I’m going to start trying to publish a watchlist whenever I can based purely on following the big money. This is the first of hopefully many watchlists I will try to post in the future. I’m going to try my best as to call out what entry would be best for the plays I list, however I’m going to assume that you at least have some experience on how to scalp, enter, and exit trades. For this watchlist, it is recommended that you are allowed to day trade or at least have a WeBull cash account which lets you trade with the settled funds you have.

Monday 12/27 Watchlist:

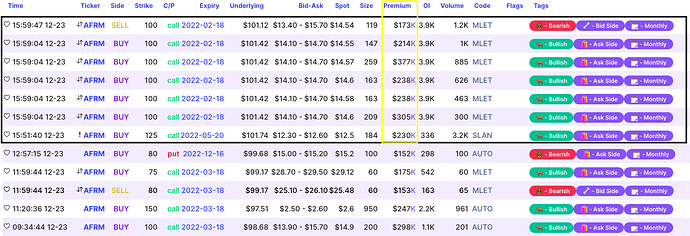

- AFRM

A lot of bullish activity into close the ATM Calls for 02/18/2022. Premiums being spent on monthly calls are in the hundreds of thousands. This could present an opportunity to scalp calls intraday. I will be eyeing the $100.94 level as potential support and perhaps an entry opportunity.

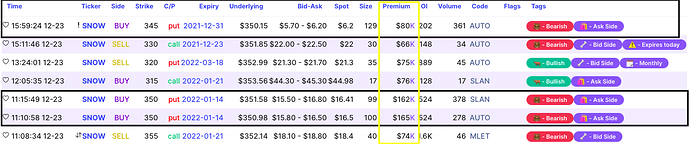

- SNOW

A lot of profit taking and bearish activity amongst the whales. I will be eyeing $349.12 area for a potential entry for puts.

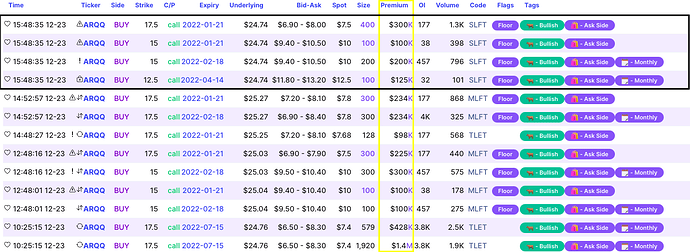

- ARQQ

A TON of bullish activity on 12/23 for ARQQ, with premiums in the hundreds of thousands, and even one print in the millions. I will be eyeing the $24.87-24.90 area for a potential area for calls.

Feel free to contribute your own picks, or any questions/concerns.