*Hope I caught your attention. But first things. First.

A.) I have zero fucking clue what I’m doing so take all this with a grain of salt and please please look over everything and challenge/ ask questions

B.) I currently do not have a position

tl;dr: SE reports earnings BMO on 11/16 and I think there’s potential for some nice gains (finally playing calls)

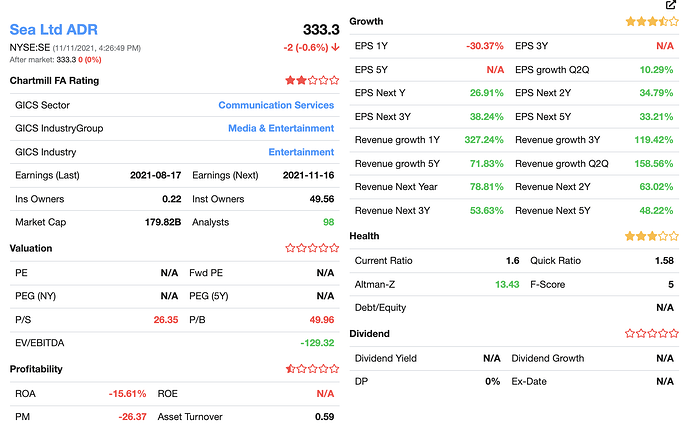

SE: Sea Limited is a leading global consumer internet company founded in Singapore. Its mission as a company is to better the lives of consumers and small businesses with the help of technology. For now, it operates through three core businesses across digital entertainment, e-commerce, as well as digital payments, and financial services. Impressively, SE stock has risen more than 75% since the start of the year.

Garena is the company’s gaming segment that provides global users access to popular and engaging games. Through its platform, gamers can socialize and build communities to have a better time. For those unfamiliar, Garena is the developer of Free Fire, a popular mobile battle royale game. This is the most downloaded mobile game globally in 2019 and 2020. And it is the profitable gaming division that played a role in helping to fund the growth of Sea’s e-commerce arm.

Financially, Sea has also been trending in the right direction. For its second quarter, its GAAP revenue was $2.3 billion, an increase of 158.6% year-over-year. Meanwhile, it posted a gross profit of $930.9 million, representing an increase of a staggering 363.5% year-over-year. So, would you consider buying SE stock ahead of its third-quarter earnings report on November 16?

Lets chat some more via charts:

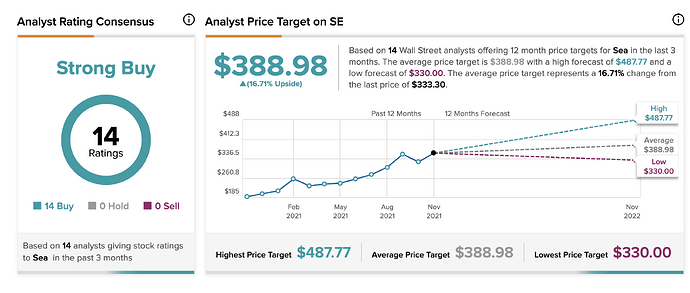

What are analyst saying (today 11/11 we closed at $333)

Again. First timer here. Don’t come yelling or dropping the “I told ya so”

Let me know what ya’ll think - give me feedback. I’m trying to get better