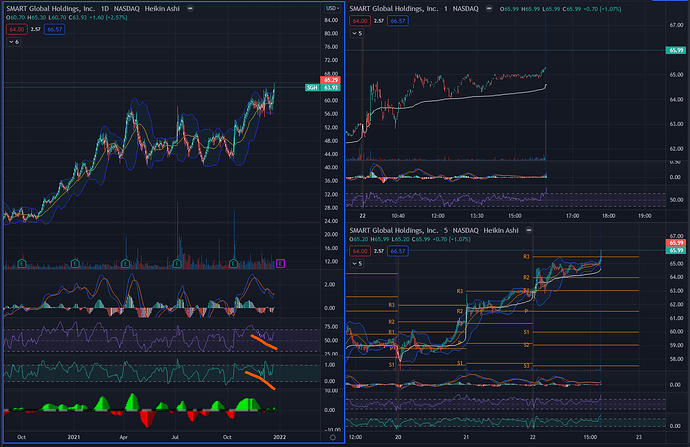

SGH – SMART Global Holdings

I pulled this company from the brainstorming earnings excel file .

Mainly starting this thread for me to add onto as I continue to research the company up to earnings. Feel free to add into this if you have read anything or have any other knowledge on this company.

Who is SGH?

SGH is a semiconductor chip manufacture and we all know that we love technology shit. We have seen plenty of green days with software and hardware companies recently with the technological increase of use because of COVID.

Prior to COVID, SGH was boring as hell with only dabbling in one portion of tech (chips). Recently, as in August of 2020, Mark Adams took over as CEO and has completely changed the dynamic and direction of the company. Wanting to see the company step its foot into other areas, he decided to the CREE LED business unit from CREE (NASDAQ: WOLF). With this acquisition, he is also pumping money into R&D and are in the AI space as well.

SMART Modular | Industrial DRAM Module | Industrial Flash Product | Industrial RUGGED SSDs

This company has also been on a rip in 2021, trading at 75% growth

Jan 4th - $38.61/share

Today - $65.29/share

Previous Earnings:

Previous two earnings for SGH have been good for the company, beatings EPS both times and subsequentially jumping up their share price by 18% the following day. After the July earnings gap up, SGH then proceeded to gap back down to the pre-earnings price and range between the $42 and $50 area until the October earnings were released.

Since October earnings, they have been in an uptrend and are currently trading at its 52 week high.

JUL 21

OCT 21

In a recent interview, SGH stated that the supply chain issues we have seen in other companies are not currently affecting their business. (just something to keep in mind)

What do analysts think?

From what I have read so far, the sentiment for this particular company us bullish. Both in the short term and long term. PTs I have seen range from $75-$85 and have remained as a recommended buy for the last few months.

As I dig deeper into this company, I will be looking for the bull/bear case for earnings in January 2022 and long-term outlook.