Agree with both of you that it feels like market could go either way. I’d go so far as to say that this week will likely determine the direction into March opex. If we do not manage to sell off enough this week, we may rally for the two weeks after.

Reasons to expect a continued selloff:

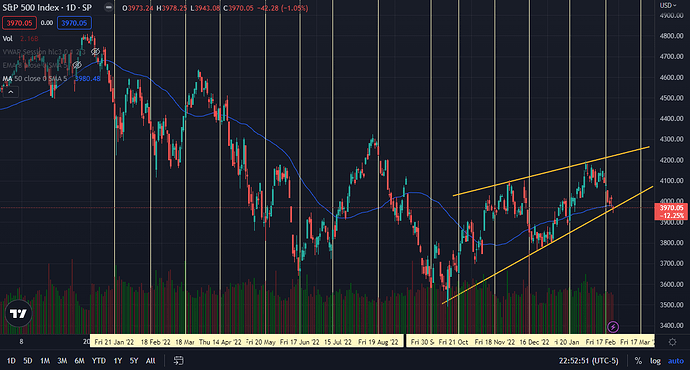

- We closed below 50 SMA and just below that wedge. (Image 1) One or two more days below the wedge and below the 50SMA should really signal a solid bear move.

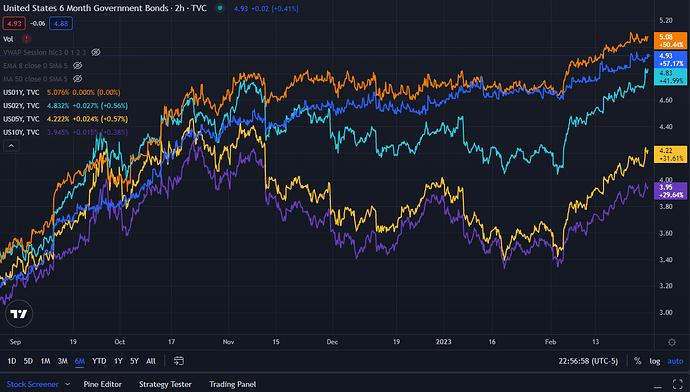

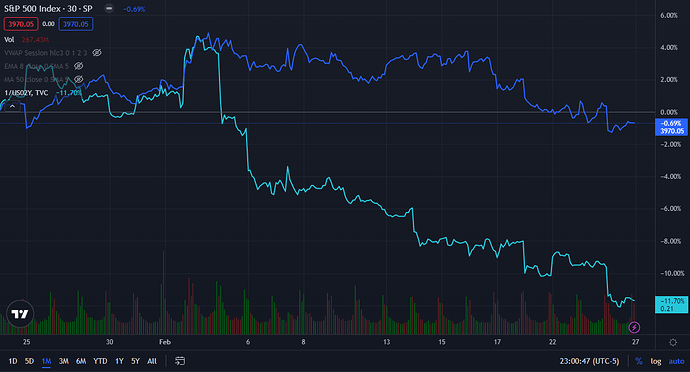

- Bonds are up. 6M and 1Y are up by about 25bps, and 2Y, 5Y and 10Y are up by about 75 bps. This is sizeable. (Image 2) Image 3 shows the gap between US02Y (inversed) and SPX.

- DXY is also going up, which should be bearish for stocks. (Image 4) Although this move is likely because of bond yields so its not a primary driver itself.

Yet… I don’t feel the kind of certainty I’ve felt at other times where a post-opex dump felt pretty certain (and delivered). Reasons:

- We had a drop the day of, and the day after opex, but since then, every day has been a range day. (Image 5) Lots of intra-day volatility thanks to 0DTE, but the days did not look like a selloff was happening.

- Bonds are up, yes, and so is DXY. But… they aren’t going to go up indefinitely. A 75bps on the 2Y is plenty, and the 10Y is just shy of 4%. The drop in bonds (and therefore rise in yields) may be coming to an end, in which case, so would the pressure on stocks.

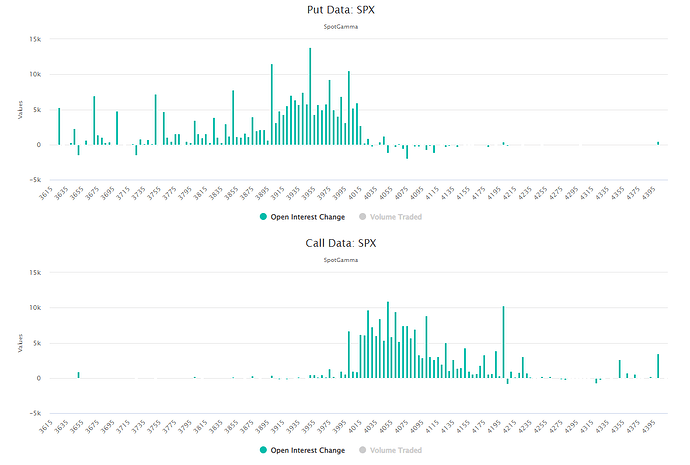

- A ton of puts have come in to provide support, so drops should be more contained. And folks are also adding calls, including many 4200 ones, which indicates bullishness. (Image 6)

- End-of and beginning-of month flows will kick in shortly, which are always bullish.

Three additional factors:

- Vol trigger is at 3950, which is just 20 points below where markets closed on Fri. This is the point where MMs stop being supportive and start moving with the market. If we end up a fair bit below 3950, we’re more likely to be in trouble.

- It doesn’t matter as much for next week, but Mar opex is massive. The flow and hedging effects from those will kick in next week for sure, maybe even toward the end of this week. Those seem supportive so far.

- 0DTE options are increasingly determining intra-day market movements. While they have not broken something horribly yet, they could tilt us to one side (the downside…) hard enough that they ignite the self-fulfilling feedback loop of a sustained drop.

All in, its a lot to consider. Overall, unless we decidedly embrace the downside Thu, I’d prob get into bullish positions up to Mar opex (3/17). Most important data point btw is probably the ISM Manufacturing Index on Wed.