This thread is being created to house signals from the upper-crust (Champions & Above) on SPY. This will essentially act as an ongoing discussion of SPY to alert the community what everyones thoughts are on the market overall.

GOOGL announced a shelf offering this morning:

https://www.sec.gov/Archives/edgar/data/0001652044/000119312522025218/d257890ds3asr.htm

The filing came at 7:53AM EST which corresponds directly to the PM peak of both GOOGL and SPY. They’ve both been in a downtrend since. Haven’t looked into the specifics of the offering, however the market has a short term memory and I would expect it to be somewhat meaningless in the grand scheme.

Looks like my previous assessment was right. The market has seemingly moved on from GOOGL’s shelf offering and is resuming its trek upward. Market calendar for the next couple days has some important data being released:

- Tomorrow at 10AM: ISM Non-Manufacturing PMI JAN

- Friday at 8:30AM Unemployment Rate JAN & Non Farm Payrolls JAN

Considering this data is probably pertinent to the overall state of the economy, I would expect the market to likely consolidate here for a second. This of course could change depending on how well AMZN & FB do with earnings.

We know GOOGL did well, so my money would be on continued bullish momentum. I probably wouldn’t do overnight holds on anything short dated at the moment though due to volatility, would reccomend holding longer dated SPY calls if you’ve got them, but certainly not taking entries right here.

One thing to consider, as I did this yesterday, see if you can get FB earnings numbers and make a decision on calls right at 4pm to 4:15. You can trade SPY options up until 4:15pm. This is still riskier than what conq said above, but this helped me go in heavy last night. I saw Google’s candles and numbers and added a few SPY calls because of it. Will be in VC and watching, but I agree so far I see bulls for now.

Seems like SPY calls were not the way afterhours with Facebook’s earnings.

Watching the daily chart so far… we’re in a similar more exaggerated pattern as we saw SPY earlier in January. What was perceived as a double-bottom on the daily led to heavy resistance on the middle bollinger, leading us down to where we are currently.

As we’ve seen the last two days, we’re hitting more resistance as we’ve reached the middle bollinger once again. If AMZN does tank, that’s certainly a catalyst for the Market to come tumbling down. It’s definitely going to be one hell of a day tomorrow.

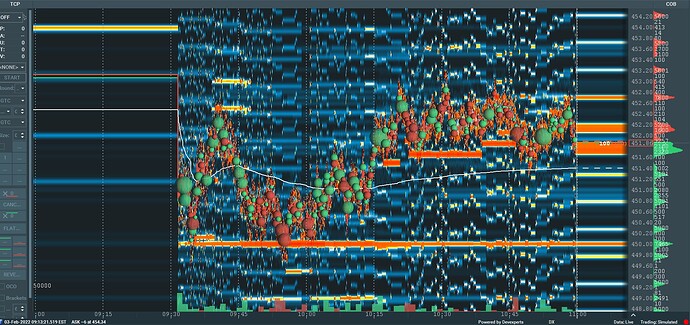

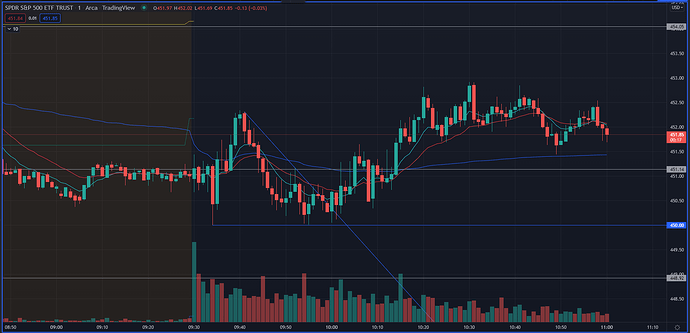

Just a quick post on bookmap and 2 scalps using bookmap.

2 quick scalps on SPY from this morning, still loads of chop so it’s hard to trade with no clear trend.

A way to scalp SPY (Or any stock) without a clear trend or strong daily support/resistance is against liquidity.

Top picture is bookmap, saw on the tradingfloor that most people didn’t know what it was so a quick introduction.

The red and green bubbles are market orders, the size and the green/red colour are determined by the net difference between market buyers/sellers (and shorts) in that timeframe. A big green bubble for example implies loads of buyers buying on the ask.

The white vertical line you see at 11:01 is the line between real time on the right and historical time on the left.

Everything to the left of the line are historical orders ( the heat) and the tape (the bubbles)

Everything to the right of the line are current orders in the LVL 2.

It’s really just the LVL 2 visualised.

The heat (colour) is relative to the size of the orders that are on the screen.

Now the SPY bookmap chart always looks a bit weird because of Algo orders, you can see the weird blue patterns all over the screen. This is all just noise, only pay attention to the big orders.

There are only 2/3 points of interest on this map, if you look at tradingview you can see a double bottom setting up on the 1 minute at the 450 level, normally I wouldn’t take a trade like this because it’s not at a daily support or resistance level. But when I saw the buy wall at 450 holding i went long with a tight stoploss underneath that liquidity.

Did the same at the 451.60 level when I saw that liquidity hold as well, it’s important to actually see a confirmation of it holding in the price action ( buyers stepping in, decrease in volume on a pullback etc) to prevent being faked out by a removal of the order or a breakthrough.

Quick thought is that for every time futures are up and then SPY tanks at open, there is a time futures are down and SPY runs. Don’t get too invested in a direction here, all the news is mostly bullish so puts can get blown out, but the antithesis is that the market may be pricing in a rate hike. Trading is sniping and this isn’t a great shot at the moment.

A push above 450 broke the weekly downtrend and some tech news has been bullish. However, watch for a 452 break and harder break of 453. Pay attention to the big dogs that make up SPY and see how they trend. Watch market data as SPY is in this sideways trend that can be dangerous to trade within until we see the inflation numbers Thursday (Economic Calendar). Set tight stop losses or be ready to average down etc. SPY also has had many days of price swings of 5-10 dollars within one day

USA Wholesale Inventory numbers came back bullish.

SPY seeming reacting downward to upcoming FED speech at 12:00PM EST.

today’s sell off was pretty violent. While hawkish fed members are usually things to take with a grain of salt, keep in mind this was combined with the ongoing sentiment we think rate hikes are coming. Combine that with today’s poor CPI data and the hawkish rumors carry more weight.

Tomorrow we have the fed monetary policy report, which combined with current sentiment, could take spy lower + a weekend selloff. We’re back to the range a couple days ago (at the top of it). Keep an eye for 450-452 resistance, with a downside towards 443-444.

The fed has called for an expedited meeting this upcoming Monday. It can either be to stop the markets from selling off with dovish talk or to discuss speeding up the rate hikes. With current sentiment, this should be spooky for investors as they saw the CPI data as well as Bullard’s statement today. I am short term bearish on SPY right now and will look to enter puts on resistance points tomorrow.

What a day of trading.

SPY respected the 2nd level of resistance (452 area) and continued to drill down, even dipping below 440 at some point. I grabbed calls around the 447 area and immediately got blown out while taking a yogurt break. Luckily scalped some puts to recover it + profit for the day. Today was a reminder for me to stick to my original plan and be flexible in my trades on both sides, calls or puts. Hope you guys fared better than I did.

Considering the upcoming FED meeting and now heightened Ukraine, the short term bearish sentiment remains in tact. There are two scenarios to come out of this FED meeting:

-

Nothing. They come out and say the rate plan is still in tact and give dovish sentiment. The emergency meeting was a reaction to the poor CPI data to cool off volatility and bring stability to the markets again. I would imagine big cap, and as a result SPY, would fucking fly off this news considering tickers like MSFT and GOOG closed below their post-ER levels.

-

Increased rates, sooner. The latest CPI data is absolutely fucked, to be frank. Oil continues to rise. Wages aren’t rising fast enough. And costs of goods continue to increase. The FED has been backed into a corner and are now having to take drastic action. While the announcement of rates increasing back in December was hawkish, there were talks for many months that inflation was going to begin coming down. It’s done the opposite and that’s why there are now talks about higher rates sooner.

I genuinely believe 1 is just as possible as 2. The current market is reacting as if 2 is for sure going to happen. The only thing for certain in the upcoming week is volatility.

We’ve closed below the weekly channel we’ve been trading in, meaning it’s kind of the wild fucking west right now. What we know from a few weeks ago is 420 is a large buy zone, with a soft floor around 428, with a top range around 440.

“Thanks swole that’s a $12 range”

Yes, yes it is, and that’s where we traded for 5 days (and back in September for a couple weeks) before breaking to the upside. It’s a high possibility that happens next week as well.

Keep your levels in tact, portion your sizes correctly, and let’s all play this shit as best as we can.

Currently waiting for news from the emergency closed door FED meeting. Discovered via Twitter earlier that the FED on December 16th, 2015 immediately hiked rates after a similar meeting. CNN’s article announcing the decisions was released at 3:23PM EST on that day:

Looking at the chart for that day:

SPY lost 5% over the next two days. There was a short lived recovery culminating in a -13% market correction. Not commenting on the likelihood, but this sort of thing is certainly a possibility to be aware of should news come out that they’re making a similar move now.

@wolfwoodx had some fantastic analysis of SPY in my challenge thread, I would suggest everyone read through it: Account Update 5 - $1,198.26 -19% - #7 by wolfwoodx

Also to @Champions and @Legends, feel free to make better use of this thread. Given the volatility, a lot of people are placing bets on SPY movement and I think together, we can help provide some better analysis than just “SPY go up, I buy PUT”.

So thinking about FOMC minutes today, which is likely the biggest news/SPY catalyst (outside of Russia news) -

I have a feeling based on the two scenarios that the minutes themselves will likely be a bull catalyst. I’m welcome to being challenged on this because there has to be a bear scenario somewhere, but let me explain:

FOMC minutes are from Jan 25-26. That’s a while ago - before a few key inflation indicators were released: CPI, PPI namely. Additionally, this was also before the ER-related runups for SPY, so markets were still on a downtrend/correction, and I’m sure that was weighing on the FOMC’s mind.

Inflation is running hotter than expected, so the Fed needs to take action. That’ll come in the form of rate hikes - and two of the levers they can pull that the market is anticipating is the frequency and the amount. I believe there are 7 meetings this year in which they can announce hikes (outside of emergency meeting hikes, which are rare). Given that the last closed door (2/14) meeting didn’t yield an emergency hike, I’d assume that the FOMC is likely going to wait until the March meeting for action.

So for FOMC minutes, you don’t have a bunch of recent of indicators inflation is running super hot and markets are down. The markets have already priced in about 7 rate hikes, and then Bullard goes on a week or so later (Bullard is the most hawkish Fed Pres) saying we need 0.5% hike in March. Markets fall on that. So now (as in today), markets have priced in 0.5% hike in March in addition to 6 other 0.25% hikes during the year. Actually, today markets also have priced in Ukraine/Russia FUD, so lower than they should be based on that.

While I still think FOMC may try to price in a 0.25% hike in March instead of the 0.5% (I don’t know if core inflation is running a lot hotter than the Fed really is worried about, 6.0% in Jan vs. 5.9% expectations), the markets have already anticipated aggressive actions today. So any retrospective news indicating that the Fed is going to have a lighter touch is likely a bull catalyst.

So looking backwards, there’s a strong possibility that the Fed, at that point in time, raised the possibility of using a 0.5% hike in March, but there probably wasn’t a strong consensus (as even today, other Fed Presidents are not banging the drum for a 0.5% hike in March - see Atlanta, Cleveland President comments recently). So you’re going to probably see discussion about putting a 0.5% hike on the table but no consensus, and maybe even more pushback to keep a 0.25% hike in March planned. If that’s the case, it’d signal that the markets have overreacted to a possible rate hike, and that would be a bull catalyst.

Scenario 2 is - well what if the hawks win, and behind those doors in Jan 0.5% is really considered and the Presidents think it’s a strong possibility? Even then, I still see that as a bull catalyst because the markets have already priced that 0.5% March hike in, so that’d be confirmation of the Fed actions. The markets really just hate uncertainty and are trying to get ahead of Fed actions - to me, the confirmation of potential Fed policy would be a bull catalyst as well.

I guess the bear scenario is that the confirmation of a 0.5% hike would cause MMs to reallocate out of high growth industries and potentially sink SPY a bit because the megacaps would get hit the hardest, but a lot of them are down almost 10% from the peak in 2021. So short of the Fed actually talking about a 0.75% hike in March (which we would’ve heard about from Bullard and which would definitely impact the market), I don’t see a confirmation of a 0.5% hike on the table as bearish.

After that novella, I decided to go back to the release of the Dec minutes in Jan to see what happened historically - turns out, Jan 5th SPY fell pretty hard after the Dec minutes were released. Now, the inner autist goes back to the Dec 15th data, and noticed that after the FOMC meeting and remarks, SPY actually jumped up $10 on the day. So on the day of FOMC and remarks, SPY anticipates whatever, goes up $10, and then a month later, minutes are released, SPY falls like $8. Honestly, I have no idea why the markets would jump on the conclusion of the FOMC and then tank on the minutes, as it seems (from the news headlines that I’ve been reading) that at the end of the FOMC meeting in December, Jpow basically said everything that was released in the minutes (no real surprises). But maybe confirmation of asset tapering and interest hikes were enough to spook the markets in the minutes.

Easy pattern match would be - well, FOMC concludes Jan, SPY down, so minutes = SPY up, but that’s intellectually lazy. That said, I don’t anticipate any surprises, and the market’s already pricing in rate hikes and Fed action on reigning in inflation - the only way I could see this being bearish is if the minutes are incredibly hawkish in the minutes themselves, even more so than Bullard has been. But if Bullard is the face of hawkish action, then we’ve already gotten the impact from those talking points in the market, so again, I can’t imagine the minutes being unexpectedly hawkish on release.

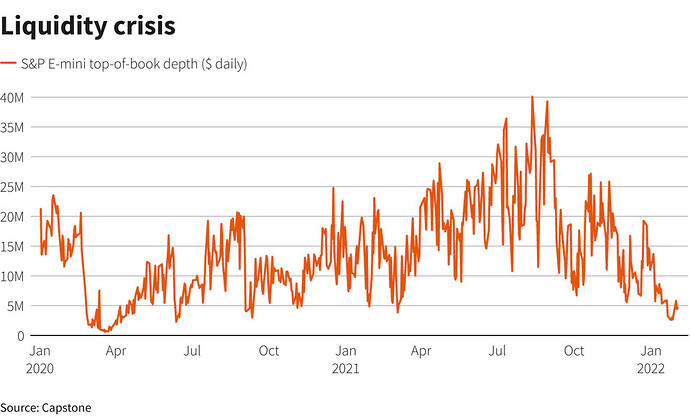

While there is no doubt that the market is experiencing news-driven volatility, what seems to be exacerbating this situation is the lack of liquidity. (Img Source)

This is, at least in some part, contributing to the violent 20-30% swings of companies valued in the 10’s of billions.

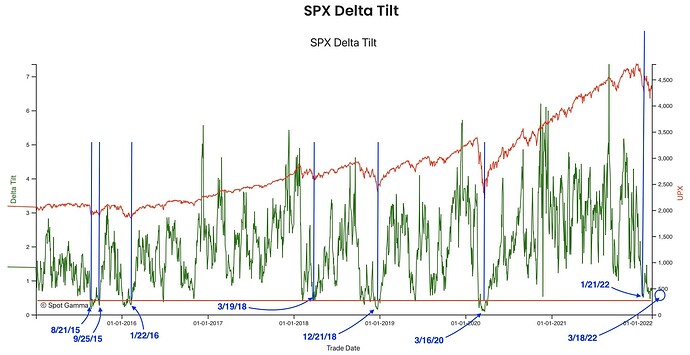

There are two things which may make for an unusually volatile 2-3 days:

-

Tomorrow is opex, where 33% of SPY gamma and 25% of SPY delta will expire, according to SpotGamma. Often enough, this leads to a vanna rally on Mon/Tue as hedges are unwound, which acts as a tailwind as shorts are closed on net puts that have expired. (We’re in net put territory at the moment - way more puts than calls.)

-

However, this also means that a ton of protection will be expiring tomorrow. Granted, even slightly higher levels of puts exist for the next monthly opex on 3/18 (wow that 2.72 put to call ratio on SPY), but unless the downside has been hedged appropriately by all parties, there is scope for violent drops where that protection does not exist.

Unfortunately, this does not help us directionally right now, or Friday. If Russia pounces on Ukraine over the weekend, the bottom may fall away on Monday. If it does not though, there could be that short-lived rally on Monday.

Will be looking to our SPY-trading pros to navigate this chop ![]()

Bidens speech is coming up soon. Be careful holding anything oil related, an announcement of a release is very likely and this will drive oil down (temporarily).

Overall I would expect this speech to focus on how upset we are with Russia, what the US will do re: oil prices and potentially briefly touch on further sanctions.

SpotGamma has this new feature called HIRO they are introducing which can supposedly track option flows in real time and present it in a concise form. They shared a version of this on Twitter mid-day, which was then updated on their discord:

This shows something very interesting - markets went up today despite there being much put buying (blue line going down) and little by way of call buying (orange line staying flat-ish).

Till now, almost all market upticks have been accompanied by the opposite - call buying (orange line would have gone up) and/or put selling (blue line would also have gone up).

This suggests that the bullishness behind the rally today was not shared by option traders who stayed away from adding calls; rather, they got more protection by buying more puts. Feels a little ominous.

Opex on Friday (3/18)

We are currently in very much a news-driven reality for markets, so the underlying technical setups for market indices matter less than it normally would, but including this SPX-related nugget from SpotGamma in case it becomes relevant in the second half of the week.

The thesis is that when all those puts expire, MMs can de-hedge (i.e. stop being short stocks) and this will cause prices to rise. Has happened like clockwork during many quarterly opexes, and some monthly opexes too.

Can this help us anticipate what might happen? Well, it depends on what scenario we end up in at the end of the week.

In addition to the ongoing Russian invasion, there is the FOMC meeting on Wednesday that can significantly affect how SPX/SPY reacts going into opex.

The Russian invasion will likely be a neutral to negative effect - unlikely for there to be a ceasefire or a win for Ukraine, so the war will continue. Markets could be roiled by sanctions on Russian oil, false flag attacks or something worse than what is happening now.

The effect of the FOMC meeting can vary from quite hawkish (0.5% rate hike plus accelerated taper) to neutral (0.5% rate hike) to dovish (just a 0.25% rate hike).

The “best case scenario” will therefore be: Russia doesn’t misbehave noticeably, and the Fed stays neutral or dovish. We can then expect some form of a rally to take place the week after, starting Monday (3/21). Any other combination with more negative version of effects give us more downside movement.

By the way, there is a possible fourth factor that might play on sentiment - the trucker convoy that is about to arrive in DC. Depending on how that plays in the new events and if something happens - violence, arrests, counter protests etc.

Interactions with underlying gamma levels

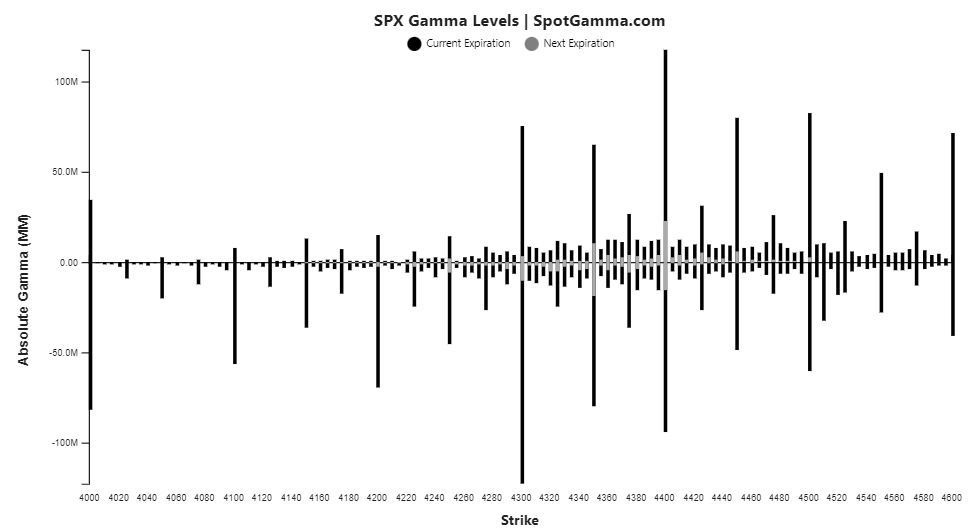

The downside movement will manifest itself simply by virtue of market participants selling. However, underlying market structures can offer support to some degree, making the difference between a staggered fall versus the bottom falling out. The are the current gamma levels, courtesy of SG:

(By the way you can see how high the current gamma levels are for this expiration, compared to the next weekly one.)

High gamma levels can act as resistance or support. The highest put gamma level is at 4300. SPX closed at 4328 on Friday and ES1 is at 4272 at the time of writing this. We are therefore exactly at the highest level of support. This is what worries me - if we puncture through this, there isn’t much support even at 4250 or 4200.

Interestingly, there are multiple call gamma levels that are not mirrored at the put side. (There are the vertical bars above the y-axis, and from the 4300 level onward.) Are market participants actually expecting a rally after FOMC? Quite intriguing. Note that if the FOMC disappoints, these calls will also be sold, adding to the downward pressure.

Quarterly Opex + Russia + anticipation of FOMC (+ maybe trucker convy) should make for a toasty two weeks.

We’ll reassess how the chips may fall after FOMC next week.

Many thanks to @Kevin for pointing out a couple of things that needed fixing or clarifying - have edited accordingly.