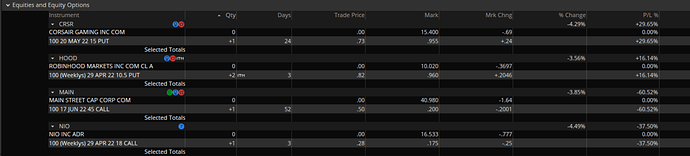

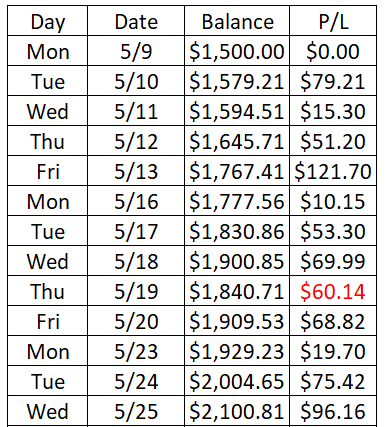

This is going to be a trading journal that follows the path of a new small account I just recently opened on TD.

This is a small portfolio that I am personally looking to grow larger and eventually turn into one of my larger main portfolios as I transition my accounts away from Webull and Robinhood.

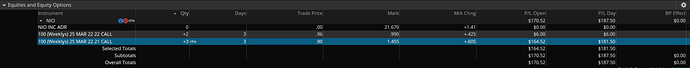

Ending Day of 3/22/22

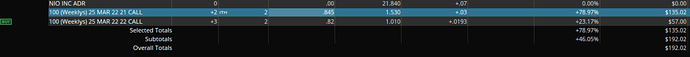

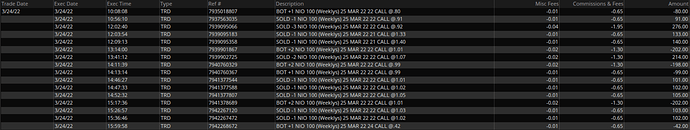

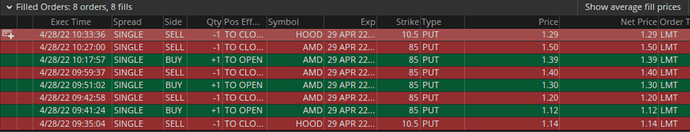

NIO $21C 3/25 - 3

NIO $22C 3/25 - 2

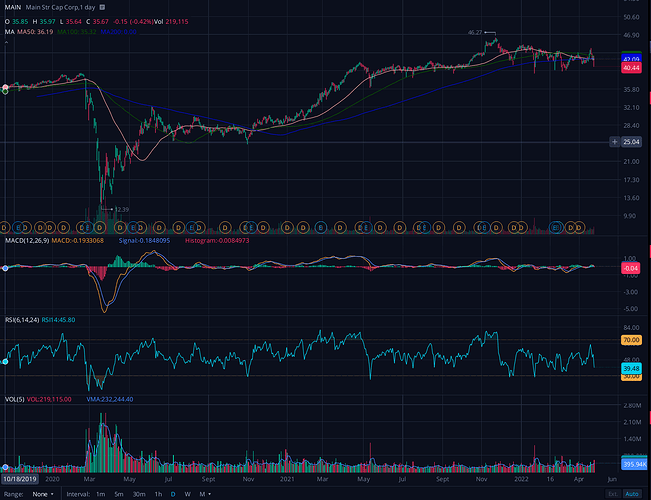

Established a position in NIO looking to play potentially up to earnings which is on Thursday evening.

NIO is a stock I have personally been long in and established my initial share position back in 2020. It is a stock I have pretty high conviction in even with it being a Chinese EV company.

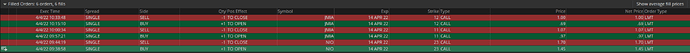

I will most likely be playing NIO again after earnings leading up to its March delivery numbers.

For reference.

NIO 2022 Monthly Delivery Figures

Jan: 9,652

Feb: 6,131

Mar: Soon

NIO 2021 Delivery Figures

Q1: 20,060

Q2: 21,896

Q3: 24,439

Q4: 25,034

Based on that initial Jan/Feb figures and estimating Mar being at least back to Jan numbers, I would be semi expecting a beat from 2021 Q4 figures which would be a potential positive catalyst to see a mini pop.

For tomorrow, I may look to re-position some if market continues to push. NIO does tend to have days of strong SPY correlation.