Currently resting at the $40 support. Could this be another BBBY?

I haven’t been paying too much attention but since the company released a PR saying they haven’t received a termination letter from any government agency I would expect this to drop back to the low 30s where it was prior to the recent news.

It’s for that reason I would expect the shorts to hold on to their positions, though we’ve seen that a positive catalyst such as a termination letter would pump this stock fast.

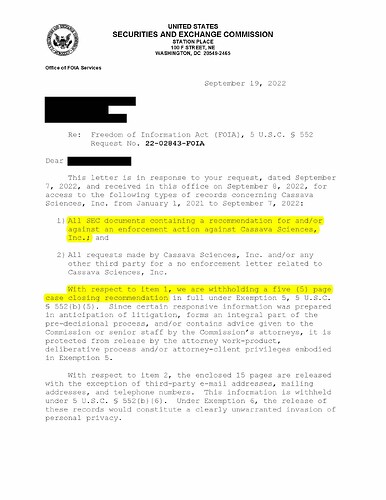

I took a Put Spread on it on Friday, I expect it to fall back down to where it was, but it has been strong while the markets have sold off. Essentially, a twitter post was being circulated early last week, it was a Freedom of Information Act request from the SEC on SAVA’s investigation. Here is the original document.

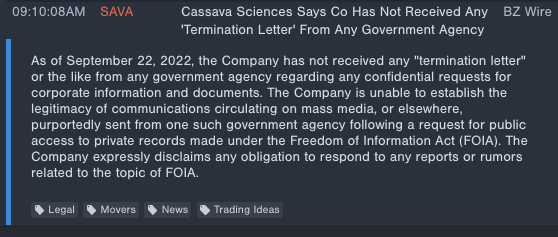

This image circulated on Tuesday? and along with options activity SAVA started getting buy pressure. After more twitter academy research, many pointed out that this was not a “Termination” of the investigation, as was reported by many different outlets, (some later changing their language I believe). On Friday Morning the company clarified that it did not receive a termination letter, and the stock sold off. I believe the options had a lot of 45c’s expiring Friday too, which seemed to be a lot of fuel.

On a side note, I believe there was also insider activity recently, excercises/purchases of stock that may be more bullish sentiment.

I’m currently in puts, but that’s because this ran from 30’s to 50 on the news, which seemed fueled by options activity + this bit of Twitter PR. With the company denying any termination letter just yet, I think it should roll back to where it launched from, at least in this market environment. I would rather be wrong, and be able to play a squeeze though…

Lastly, I am sure this has brought a lot of attention back to the ticker. Which could be a nice setup if not now, perhaps soon. I believe I read somewhere there is more data coming out soon, which would be a catalyst.

I don’t like my position I’m in, SAVA is still strong, almost feels as if it inverses SPY at times. I’ve closed my puts just now, perhaps the Squeeze theory is right, because these past few years, nonsense sometimes means bull fuel. I primarily am closing these because I expected follow through today, and my options expire Friday. At this point im going to wait for another position, I still believe it should roll back downhill, but the options I took expire to soon for my comfort.

SI is similar to BBBY but the float is smaller.

I don’t see this going below 38 for a while, there’s a lot of chatter about it on the short squeeze subreddit.

With the recent BIIB news that came out this morning, there are even more eyes on Alzheimer related tickers now as well, perhaps the short squeeze holds more merit, do you have catalysts dates for SAVA? All Alzheimer related tickers today are getting movement

Likely this year for the first batch of results and then the second batch sometime next year (timing of release of info on the first should help timing for the second). The first batch completed in September, so awaiting news on how that went.

This topic was automatically closed 14 days after the last reply. New replies are no longer allowed.