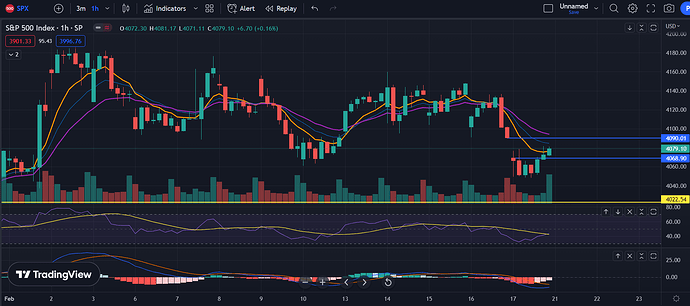

TLDR: I think that we’re going to get some downside soon, maybe starting Monday or Tuesday. Dollar broke out and the yields started to spike up after the job numbers.

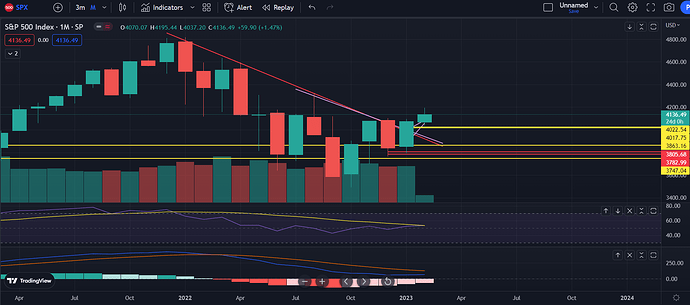

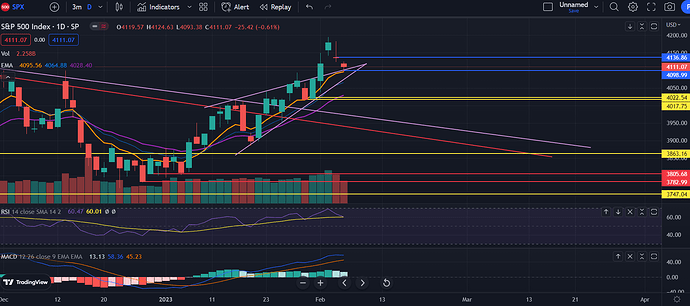

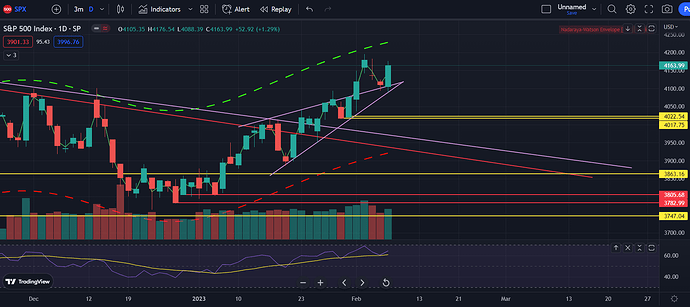

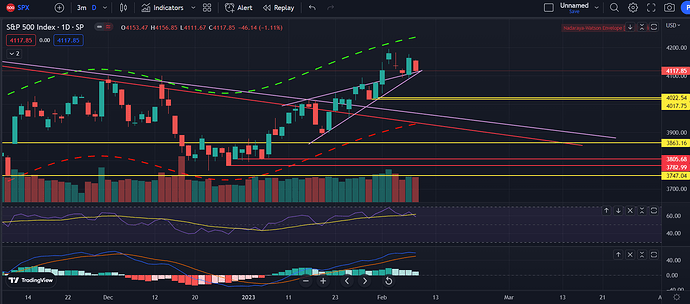

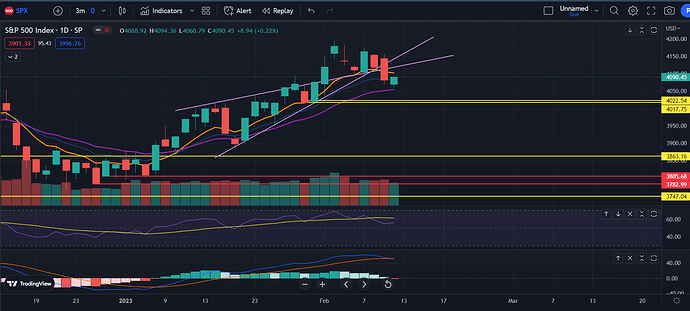

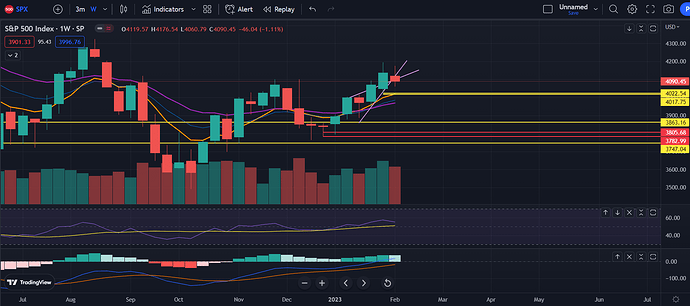

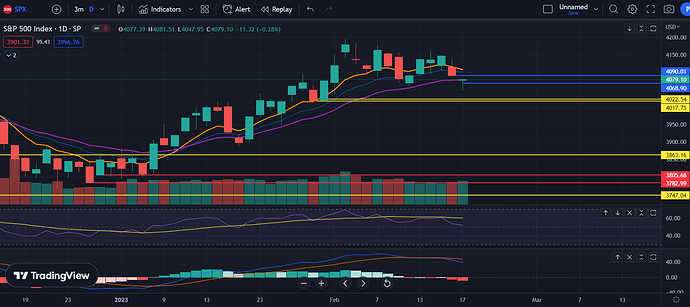

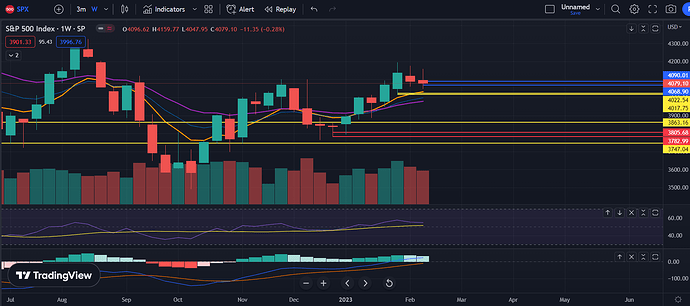

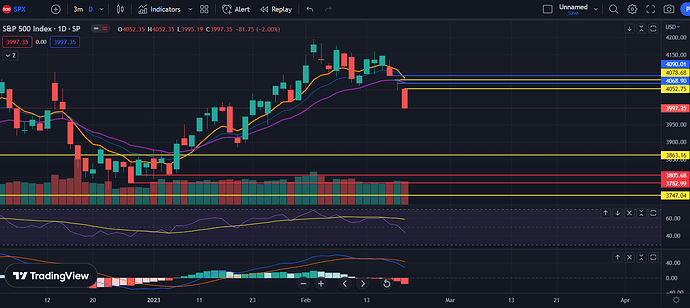

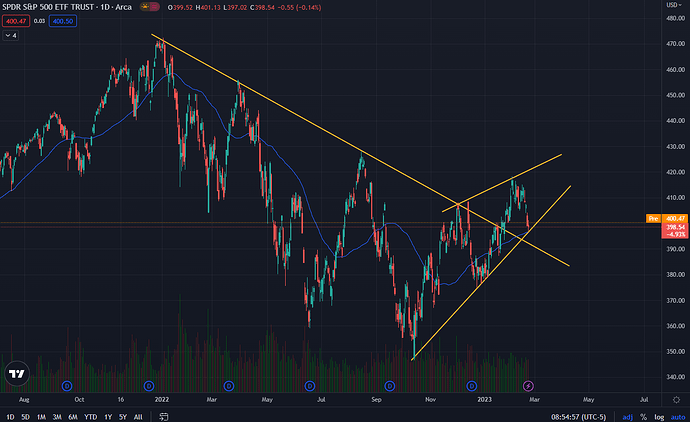

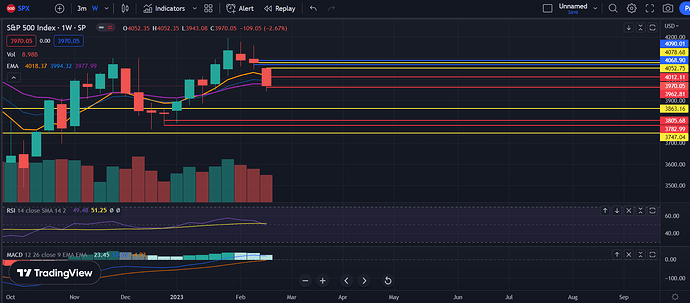

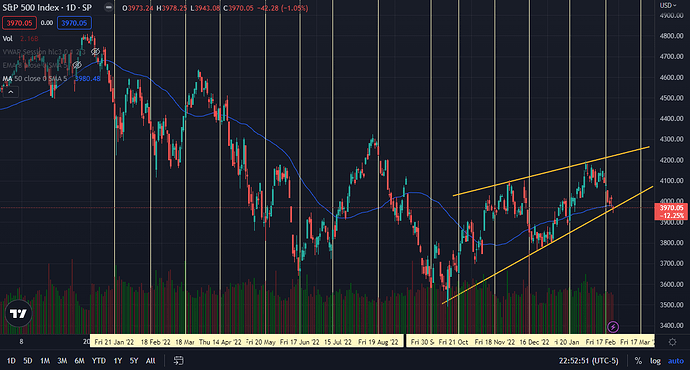

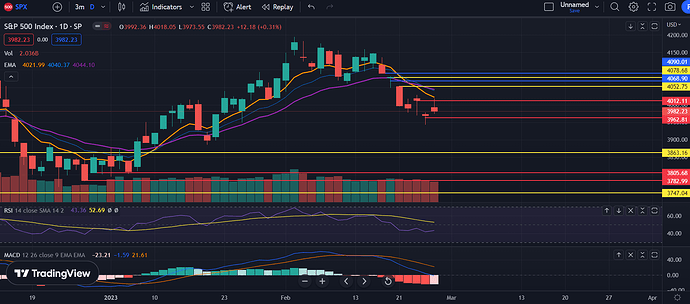

I forgot to do the monthly close for January so we’ll start there. On the monthly, we basically reversed the entire December dickdown and we had an inside bar. This is typically bullish, but the only thing I’m hesitant on is that the monthly volume on the January bar is lower than the December. We’ll see, but on the monthly, it does seem like the trend might be changing and we could have more upside.

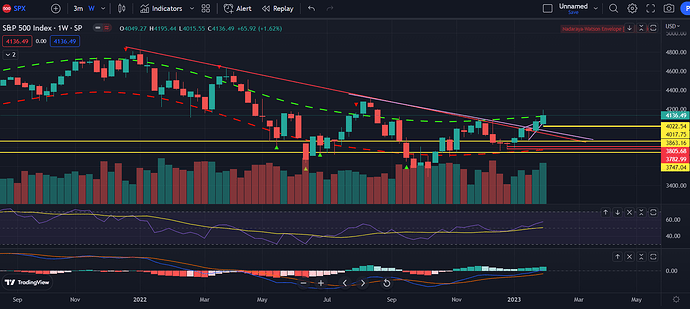

On the weekly chart, we do have an upwick, but it does have increasing volume (using SPY). Which makes sense because this week was full was huge news. So I won’t put too much emphasis on it, but it is good to see that there is increasing weekly volume on this run. Also good to see that us having multiple closes above the downtrend line, which I think shows that we’re can ignore that line now. Only thing that worries me is that the weekly bar is now slightly above the Nadaraya-Watson Envelope (the red and green dotted lines). These are basically just like the bolinger bands, shows the extremes. Last times we were up at these extremes on the weekly, it showed the tops and bottoms. But, it typically lasts like a week above, so maybe we have another green week.

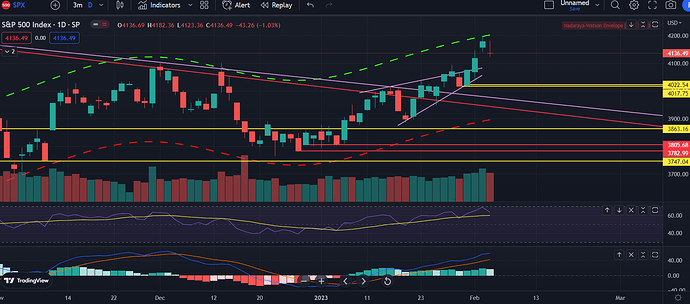

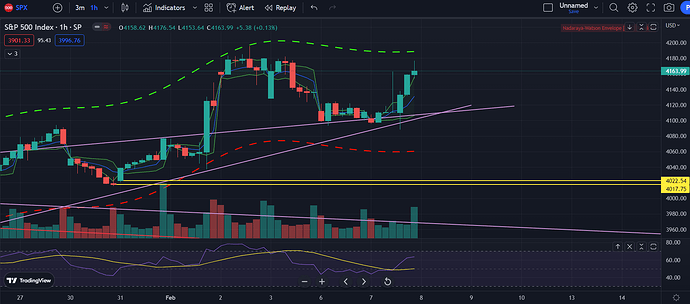

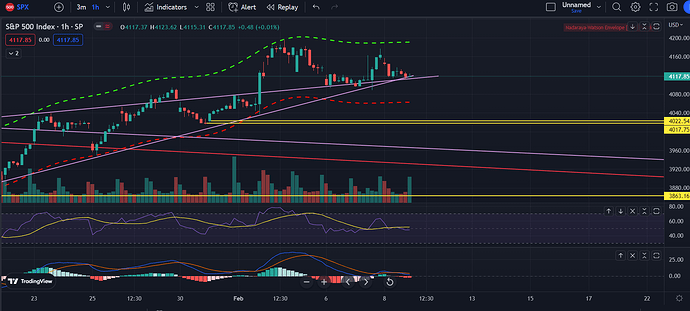

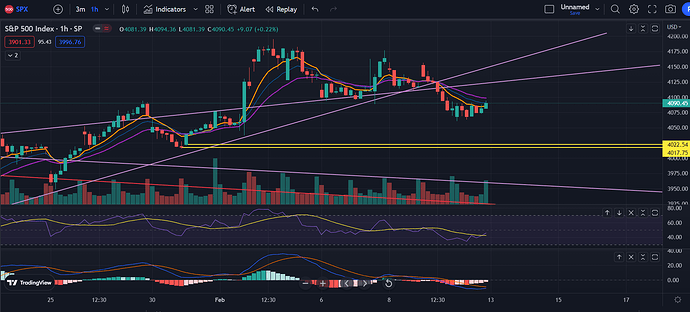

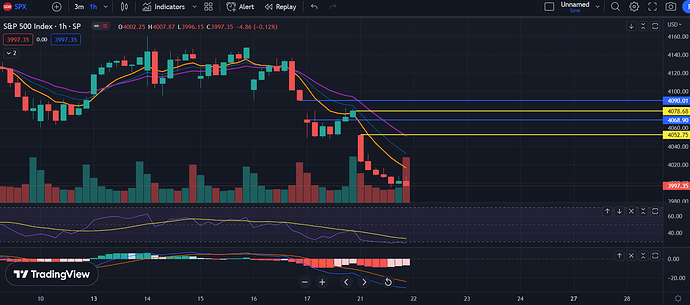

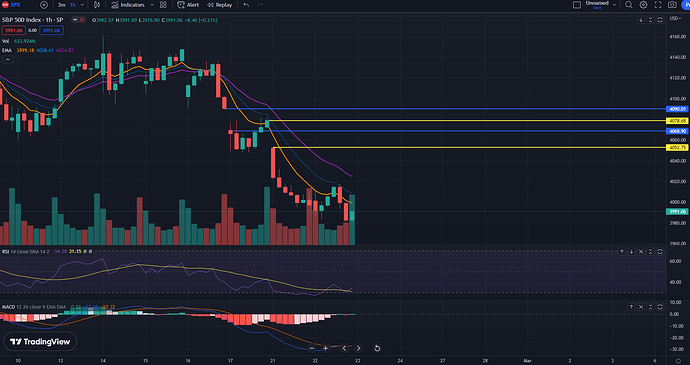

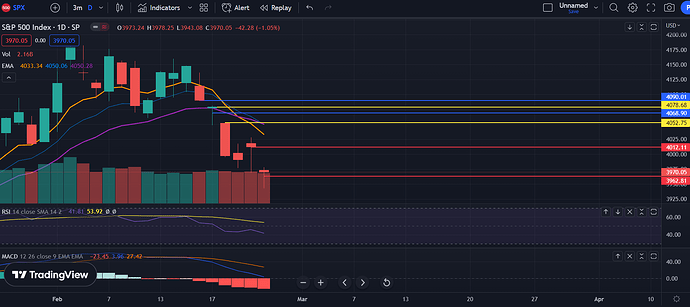

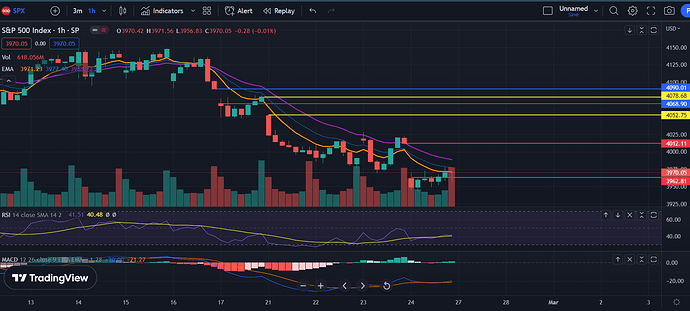

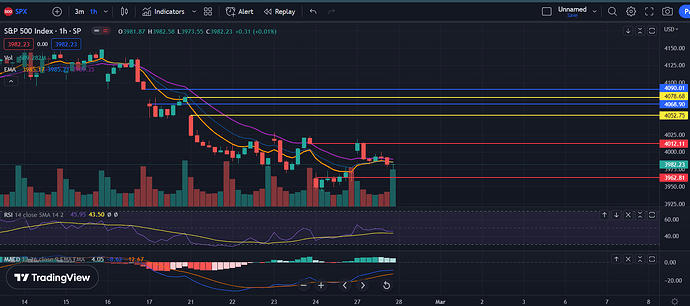

On the daily, we did fill the gap above and below. We formed some bearish candles with a gap up and then a huge upwick. Interesting to see, but we’ll see if bears can follow through on this and push it through to form a higher low and show that the trend is actually changing. MACD and RSI still look strong, so we’ll see what happens. The hourly just shows range trading so nothing to say there.

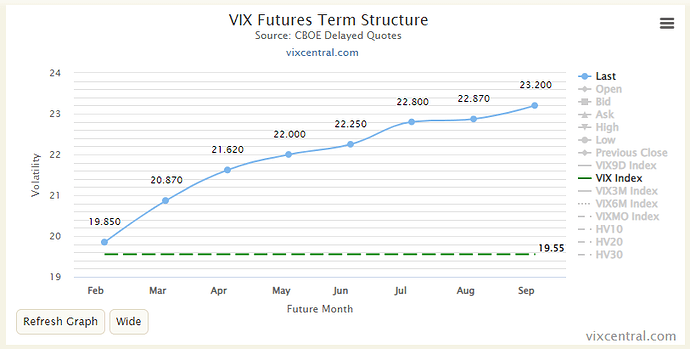

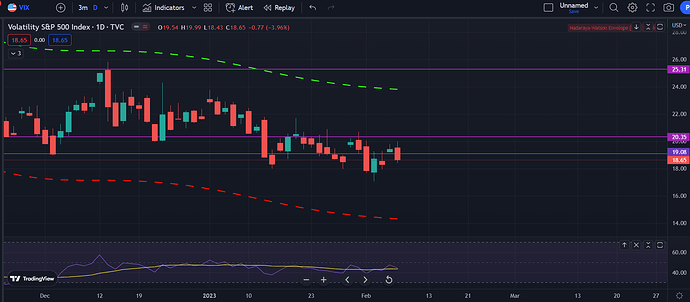

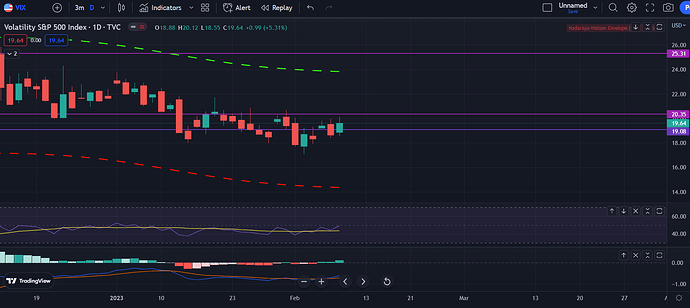

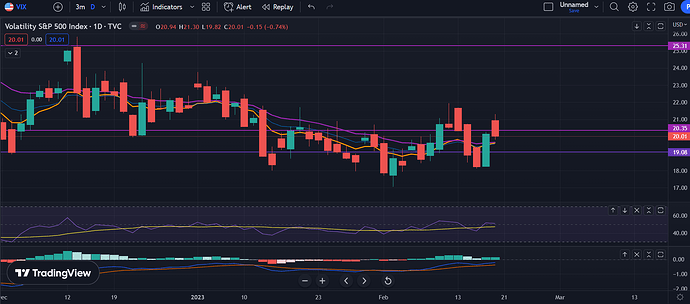

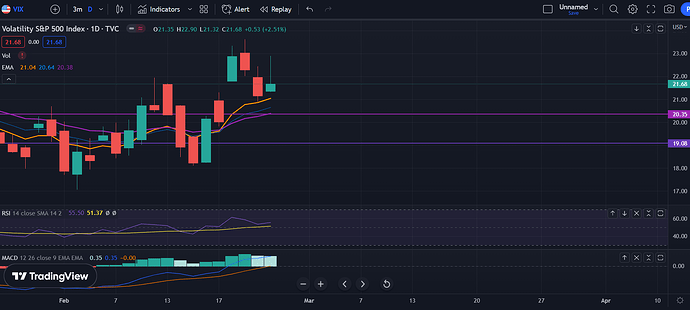

The VIX is dicking around again, so we’ll see if that pump before was just because of the big tech earnings and FOMC.

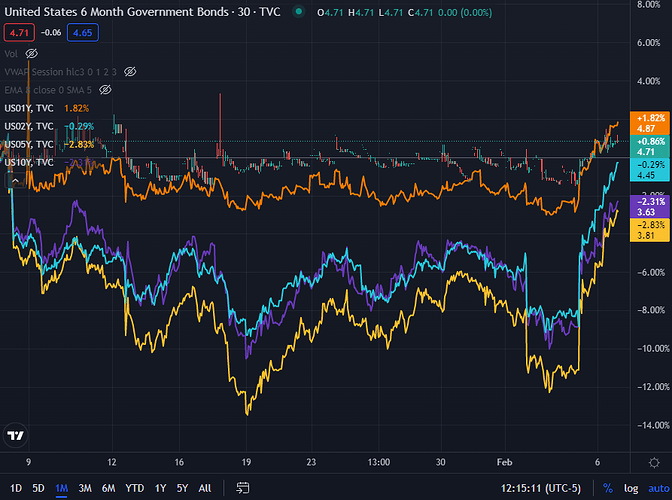

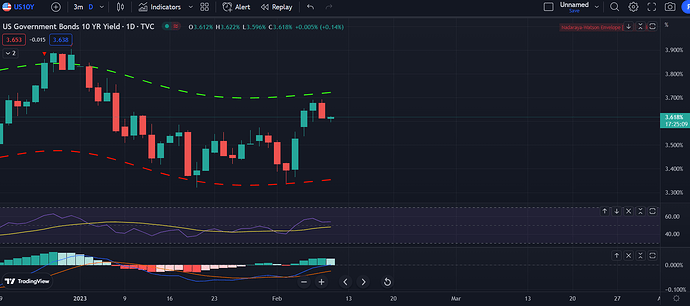

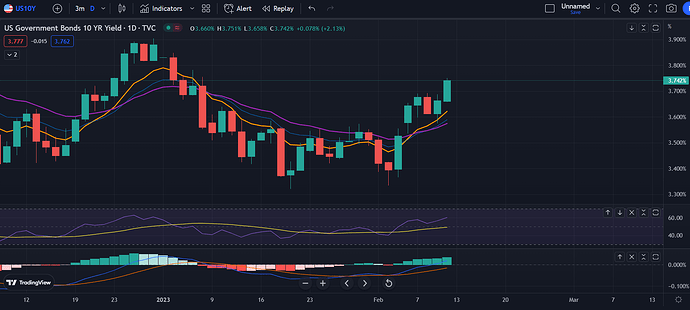

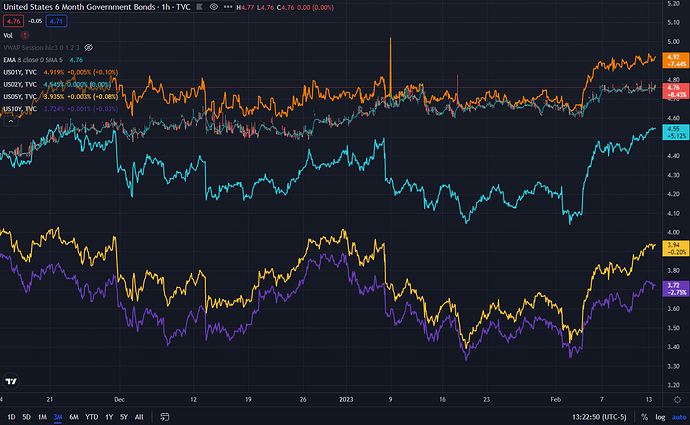

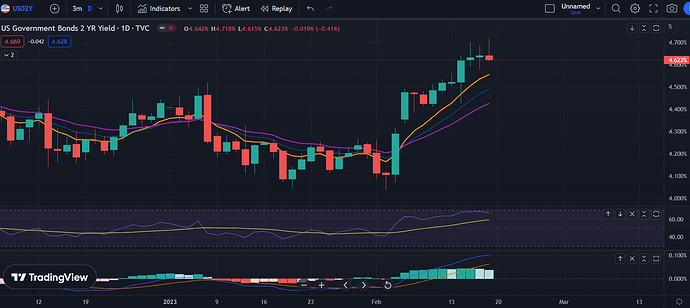

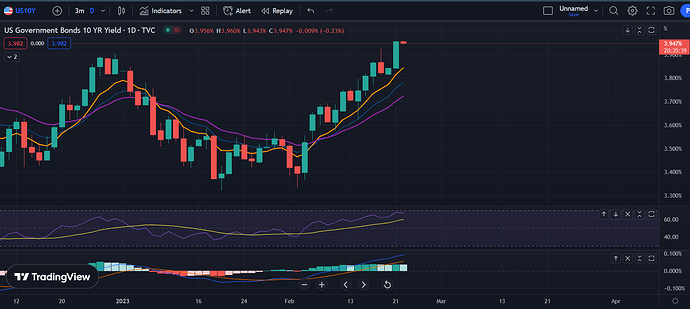

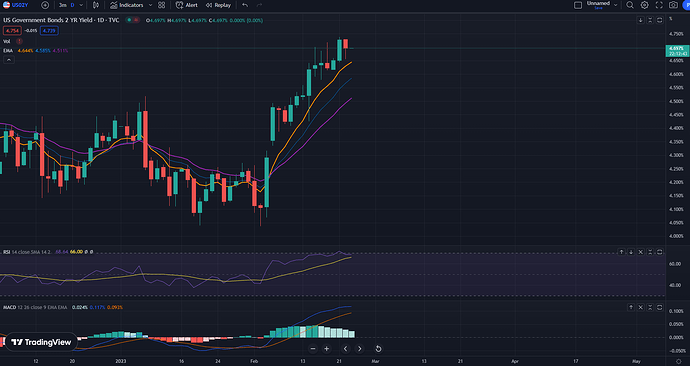

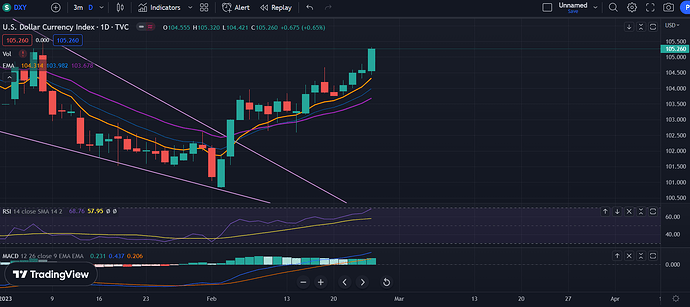

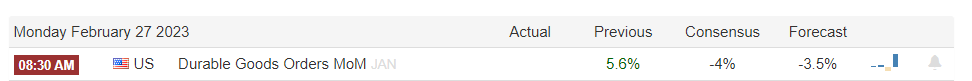

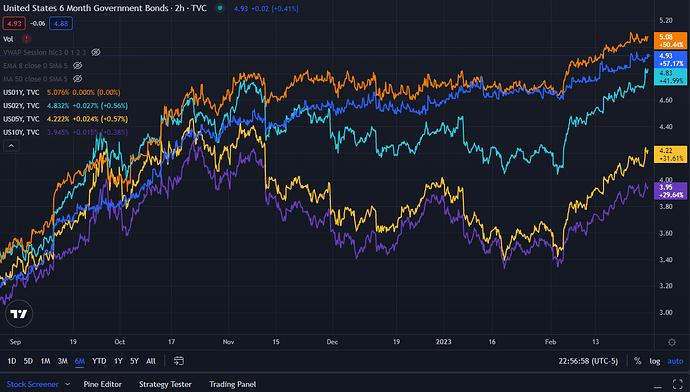

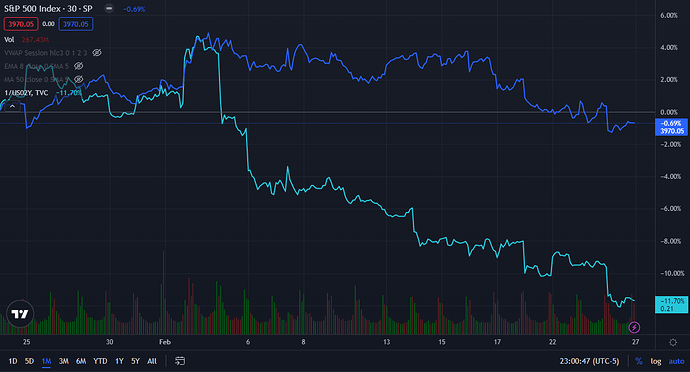

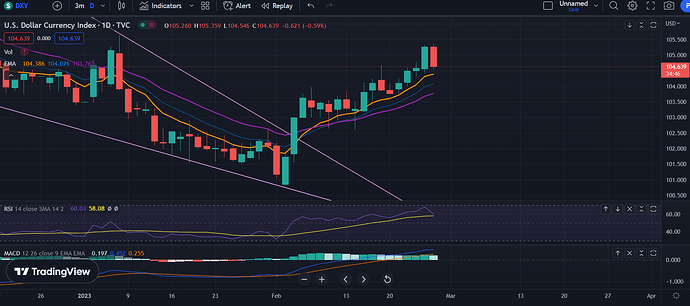

Now here are the biggest factors why I think downside is coming soon. The yields spiked hard when the job numbers hit super strong. Markets are starting to think that Fed will raise rates more or hold it for longer. Interesting to see.

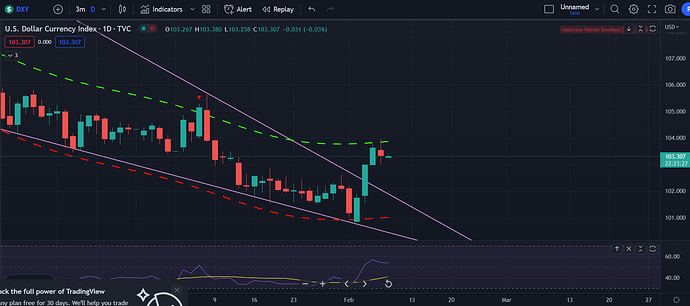

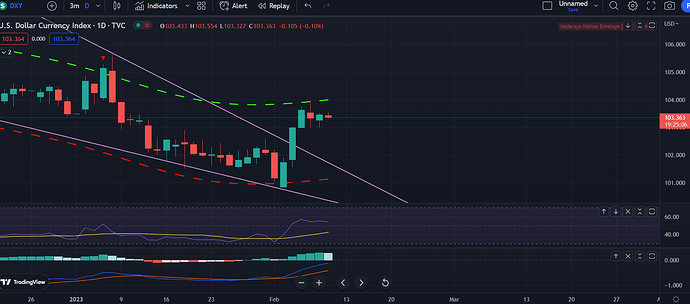

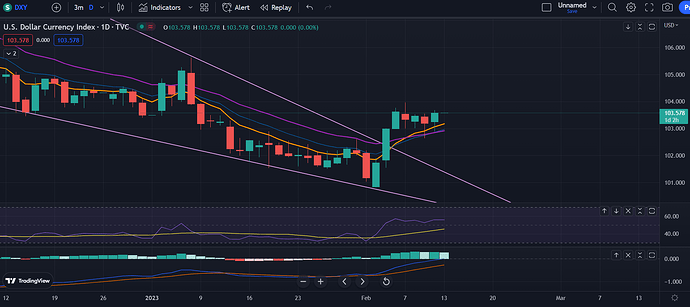

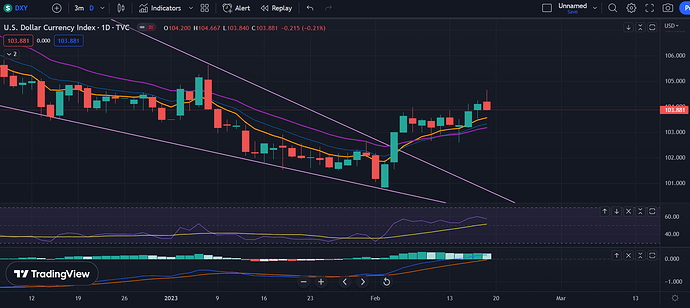

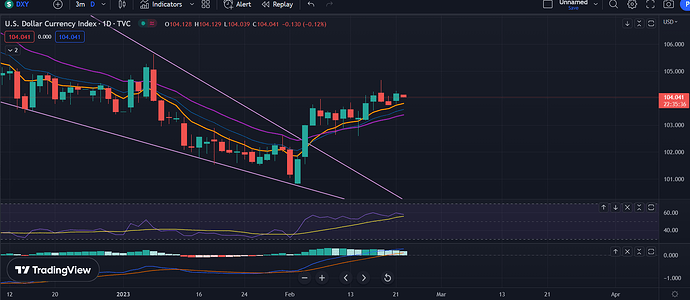

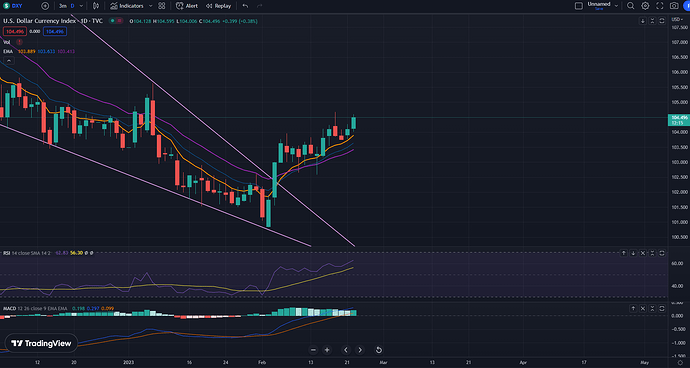

Another big thing that I’m seeing is that the dollar is breaking out. The last time the dollar broke out of the wedge, it was the December top, but it did lead to another big run, so we’ll see if this breakout leads to a huge rug pull or just another higher low form. We’ll see what happens with this breakout, but it hasn’t led to good things in 2022.

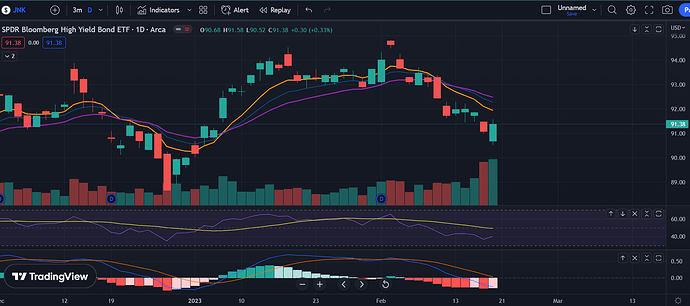

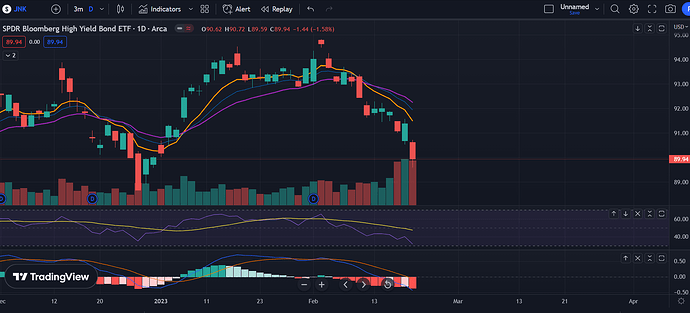

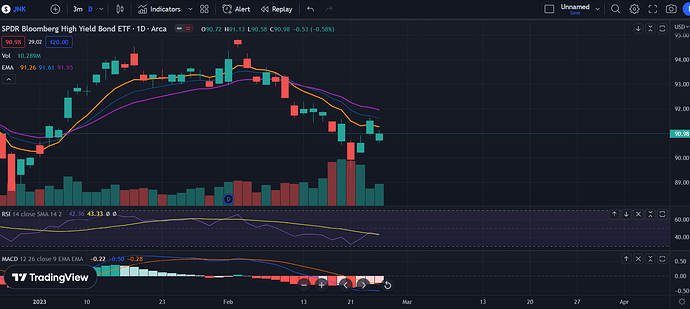

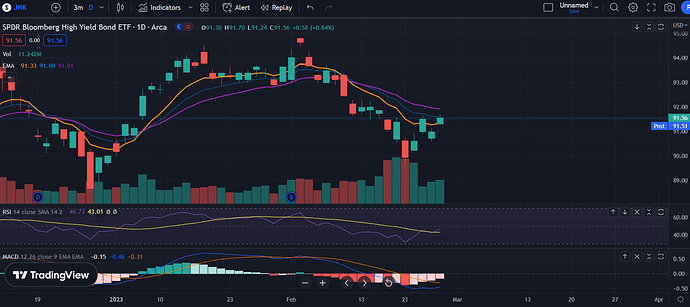

Another red flag I’m seeing is that the junk bonds got shat on and showing an island reversal. Interesting to see, but we’ll see if this is another red flag that’ll play out. If junk bonds are diverging from SPX, it typically shows that the SPX move is not supported.

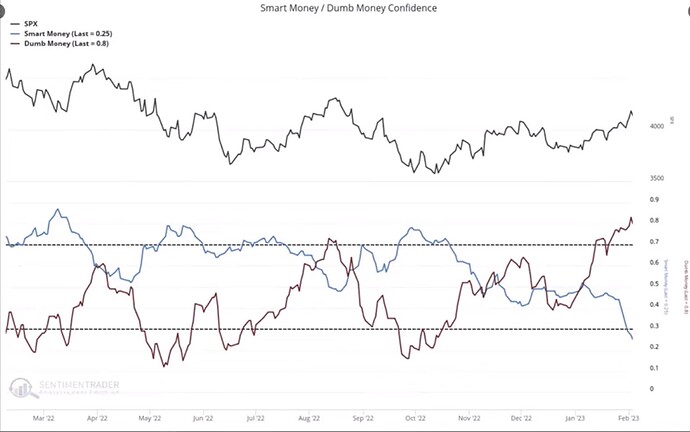

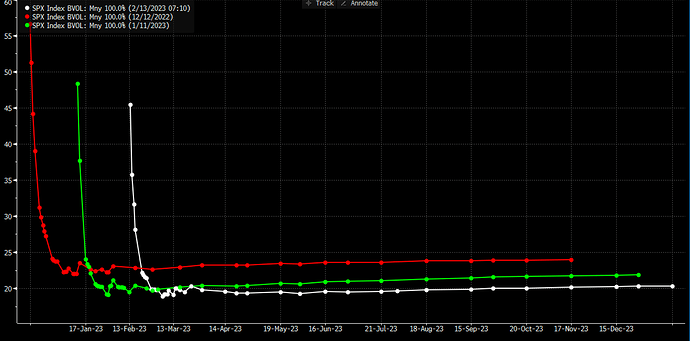

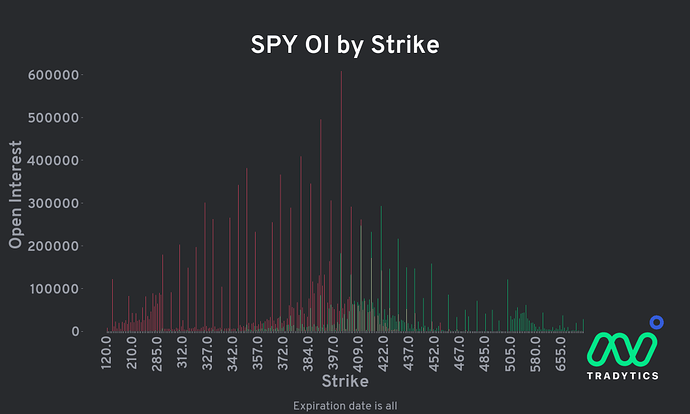

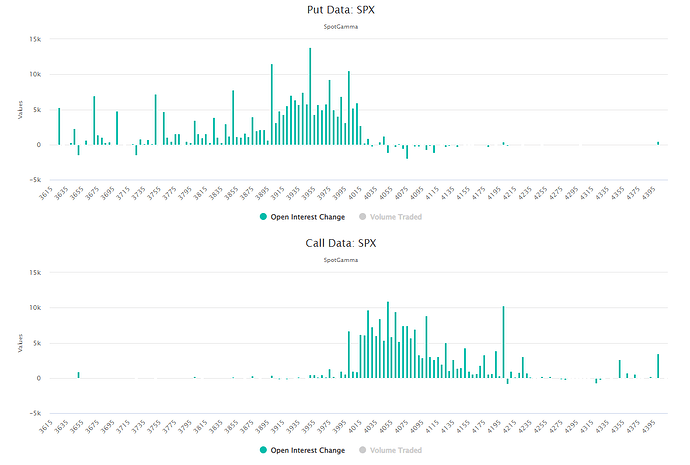

Now another big red flag I’m seeing is that smart money is pulling out even more. I would think that smart money would be entering the markets if they thought that markets were going to go up more, but we’ll see if the rug pull comes soon. Smart money pulling out this heavily is not a good sign as it has marked the tops of the markets the entirety of 2022, not the exact tops, but around the same points. BUT something to say is that this isn’t a 100% accurate indicator. Smart money was pulling out hard during the post-Covid crash rally and then started re-entering way later on. Maybe this happens again and then smart money re-enters once they realize that markets aren’t coming down anytime soon.

Overall, red flags are flashing for downside on SPX, but we’ll see if any of them even play out. I do think that we’ll have a green day on Monday because VIX and SPY was both red and this typically leads to a green day, but we’ll see what happens afterwards. Good luck all.