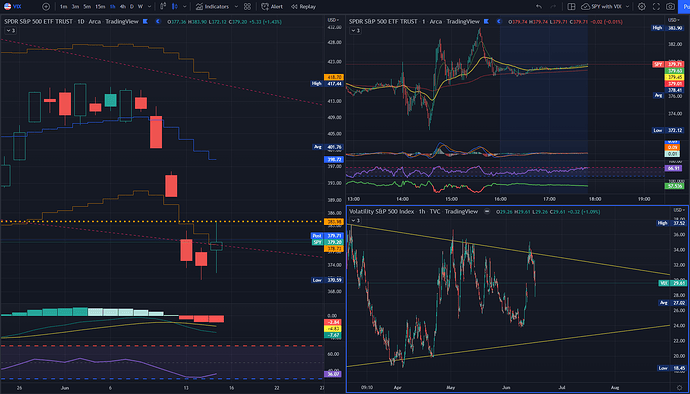

I think we will be testing 383 sooner than 370…

SPY high targets next week will be 390 and 395.

For that, I want to see VIX dip back down to around 25.

We still have a couple of critical reports tomorrow morning, so that will be interesting.

For the Quad-Witching even on Friday, please follow this thread:

Once again, the bell tolls for Quarterly FDs next week. With the excess volatility recently in SPY, options seems to be putting more influence in Indices and ETFs. Given the previous Witching, I was absolutely inversed into oblivion. Next week, I’m going to HOPEFULLY not make the same mistake…

A brief explanation:

“Each quarter (Every 3rd Friday of March/June/September/December), there is an event where a large amount of Open Interest disappears from the Market from Indices and Futures. Typically, this can cause a large amount of volatility in the Market. The previous Witching saw us rallying all the way to 460 along with dovish news from FOMC. This could occur again, but currently I’m in a state of watching rather than entering based on opinion this time around.”

I recollect @Kevin posting in the last Witching Thread something relating to the possibility that depending on how much OI there is on Puts, there is potential that downward bets can become quickly inversed and ‘squeezed’ out of their positions as the expirations hit. That vice-versa could happen if there’s a larger OI on Calls instead.

If anyone would like to add onto the topic, please go ahead. The point of this thread is to bring awareness and see if we could make better predictions for future Quad Witchings. For now, when I do end up entering SPY positions for next week, I’ll post here.

Thanks to @bigglyoptionoligist for reminding me about it this month. Work’s been a mess.

2 Likes