If you haven’t read the 12/29 watchlist, I recommend you do so before continuing.

Not a bad day today despite the volatile pullback we had early in the morning.

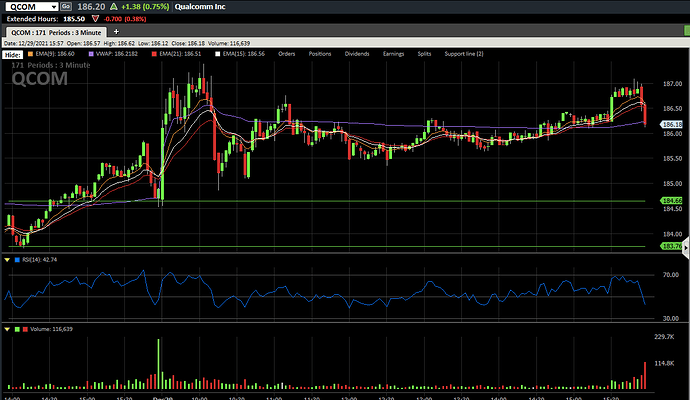

QCOM:

This one ran today. Didn’t give a chance for entry at our support/trigger point other than at open, so congrats if you bought there, could’ve scalped off of the 185 bounce after or small scalps off of 185.6 break, as well. Great pick.

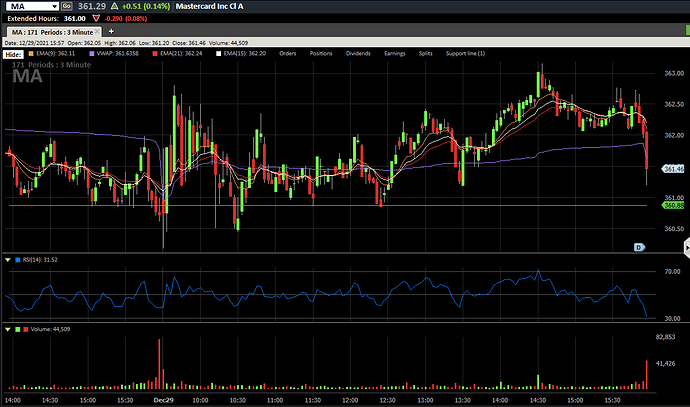

MA:

This one was great for scalping, bouncing off of our support/trigger level all through out the day. Also a nice pick. Congrats to those who took that trade.

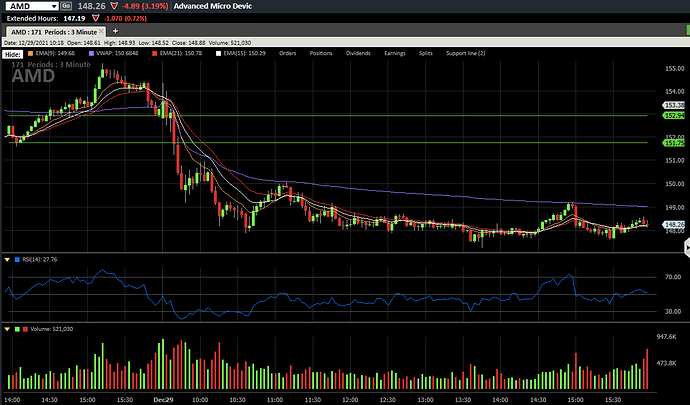

AMD:

Look at how they massacred my boy… The market-wide pullback in the AM pretty much messed up this play. Couldn’t recover for the rest of the day. Could be a good swing, in my opinion at this level, but that isn’t what this is about.

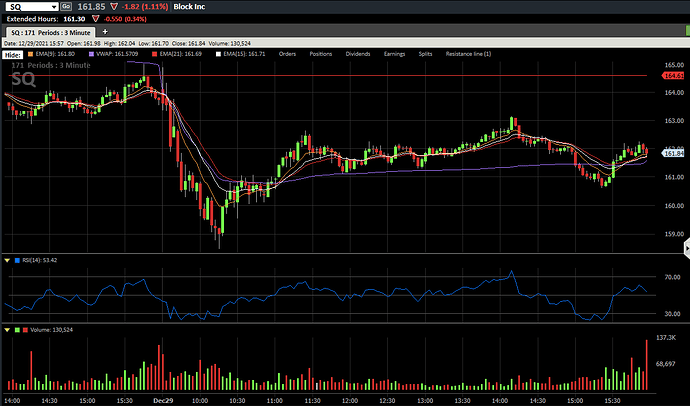

SQ:

This is another that ran right out of the gate. Immediately dumped. Could’ve picked up some puts at the wick back up to our resistance/trigger level. Congrats to any that took that trade.

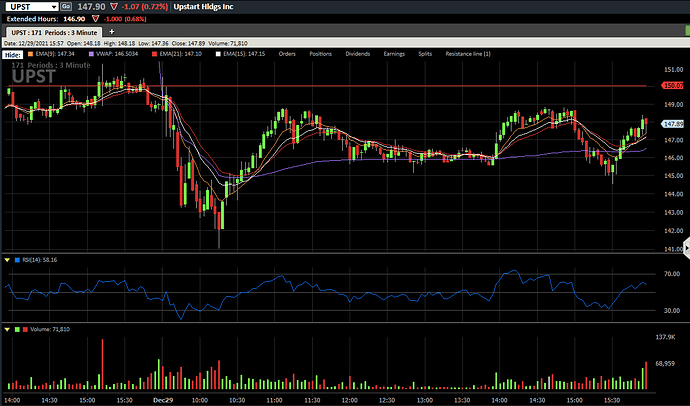

UPST:

Also ran right out of the gate. Could’ve picked up puts, like SQ, on that wick up to our level. Congrats to any that took this trade.

12/30 Watchlist

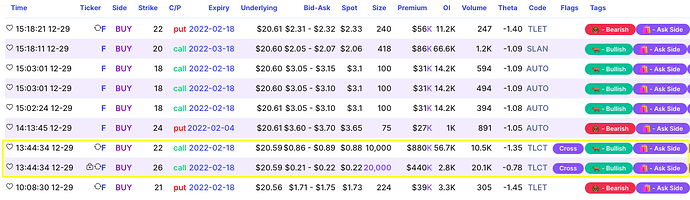

F:

A lot of bullish buying today, especially those two OTM call orders with hundreds of thousands in premium. I’m eyeing calls if the price stays above $20.56.

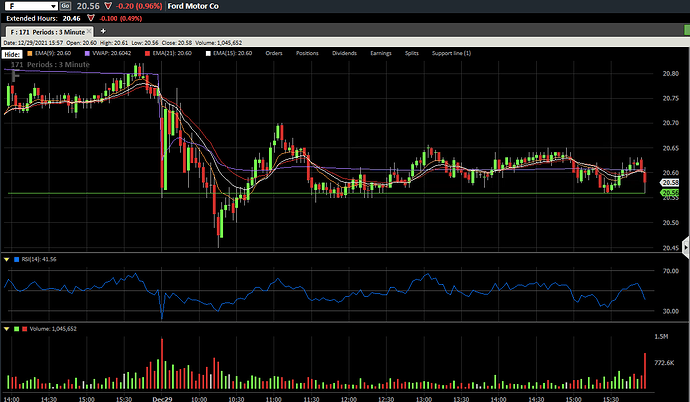

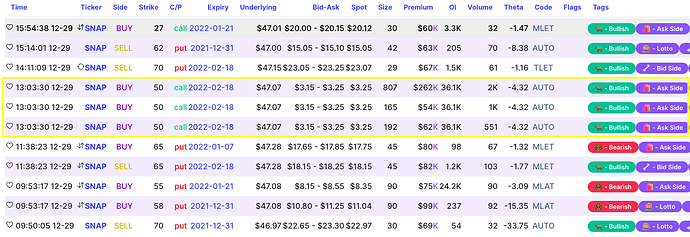

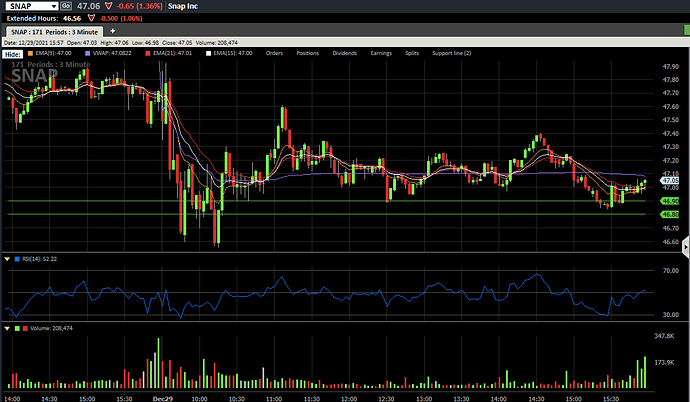

SNAP:

Also a lot of Bullish activity today, especially these slightly OTM call contracts I highlighted. I’m eyeing calls if the price stays above that 46.8-46.9 support area.

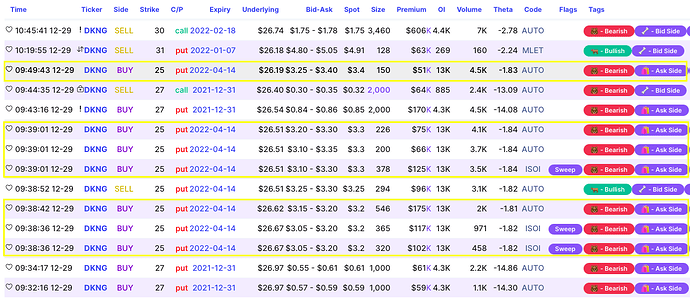

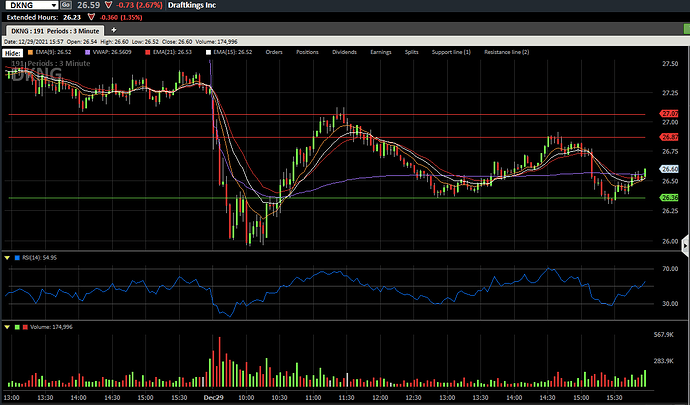

DKNG:

Looks like DKNG puts are back on the table, again. A lot of bearish activity with whales buying the OTM puts with premiums in the hundreds of thousands. I’m eyeing puts if the price stays below those two resistance levels I drew on the chart (27.07 & 26.87). A break below that 26.36 support would be beautiful.

Just some additional insight: beware of SPY correlation/price action. That market wide pullback thankfully only killed one of our three bullish plays. However, macroeconomic awareness is always a must when trading.

Good luck!!! And, as always, feel free to ask any questions/voice any concerns, or share any that are on your watchlist!!!

P.S. Do you prefer light mode or dark mode on the flow? I personally don’t care either way but do want to hear your thoughts.