If you haven’t read my 12/28 watchlist, I suggest you do so before continuing.

TL;DR of the Analysis Portion: Beautiful open and AM, disappointing rest of day into EOD.

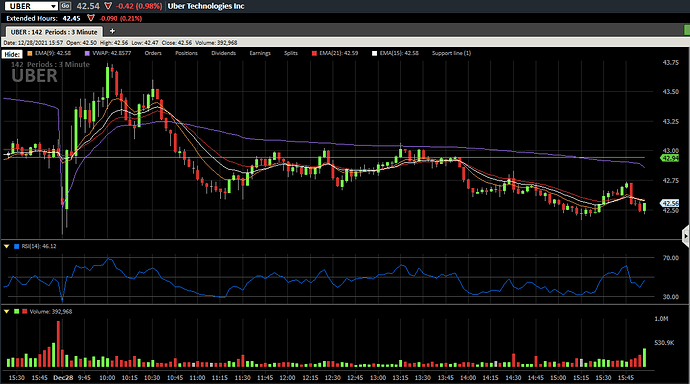

UBER:

Ran right out of the gates with a small hesitation at our support line, bull flagged, then broke out into the high of day at 43.75. Great trade if you got in at support at open, but disappointing the rest of the day.

RBLX:

Beautiful trade (only one I took today due to spending time with family. That’s why the watchlist is being posted this late) if you got in on that retracement to our drawn support at around 10:00 am. As I said with UBER, disappointing into EOD.

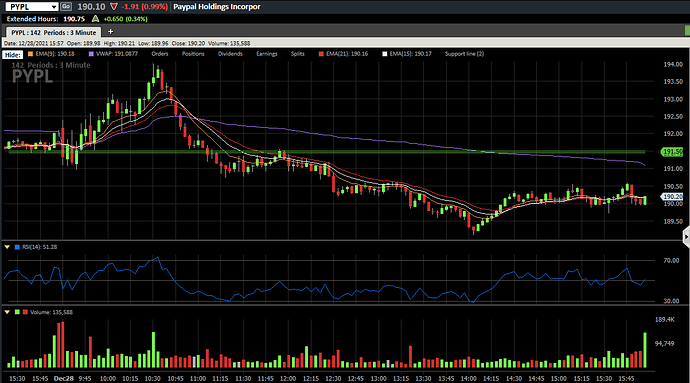

PYPL:

Consolidated at support at open before running into HOD at 194. Great trade if you got in at our level, but, again, disappointing into EOD.

DKNG:

Probably the most beautiful on our watchlist. 28.5 resistance got rejected many times, allowing for many entries, and the only play that was beautiful into EOD.

Watchlist for 12/29

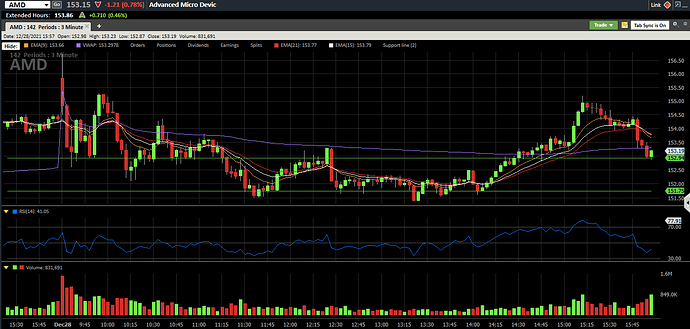

AMD:

A lot of bullish buying on short-term options with premiums in the hundreds of thousands. I’m eyeing calls if the price stays above 152.94 (included a second level of support at 151.75 in case our first breaks, but personally wouldn’t enter if 152.94 doesn’t hold).

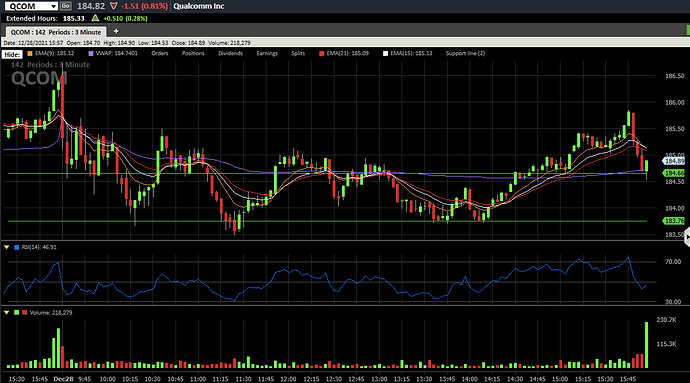

QCOM:

A lot of Bullish buying in short term contracts with premiums in the hundreds of thousands (before you ask, the crossed out trades are orders that were cancelled by a broker). I’m eyeing calls if the price stays above 184.66, but, as with AMD, I’m including a second support at 183.76 for anyone interested (again, personally wouldn’t enter if 184.66 is broken).

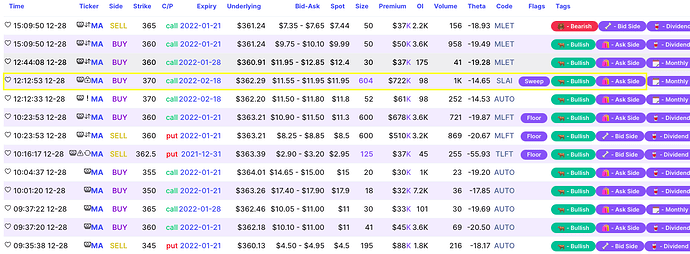

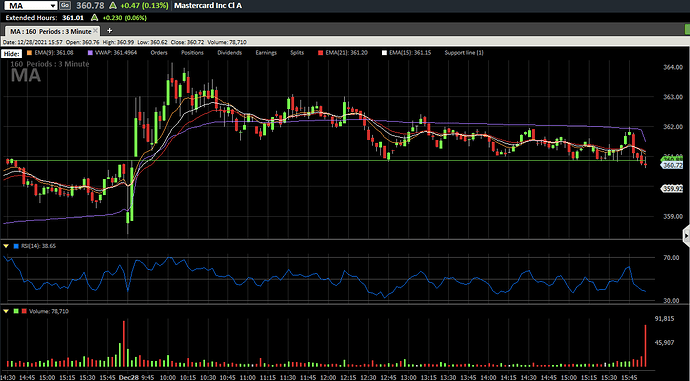

MA:

A lot of Bullish activity on short-term contracts, with one order in out-of-the-money call contracts with $722 K spent on premium. I’m eyeing calls if the price stays above $360.88-360.9 support area.

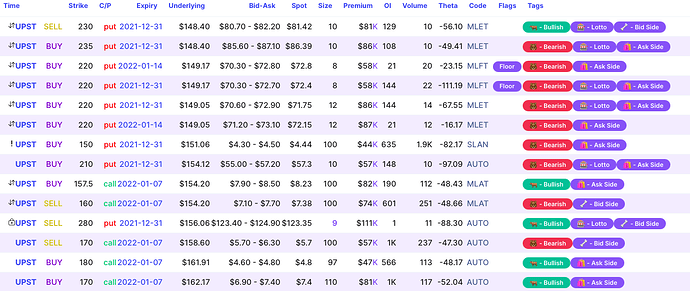

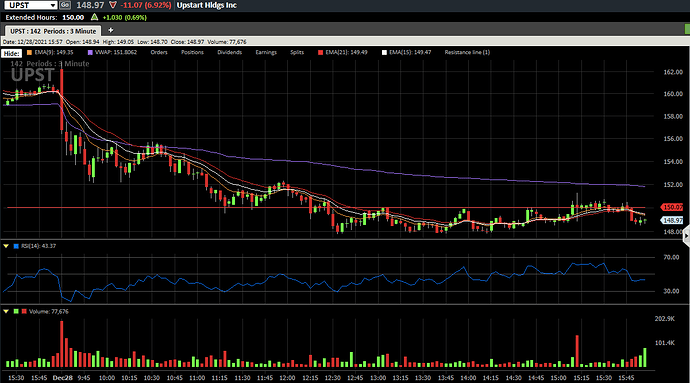

UPST:

A lot of Bearish activity on short-term contracts, even after the stock had knifed more than 5%. I’m eyeing puts if the price stays below $150.07 resistance.

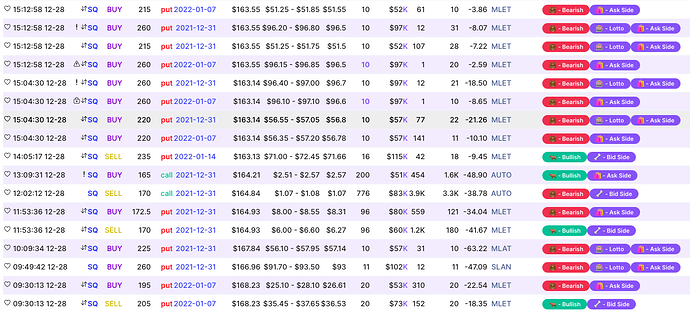

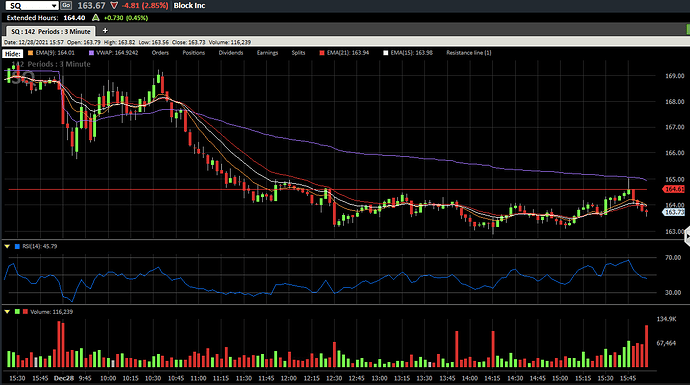

SQ:

A lot of bearish activity on short-term contracts with premiums above $50K. I’m eyeing puts if the price stays below $164.61 resistance.

Feel free to ask questions/voice any concerns or share any that you’re watching for tomorrow!