I’m gonna be going off to the Caribbeans for Spring break so the March TA will probably not be started until sometime next week.

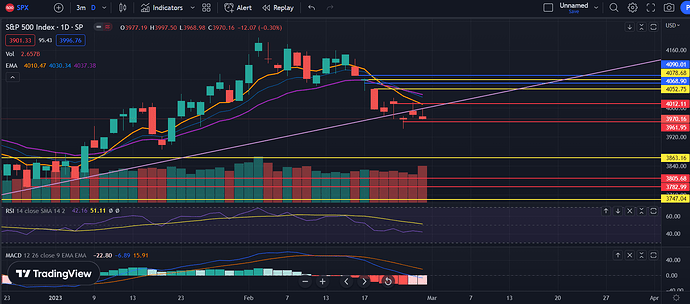

TLDR: Honestly, I flipped to bearish given the back to back sell off days and the higher selling volume, but we could also just dick around in a range like the December chop so I wouldn’t be super bearish or bullish at this point.

On the hourly, it seems like we filled the gap from two days ago and on pace to fully fill the gap from a bit ago. It went from looking like an island reversal to a gap fill and maybe a consolidation into further dump. RSI and MACD are in the bearish zones so it’s not like we have much bullish momentum here. Interesting to see, but until it has a close under the previous low, I’m gonna guess range.

On the hourly, we had an increased selling volume, esp that last candle of the day where we wiped out a fuck ton of gains. Maybe something about monthly options expiry? Who knows. But given the back to back top wicks and increasing sell volume, I am leaning more towards the bear side, although I am not fully bearish. The MACD is crossing below the 0 line so we’ll see what happens. Also another rejection of the 8 EMA so it could be a sign that we’re going to head lower before a big move up.

The VIX is kinda dicking around and isn’t showing much. But had an upwick, but since it had a red day with SPY having a red day, there’s a chance that this selling isn’t supported.

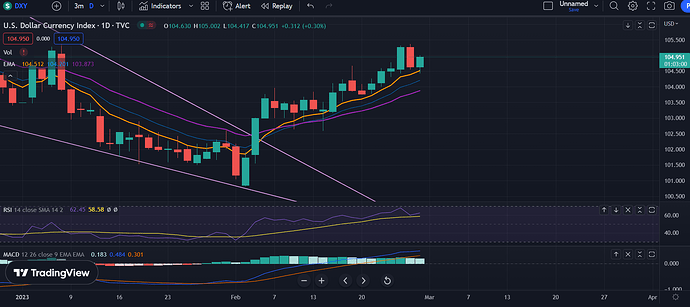

The dollar started to move back up with a solid green close. We’ll see if this continues higher and keeps pressure on the markets. The yields did nothing and the junk bonds was also flat. Overall, seems like no information can be gotten here.

Overall, it seems like things are starting to learn more bearish, but that chop zone can happen again for like 7-14 days so we’ll see what happens. Good luck all and let’s hope that March gives us a solid trend to trade.