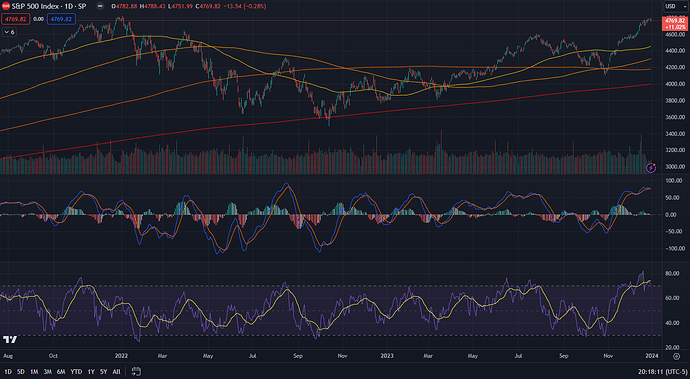

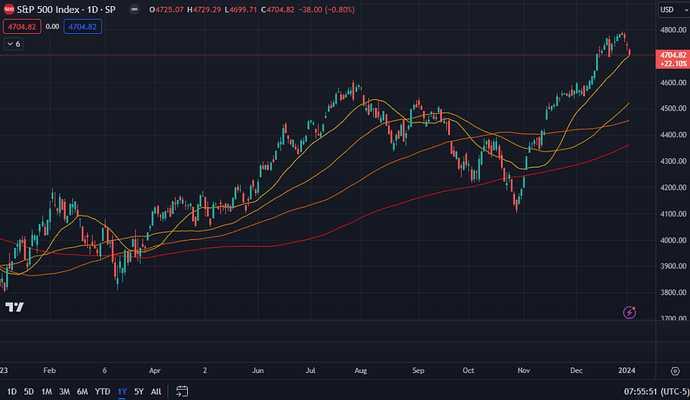

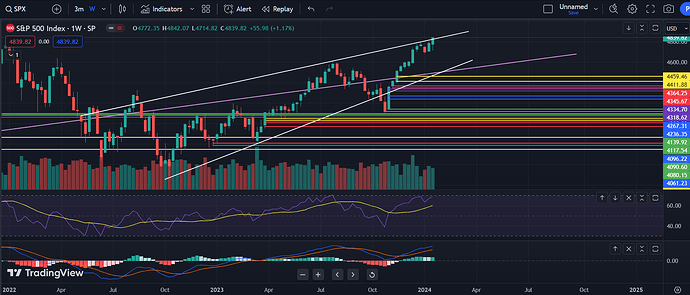

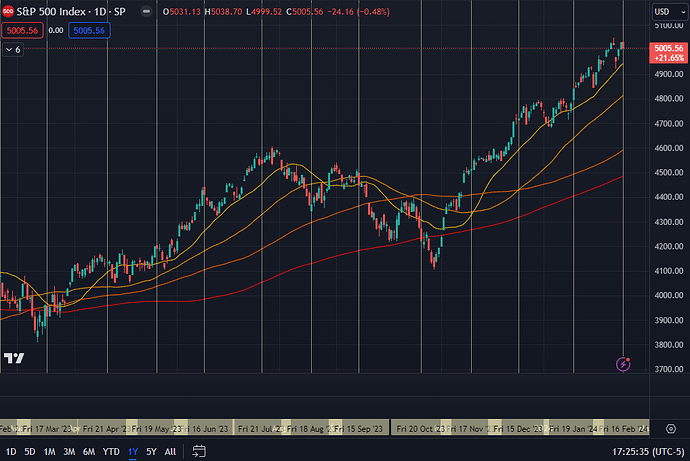

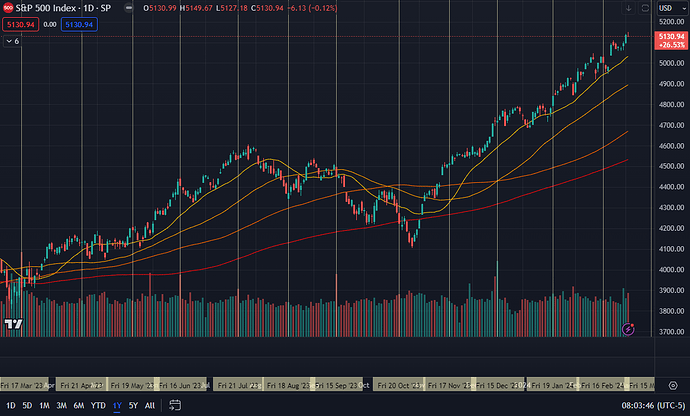

2023 ended just a whisker away from SPX’s all time highs. It would be a shame to not kiss that level at least. Folks coming back to realloacte funds for the new year, and pre-opex supportive flows should see it happen.

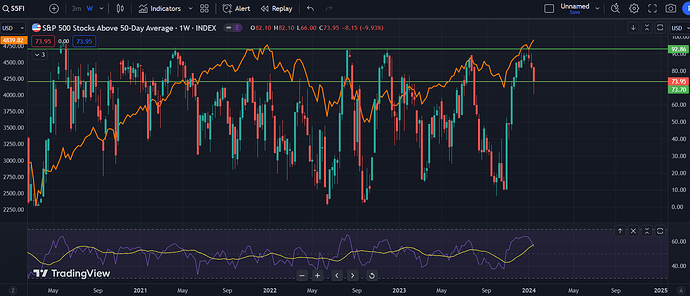

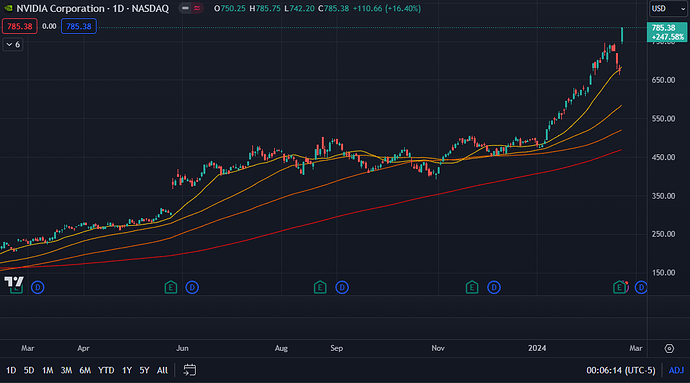

Generally, the markets are extended by most measures:

- Moving averages, RSI and MACD (above)

- % of stocks over 20SMA, 50SMA and 100SMA

- NAIIM exposure index

- AAII investor sentiment

- Put-call ratio

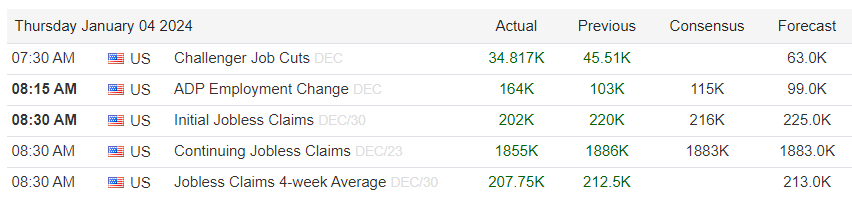

Nevertheless, rates, DXY and global liqiudity levels continue to be supportive, so there does not seem to be any imminent trigger for a rollover.

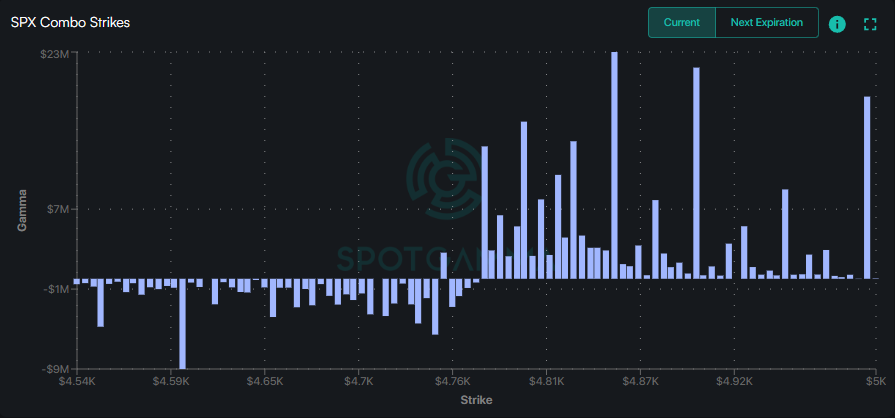

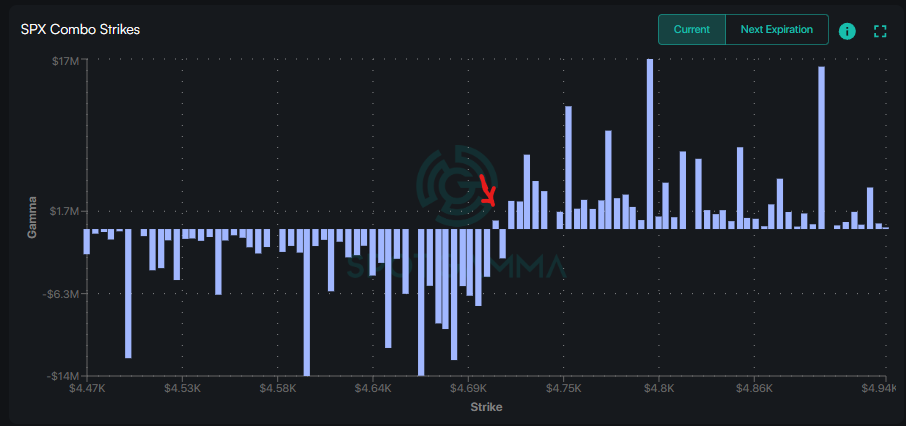

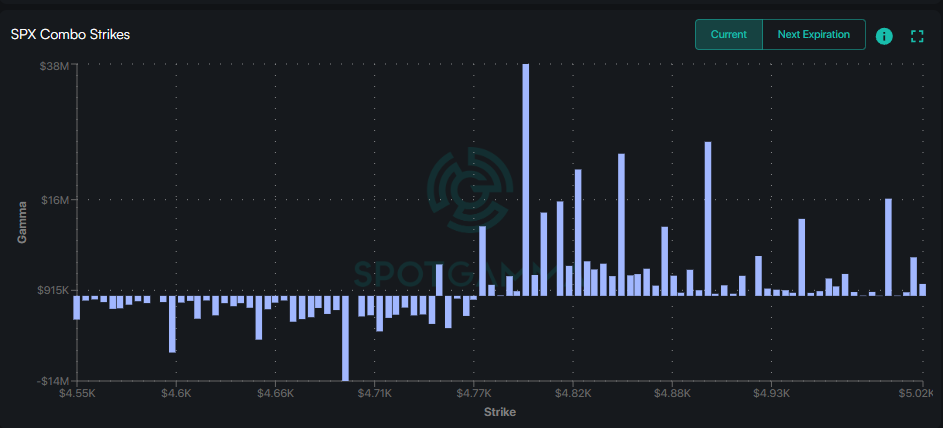

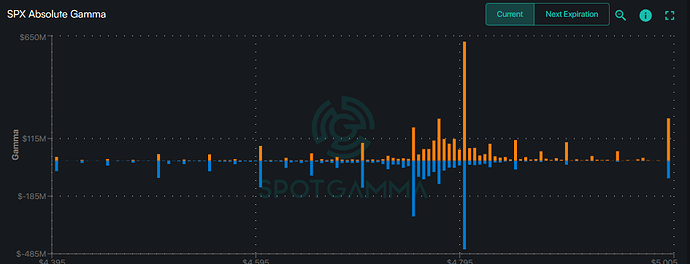

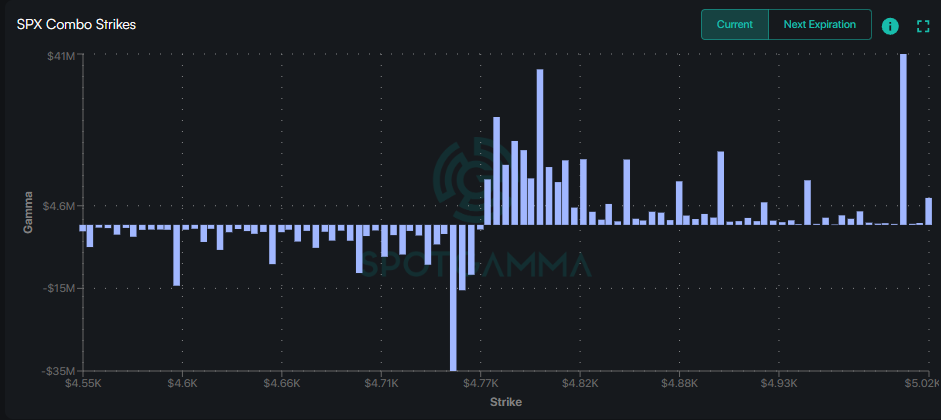

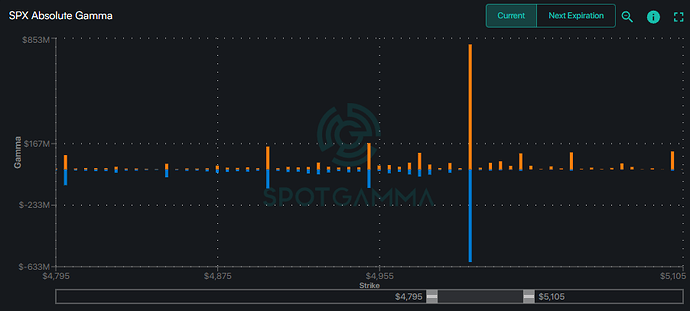

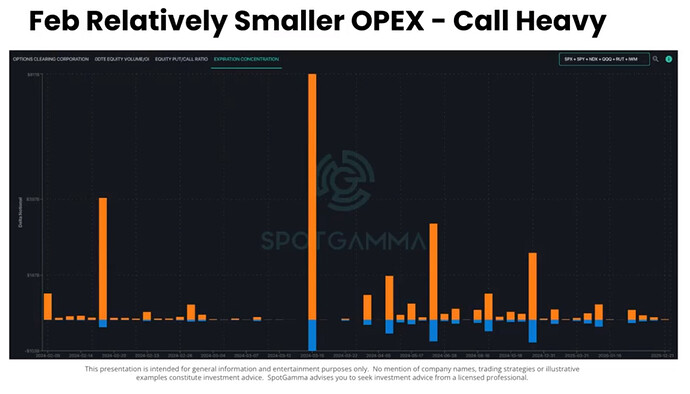

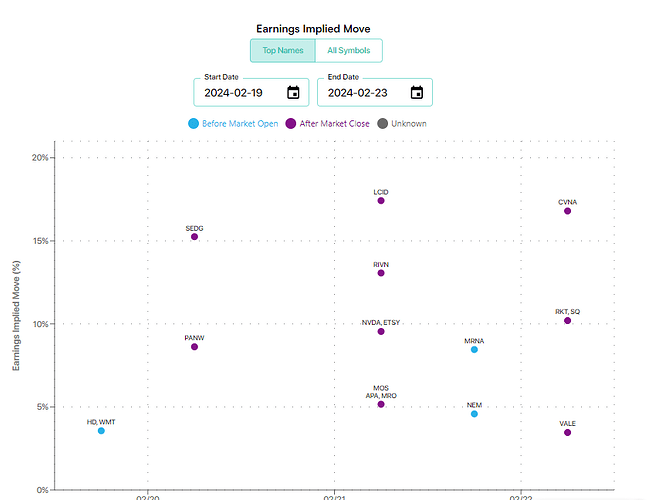

And as usual, we are entering the two weeks before opex, so we can expect supporting flows from all that positive gamma all the way up to SPX 5000:

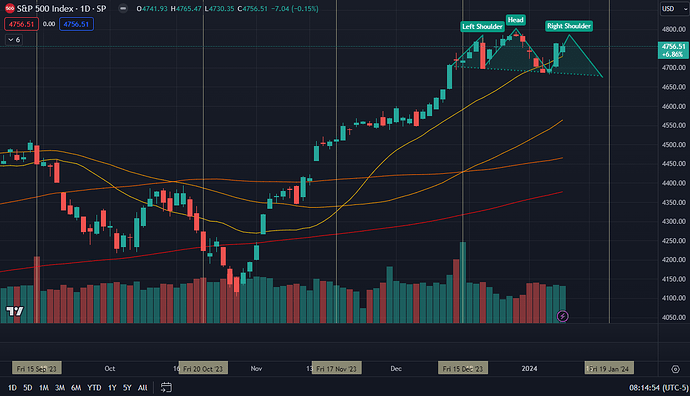

Thus, expecting mostly positive movement into opex (1/19).

Some smart people I have learned much from have been calling Jan 17 (Vixpiration) to be the start of the correction. Other near term potential inflection points are QRA announcement on Jan 29 (bond/bill issuance), and FOMC on Jan 30 (will Fed cut rates?).

What happens after that really depends on how the economy continues to respond to the lagged effects of all the rate increases under our belt, along with global liquidity levels, EPS revisions, and of course, the occasional thing that will go bump at night.

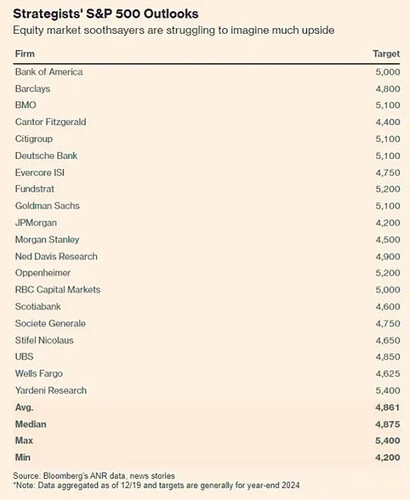

Here’s a list of end of 2024 targets from Wall Street’s best and brightest (h/t @DonDegenerate). Note that they all missed 2023 by being too bearish…

On an admin note, @Yong I’ve started this annual thread as volume had died down for our monthly threads on this topic. And it’s nice to be able to go back months at a time without having to scroll through multiple threads.

Everyone, please share any perspectives you have on markets in this thread.

Re: Wood Dragon:

According to the Chinese Horoscope 2024, the dragon represents authority, prosperity, and good fortune. Those who were born in the year of the dragon are known for their captivating demeanour, distinct personality, and strong leadership abilities.

The Wood Dragon year 2024, when combined with the nourishing Wood element, will bring evolution, improvement, and abundance; it is the perfect time for rejuvenated beginnings and setting the foundation for long-term success.