Finally, a spicy opex week, after a long time!

Normally, this is where I’d turn bullish, at least for the short term, for two main reasons:

-

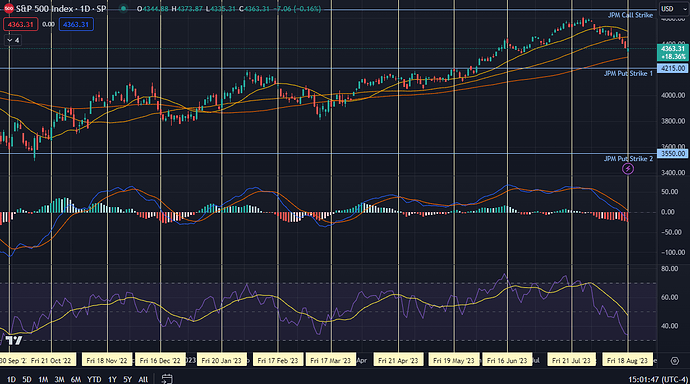

SPX is starting to dip into oversold territory, down 5% in 3 weeks. And NDX is also down 7%. Reasonable to expect a tapering off of the selling, since this still seems to be more of a technical correction than a change-in-reality induced selloff.

-

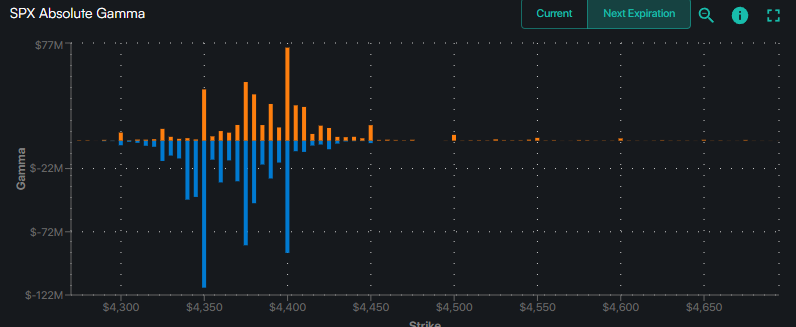

We’re swimming in a decent amount of index puts, which will go poof by the end of the day when they expire. We’re in a net put zone (more blue puts than orange calls), and negative gamma which made MMs short more, as we moved lower. That means that when all the blue stuff expires, it should result in a move up as the short hedges are unwound.

Here’s what gives me some pause:

-

The size of the option expiry is not that big compared to previous months, or next month, so the kick we might get is weak.

-

The bond yields of 5Y, 10Y, 20Y and 30Y have gone up 9-11% over the last month - very likely resulted in draning of liqiudity from equity markets

-

There’s nervousness around China, with various contagion risks. The impact of the various pathways - internal recession, currency devaluation, ad hoc stimulus - is not clear, but it all adds to volatility

-

DXY has also been on an upward march, which isn’t helping the market either:

-

Finally, 0DTE… that shit’s been wild. Leaving some SG tweets below if you are interested in the details; in short, they have played an outsized role in the downward moves this week. We have no idea which way these tutes will tip the cow next week. Though it’s fair to say that while we remain in negative gamma territory, tip the cow, they shall.

I’m keenly looking forward to what the option structure looks like on Monday, after the dust from today has cleared out. Where the call and put walls are, we well as vol trigger, will provide hints as to whether George can start chilling again, or hot girl still has some more excitement for us as we get into the waning part of summer.