If you haven’t read the 12/31 watchlist, I suggest you do so before continuing.

Great day for our plays. 3/3.

AFRM:

Great for scalping in the AM, kept bouncing off of our support level many times. Sold off towards EOD, so slightly disappointing, but still a good pick, overall.

AMD:

This one gave many entries throughout the day. After that big spike at open then consolidation at our level, there were many entries for our puts, including one tasty VWAP rejection that led to a sell-off into EOD. Great play.

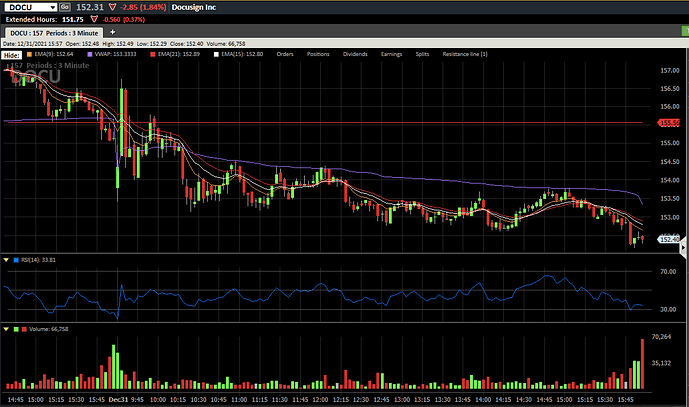

DOCU:

Scalpers dream. Gave two entries in the AM at our resistance level, then pretty much kept getting rejected at VWAP into EOD. Great pick.

Watchlist for 01/03

First off, Happy New Year!!! 2022 will bring us all many profits!!! Now, onto the watchlist. This one is short but sweet, with just two pretty high conviction picks:

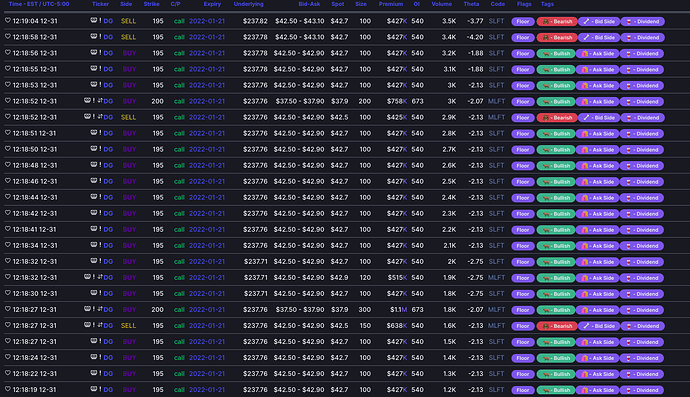

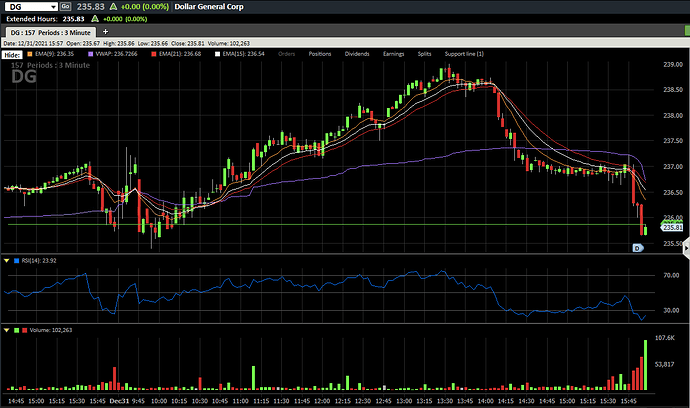

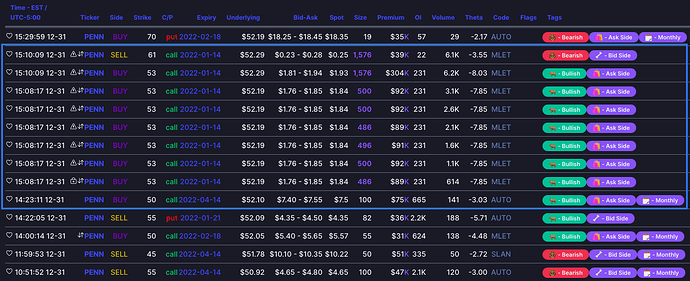

DG:

Look at all those calls being bought today. Millions of dollars in premium being spent today on 01/21/2022 exp call contracts. 01/03 is the ex-div date, so expect some volatility. I’m eyeing calls if the price stays above $235.88.

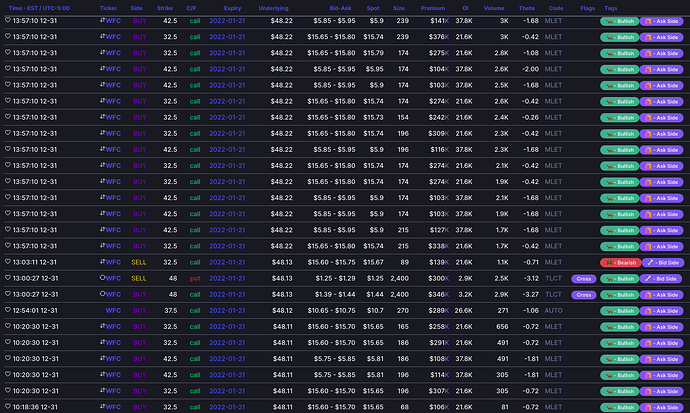

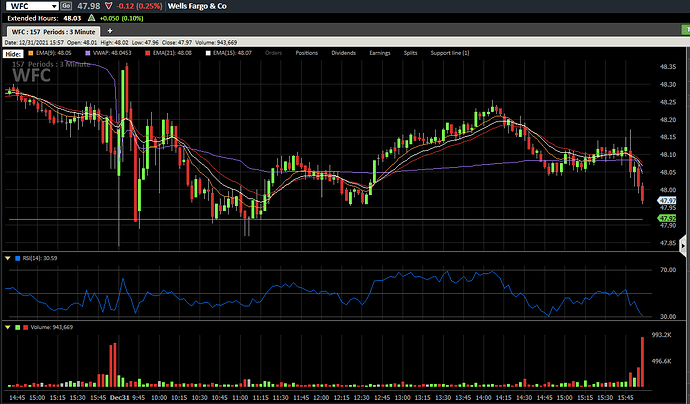

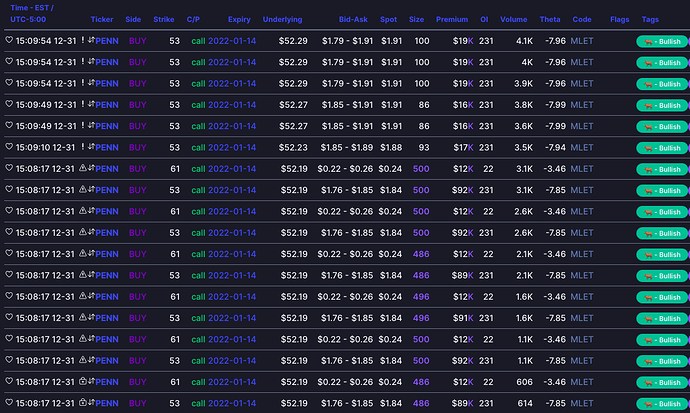

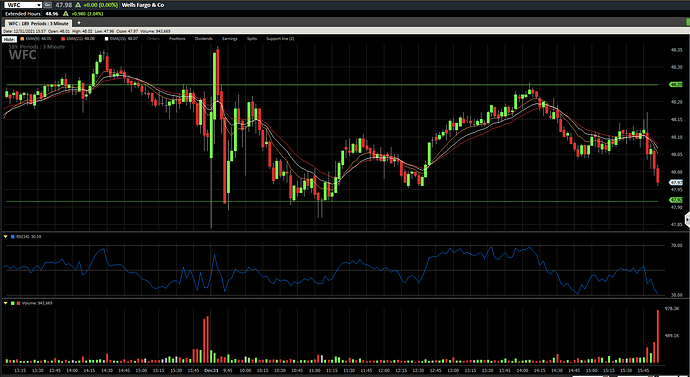

WFC:

Same deal as DG. Millions in premium being spent in 01/21/2022 call option contracts. I’m eyeing calls if the price stays above $47.92.

Happy New Year and good luck on Monday!!!