I’m starting this to keep me honest, for the past month or so I’ve been pretty reliably scalping SPX daily (2DTE, usually $5-6 “dollars” OTM) using Lux Algo (2 min mostly with a pretty high sensitivity). I shoot for $300-$500 per trade and have SL set and then limit sells for what I want so I don’t get blown out.

I never enter before 10:15, SPY/SPX is way too volatile and have to remind myself that it will not just dump or run all day if it does that at open. If I get the $300 - $500 I’m done for the day unless I’m REALLY confident about a direction for that day based on news or sentiment AND if its breaks certain support or resistances. I have achieved the $300 - $500 a good amount over the last few months but then got bad FOMO if it dumped or ran and overtraded and lost most of it or all of it and go red. I’ve gotten very good lately at just being grateful to make money and bounce for the day. This was the hardest lesson for me to learn, I was in a race against myself to make more or the most money which is dumb.

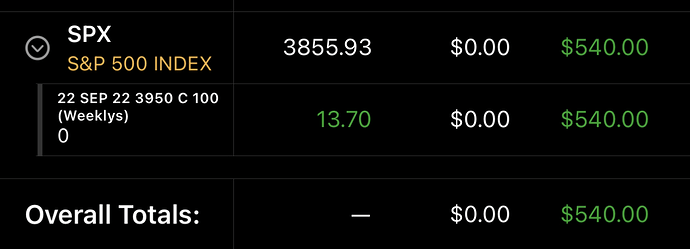

Today’s trade was 3 September 22nd 3950 SPX bought at 14.50 and sold at 16.30. I normally hope to get in an out of a trade in 10 minutes or less but this one took about an hour for me to hit and never hit my SL.

I will not have a position going into FOMC and may not play it depending on what I see earlier in the day. I have had lots of red days playing very volatile swings and I don’t want to fuck myself.