Hello to anyone reading, as the title says my discord name on trading floor is Smallpump.

I’ve procrastinated starting a trading journal for too long, and I know it’s holding me back. I continue to make the same mistakes which are hindering my gains. The typical cycle for my account and trades is that I trade well and stick to my strategy > make consistent and reasonable gains > do a stupid trade that nets me a large loss > start again. A clear cut example of this is last week ending 4/1 my account balance was 31.5k on Tuesday, and is now at 26k. I believe writing my trades down and putting them out in the open will help keep me more accountable. My goal is to make trading a career, and this is a step in the right direction.

My day trading strategy is scalping SPY, which I will go further in depth with down below.

I do follow a long with a lot of the tickers Conqueror plays, just with adjustments as far as entry’s and profit taking go.

I plan on being very thorough with this journal. Every trade and scalp on SPY will have my entry’s, exit’s, profit or loss amount, and a picture on the chart to give a clear visual of the trade. Blue circle = Buy, Red circle = Sell. At the end of each day I’ll also post my account balance. (As of close on 4/1 it is $26,010.89)

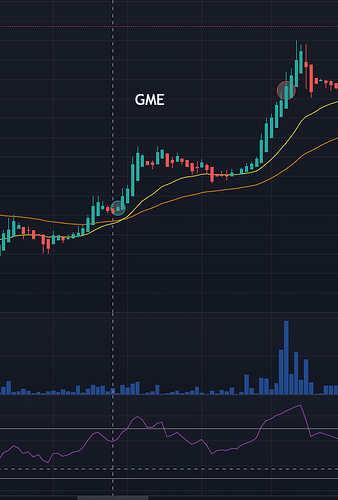

![]()

I’ll also post positions that I am holding EOD overnight, but most likely those are only conqueror’s plays. I don’t hold SPY overnight typically ever unless they’re clear trades (like initial ukraine dump etc.)

Anyways an example of a posted scalp would be:

SPY 452P x1 2.30 > 2.50 Gain 8.7%

My typical SPY trade lasts anywhere from 1-8 minutes, most of them being on the shorter side. I get calls or puts that are just ITM with a delta of .5, and my trade size is usually 10 contracts. This means my position on each trade is about 2k-3k.

My strategy is to trade clean bounces or rejections off the 20 and 50 EMA’s. My only 4 indicators are 20 ema, 50 ema, volume, and RSI. I use RSI to make sure I’m not buying into a reversal.

I also use heiken ashi candles, this means that I will NOT have perfect entry’s, but I will be more confident in the trend I’m playing.

The rules: If I take calls the 20 ema MUST be over the 50 ema, if I take puts the 20 ema MUST be below the 50 ema. Always check RSI for a trend weakness and potential reversal. Cut losers fast, never hold waiting for it to come back (this is fucking hard but imperative.) Below is the chart I look at everyday with indicators, and entry’s I’d be looking for.

I look for the doji candle for the rejection or bounce, and then take my position.

If anyone does decide to take a look at this, I hope that you find useful information and maybe this scalping strategy will make sense. I’ve been able to slowly grow my account taking 3-10% gains on each trade.

My kryptonite and what I continue to work on is holding losing trades for too long and trying to average them down, which tbh i’m shit at. Overtrading is also a big one, eventually I need to stop scalping the trend trying to squeeze every last bit out and wait for the new trend to begin.

Anyways i’m excited to start this and do it thoroughly and correctly, thanks if you read this whole thing! ![]() Here’s to a great trading day, week, month, and year starting tomorrow.

Here’s to a great trading day, week, month, and year starting tomorrow.