If you haven’t read the 01/04 watchlist, I recommend you do so before continuing.

For those in ESSC, congrats!!! Hope you bought those tasty dips today. For those of us in the NonESSCClub, I got you. Scroll down for a few ideas on plays for tomorrow.

Before we do talk about the watchlist for tomorrow, I want to first talk about today. Pretty rough day today overall, had a few winners and a few losers. Here’s how it went.

QCOM:

Scalped this in the AM for a 30% gain. Recovered into EOD, could’ve also scalped once it broke our level for some quick profits. Decent pick.

SNOW:

Sold off, no other way to say it. Bad play. Used our level for a little consolidation before the next leg lower and didn’t recover for the rest of the day.

AMD:

Also sold off, Had a little pause at our level, but then dipped without recovering for the rest of the day.

TSM:

Gapped and stayed above our level. Congrats to anyone that took this, I personally didn’t chase. Decent pick.

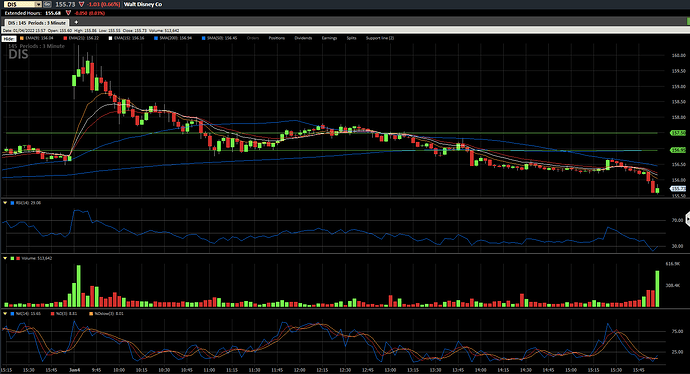

DIS:

Gapped up hard but sold off into EOD. Had a quick bounce off of our level midday, but pretty disappointing overall.

Before we get into the watchlist, quick PSA. Tomorrow is FOMC minutes. Will most likely have some volatility. Just a quick heads up. And one more thing that I haven’t mentioned on these. Be mindful of spreads. Try to go for contracts that have high liquidity and tight spreads, if possible. If not, always bid low and don’t chase.

Now sit back and pick your favorites, we have a long one again.

Watchlist for 01/05

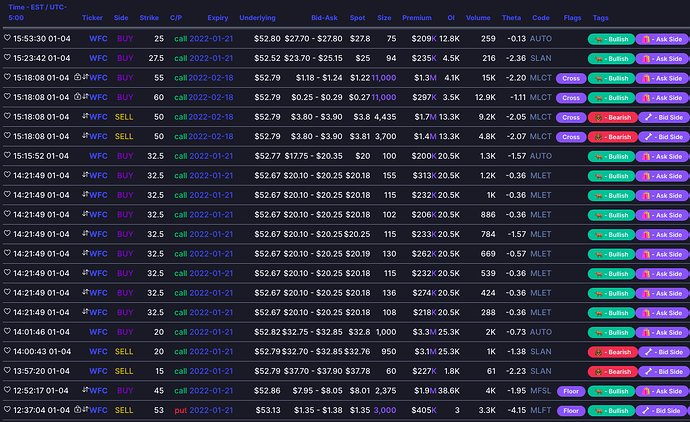

WFC:

Mentioned last time that it was still on for a quick swing. Looks like whales agree that it still has room to run. I’m eyeing calls if the price stays above the $52.42-52.53 support area.

PINS:

ITM monthly puts being bought up going into EOD, I’m eyeing puts if the price stays below $33.22.

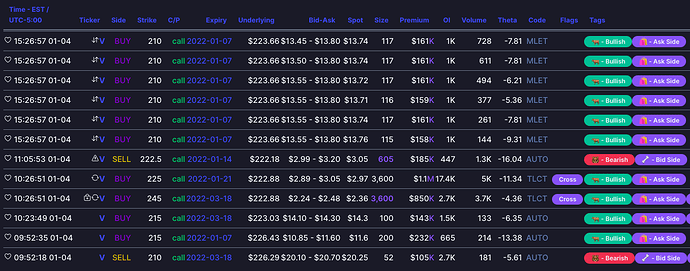

V:

This payment giant looks to be recovering, testing the 200 on the daily. Whales agree that the recovery has started and has room to run. I’m eyeing calls if the price stays above $221.84.

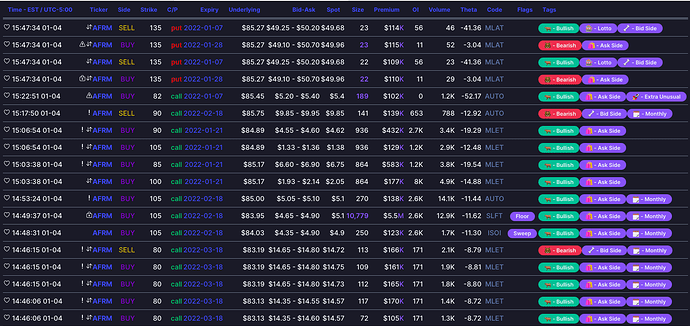

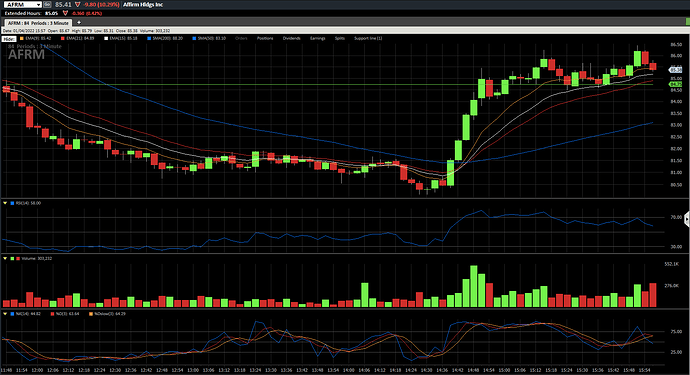

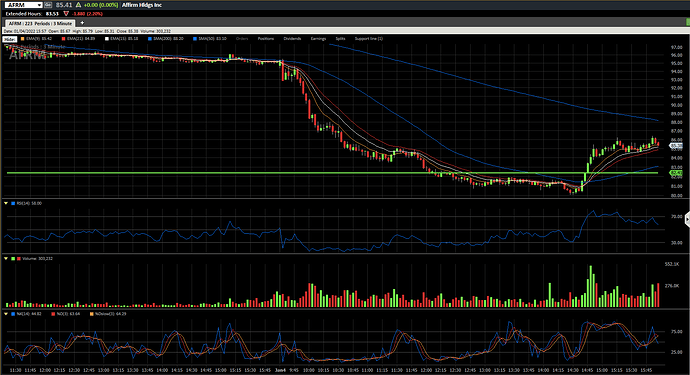

AFRM:

Lots of call buying going into EOD, even after the rally we had going into close, plus one OTM monthly order being bought for millions in premium. I’m eyeing calls if the price stays above $84.75.

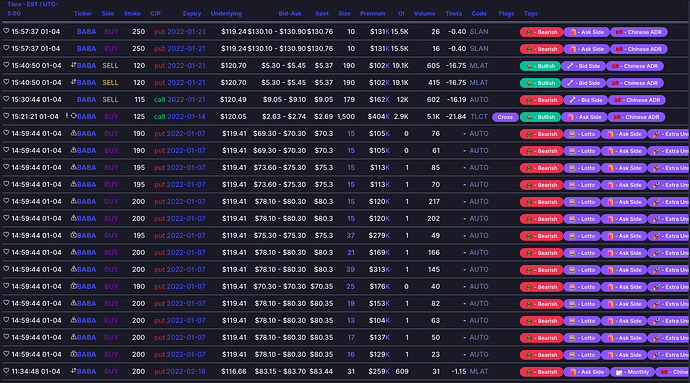

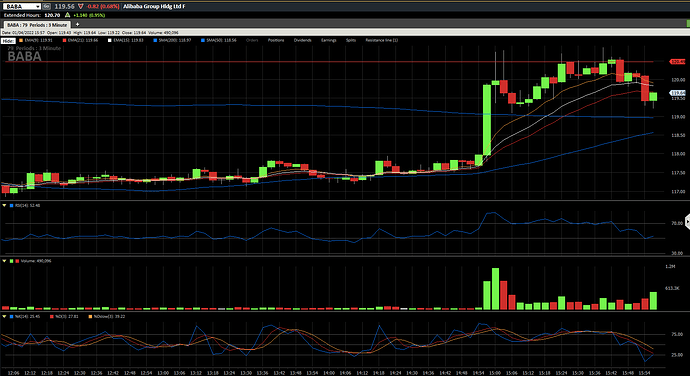

BABA:

Look at all those deep ITM puts being bought going into EOD, most, if not all, to open even after the mini-rally it had going into EOD to fill the gap down it had this AM. I’m eyeing puts if the price stays below $120.49.

Good luck tomorrow!!!

P.S. Just some quick info for the people that have been asking about how I look for these plays. I like to filter for premium and DTE. Some other stuff goes into it, too. For example, if I were to follow all the flow I saw, I would not be very happy…

Talk about throwing away money lol.

Anyways, good luck!!! And remember, FOMC and be mindful of spreads!!! DON’T CHASE