This will be the first little thread I make on the forums, so bear with me. Many of the things I typically post in regards to SPY are speculative and mostly predictions, but I do believe when it comes to Quadruple Witching that it provides a better chance at profit on the downside even if news isn’t all doom and gloom.

[size=4]So… What is Quadruple Witching?[/size]

Basically it is when four different assets (stock index futures, stock index options, stock futures, and single stock futures) expire all at once. This event occurs each quarter on the third Friday of March, June, and finally December. Next week is when when we will see this happen.

[size=4]Okay, but what does THAT mean?[/size]

It means a ridiculous amount of open interest drops off the face of the earth. Think of SPY monthlys disappearing, but on a larger scale due to it including Index options and futures.

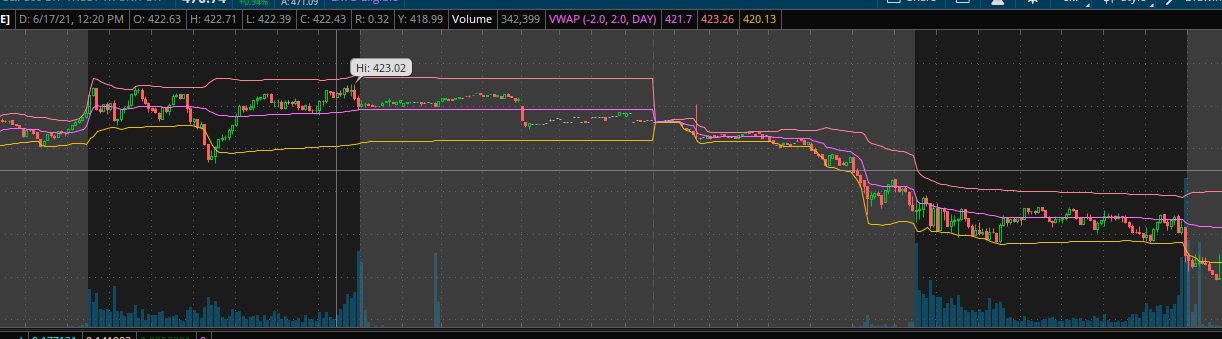

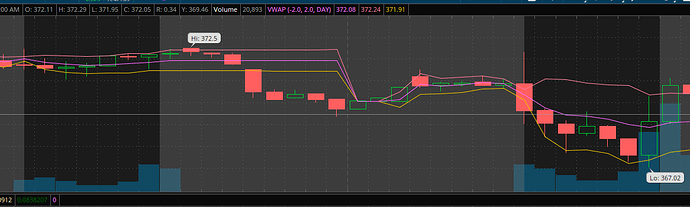

[size=4]Here’s an example of what can occur…[/size]

This was the most recent and I think the more memorable one for everyone as this along with mentions of Evergrande & Debt Ceiling Talks kept the Market from rebounding for so long. Will it be as bad? Likely not, as you these two important situations happen that likely spooked a lot of people out of the Market for a time.

[size=4]Best entry?[/size]

You’d likely be looking at getting a put Thursday into Friday. We’re still seeing a resistance at 470, so if you perceive 470 as the ‘top’ of next week, you can try to buy a put there. So far the Monday after involves a gap down, but I won’t recommend holding any options EOD Friday as there has been times that SPY has not gapped down after a Witching Hour.

[size=4]Disclaimer[/size]

The biggest problem I see with this method is that it’s a natural part of the Market, meaning it can be ‘priced in’ or outright ignored on a good trading day. If you do consider investing in my madness, please don’t risk anything you’re not willing to lose. My reasoning for bringing this up is that we’re struggling to reach above 470 and this year being highly volatile overall has these events come with an expected outcome of downward movement within the latest Monday.

[event start=“2021-12-17 14:30” status=“public” name=“Spy Quad Witching Play” end=“2021-12-17 21:00” allowedGroups=“trust_level_0” reminders=“1.days”]

[/event]