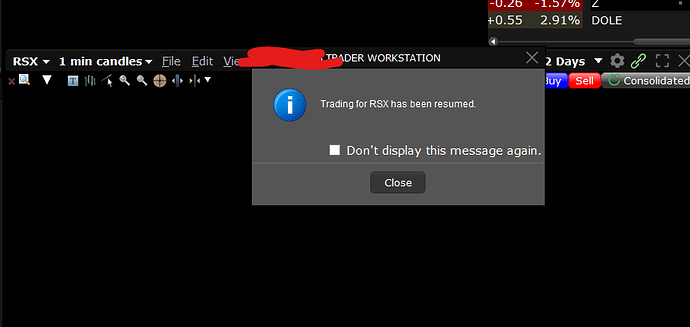

It is first important to note that all shares of RSX are currently untradeable as they are halted. This would also mean that the since the underlying of RSX is halted, the options contracts on RSX have also become halted or untradeable.

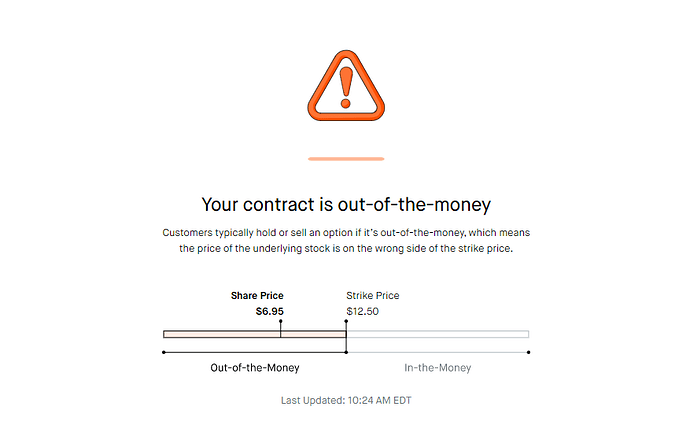

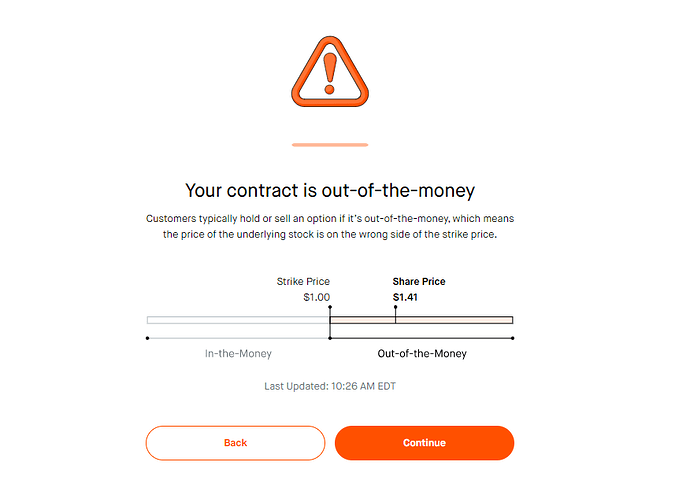

Since we have 5 RSX 2022-03-18 Put $5.50 puts, in order to exercise the position, we would need 500 shares of RSX which we currently do not have and since the shares are halted, cannot be purchased. This would mean that we are unable to participate in broker to broker settlement of exercise and assignment because we are unable to obtain the deliverable of 500 shares and if we did, you would be selling short 500 shares of RSX.

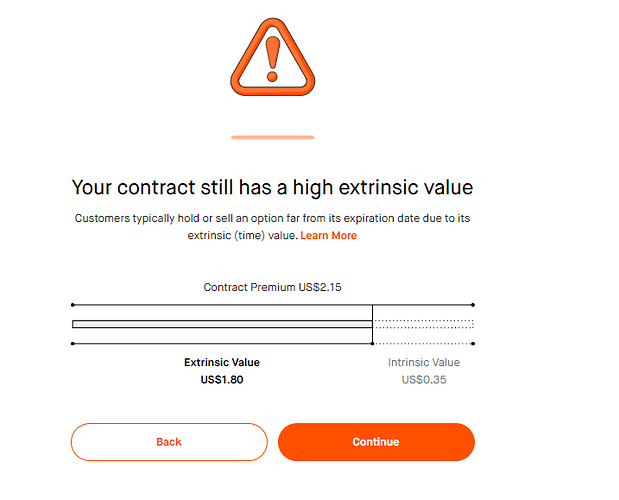

As alluded to previously, these contracts have also been halted from being traded meaning you are unable to buy or sell these contract currently due to the underlying halt on RSX. If RSX remains halted by the expiration date of these contracts, these contracts will expire worthless.

I know this can be extremely frustrating, but we have no control over the halts nor adjustments to the contracts purchased on RSX, nor did we have any idea these events would take place.

I hope this clears things up and if you do have any further questions, feel free to reach back out.

Have a great rest of your week.

Sincerely,

Robert

Case ID: 23056810

Cash Management is an additional feature offered as part of your Robinhood Financial LLC brokerage account. The Annual Percentage Yield (APY) paid by program banks is subject to change at any time at the program banks’ discretion. Neither Robinhood Financial LLC nor any of its affiliates are banks. The debit card is issued by Sutton Bank, member FDIC, pursuant to license by Mastercard® International Incorporated. Robinhood Financial LLC, member SIPC and FINRA. Click here for more information.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risks. To learn more about the risks associated with options trading, please review the options disclosure document entitled Characteristics and Risks of Standardized Options, available here or through https://www.theocc.com/about/publications/character-risks.jsp. Investors should consider their investment objectives and risks carefully before trading options. Supporting documentation for any claims, if applicable, will be furnished upon request.

Purchasing digital assets (such cryptocurrencies and associated derivative products) comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, digital asset markets and exchanges are generally not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. These exchanges are also sometimes vulnerable to intrusions in which digital assets are taken away from their rightful owners. Digital assets prices can change radically in a trading day and thus lead to significant and sudden financial losses. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. For additional information please refer to our Cryptocurrency Risk Disclosure.

For more information on Robinhood Gold click here.

All investments involve risk and loss of principal is possible.

You are receiving this email in response to your request for information or Robinhood servicing your account. You cannot unsubscribe from these emails.

Robinhood Financial LLC is a registered broker dealer (member SIPC). Robinhood Securities, LLC, provides brokerage clearing services. Robinhood Crypto, LLC provides crypto currency trading. All are subsidiaries of Robinhood Markets, Inc. (‘Robinhood’).

Read our privacy policy© 2021 Robinhood Financial LLC. Robinhood®