Hey y’all. I began actively trading in January of last year in the beginning of the GME craze. I have learned a lot since then. I’ve been telling myself I need to make a journal to record my trades and to receive critiques for my personal growth as a trader. Not gonna lie, I’m actually nervous about making this journal since it is public, however it will be good for me to be open and honest. I feel comfortable with this community, so here goes.

I slowly unwound positions in this account to “start fresh” and not have positions crowding the purpose of this journal.

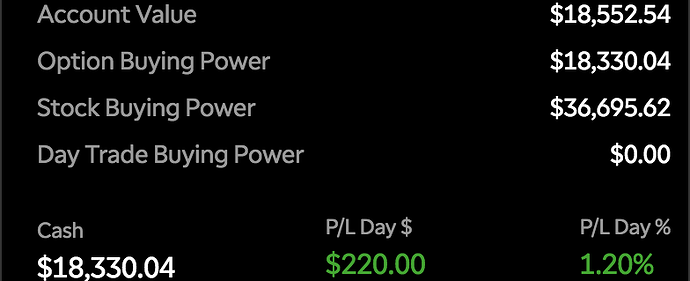

I am beginning this journey with an account balance at $18343.32. I have $18120.82 in cash and a position in SNDL. I’ll begin there.

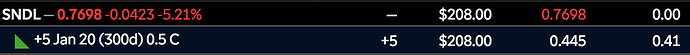

I have SNDL 1/20/23 0.5Cs @ $0.421 x5. I like to calculate the fees both ways into my cost, so these were filled at $0.41.

In addition to opening this position following Conq’s Challenge Account, I think the sentiment behind weed stocks will continue to grow as the current bill moves through the house. SNDL can be a bit meme-y and is cheap, which can help it run. I looked at TLRY, but it was already running hard and IV on those options was not ideal. People will see TLRY already running, among others, and will look to get into other weed stocks. A little sympathy is in play here. At the time of opening this position the IV was not as jacked up as TLRY. I like the protection from theta on these calls due to it being 300 days out.

I am still learning to how read and draw charts. A basic tool that I have adapted to is using the Fibonacci Retracement Levels. I have been using this to find resistance levels quickly and I identify them on the 1YR:1DA chart. Looking at SNDL’s chart, I can see that $1.00 is the first strong resistance and psych level to keep an eye on. It had a gap up in November and was quickly shot down at the $1.00 level.

I want to follow the mindset of learning and getting proficient at trading a smaller core amount of tickers. The S&P is one I follow and I want to learn. Since this account is under $25k and margin is enabled, it is limited with day trading restrictions. However, futures are enabled on this account. I trade /MES and chart on /ES. I set my stops for 10 ticks or a $2.50 drop, which equals to a $12.5 gain or loss. This is a rule I am following on /MES to cement it into my trading style before I graduate up to /ES where I would experience greater gains or losses.

Looking at /ES’s chart, I can see we are approaching a resistance around $4540 and the next would be around $4660. After this extremely and historical bullish rally, I am being cautious of opening a bullish position here. It appears as if we broke the downtrend and the constant flow of bad news and chance of heightening conflict in Europe is being ignored. I will try to follow the daily trends for the time being and have those stops set to keep from being blown out. Mostly watching a rejection at that first resistance.

The next /ES chart I am keeping an eye on is 5DA:15MIN. In this chart, I drew a broadening formation which could indicate more volatility to come and an indecision in the market. This may be confirmation or bias for previous statements.

Lastly, looking ahead into this week. I will be looking for possible entries into GME, AMC, UUUU and more marijuana stocks. For the marijuana stocks, someone mentioned the MSOS etf on Friday and spoke about the companies held inside of it. I want to pick out a couple of those not already mentioned on the forums and attempt at writing a DD.

Thanks for reading, cheers.