This is going to serve as my trade journal for my current ToS main account. I’m currently balls deep in an outsized position with PARA (600 shares, sub $30 avg cost with some Jan 23 $35c and 50c). I believe in PARA as a major player in the streaming space and plan on holding this for awhile. Outside of that position, I have a few thousand that I throw around trying to learn how to scalp SPY options or entering some of the plays I read about here. For my journey moving forward, I’m going to be focused on the following:

Limiting myself to 1-2 trades per day, with a 5% gain target.

Watching for opportunities to put cash in long positions I believe in (e.g. buying 5 shares of AMZN if it touches $2K before the split)

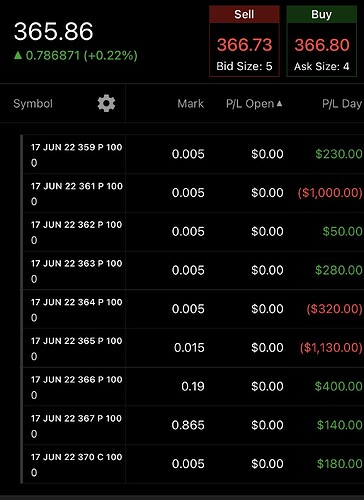

Playing SPY movements based on the wealth of genius that exists in TF

Reinvesting gains in companies that will be part of the “cyclical economy” such as EV battery reconditioning, heavy metal recycling & drones

I’m also reserving a fair amount of cash to throw at some dividend paying stocks once we get the predicted 5-10% drop from current levels that I believe will be the clearest sign of “bottom” that I can comprehend. Here’s to compounding gains and early retirement.