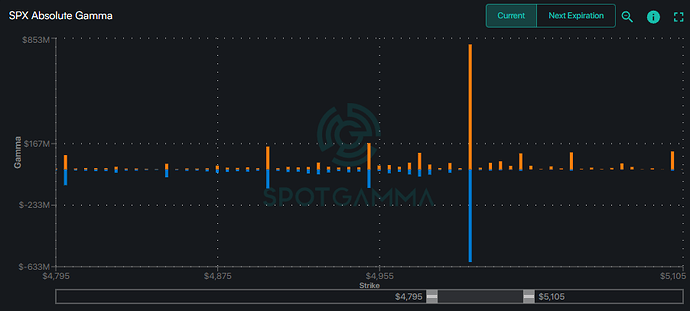

We are about a week and a bit away from Feb Opex. SPX 5000 has massive amounts of gamma, and is acting like a magnet. Call wall is also there. Vol trigger is way below at 4895, so we should be stuck pretty much around here until next

The underlying situation is not that solid, though. Even though we are at ATH, breadth is bad - 38% of shares are below their 50SMA:

We had a good 10Y auction yesterday, but there’s a ton more issuance coming, and rates are still over 4% and it’s not clear they will remain at these levels.

And IWM is near the top of the range from recent times, but still far from an ATH:

None of these signal an imminent correction, but the “window of weakness” allows that to happen mmore easily after opex next week.

My default view is therefore that we stay flat-ish into middle of next week, and then correct a bit. Making the current move more one of exhaustion from overextension, and not consolidation followed by more upside.