Overview

Snowflake is a recently IPO’d (2020) tech company that specializes in data warehousing. In 2020 they reached an ATH of ~429 and proceeded to dump for about 6 months after to a low of 184. Since then it’s been on a up and to the right trajectory. A few days ago it started edging close to its ATH at about 404 before dumping with the rest of the tech stocks this Monday and Tuesday. Earnings are 12/1 AH and I think there can be some volatility leading up and after ER. More on that below.

What do they do?

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that came public in 2020. To date, the company has over 3,000 customers including nearly 30% of the Fortune 500 as its customers. Snowflake’s data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake’s data sharing capability allows enterprises to easily buy and ingest data almost instantaneously compared with a traditionally months-long process. Overall, the company is known for the fact that all of its data solutions that can be hosted on various public clouds.

How do they make money?

Selling SaaS related products, specifically their data warehousing service. Recently they have also got into the data marketplace business.

Why are they important?

Disrupting the cloud storage sector by creating cross cloud solutions to large data problems. Being cloud agnostic has become super important for more and more companies. It provides agility to move from different cloud providers easily. Snowflake supports the big 3 (AWS, Google, Azure).

What are their products?

Cloud storage, data exchange

Industry – Cloud Computing / Data Warehousing

Competitors

- Amazon Web Services (AWS)

- Microsoft (Azure)

- Cloudera

- Oracle

- Teradata

- IBM

- Databricks

Metrics

Market Cap: 119B

Revenue (ttm): 851.2M

% Held by Institutions: 68.96%

Put/Call Ratio: 0.48

Put/Call OI Ratio: 0.84

Total Cash (mrq): 4.14B

Next Earnings Estimate:

Est EPS: -$0.06

Est EPS Whisper: -$0.01

Est Revenue: $305.51M

Last Quarter Snapshot

Pros

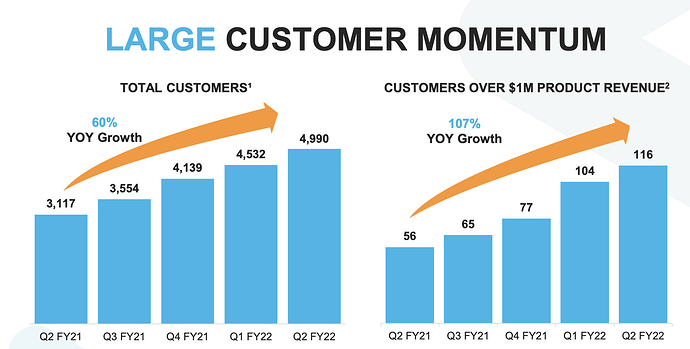

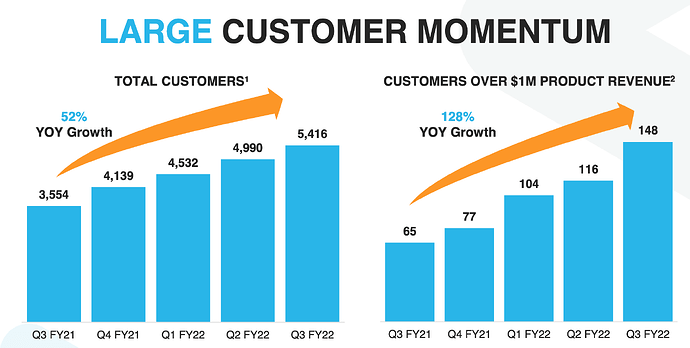

- They have grabbed a large number of fortune 500 companies, ~200. Once they have a foothold in the market, other companies may follow.

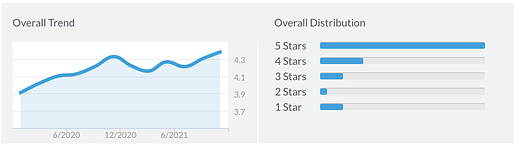

- Employees appear to be happy, as well as the overall rating from indeed is slightly trending up.

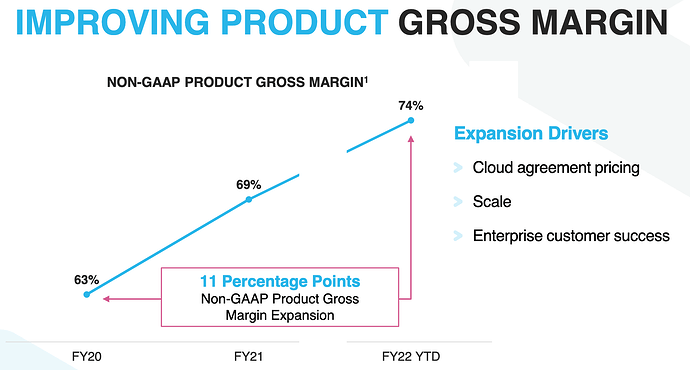

- They bill customers based on consumption, so they are banking on the ever increasing data usage. e.g. More data = more usage → more $$$.

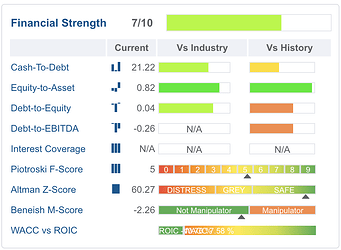

- They have cash on hand to continue to burn through while they expand and grow. Overall good financials.

- Good retention rate and overall great NPS score means people like the product.

Cons

-

Technicals: Reaching close to its ATH, earnings may push it through or drop it back down to reality.

-

Insider trading: Last few weeks the CEO and top staff have been selling a good amount of shares.

-

Some are more bearish, and think a share dilution may be coming ref. Not sure I believe that will happen soon, but who knows.

-

For their valuation, overall revenue is low. By comparison Teradata (another data warehouse company) has about a 5B market cap, and generates 1.93B in revenue.

-

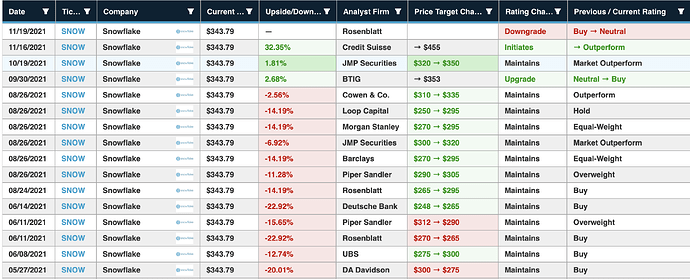

Analyst ratings have gone up in the past but seem to be leveling off.

-

They are in a crowded vertical with many big players (AWS, Google, Azure) that have similar or competing products.

Financial health

Overall health is strong. They have a large amount of cash on hand (~$4 Billion)

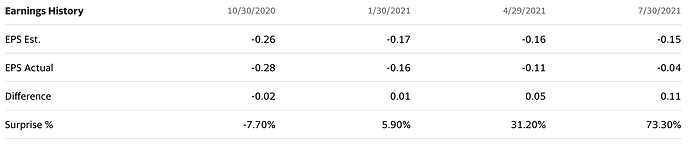

Earnings history

Overall they have been beating quarterly estimates

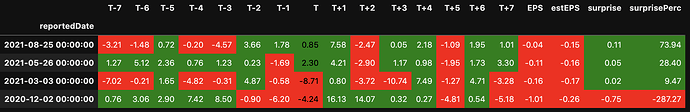

Breakdown of the days leading up (% change close to close) and trailing earnings. Earnings are AH, so price action of earnings are in the T+1 column.

Overall some good volatility.

Conclusion

Snowflake overall appears to be overvalued and could take a hit during earnings this quarter. It really depends on if their growth is slowing and/or spending significantly increases. However, because of their strong financials many may dismiss anything negative and continue buying because of future potential. Since the stock price has taken a beating the last few days I’m slightly unsure which way to play this. Medium term I think we’ll see some downturn if it get’s rejected from the ATH resistance. Not sure if the current downtrend counts as a real rejection. Options are ridiculous expensive, so size your risk appropriately.

Disclaimer

This is my first real DD so I would love the feedback so I can improve. Cheers!

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing in this DD constitutes professional and/or financial advice, nor does any of this information constitute a comprehensive or complete statement of the matters discussed or the law relating thereto.

References:

https://www.chartmill.com/stock/quote/SNOW/profile

https://finance.yahoo.com/quote/SNOW/key-statistics?p=SNOW