After noticing some weird price action with SPAC warrants, used SpacHero to pull those with a target identified but that have not merged, that also have the lowest warrant prices. Turns out priecs have plummeted indeed, with a few went down hard even last Friday (1/28). 17 are below $0.30, and they haven’t even de-SPACed yet!

Can think of three reasons for a price drop in warrants:

- This comes with the negative sentiment associated with the SPAC winter we are in. People just hate SPACs at the moment. And these are the ones that they hate most.

- The market is already pricing in future drops in price of commons - much more so than it was before. Which is not unreasonable, since SPACs have almost universally fallen in value so recently.

- The market thinks these deals will not go through, and that the SPAC will be liquidated. At which point the warrants go to 0.

Taken as a portfolio though, I am having a hard time making sense of this. Given that warrants basically behave like like super-long-dated calls without the theta, #1 and #2 shouldn’t matter as much, as sentiment should return over time, and many of these companies could turn out to not be complete turds. Only #3 could justify this, though I can’t think of a case where the merger deal fell apart, and the SPAC got liquidated. (Each has happened separately.)

So the first set of questions are: What am I missing? What else could be explanations for prices to plummet like this? And for them to stay down?

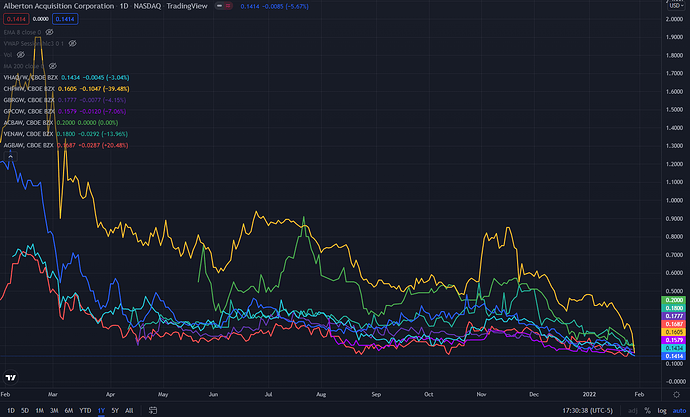

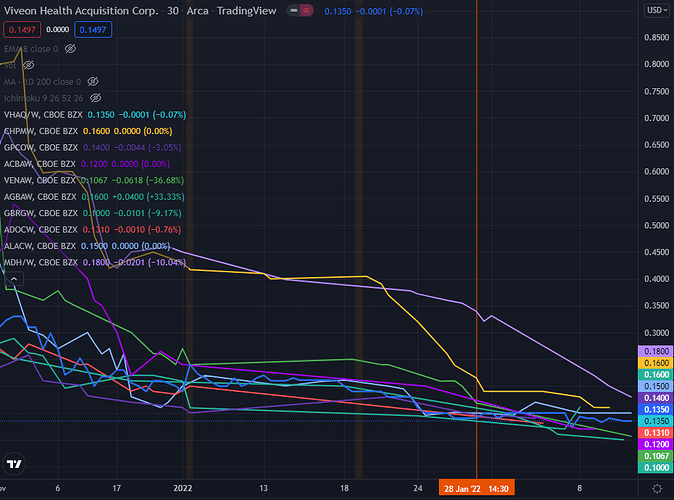

Next, charted all the warrants with prices below $0.20 (arbitrary threshold…) and this is what the annual price movement looks like:

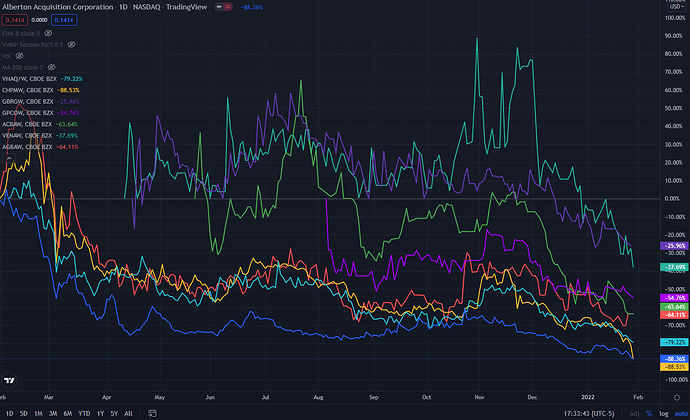

And this, as percentages:

Looking at these graphs, can’t help but feel like this is a temporary over reaction, and that prices will eventually go up, though probably not to previous highs. Warrants give us years of runway though. And they can’t go below $0 in price.

Because all SPACs are very risky, I wonder if it makes sense to take a portfolio approach, after weeding the truly terribad ones that should never have been conceived. So one could buy up a bit of the 8 that are priced below $0.20, the 17 priced below $0.30, or any combination thereof, and just wait.

So second question is: What do you think about this portfolio approach? Good way to play the risky field? Or is there a better way?

(The list, if anyone wants to play with this, is: AGBA, ALAC, VHAQ, CHPM, GBRG, GPCO, ACBA, VENA, BREZ, ESSC, MPAC, AACI, ARIZ, BIOT, KWAC, TUGC, FOXW)