Make sure y’all are looking at the big picture when deciding on calls or puts. We are still in an overall downtrend and I don’t believe we have bottomed yet.

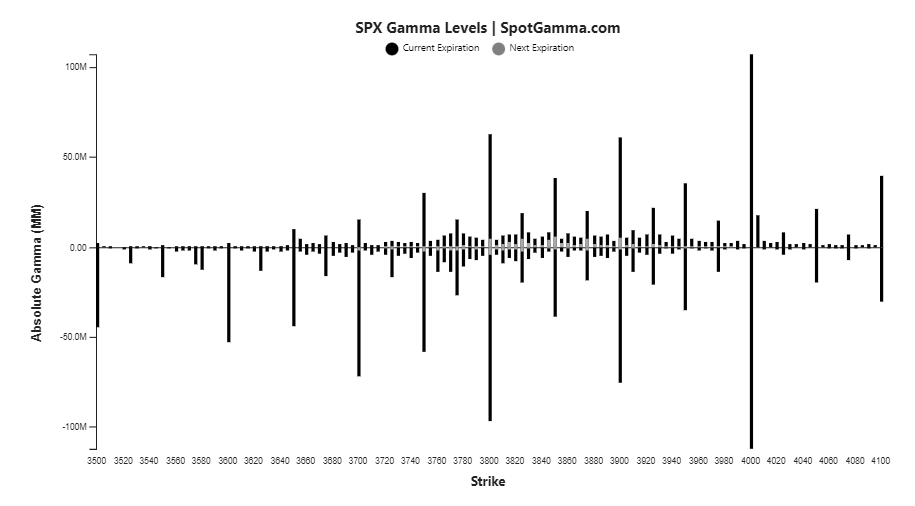

Looks like markets have chosen a level - SPX 4000 has really beefed up and is towering over the other levels on both the put and call side. SG also notes 4000 as the zero gamma level, and Vol Trigger at 3910. We closed at 3900 even on Monday - talk about pinning… - so all signs suggest that in the absence of any news, we’ll float up to the 4000 level for now, with MMs behaving unless we have a bad slide.

Not sure if will be able to time the calls, but once SPX hits 4000, will definitely be getting long dated puts. VIX is moving down nicely too, in the short term.

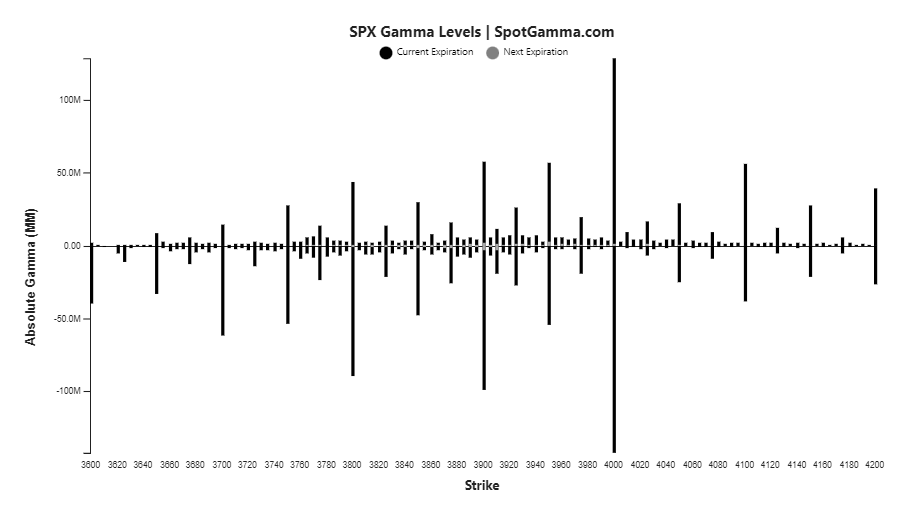

These are the SG gamma levels as of today:

SPX closed at 3825, and the volatility trigger is right at 3825. At higher levels, MMs will dampen market moves; at lower levels, MMs will move with the market. But this effect should not be that strong if we stay close to this level.

Zero gamma is SPX 4000. So the tendency would be an upward drift, in the absence of any macro events. (I wonder if they reported the vol trigger wrong… I haven’t seen a 200 point gulf between the two before.)

In short, no strong guidance from gamma levels, other than we’ll probably be stuck below the 4000 level barring some major macro news.