There was a good discussion on TF Tuesday around when to enter puts/calls on SPY. @Sejit mentioned that he bought a put when SPY fell through support. Only for SPY to reverse and trigger his stop loss. This is not the time to buy, it’s a time to sell.

Once SPY breaks through support, you want to wait for it to come back to that point, and see if support has now become resistance. The opposite applies to taking calls. Don’t buy them when SPY breaks through resistance, wait for the price to come back down, and test the resistance line for support.

Another to thing to think about is the trend on the day. SPY was in a downtrend on Tuesday and there was not much positive news coming out. Buying puts on green candles (near resistance) would have given you the best entry. Don’t take a full position so you can average down if needed. Tuesday, for example, $421 and $422.30 become resistance throughout the day. If you were to take a put at $421, be ready to average down at $422 with another. Plan to cut at either the $420 or $419 support lines. With so much volatility in the market, taking small positions to preserve capital and compounding small gains is key. Way too easy to get blown out.

Lastly, when thinking about your stop losses and/or cutting if the trade moves against you, many use a fixed 5, 10, or 15%. This is a perfectly valid strategy, but another would be to set your stops just above a know support/resistance line. In the above example, you could set your stops at $423 (or $422.50 / $422.75 depending on your risk tolerance), to allow for a rejection of the resistance break.

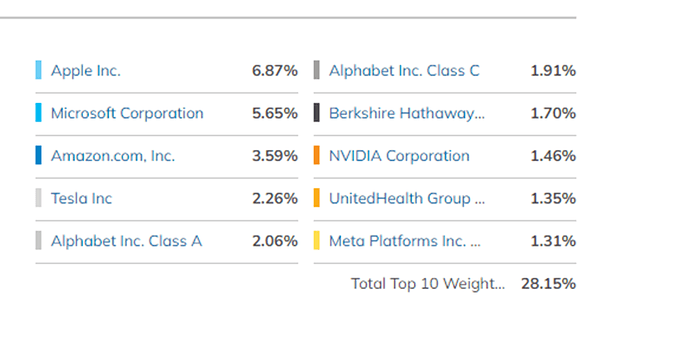

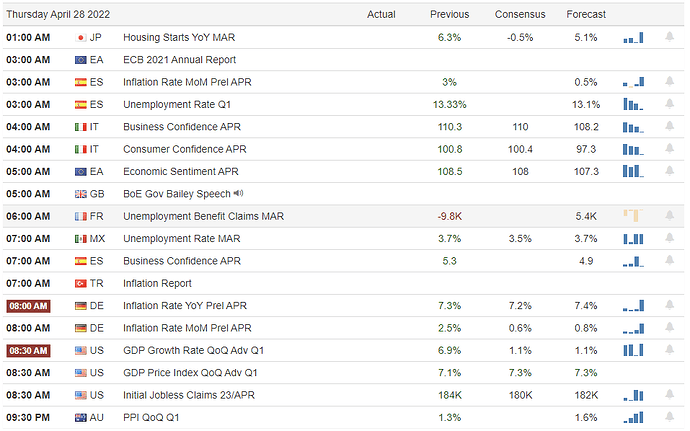

Related to this, keep an eye on the top holdings of SPY to get an idea for how it might move. These are AAPL, MSFT, AMZN, TSLA, and GOOG (they each make up more than 2% of SPY). Others to watch are BRK, NVDA, UNH, and FB. While they will typically trend similar to SPY, if you see a news pop (or drop) intraday, that can help in your scalping. Additionally, keep the market calendar in mind when thinking about sentiment / overall trend for the day. Finally, looking at how SPY traded overnight and during pre-market can help identify a direction in many instances.