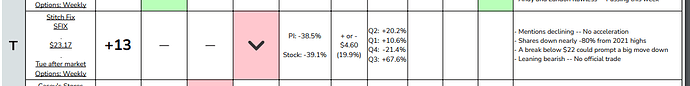

Earnings in the AH of December 7th.

What is it? StitchFix is an “Online personal styling service.” Basically, you answer some questions, and they send you boxes of clothing at certain intervals and you decide what you want to keep. Yes, it’s dumb.

YTD, SFIX is already down over 60%. Yet, I’m gambling that it can go lower. The expected growth for the quarter being reported is estimated to be, at best, 23% lower than the growth at the end of fiscal year 2021. Are they trying to simply hit a low bar? As of last reporting, they had 4.2 million active customers at an average annual spending rate of over $500. Their clothing isn’t cheap, so this average means that customer is probably buying 4-5 items a year. Management’s official fiscal 2022 forecast calls for sales to rise just over 15%, while its adjusted EBITDA margin lands around 2%.

IMO, their business model finds itself in a weird place due to COVID. Consumers are now returning to stores, but retail is still suffering. Somehow both of these would seem to negatively effect StitchFix. Anecdotally, I don’t know a single person who has used StitchFix on a recurring basis. While I have friends who have tried it, I don’t know anyone who has stuck with it. Additionally, Nordstrom’s TrunkClub is a direct competitor and other similar brands like Ann Taylor and Express have similar programs.

Bull case? The only thing I’m seeing right now is that you can now buy items directly as opposed to having to order the box. But why would StitchFix be your first stop if you’re looking for clothing? Answer: it wouldn’t.

This earnings season, we’ve seen that retail has done poorly. Online consignment like Poshmark also shit the bed on earnings. I’m struggling to find a reason why SFIX will buck this trend. I’d expect supply chain struggles and shipping challenges to disrupt their model as well.

Some analyst info which contradicts my DD: Stitch Fix (NASDAQ:SFIX) was upgraded by stock analysts at Morgan Stanley to an “equal weight” rating in a research note issued on Friday. The brokerage presently has a $27.00 price objective on the stock.

SFIX has been the topic of several other research reports. Truist dropped their price target on shares of Stitch Fix from $77.00 to $60.00 and set a “buy” rating on the stock in a research note on Wednesday, September 22nd. Telsey Advisory Group dropped their price target on shares of Stitch Fix from $84.00 to $55.00 and set an “outperform” rating on the stock in a research note on Wednesday, September 22nd. MKM Partners dropped their price target on shares of Stitch Fix from $31.00 to $19.00 and set a “sell” rating on the stock in a research note on Thursday. Barclays dropped their price target on shares of Stitch Fix from $59.00 to $37.00 and set an “equal weight” rating on the stock in a research note on Wednesday, September 22nd. Finally, UBS Group initiated coverage on shares of Stitch Fix in a research report on Thursday. They issued a “neutral” rating and a $30.00 target price for the company. Two research analysts have rated the stock with a sell rating, ten have given a hold rating and seven have given a buy rating to the company’s stock. According to MarketBeat, Stitch Fix currently has an average rating of “Hold” and a consensus target price of $78.10.

I’d love to hear others thoughts on this one, especially with regards to their financial expectations.

glad I joined the play.

glad I joined the play.