I tried last week with my 3/11s at a market sell. No action with the order in over 5 mins so I closed the trade.

I had a sell order pending all week no fills

I’ve tried it to sell with RH everyday just to see if it goes through and it did not. But you try it and let us know.

thanks! i’m gonna just leave it out at a limit price for the last change for the day and see what happens as a test case for the rest of us. taking a loss but i still have one to exercise. just want to see if there’s a market for it.

As per this memo, to the extent that brokers are basically saying they “cannot effect delivery of the RSX shares” because they do not have them, does this not necessarily punt things to “such time as OCC designates a new exercise settlement date, settlement method and/or settlement value” because because the OCC has now specifically allowed for delayed settlement? I.e. past expiration date?

In other words, OCC is saying if brokers can’t deliver shares, they must allow option holders to punt settlement until OCC provides further guidance?

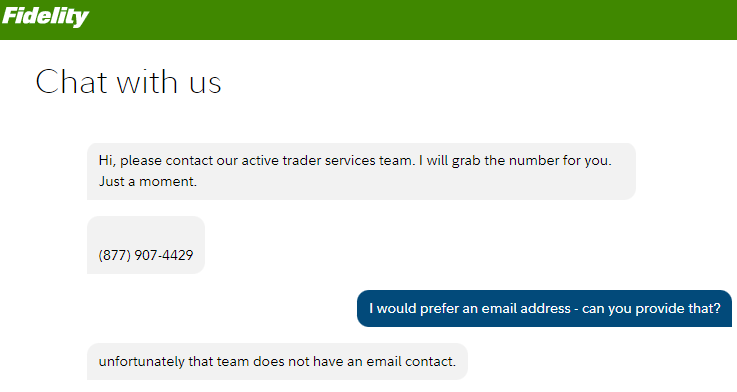

This is what I received when I contacted Fidelity chat support regarding the OCC memo #50188 and exercising, specifically regarding the line “Pursuant to customary OCC broker to broker settlement procedures, inability to effect delivery may subsequently occasion cash settlement as determined by OCC.”.

Emailed RH, more to have written records for the probable lawsuit that results of this. I have no where near the required capital to actually exercise, but still, I wanted it in writing that I wanted to close positions and if that wasn’t possible, to exercise and hold the short shares.

Message was-

I would like to formally request to Exercise my RSX positions considering the new information brought forward in https://infomemo.theocc.com/infomemos?number=50188

I would also be looking into Exercising OZON positions, due to similar information being released today https://infomemo.theocc.com/infomemos?number=50190

I understand shares are not easy to find right now and CTB is quite high, and it’s honestly mind blowing the OCC, CBOE, and VanEck have not yet announced delistment/liquidation of RSX especially, but this is where we ended up. I would much rather just close out all positions as they stand right now instead of dealing with the headache of Exercising and/or waiting for the liquidation announcement.

I know holders of the 3/11s that expired worthless are pursuing legal action against VanEck, the OCC, certain brokers, and CBOE, I would also like to avoid needing to join a class action for 3/18 holders, so even though these contracts should be worth ~$4.5k at current NAV, at this point I’d settle for getting my cost basis back over dealing with all the above. Thank you for your time and assistance -real name

So per my layman understanding cash settlement should not be the default.

The memo states: “ If it is not possible for the delivering Clearing Member to effect delivery of the RSX shares on the designated settlement date, then the settlement obligations of both delivering and receiving Members shall be delayed until such time as OCC designates a new exercise settlement date, settlement method and/or settlement value. This determination allows delivering Members the opportunity to effect settlement if they have RSX shares and are able to effect delivery, but delays the settlement obligation when this is not possible. (emphasis mine)

The section on cash settlement comes later and states it may be used if the shares never become available.

Chat with IBKR. In short, my account is a cash one so I can not exercise my options as that would be me in a short position, which is not allowed in cash accounts. I can only do this in a margin account. IBKR has confirmed that even if I open a margin account, I can not transfer my options to it so that I can exercise them. Therefore, I have no way to exercise my shares. IBKR refuses to do a cash settlement even though the above proves that they are unable to deliver the shares to me in my opinion. This seems contrary to what the OCC says.

ChatSys: This chat is associated with ticket ########. Please record this number for use in future inquiries. You are currently in room ‘Trade Problems’.

me: I have put options in RSX on March 18th in a cash account. I would like to exercise these options. Can you please help me?

Onur P: Hello, this is ‘Onur P’. Please allow me a moment to read the question you submitted to iBot and I’ll respond to you shortly.

me: Hello Onur

Onur P: Option on RSX are not able to be exercised automatically atm thus you should submit a ticket

you can do so by following the below procedure

me: I already had my RSX puts from 3/11 expire worthless, some ITM, and I am very upset about that.

Onur P: Log in to Client Portal, click on the User menu (head and shoulders icon in the top right corner) followed by Secure Message Center, then click Compose followed by New Ticket. Please select Trade Issues as the ticket category followed by Other Trade Problem, then type “Option Exercise Request” as the subject along with detailed instructions of the contracts you want to early exercise in the body of the message. Future Option exercise requests are processed by the exchange in the evening and positions are updated to your account overnight.

me: Am I able to even exercise that with my TFSA cash account? I tried exercising using the mobile app and it said it was not possible.

Onur P: I understand your this however the OCC informed that automatic exercise was not possible for this underlying

let me check this for you

me: OK

Onur P: Have you received any specific error message?

me: On my mobile when I tried to exercise my 3/11 puts, I did see an error message. I will upload it

Onur P: thank you

ChatSys: ATTACHED FILE : Screenshot_20220311-144916.jpg

me: "Short stock positions can only be held in a margin account (you are using a cash account).

Onur P: I see yes, so the situation here is that option exercise resulting in short position of the underlying is not allowed in cash type account

for this reason it is not possible

me: I would like to reference this new OCC memo: https://infomemo.theocc.com/infomemos?number=50188

I also spoke with the OCC and I was told by them that these memos effectively mean that you can exercise your contracts and if the broker is unable to deliver the shares, it would result in cash settlement… In this case, I do not have a margin account so you are refusing to deliver the shares. Is my understanding correct?

The OCC seems to make it clear that the broker (in this case, you) should be able to apply to have a settlement done in cash

And since I already went through this and saw some significant ITM options expire last week, I am really determined to not let that happen again this week.

Onur P: I understand what you mean. However the situation here is different. We should actually be able to deliver the shares but your account is actually not allowing this. The reason to not be able to exercise this option is the feature of your account which cannot hold short position

me: But cash settlement should be an option then, since I am not able to exercise.

You must realize how frustrating the situation is when your prediction was RIGHT, you had options in the money significantly, and then have to see those options expire in the money yet worthless. I seem to have no options available to me, but the OCC is saying cash settlement should be one of them.

Onur P: the type of option you hold is not a cash settled option type, thus we are not able to settle this as cash. The disclosure of the OCC is that we can cash settle only when we are not able to provide you the underlying shares

me: Is it even possible for me to open a margin account and transfer these options to it at this time?

Onur P: I am afraid the upgrade to a margin type account would not help in this situation

Account holders who seek to convert their account from a TFSA to a margin account must first initiate a new account application for a margin account and then withdraw the funds from the TFSA account back to their bank and re-deposit funds into the new margin account

me: So if I am not able to open the account type needed with you, then therefore IBKR is not able to provide me the underlying shares, and therefore I should be eligible for a cash settlement

Onur P: If you make the request to open a margin account you should be able to use it. There should be no issue for you to open a margin type account

me: You said above that the upgrade to a margin type account would not help in this situation - why is that?

Onur P: because you should first open a margin account and asset transfer cannot be done in TFSA account to your margin account

however there is no restriction for you to open a margin account

me: OK, so Onur, you must understand my frustration here

Onur P: I totally understand your frustration and I am sorry to here this really

but unfortunately your account capabilities restrict the delivery of a short position

me: I am unable to exercise my options that are currently ITM at the last trade price of RSX at $5.60 (even though the NAV of the ETF is currently around $0.30). You say that you have the ability to provide me the underlying shares if I want to exercise. However, IBKR is also preventing me from exercising because of my account type. You say I need a different account type, one that I can’t transfer ownership of the options contracts to.

Therefore you are unable to deliver the shares, and I refer to the OCC stating that if the broker can not deliver the shares, that cash settlement is an option

Onur P: alright please bear with me, I will check this further and discuss the situation with my counterparts

me: OK, thank you. I apologize if I am coming across a little aggressively - you have to understand that I saw a few thousand dollars expire worthless last weekend even though my prediction was correct. I am about to see a few thousand more dollars expire worthless (if we are considering the NAV price of the ETF) tomorrow. This is not a small amount of money for me.

Onur P: no problem at all, I do understand your situation. And I am checking if there is anything that can be done here

thank you for your patience

me: I hope you will bring me some good news!

ChatSys: There has been no activity on this chat for a while. Please post a message to confirm you’re still there or this chat will be terminated.

me: Bump

EDIT: Continued conversation. There are no choices for me. My options will expiry worthless even though I would like to exercise and also requested cash settlement. IBKR says cash settlement is not an option for me.

Onur P: After contacting my superior and our risk department, the exercise of your long put option on RSX will result in short position of RSX stocks. Holding short position is not allowed in a cash type account. Furthermore, cash settlement is also not an option here as we could have deliver you the short underlying if you had a margin account but your account capabilities does not allow you to hold short position as it is a cash type account.

You can always open a margin type account and trade this kind of options an exercise them in the future. There should be nothing that could prevent this

I am sorry for any inconvenience.

me: Onur I am deeply disappointed as this seems to contradict what the OCC is saying

But thank you for your time and for looking into this for me.

I just did the same, thank you for the template, Will report their reply here to compare.

Yeah it seems at least for us cash accounts on IBKR that we are screwed either way, would love to be told i’m wrong but we don’t have the option to exercise these puts so i guess technically we aren’t even at the point of requesting them to locate shares?

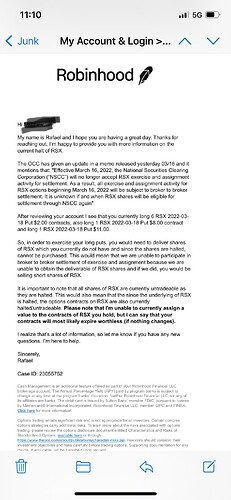

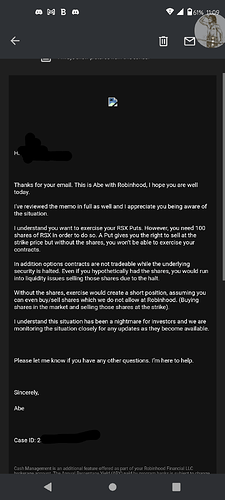

This is what robinhood said to me, when I showed them the new memo and ask for clarification:

My names Mike, and i’m on the Advanced Brokerage Team here at Robinhood Financial, I hope you’re doing well!

I see the contracts you referenced:

RSX 2022-03-18 Put $1.00

RSX 2022-03-18 Put $5.00

I appreciate you providing the OCC memo is regards to RSX.

We are handling this situation the same we typically handle option contracts.

Unless you have the collateral to perform the exercise, (100 shares a contract for puts) then you would not be able exercise. I know this isn’t ideal because RSX is halted and there isn’t a way to obtain shares and also you are unable to trade option contracts on halted securities.

I can definitely understand this isn’t the best experience, this is a unique situation in regards to Russian ETFs such as RSX.

If there’s anything further I can assist you with, feel free to reach out.

Sincerely,

Mike

This was one of my questions in my ticket from IBKR. I’ll let you know when they respond

They are effectively refusing to deliver the shares to you, technicalities aside. Full stop, they’re refusing to give you shares.

ask them if they would be willing to at least close your positions. this is what my Canadian bank is looking into for the puts i held in the TFSA. i think trying to mitigate, as much as possible, the harm that the halt incurs would show that we’ve done as much as possible on our end. especially if you bring it up to IBKR and they’re not offering that option for you.

Just for documentation’s sake:

I called Schwab at 9:43 AM and was told that I can’t exercise, no short shares available.

I see the memo, call in again at 10:36 AM and was told that there was a new internal memo just released and that I can now short but at a 500% requirement. Meaning for 20 7p’s they asked for 70k in the account.

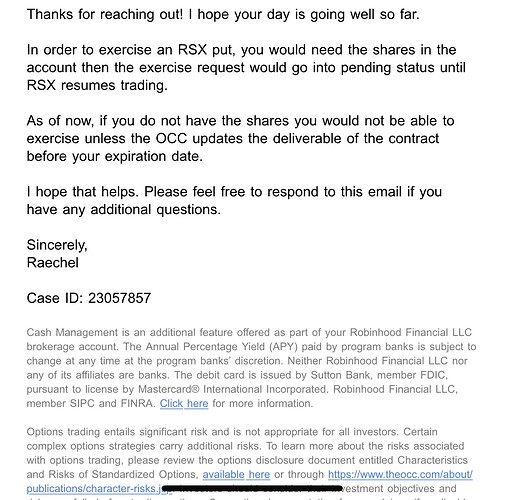

There Reply -

Hi ----------,

I appreciate you reaching back out, I can definitely give some more clarification here to the memo.

The deliverable of these contracts is still 100 shares of RSX and we are unable to effect delivery of these shares in a broker to broker settlement procedures.

If the OCC determined that there would be a cash deliverable by tomorrow for these contracts, instead of the current deliverable of 100 shares, then this would change the current situation. However as of right now based off the current deliverable, exercising these positions would result in a short position.

If RSX were to begin trading tomorrow as well, you should be able to sell to close the positions as well. We are unsure if this will take place as well.

I know these memos can be very confusing, but the deliverable has not changed and you would be unable to deliver the deliverable to exercise these contracts.

If you have any further questions, feel free to reach back out. I am here to help.

Sincerely,

Robert

Case ID: 23056810

Cash Management is an additional feature offered as part of your Robinhood Financial LLC brokerage account. The Annual Percentage Yield (APY) paid by program banks is subject to change at any time at the program banks’ discretion. Neither Robinhood Financial LLC nor any of its affiliates are banks. The debit card is issued by Sutton Bank, member FDIC, pursuant to license by Mastercard® International Incorporated. Robinhood Financial LLC, member SIPC and FINRA. Click here for more information.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risks. To learn more about the risks associated with options trading, please review the options disclosure document entitled Characteristics and Risks of Standardized Options, available here or through https://www.theocc.com/about/publications/character-risks.jsp. Investors should consider their investment objectives and risks carefully before trading options. Supporting documentation for any claims, if applicable, will be furnished upon request.

Purchasing digital assets (such cryptocurrencies and associated derivative products) comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, digital asset markets and exchanges are generally not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. These exchanges are also sometimes vulnerable to intrusions in which digital assets are taken away from their rightful owners. Digital assets prices can change radically in a trading day and thus lead to significant and sudden financial losses. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. For additional information please refer to our Cryptocurrency Risk Disclosure.

For more information on Robinhood Gold click here.

All investments involve risk and loss of principal is possible.

You are receiving this email in response to your request for information or Robinhood servicing your account. You cannot unsubscribe from these emails.

Robinhood Financial LLC is a registered broker dealer (member SIPC). Robinhood Securities, LLC, provides brokerage clearing services. Robinhood Crypto, LLC provides crypto currency trading. All are subsidiaries of Robinhood Markets, Inc. (‘Robinhood’).

Read our privacy policy© 2021 Robinhood Financial LLC. Robinhood®

ref:_00D2E1FVxT._5002E1wTK59:ref