[size=3]This is a DD sourced from reddit, not my own. I will post the references at the bottom. Note they’ve run up 50% in the last month from when this DD was posted, so look for entry points and proceed with caution. No options are available, yet. Note the DD refers to $MKTY; they went through a merger on Monday and are now known as $SLNH. [/size]

[size=3]Edit: I now own shares of this stock, for full disclosure.[/size]

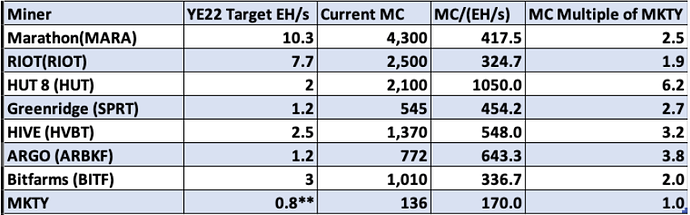

TLDR: $MKTY is an extremely undervalued mining company trading at multiples 2-3x lower than all other competitors (table below) in the context of a tiny 5.5 mil float. It has an upside of nearly 250% given a fair valuation and the imminent approval of a BTC ETF signals strong institutional confidence in the crypto space. The low float, mispriced bitcoin exposure, 100% green mining and now BTC ETF are all likely to cause a major upward price rally.

[size=4]Brief Rundown, Disclaimers, Crypto Rally:[/size]

Hey everyone, it’s me Ropirito, back from losing 20k yoloing into SPY and deSPAC FDs. I took a few weeks to collect my thoughts and escape the toxicity that is Reddit and recently a play from u/joeskunk caught my attention.

Full Disclaimer: I have worked on this DD with u/MillennialBets as he is quite informed about the crypto world. All information being presented here is original and to the best of my knowledge. Additionally, I will be covering bear cases first, and play types in the end so that there is a clear outline of what plays fit with this DD. I am not responsible for your $69K 1DTE yolo and none of this DD is financial advice.

Cool, now that the disclaimers are out for all the whiny little bitches, let me introduce you to $MKTY , Mechanical Technology Inc. This is a micro-cap company that has no options, no gamma squeezing, minimal shart interest and no other gimmicks involved. It simply has a tiny float of 5.5M . A full breakdown of how this was calculated is also listed later (you can correct me if I’m wrong).

[size=4]I. What’s MKTY?[/size]

Mechanical Technologies, $MKTY, has a profitable legacy business that is leveraging their technology of solar power with Bitcoin mining. Their legacy business, MTI Instruments, serves the manufacturing, electronics, semiconductor, solar, aviation, automotive, and data storage industries by providing instruments and analysis systems for calibration and defect detection. This applies to semiconductors, sensors, and engine systems in both military and commercial products. Your favorite fuel cell stock $PLUG (Plug Power) is a spinoff of $MTKY, while this company itself has collaborations with Ford and others in developing completely green Stirling Engine technology. They have further expertise in high-efficiency, energy-conserving steam turbines and created breakthrough radial-Inflow steam turbines.

Currently, $MKTY is the most power-efficient of the cryptocurrency miners as highlighted above . The cryptocurrency mining segment is called Ecochain, a fully renewables-based mining operation that outperforms every other miner in the market. Each of these divisions currently comprise 50% of their revenue. Ecochain is powered entirely by renewable energy sources and ensures that all mining operations are 100% green. Taken directly from their investor’s website, “EcoChain’s first investment is in a mine running off the power of a 100% green, hydroelectric power from a 1,300MW dam. The mine has the potential to operate at 3.3MW based on one of the lowest-cost power sources in the world.” As of September, they have achieved a total of approx. 25MW and a 107% increase in hashrates from the previous 2 months . More on this soon….

They recently acquired Soluna Technologies (with a planned ticker change in the near future to SLNH). Just like the average r/shortsqueeze member trying to sell you their bags, Soluna’s motto is SELL. EVERY. MEGAWATT. They essentially crowdsource green energy generation through clients, buy the excess, and use it to power their data and mining centers for a completely energy clean system for customers.

$MKTY is actively building new mining facilities, and their main one is Project Anaconda. As the saying goes, “my anaconda don’t want none unless you got buns hun” , and $MKTY definitely got deez buns. You can see a live feed and timeline of the facility working here @Project-anaconda, which I believe is another step of transparency that separates them from the other miners. MTI would like to reach a 50MW production target for their mining facilities and Project Anaconda will be a 25 MW facility located in Kentucky, supplying 50% of this goal.

[size=4]II. Bear Thesis (for you beartards):[/size]

Due to the general distaste towards crypto on Reddit, I’ll satisfy the thirsty Buttcoin bears’ off the bat:

- As we all know, Bitcoin is in a rally and may very well hit new ATHs up to potentially 75k this year (I pulled this number out of nowhere). Bitcoin prices declining would have a significant impact on revenues of course, but the CEO clarifies in the last earnings report that miners are still profitable above the 25k price range. In a disaster scenario where Buttcoins hit < $10k, the CEO explains that Ecochain could pivot to providing a data server with the hardware they bought. I find this to be the true bear case because the client base for Ecochain servers is minimal and would require further expenditure to bring extra clients.

- The mining business in general is highly expensive and a failure to deliver expected revenue and hash rates would be truly bearish. Based on MKTY’s update from October 12th, they are exceeding their projected PH by 33% on ramping of the second mining facility , however this may only matter if they were sufficiently set up before the latest crypto rally. Miners have to continuously upgrade their hardware as network hashrates increase and continuously compete with other miners for bulk purchases.

Hijacking a comment from u/pennyether:

The conclusion was miners see short term windfalls if they’re well set-up before BTC spikes… but in all other times, they suffer. Network hashrate always climbs and forces them to buy new hardware. They are perpetually competing with one another and the only real winner is the hardware manufacturers which serve as arms dealers. MARA, RIOT, etc, got extremely lucky that BTC surged just as chip shortages started to fall into place… and then another stroke of luck that China ban-hammered miners. Otherwise, these companies would be 10x overvalued.

Basically, if MKTY bought S19J Miners at “inflated” prices, they may receive the short end of the stick due to much lower ROI even as BTC and other cryptos currently climb. However, based on 10-Q filings, most of their miner purchases were done soon after China “unplugged” its entire mining industry.

III. Catalysts:

From what I see given current “macro” events and fundamentals, there are five primary reasons why MKTY has a very high probability of increased volatility and an upward trend:

Underpriced Bitcoin Exposure

-

MKTY’s bitcoin exposure has become much stronger since their last updated filing. Bitcoin traded at 52.7k on September 6th. MKTYs last high was on September 1st at 10.96. MKTY’s now greater exposure to BTC ($60K at time of writing), should be trading at a higher multiple than what is currently being priced from a Bitcoin price multiple perspective.

-

The MTI CEO has hinted at a possible sale of the legacy business which would be used to further invest in the Ecochain cryptocurrency mining segment. This would again increase bitcoin exposure and allow it to be evaluated more closely with its cryptocurrency mining peers.

-

If BTC spikes or shows continuous strength, $MKTY will rally along with the other miners. Currently, we are in the midst of this. This is not a play where you secure a 1-2 bagger on shares overnight but rather a compounding effect of double digit percentages over the course of week as it trends with BTC.

Political Tailwinds

- MKTY’s instrumentation segment will benefit from an infrastructure package passing. The infrastructure bill focuses heavily on EV adoption and making a robust semiconductor supply chain (ding ding ding! Guess who?).

- A Bitcoin ETF may be passed in the near future. SEC chair Gary Gensler who taught some of the first courses on block chain technology has made comments regarding a Bitcoin futures ETF being likely approved. We have further approval of this through a recent tweet from the SEC’s official twitter account asking investors to be careful when investing Bitcoin ETFs. Ultimately, this provides more legitimacy to the entire crypto space and causes r/Buttcoin members to pull their hair out. I see this as very bullish for the long-term sustainability of BTC’s high prices.

Tiny Float of 5.5M Shares

- MKTY has significant exposure to very volatile market changes with an extremely low float. This stock has a 12.7M shares outstanding as of August 9th, 2021. Adding on ~800K warrants, the total is 13.6M shares outstanding. The insider ownership is ~ 8.1M giving the effective float of only 5.5M . The short interest is negligible at 2.6% (who is going to short a low float stock with zero debt and cryptocurrency exposure?).

Zero Retail Footprint:

- There are is only one post on MKTY in the MillennialBets database made by u/JoeSkunk 10/14/21. MKTY stocktwits has only 757 followers. If you are reading this post you are early, yet will still benefit from the ongoing crypto rally. I also believe that MKTY is being ignored due to its relatively tiny market cap of ~136M preventing it from being discussed in most subs.

Lack of Institutional Ownership

- There is an institutional ownership of 4.31%. This contrasts with institutional ownership of 51% of GREE, 36% of MARA, 29.68% of RIOT, 11.5% of HIVE. The price could be impacted significantly when institutions realize how significantly underpriced MKTY is considering the high hashrate and sustained expansion of revenues. I theorize that due to the already minuscule float, institutions do not see that advantage of becoming a majority holder.

IV. Fundamentals & Financials, PTs Etc:

I have linked the Aug 2021 & Sept 2021 Flash Updates from $MKTY and Ecochain, regarding hashrate and Non-GAAP earnings data.

Based on the current data, we can see that a 0.8 EH/s hash rate is a conservative increase for their 33% increase in production, lower network hashrates and the ongoing crypto rally. If each of these miners were at the same growth and current EH as $MKTY, these would be how much more their market caps are worth relatively. We can see that at a minimum, $MKTY should be worth 2x more when compared to its peers, and on average about 2.9x more. Even if the underlying doubles, it could be considered undervalued.

Based on the table above that I have shamelessly taken from this Seeking Alpha article, BTC’s rally to nearly 60k currently shows that miners can remain operational 100% of the time and maximize revenue. We can see that in comparison to lower values in the summer near $25K, contribution margins increase by 12.1% while BTC sustains high values .

By the end of the year, if the goal of 50MW and 0.9 EH/s can be hit, revenue will nearly triple with BTC values close to 60K.

Overall, the financials on $MKTY relative to the biggest miners are amazing. Taking a look at the table below:

Previous assumptions were that the Global Hashrate would stay high around 203K but this has since then changed to 143K as China unplugged out of the crypto world. We also see a strong revenu beat again of 76.1% for Q2. We can also see that MKTY has $0 of debt but also sits on $0 of cash as it immediately sells all mined Buttcoins and most likely invested it towards the development of the second Anaconda facility through Ecochain.

Assuming EcoChain reaches their 50MW expansion by the end of the year, their hash rate can grow from 912.27PH/s to 1.69EH/s. Depending on mining efficiency and the various miners they use, this is the following comparison drawn from Seeking Alpha:

Within their original Python facility and Anaconda combined, we can see the rapid expected hashrate growth of nearly 863% from the previous quarter .

V. Float:

Thankfully this doesn’t have the same complexity as a deSpac where outstanding shares are magically pulled out of an 8-Ks ass, so we can do a simple rundown.

Across the board, shares outstanding are listed as 12,699,670 shares. Based on the Q2 10-Q filing, there are about ~230k of underwriter’s warrants and ~674k options.

Therefore, total outstanding shares is 13.6M.

On Fintel, we can see that there is 64.43% insider ownership and of these ~8M shares, 7.5M are owned by Brookstone Partners Acquisition XXIV, LLC. Note that primary insider has not sold since 2016, so it is highly unlikely they will sell on anyone in the short term.

This means our final float is 5.5M shares .

In terms of short data, what I am seeing is 180K shares shorted, which is about 3.27% SI. This is great news as it consistently shows faith in the company itself. We also see around 55% Utilization as there are about 330K short shares available in total.

The one SI statistic that grabbed my attention is a Dark Pool Short Volume Ratio of 70.54%

Generally, the trend with this ratio has been if it reaches 55-65%, then shorts are attempting to cover through the dark pool. Before the squeezes for GME, AMC, SPRT, and others, these values hit around 55-65% for them. In the case of $MKTY, this does not indicate a short squeeze but rather confidence that it will rally, causing shorts to exit before their trade goes wrong.

Previous Runups During BTC Rallies?

In BTC’s previous run up to $60K, $MKTY reached a price of nearly $15, which was overvalued at the time due to minimal EH expansion. Now however, as BTC crosses $60K, there is a strong case for MKTY to rally past these prices as $25-$30 would be a conservative price target.

The Play & Being Realistic:

Based on all of the data above and the general trends in the crypto market my final conclusions are laid out below:

- PT: $30 ~200% Upside (Conservative, I know…)

- Due to their integration with Soluna, $MKTY has the best power costs, timed their facility development right after China unplugged (allowing for cheaper hardware).

- If Bitcoin goes bust, $MKTY will fall the softest as the data center market has an expected market size of $58Bn by 2026, and renewable energy-powered green data centers are expected to grow at 18.4% CAGR during 2021-2026.

- There are many catalysts including their expansion to 50MW of capacity which is already being secured, severe undervaluation, and the growing crypto rally.

- The tiny float of 5.5M indicates that any buying pressure will result in a possible multibagger play off shares. This is the best unknown mining play on the market currently.

Since there are only shares available, the downside risk is quite low. However, be careful and don’t overextend yourself. The tiny float indicates quick potentially volatile price action so be realistic about your own trades.