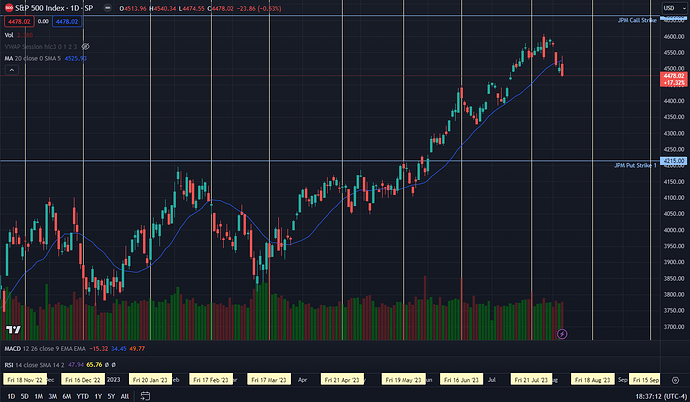

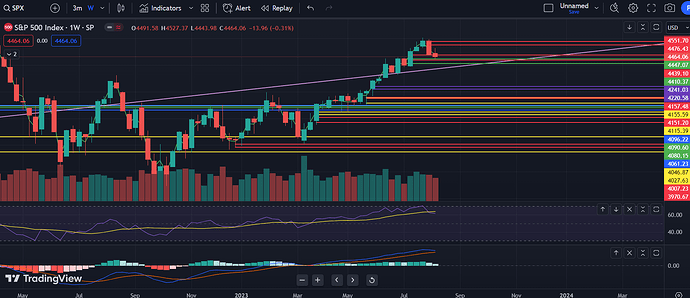

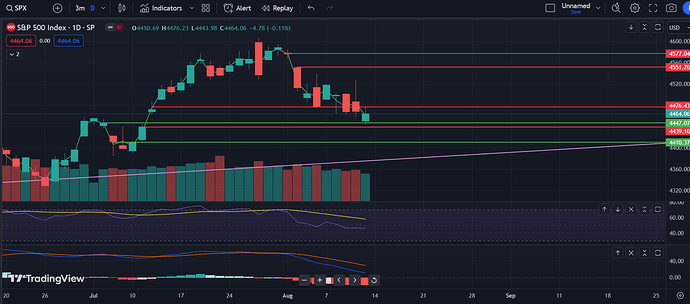

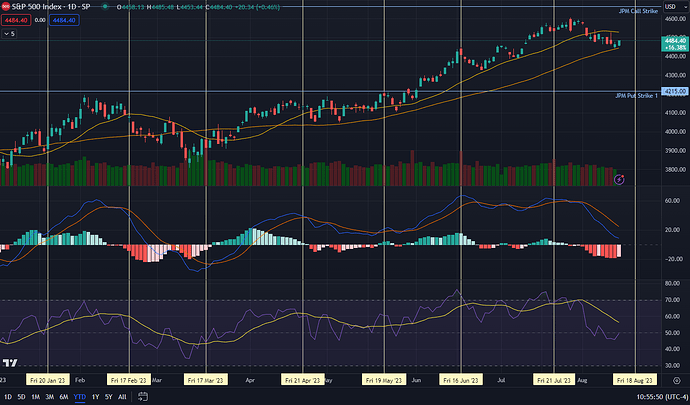

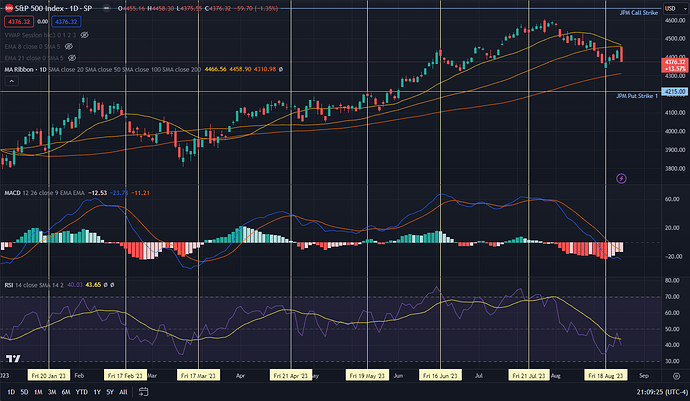

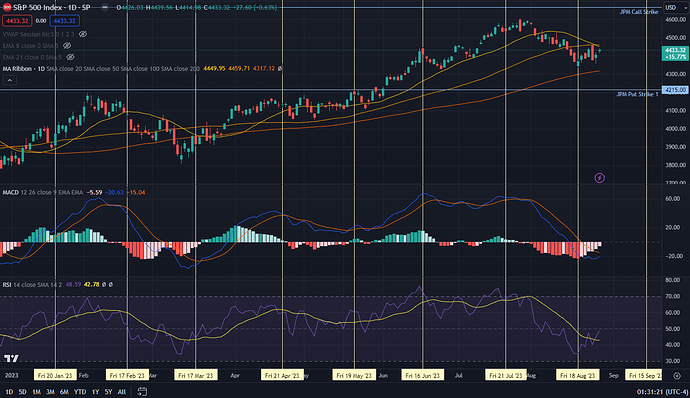

Tl;dr - Aug could be spicy. If we get stuck below vol trigger, we may drift downward into opex (8/18). If we manage to get above it, we might remain in the 4,500-4,600 zone.

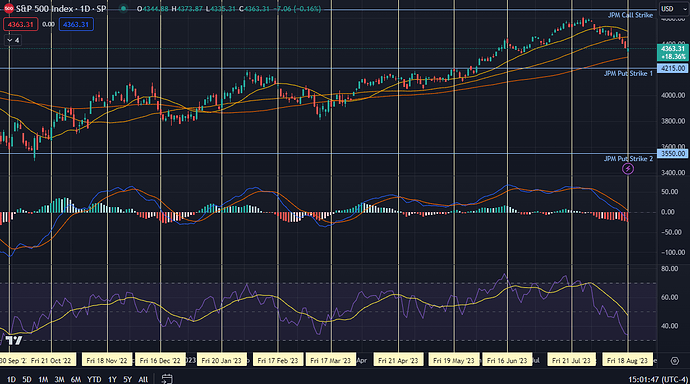

What a difference a month makes - folks may want to check out the July piece as it is important backdrop for August. (Also, I really need to get better at actioning these readings of the tea leaves … ![]() )

)

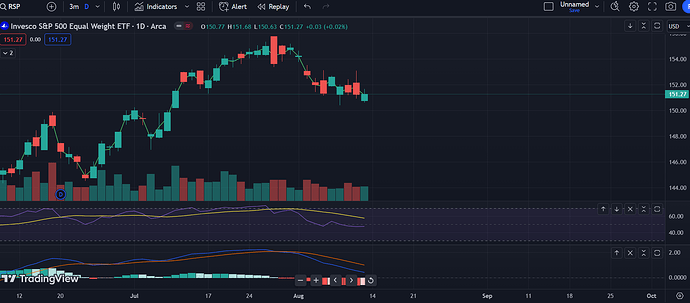

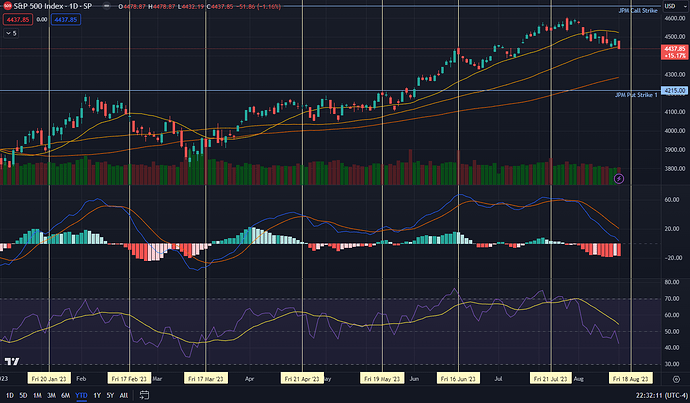

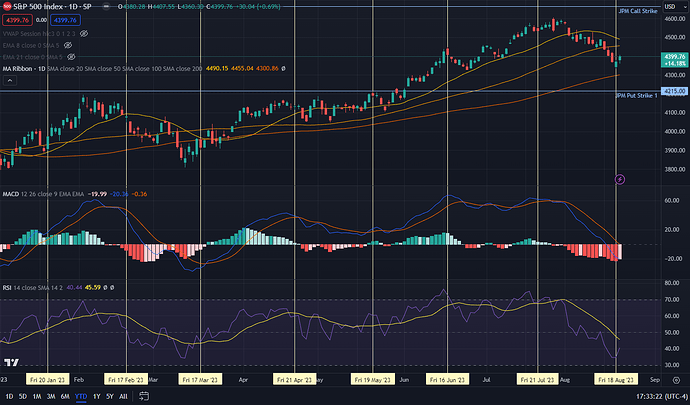

Everyone and their favorite furus were expecting a pullback because we were so overextended. Which we got last week. A 2% SPX drawdown after a 21% rally since March lows may not satisfy the market gods though, so it’s reasonable to expect a bit more of a drawdown.

Tomorrow will likely be pivotal:

-

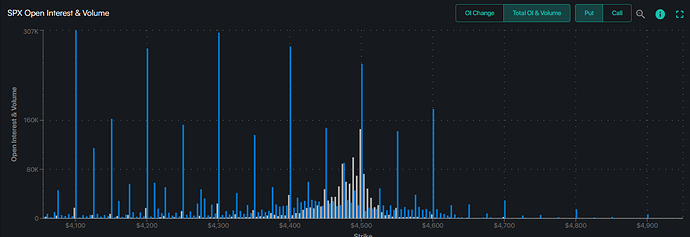

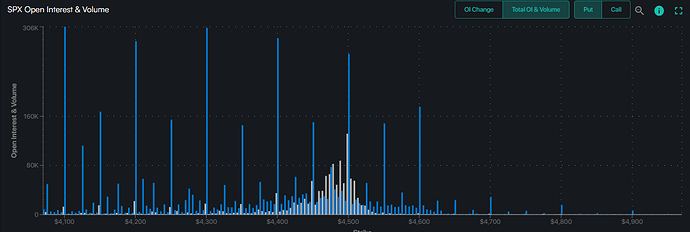

If we manage to close over the 20SMA and over vol trigger (level for which we will know in the morning), we may end up futzing around in the 4,500-4,600 zone into Aug opex (8/18). Since positive vanna and charm feedback flows start now. The effect will be less muted than quarterly opexes because there isn’t as much OI expiring this time around. Thinking we will be range bound even if we make it above the vol trigger because there really isn’t anything by way of call levels over 4,600, suggesting market really feels this is the top. For now. Will track Call Wall to see if this changes.

-

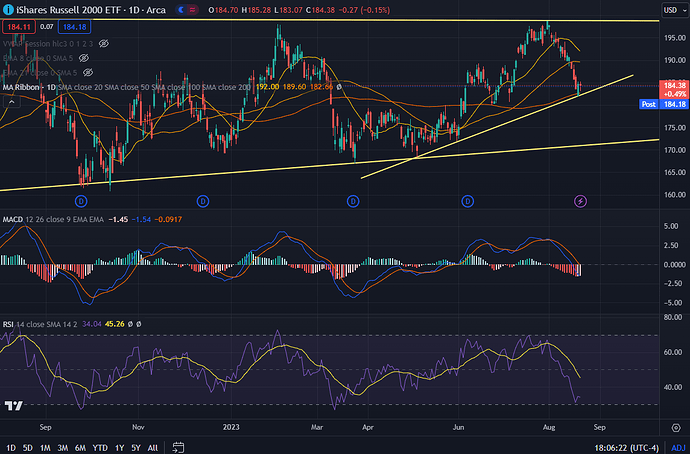

If we don’t manage to close over the vol trigger, MMs will tip the cow over and keep it rolling downhill, even as market likely sells off because we are still below 20SMA. This is where gamma (and resulting delta) hedging overwhelms whatever vanna or charm effects there might be. If this were to happen, we could fall all the way into opex, i.e. for the next 2 weeks. Was surprised to see the Put Wall come up so much last week, and then so easily breached; not sure what to read into that.

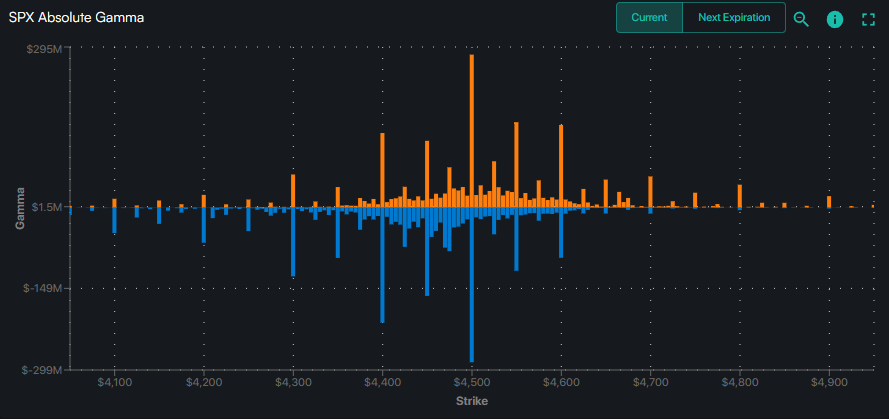

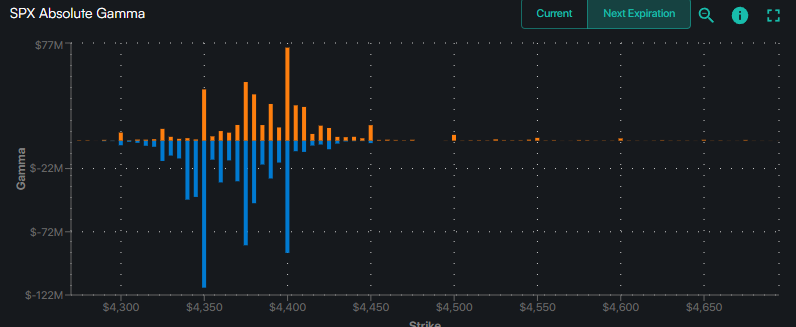

Using the SPX gamme levels in the image below, we’re basically trying to get from the region with the negative bars to the region with the positive bars over the next day or so - that’s where the gamma kinda starts to straighten out. Ofc the option complex will change over the next few weeks, so we’ll have to keep an eye on this.

If we did end up in a negative gamma cycle, MMs might stop tipping the cow once we reach the 4200 level.

Some important dates this month:

-

CPI - Aug 10. Might be a damp squib.

-

Michigan Sentiment - Aug 11. Market seems to have reacted to this the last few times.

-

Opex - Aug 18. Our dear pilot point. If we are in the 4500-4600 zone, I think we go lower the week after. If we are lowe than this, we will probably have one good week after opex, and then resume the downward move. But more on tihs in two weeks, depending on where things are.

-

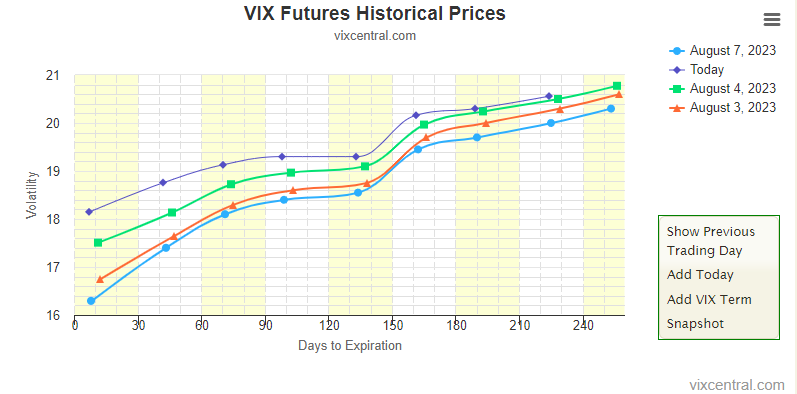

Jackson Hole - Aug 26. It was a big deal last year. The biggest deal. Yet no one seems to give a sh*t about what Powell has to say these days. We’ll have to wait to see the vol complex for clues on whether he’s solidly in the “ok boomer” forgotten zone now for now.