Ticker:

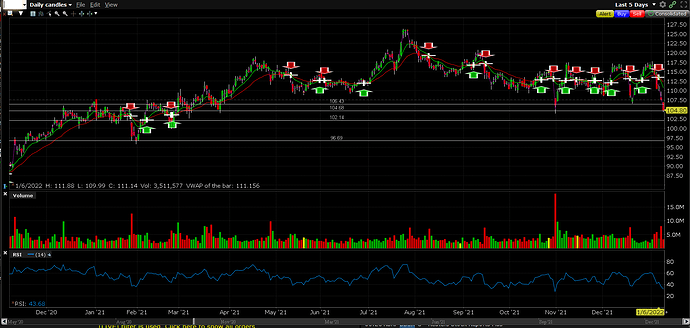

Don’t get me wrong. My wife loves SBUX and have spent many minutes in the drive-thru waiting for a caramel-macchiato-whatever. But this is just a starter DD. Today’s chart looks bad as it starts to break through some of my crude support/resistance levels. It seems like there’s a tight range but the next significant one is $96.70ish.

But it’s the run up to ER on 01/25 that I think could be a put play here. Labour issues are real. One of the rare unionized Starbucks in Buffalo has gone on strike due to unsafe working conditions during COVID. https://www.consumeraffairs.com/news/starbucks-employees-in-buffalo-go-on-strike-010622.html

Furthermore, SBUX has not been getting love from their employees (they call them “partners” lmao) in South Korea. South Korea is actually a huge market for SBUX. https://www.aljazeera.com/economy/2022/1/6/wont-take-it-any-more-south-koreas-starbucks-baristas-rebel

I’m sure you’ve heard of the fed-up barista quitting over taking a 30-item order or trying to fill 100 online pickups. I don’t think in the near future, especially next quarter, that SBUX can provide good guidance on wages, filling positions, or reduced safety costs.

Interestingly, there is a forecast that the price of arabica beans may be going down in Q1. So this could be bullish given that the price of beans has been steadily on the rise all of 2021. https://tradingeconomics.com/commodity/coffee

Also, there have been many revisions for PT’s down and “HOLD” guidances are on the rise as well. This is one I’m watching but dropping to that $96 support level doesn’t seem impossible. Just a starter DD but would welcome some in-depth analysis. Thanks and let’s go East Stone!

4 Likes

Love how all my shouting into the abyss DD have been put plays - when the markets are tanking. But it wasn’t just random observation. Lots of stocks have been showing technical weakness and macroeconomic signals have been there for quite some time. ER for SBUX is next week and even when we had little bumps up in SPY and Big Tech, SBUX was bleeding out slowly.

Labour is their biggest issue and this stems from omicron. You can’t make more frappes with less workers. It’s not an automated process yet. Longer lines in stores could just indicate longer wait times. The less coffee you’re churning out, the less money you’re making. Earnings are next week and one could ride the IV wave up until the 25th. But like it’s been stated in this server many times, holding positions through earnings is extremely risky. Didn’t have the guts to go in on this trade therefore SBUX should fall another 20%.

Earnings call is Tuesday, Feb. 1st, AH. I’m not in this play but thought I would post this for anyone who might want a consolidated thread to research before ER.

Here’s some bullish news that saw an uptick on SBUX. They’ve come out with an energy drink:

https://www.businessinsider.com/starbucks-energy-drinks-baya-pepsico-cans-beverage-caffeine-oat-milk-2022-1

Here’s an article from Yahoo that says restaurants and big-chains are starting to be favoured by institutional traders. There is some points here to consider though. Starbucks Loyalty Program is a valuable asset that has rewarded them during COVID even though customers haven’t returned to pre-pandemic levels. There’s also some bullish info on Dutch. More importantly, China, SBUX’s second-biggest market, while gaining popularity has been hit by NO-COVID policies that shut down parts of the country:

https://finance.yahoo.com/news/why-wall-street-likes-starbucks-restaurant-stocks-after-sell-off-164510174.html

As a barista, seeing a SBUX thread here has definitely piqued my interest.

In my neck of the woods, the labour issues you brought up are no joke with many locations reducing their hours or outright closing on days when staffing is a problem. Locations that are able to stay open but are not adequately staffed often disable their mobile ordering system in an attempt to reduce traffic as to not overwhelm the baristas that are able to work. I’m wondering if these trends I’ve observed locally are indicative of broader problems faced by the company that will be reflected in ER on Tuesday.

Additionally, Starbucks workers are trying to join the unionization wave in cities such as Santa Cruz, Atlanta, Philidelphia, Chicago, Kansas City, and more.

I’m also interested in how China’s NO-COVID policies have affected SBUX this past quarter. According to the last ER on October 28th, SBUX sales increased in North America but dropped 7% in China due to challenges arising from the reemergence of COVID. The next day, SBUX dropped from $113 to $106:

Starbucks Stock Drops; Analysts Slash Price Targets on Sales Miss - TheStreet

I wish I had more information to make a definitive Bear case that would let me end this post with something like SBUX is starfucked or starcucked, but at this point I’m not 100% sure. I currently do not have a position, but I might try to capture some IV riding into earnings, cutting before, and maybe reentering to follow the trend the next day. Thanks for the thread!

2 Likes

thank you for the reply! it’s really valuable DD knowing that sales have been directly affected by labour issues. even if i conservatively extrapolate your experience to SBUX as a whole, it doesn’t seem like ER would be better this quarter than last. and given the market sentiment right now, anything with poor guidance or lackluster results seems to hurtle price action downwards.

also, i hope that my posts don’t come across as facetious. i think SBUX has been having a labour issues long before COVID - mobile ordering has been an overwhelming challenge for baristas - and the pandemic has just exasperated it and brought it to the forefront. if anything, i side with labour in that if SBUX had increased competition and addressed these issues long-before it wouldn’t face a labour crunch now.

i’m also not in but definitely looking towards the trends after ER. hope your trading goes well!

1 Like

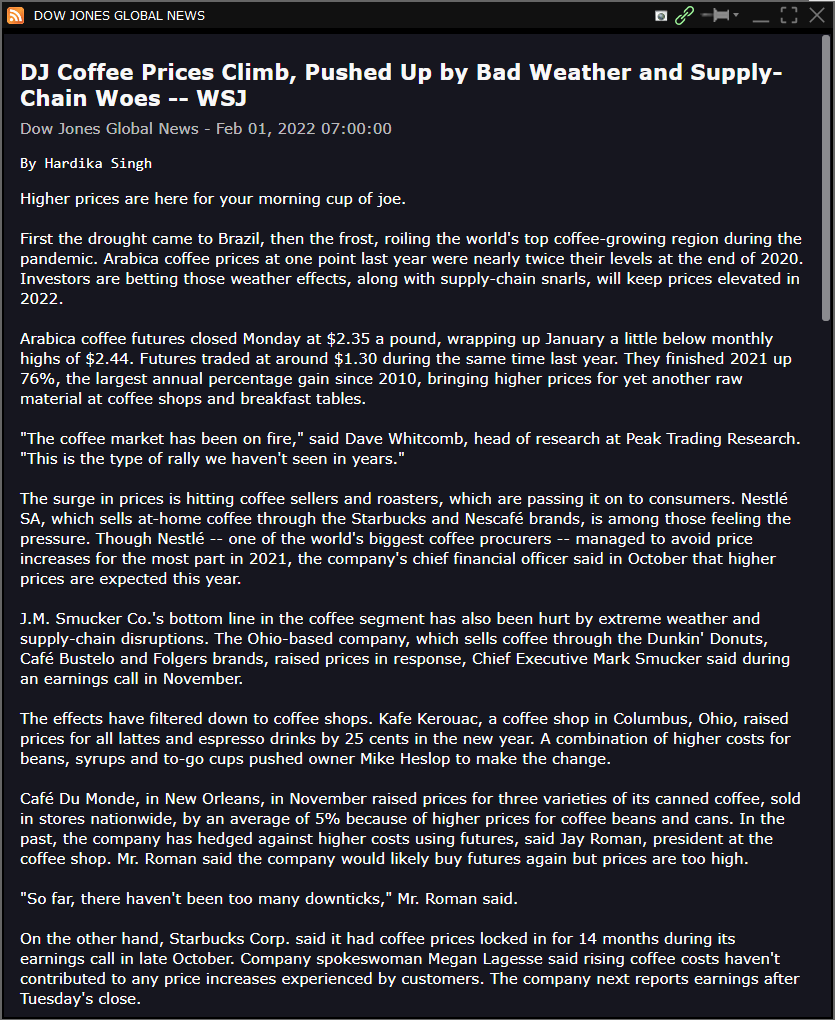

tldr: arabic beans prices are going through the roof because of weather, transportation, and labour. HOWEVER, SBUX locked in their prices for 14 months last ER in October and have been insulated from rising prices.

2 Likes

Also, this past quarter for SBUX will account for both pumpkin spice season and holiday drink/merchandise season which is usually profitable for the company. However, I’m still new to the trading and earnings game so I’m not sure if that sort of information is already Priced In to ER expectations. Good find on SBUX insulating themselves from rising bean prices!

1 Like

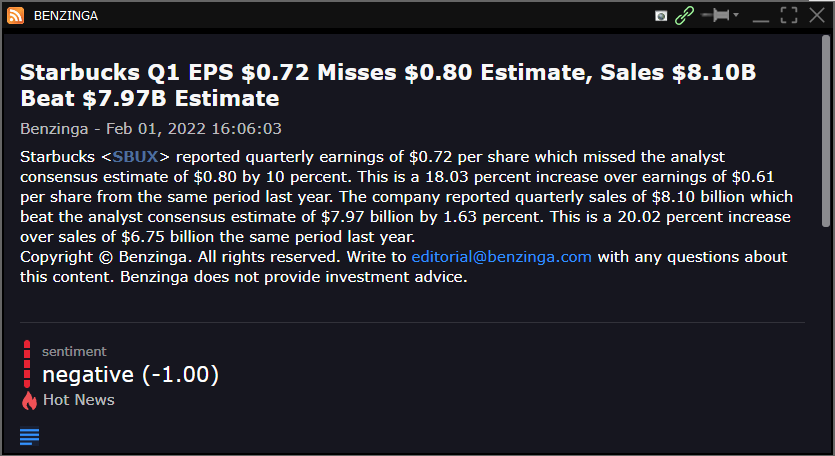

just gonna post some screenshots for those that missed it, but probably everyone’s all over the news if they’re playing this. something interesting is that same-store sales in their international division declined 3%, reflecting a 14% drop in China. expectations were +0.5%.

i think guidance, with diminished Q1, is going to be lowered. like meltedcrayon has said, any mention of “supply chain issues” during ER is sort of a death blow. labour issues will also be at the forefront. might not be enough to continue the downward trend, though.

thanks for everyone that contributed to the DD, especially @carlosdanger and those on TF today. gonna be interesting day tomorrow.

2 Likes

This thread can probably be archived now. Hope everyone who held puts overnight were able to profit early this morning. I’ve included a link to the conference call transcript if anyone still wants to look into trading SBUX post-earnings. The AH/PM price action here emphasizes just how important conference calls are. Here’s my takeaways:

-

On the conference call, “supply-chain issues” were not the death knell for SBUX which means that investors seem patient to give management a chance to regain margins of 17-18% by the end of 2022 and going into 2023. They’re going to offset most of their inflationary costs by raising prices (once already late in 2021) throughout 2022, using data analytics/AI to test demand elasticity. Most PTs have been cut or downgraded but still hover around the $100-$120 range.

-

They announced a share buyback which is also a boon to investors looking for a stable stock. The ex-dividend date of Feb. 10 means that we probably won’t see a sell-off for those that are holding, and may even see some buying, approaching this date.

-

Still, the challenges SBUX faces haven’t subsided and with their most profitable quarter just past, any new event could test the strength of the share price. I’m expecting any news of further unionization in the months ahead to create significant downward price action. But overall I’m impressed with the strength it’s shown today since the market seems overall red.

https://www.fool.com/earnings/call-transcripts/2022/02/01/starbucks-sbux-q1-2022-earnings-call-transcript/

1 Like

I know this thread was originally intended for an ER play back in January, but I saw an article earlier today that got me thinking about SBUX once again:

https://www.zerohedge.com/commodities/mega-emergency-unfolds-worlds-top-coffee-growers-fertilizer-costs-spike

I’m now wondering how reduced coffee bean harvests due to rising fertilizer prices will affect SBUX and other coffee related tickers going forward. I don’t really have a full fledged thesis yet, just gathering my thoughts for now.

In other SBUX news, some of the negative catalysts detailed in this thread back in January such as covid lockdowns in China and unionization still persist. In fact, the union push has even reached my neck of the woods in the Midwest. Also, CEO Kevin Johnson retired and our glorious leader Howard Schultz has returned.

https://www.thestreet.com/investing/starbucks-may-solve-a-big-problem-for-tesla-and-the-ev-industry

Interesting article about starbucks adding EV charging stations to their locations in an attempt to increase revenue. Also, if it’s not a problem I’ll probably continue consolidating SBUX news here that could potentially be used by the community in future plays

1 Like

Carlos, if it’s not too much trouble I would start another thread. Your insight and contribution is really valuable and imo it’s easier to recognize as a separate thread. Since we’ve had 2 earnings since this post the original posts might be a bit stale. I agree that the constraints still apply though