So I’m starting this because one, I want to track myself a little better and two, maybe I’ll learn from my mistakes.

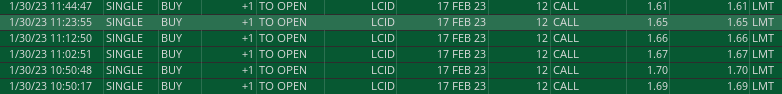

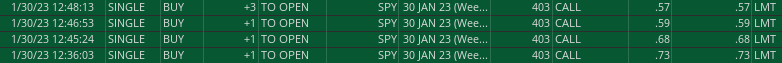

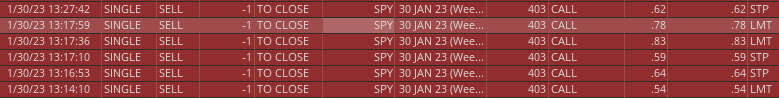

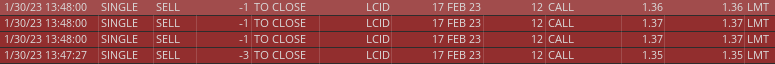

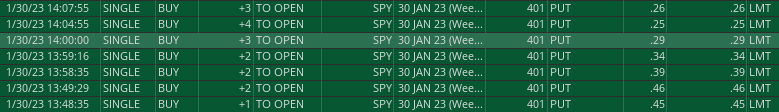

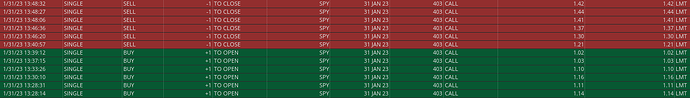

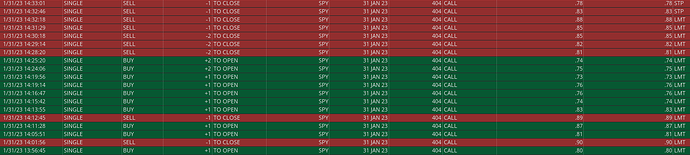

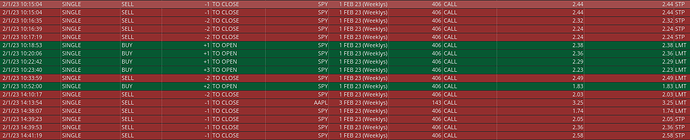

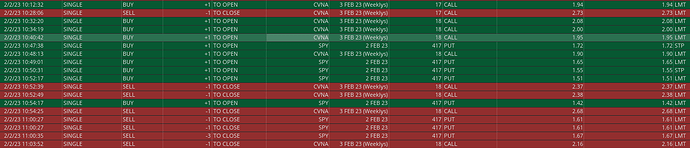

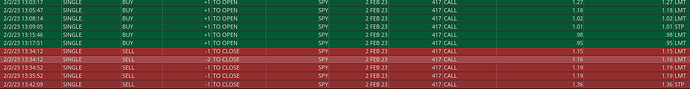

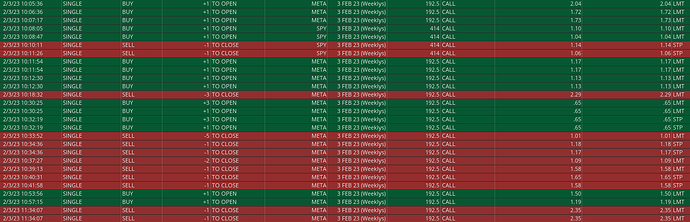

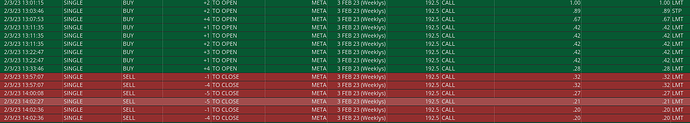

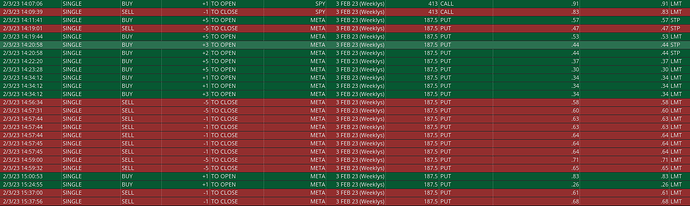

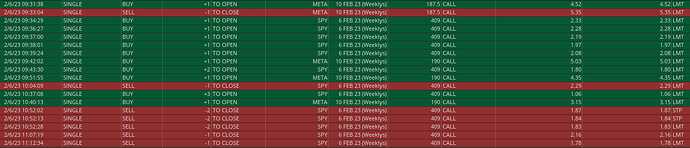

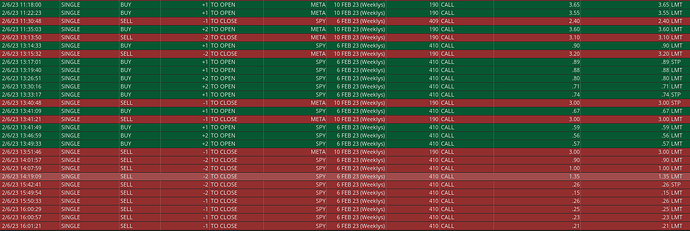

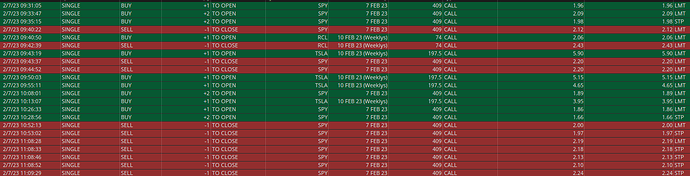

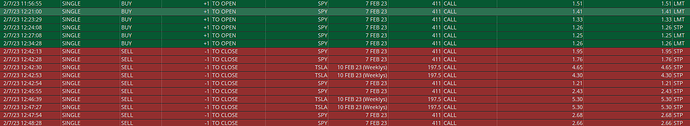

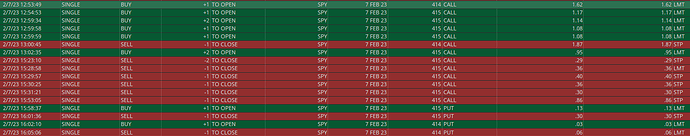

I changed my rules alot and basically it’s been a hard line of taking profits and cutting losses quickly. I will elaborate more on what I’m doing but it’s basically averaging into supports and cutting profits quick. I opened a new account to specifically focus on this.

I hope to learn how to accumulate capital slowly instead of searching for big returns. Also eventually I want to let my winners run a little to try and maximize returns. But, what I’ve been doing has been working ok so far.

I’ve been playing the news, post earnings, and sentiment.

I have to thank Valhalla for most of this, the education and also peeking on TF to see what everyone is chatting about. The value that you all bring is more than what I can describe with words.

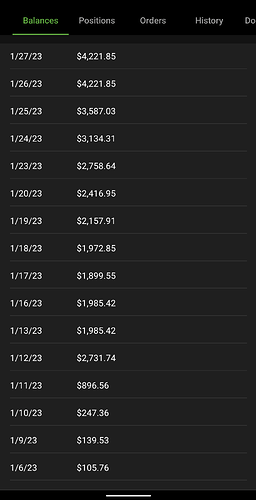

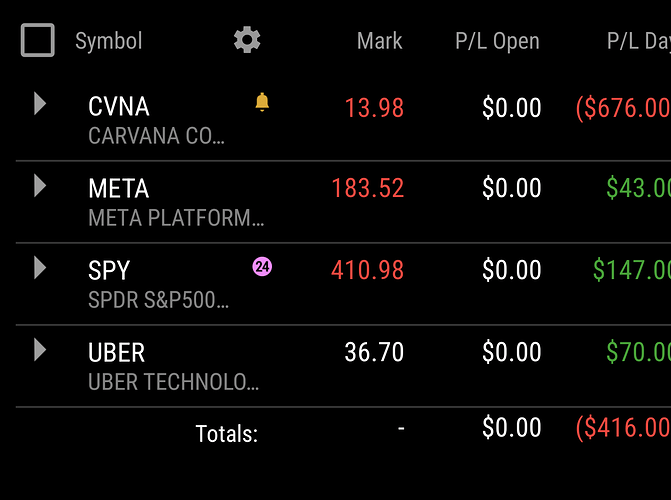

Below is my last 30 days roughly. I know most of this is credited to the recent stretch of green we’ve had but I plan on continuing it through the ups and the downs.

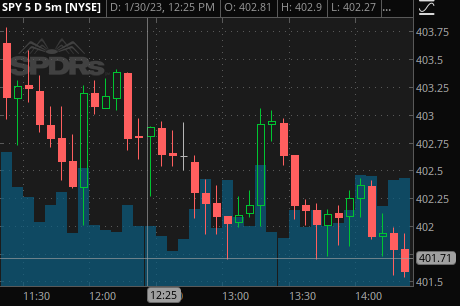

I don’t always get time to update on the callout but I want to go over each day here to give an honest view of what’s working and what’s not.

Lastly, am I the only retard that bought MARA calls today… Fucker was down 8% while everything else ripped. Got out with only a $65 loss but still hurts lol (I choose MARA over TSLA at the open, still mad about it)

I hope to grow with you all and maybe help along the way. There’s money to be made and I’m dedicated to figuring out how.