If you haven’t read the 01/13 watchlist, I suggest you do so before continuing.

Disclaimer before continuing: My Schwab charting software is down, so I had to do the charting on TradingView.

Pretty decent day for our picks. This is how it went.

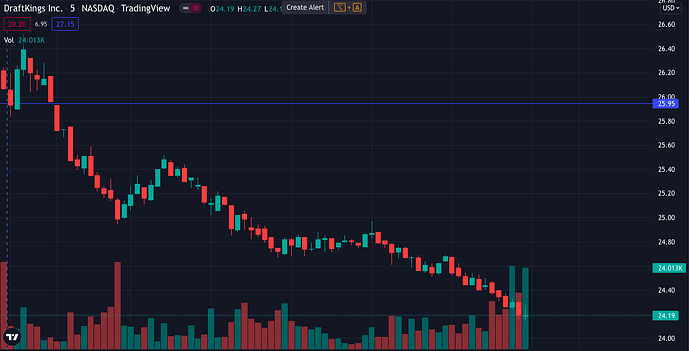

DKNG:

Had a spike in the morning after testing our level. Scalping that spike could’ve netted you 50%+ depending on the contract/entry. Decent pick.

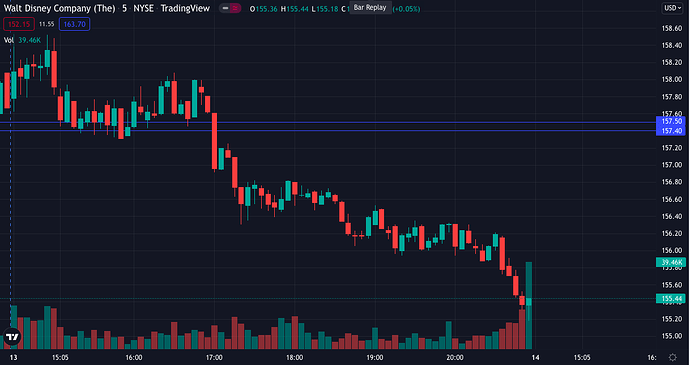

DIS:

Had some consolidation at our level, then a small run that could’ve netted around a 20% scalp. Decent play.

NFLX:

Probably the easiest trade to take from the watchlist today. There was a perfect entry after it broke then retested our level and would’ve caught the sell-off into EOD. Great pick.

Watchlist for 01/14

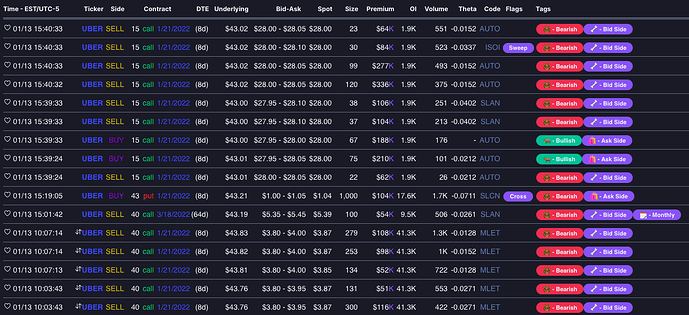

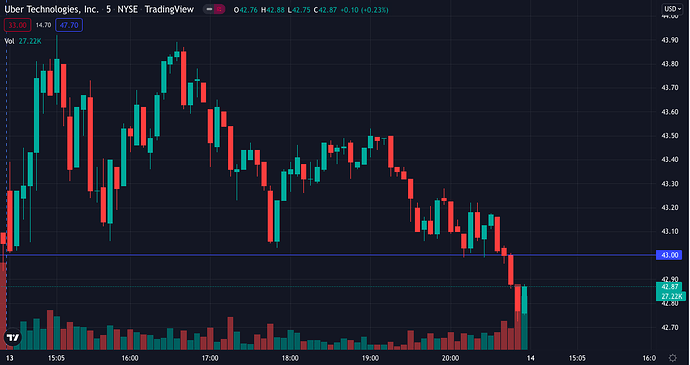

UBER:

A lot of exiting deep ITM positions going into EOD. I’m eyeing puts if the price stays below $43.00

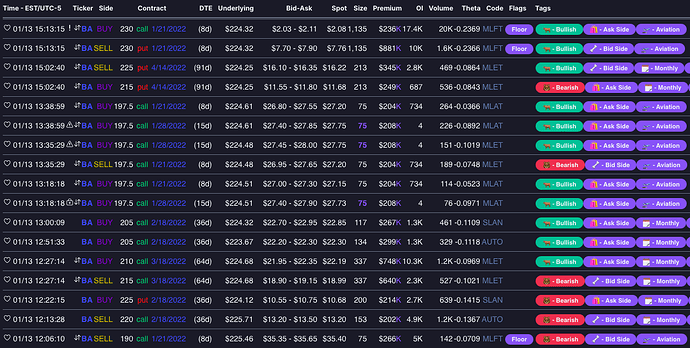

BA:

A lot of call-buying going into EOD, even after it had ran intraday. I’m eyeing calls if the price stays above $223.36

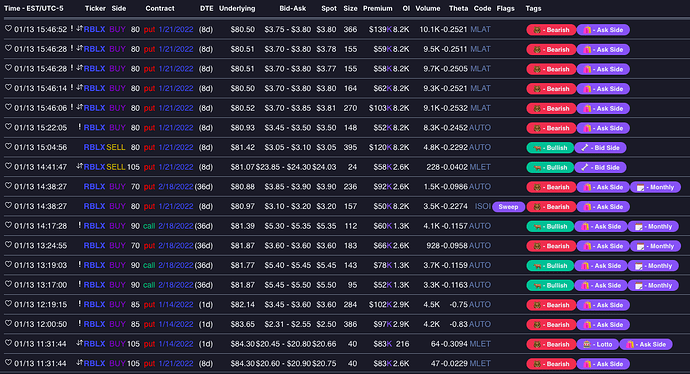

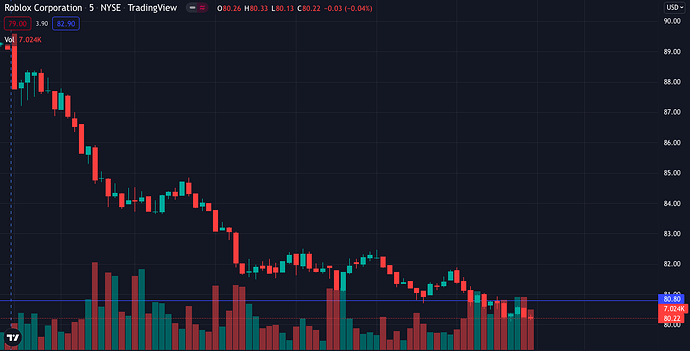

RBLX:

1/21 $80 puts getting hit 15 minutes from EOD. I’m eyeing puts if the price stays below $80.80.

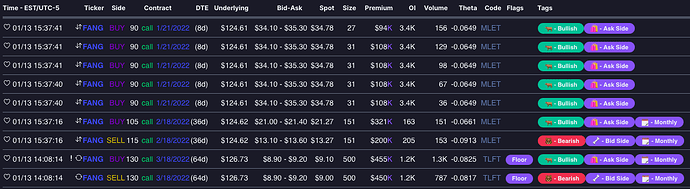

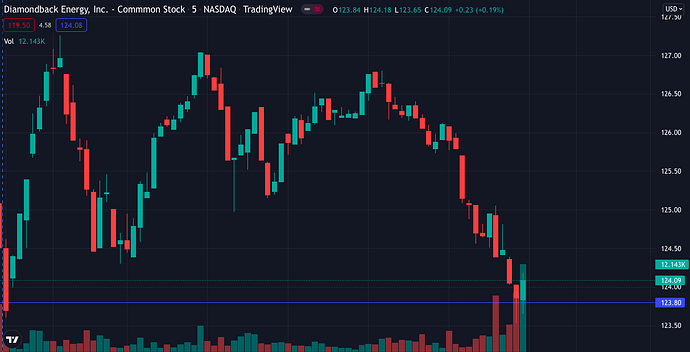

FANG:

A lot of $90 calls for 1/21 being bought going into EOD. Doesn’t have great spreads, so bid low. I’m eyeing calls if the price stays above $123.80

Bonus Picks for anyone interested:

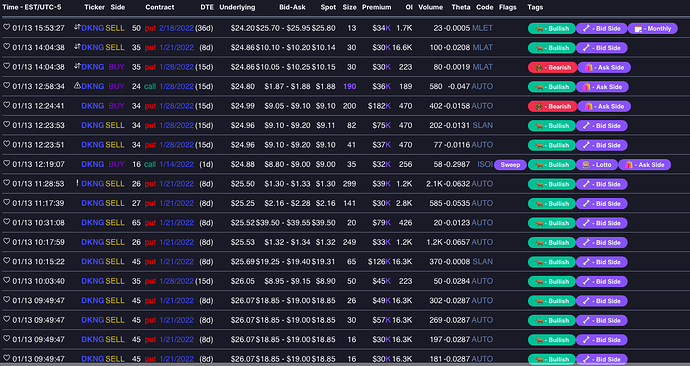

DKNG

This one still has some bullish flow from whales exiting their puts. Could have some scalping opportunities to the upside.

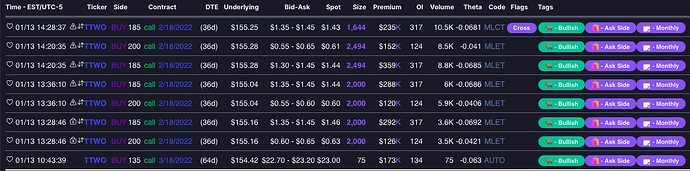

TTWO:

A lot of OTM call buying expiring in February. Could have scalp opportunities to the upside, or even a swing?

Good luck tomorrow!!!