If you haven’t read the 01/03 watchlist, I recommend you do so before continuing.

For those in ESSC, congrats!!! For those who aren’t, join me in the NoPositionsClub as we play other stuff and not FOMO in at the top!

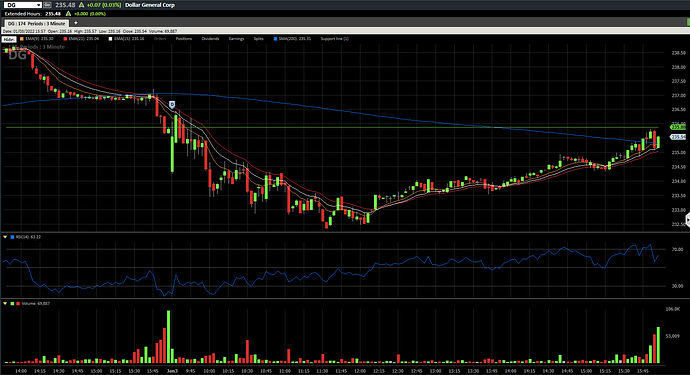

DG:

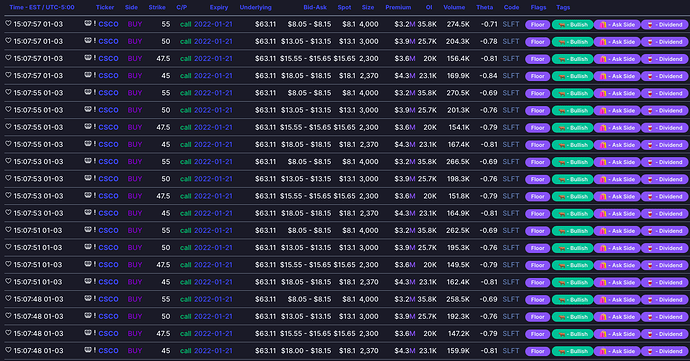

Flow was most likely from Hedge Funds looking to exercise their options and get in on the dividend date. For comparison, look at the CSCO option flow that came in today, for the exact same reason for tomorrow.

Couldn’t even fit it all in one screenshot. This is all most likely hedge funds who plan on exercising tomorrow in order to get the dividend. Needless to say, failed play.

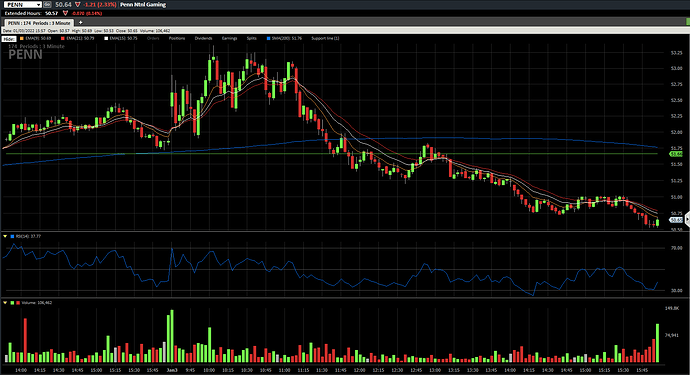

PENN:

For those who are experienced scalpers, this one was good for calls in the AM. Still going to count it as a failed play since it didn’t give us a good entry and sold off into EOD.

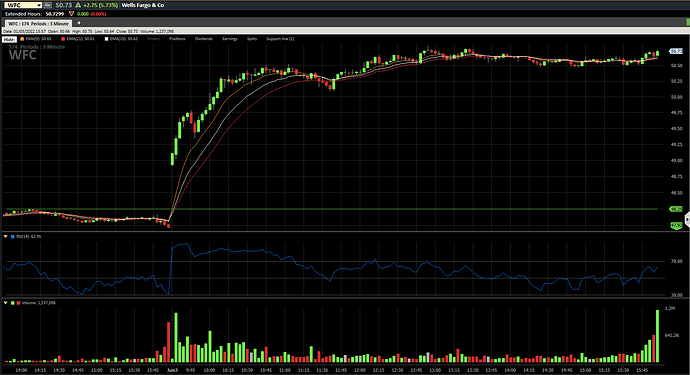

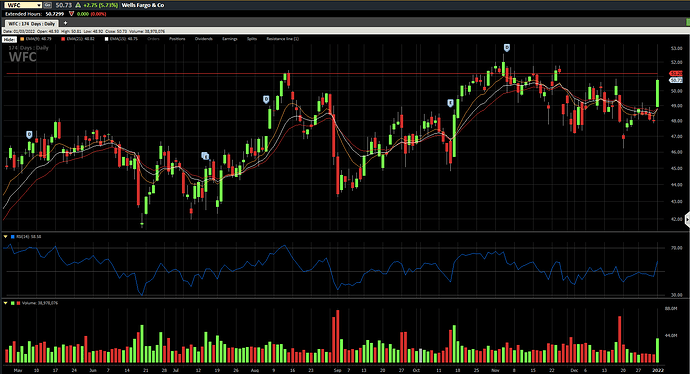

WFC:

Melted up. Gapped and went along with the other bank stocks. Didn’t really dip for a good entry at our level, but congrats if anyone got in. Still has some more room to run, in my opinion, if anyone wants to swing it. Still has a gap to fill at $51.20

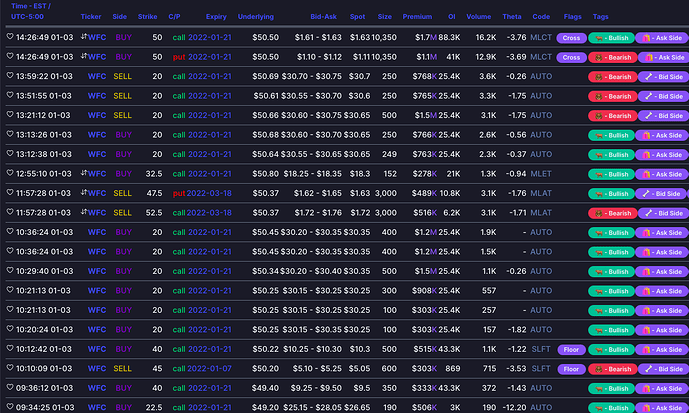

Whales are still betting on it, as well. Here’s the flow for today.

A lot of deep ITM calls being bought, and one ATM call bought near EOD for $1.7 M in premium. Some other Bank stocks that could be worth swinging, for anyone interested, are:

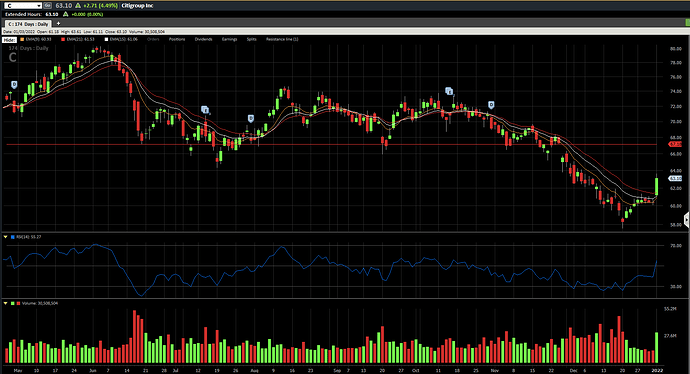

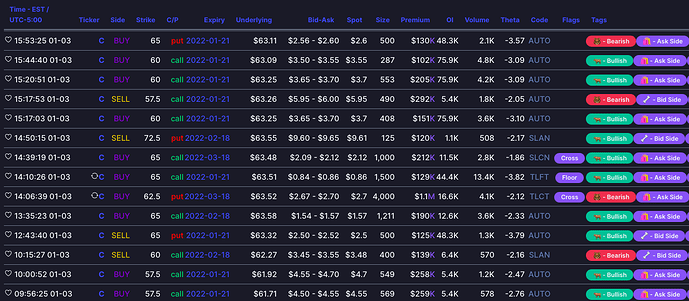

C:

Still has a gap to fill above at $67.18. Here’s what whales were doing today.

Slightly more mixed than WFC, but still overall bullish flow, with Whales picking up ATM, OTM, and Slightly ITM calls.

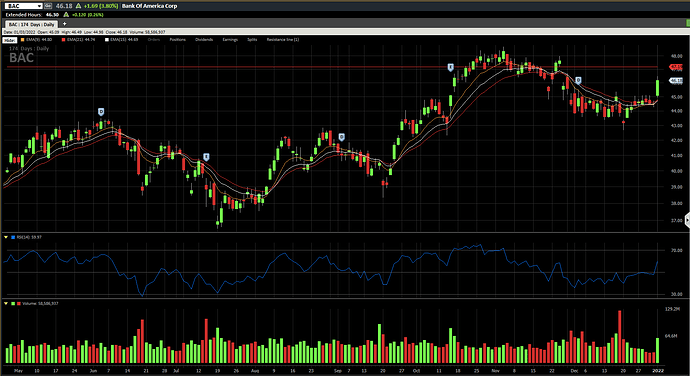

BAC:

Also has a gap to fill above at $47.19. Here’s what Whales were doing today.

Slightly less activity here, but still bullish, with whales mostly eyeing ITM and ATM calls.

Watchlist for 01/04

This one is a long one, so sit back and pick your favorite.

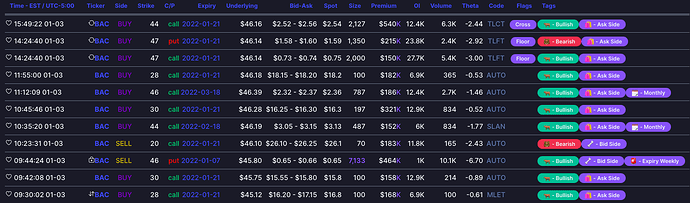

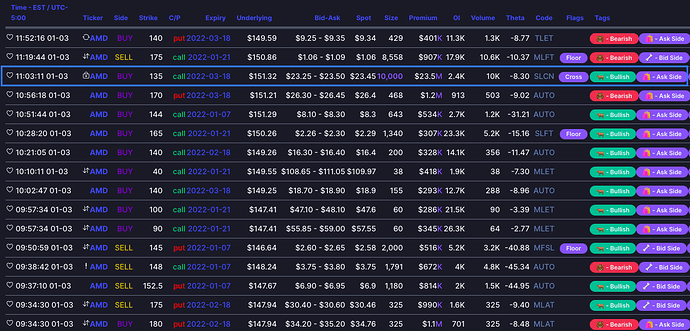

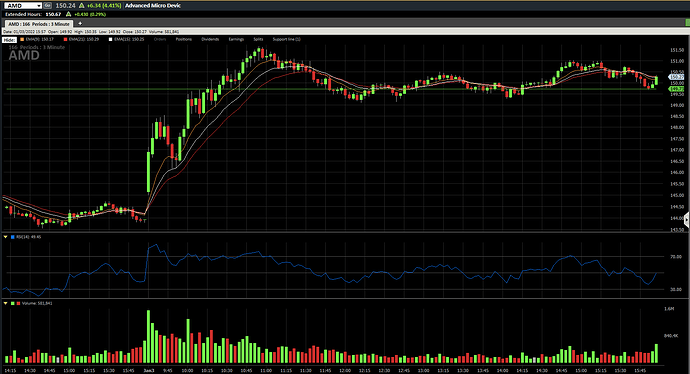

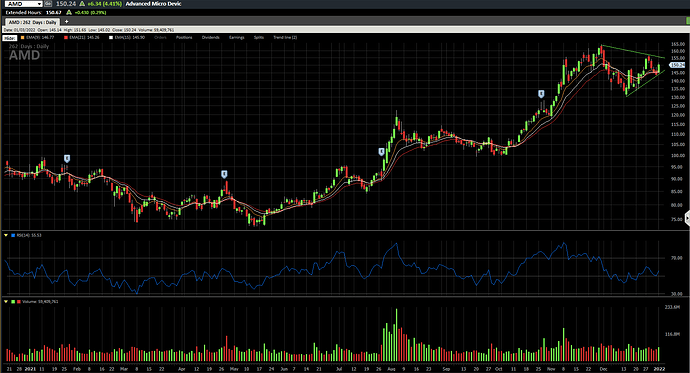

AMD:

Bullish activity from the whales, especially that one ITM order expiring in March for $23.5 M in premium. I’m eyeing calls if the price stays above $149.73.

Could also be a good swing play for anyone interested. Currently trading inside this triangle.

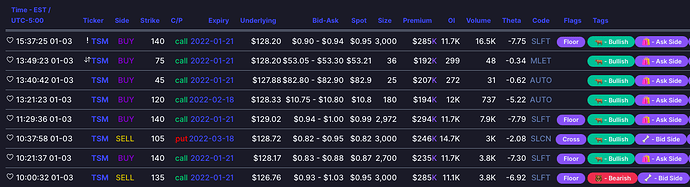

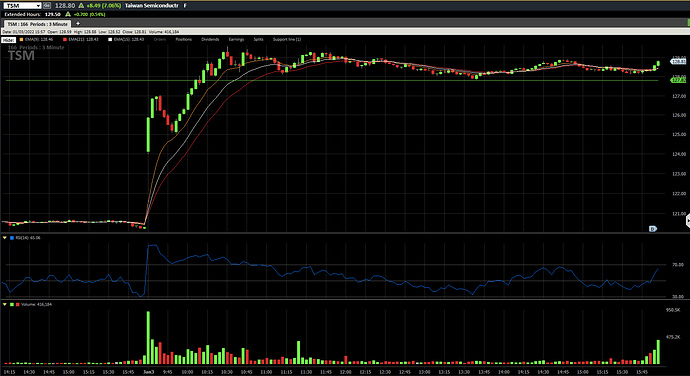

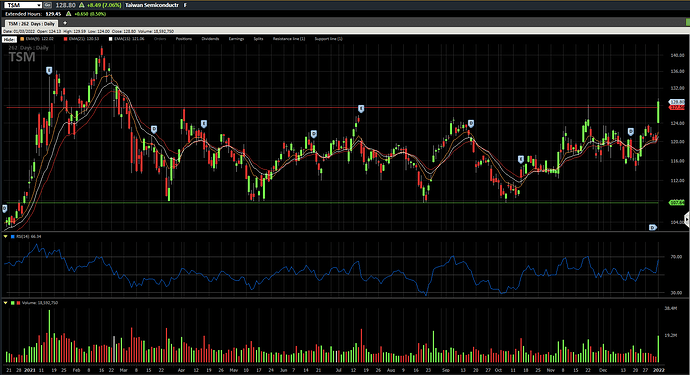

TSM:

Finally getting some love from the whales. A lot of $100k+ premiums being spent on calls, some even OTM monthlies. I’m eyeing calls if the price stays above $127.82

Could also be a good swing trade now that it’s breaking out of the channel it has been in for the past few months.

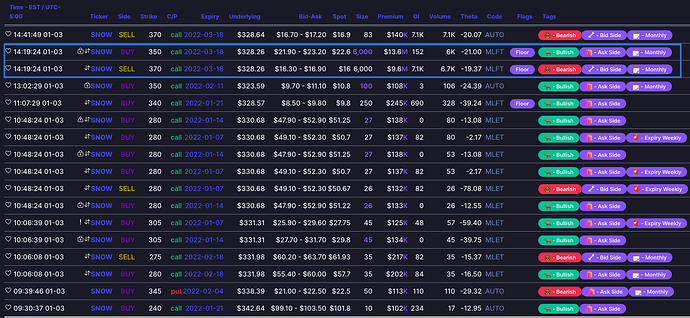

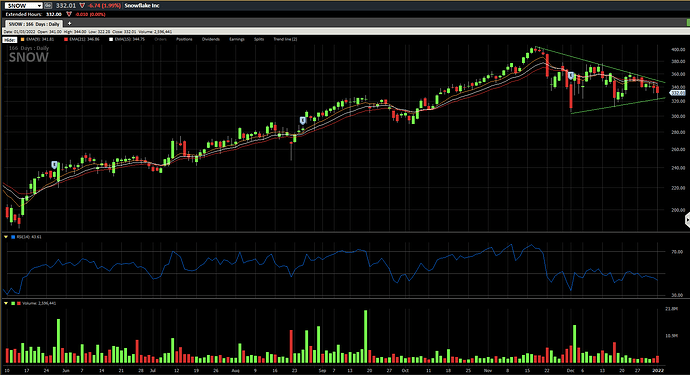

SNOW:

Whales bought the dip today, with one whale opening an OTM call spread for millions in premium. I’m eyeing calls if the price stays above $329.96.

Also a potential swing trade, currently trading inside a triangle.

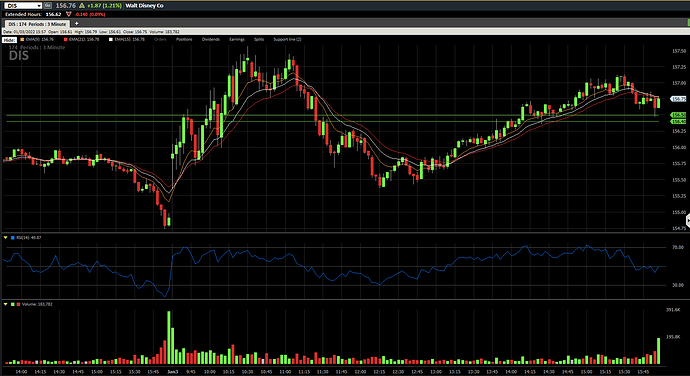

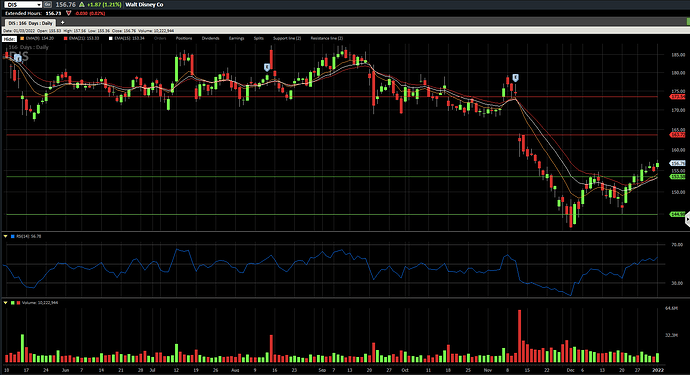

DIS:

Lots of monthly calls being bought in the House of Mouse, mostly ITM and ATM. I’m eyeing calls if the price stays above this $156.40-156.50 range.

Could also be a good swing trade. Found support with that double bottom and has that gap to fill above at $173.54

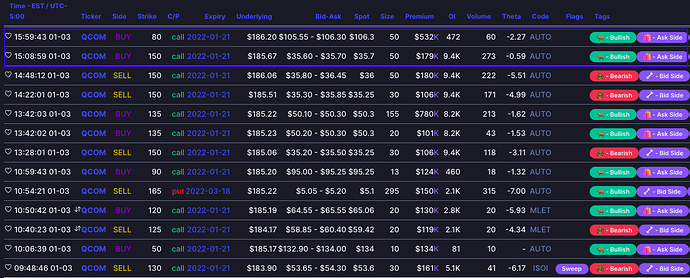

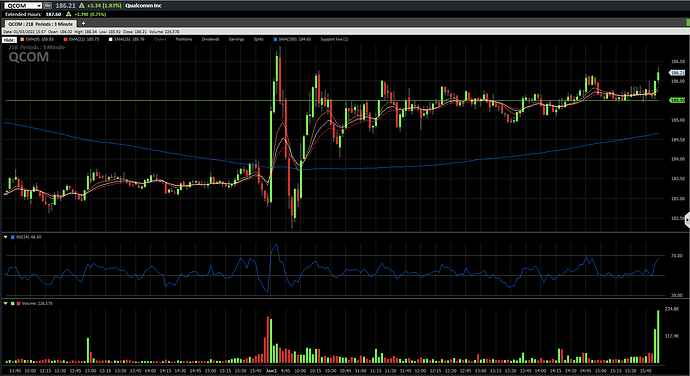

QCOM:

Lots of bullish activity from the whales on the 01/21/2022 calls, especially deep ITM going into EOD. I’m eyeing calls if the price stays above $185.50

Good luck tomorrow!!!