This thread is for general discussion about SPY, SPX & /ES

I’m seeing a lot of growing discussion surrounding the upcoming index options expiration and a negative gamma/delta scenario which could force a bear market rally.

https://twitter.com/eewspeedy/status/1514227065607921665?s=20&t=8dZv_Zl_qaF-0QVrT4xVUwg

I’ve played something similar to this before and it did end up working out. I suppose a word of caution is that this could cause a gamma squeeze in either direction so be careful. However, given the current market and sentiment I think we’re probably looking at an upward push.

The following is a Reddit post explaining what the buzz is about:

Look at all you retards buying puts on 10x leverage just because the market went into a little downturn, some of you may have even made money but going into OPEX Wednesday and Thursday that’s about to change.

Why? Negative gamma/delta expiry… say it with me "Negative gamma/delta expiry. But anon what is negative gamma and negative delta, worry not little retard Daddy BGC is here to help.

Negative delta is the number of shares that are needed to be shorted in order to hedge selling a put position, eg: -0.67 = 67 shares short. why is this important? because everyone is now loaded to the tits with puts on most indices and shitcos, the Market Makers selling the puts will have to hedge that position and are now short the stock.

Gamma is the rate of change of delta, so higher gamma means a greater increase in the rate of delta, for put options it’s the same but the delta is negative. Now, why is negative gamma important? because right now we have a fuckload of negative gamma set to expire on the indices and that will lead to massive decreases in negative delta leading to Market Makers covering short positions.

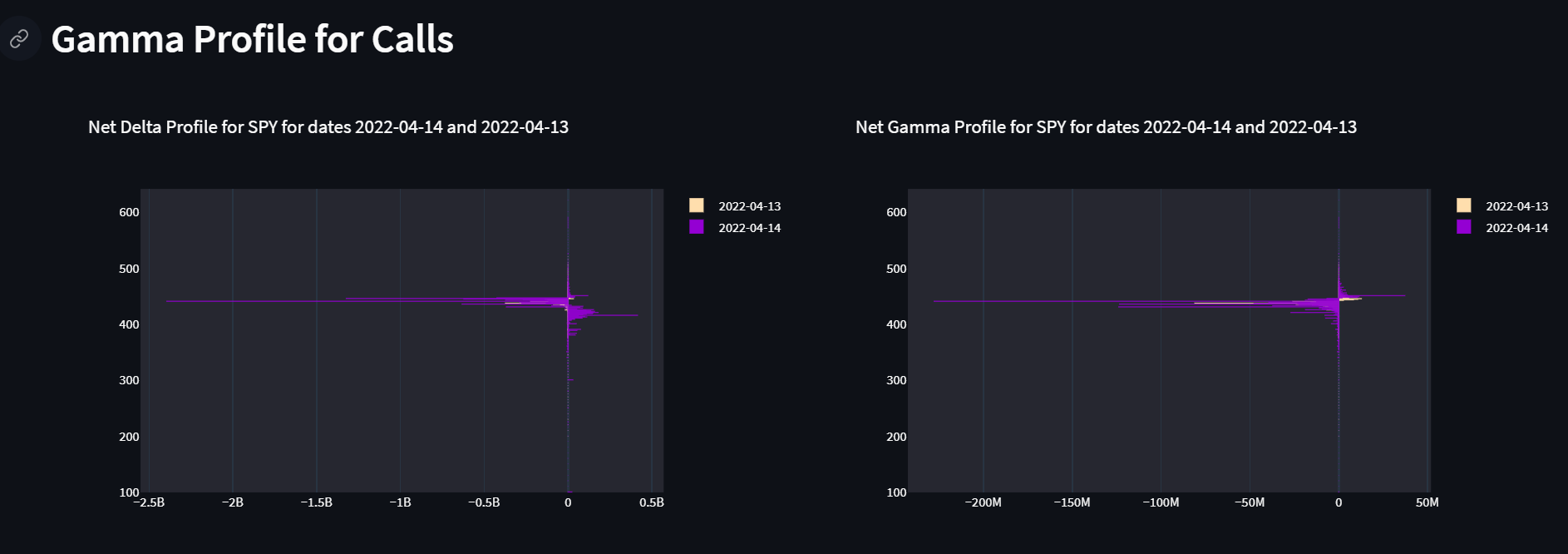

The gamma/delta profiles for SPY

Now for the retards in the room on the graph it shows we have around -5 BILLION delta on SPY (Billion with a B) that’s a lot of shares that are short. We also have around -1 Billion net gamma.

As many of you know theta takes without asking and many a retard’s account been blown up buying 0DTEs, this is important here because as theta decay exponentially increases we have the value of put contracts decreasing much more quickly as we approach the end of the day. This would cause people to sell their puts leading to a reversal on the indices as market makers rehedge and cover shorts as people sell their puts, this is known as the charm effect.

We also have a double OPEX both on Wednesday and Thursday so we should see heightened volatility so swings up are exacerbated especially given how much negative delta there is.

We are likely to see another massive bear rally and if there is any good news or the fed walks back a bit we will see SPX 4520 before Thursday’s close.

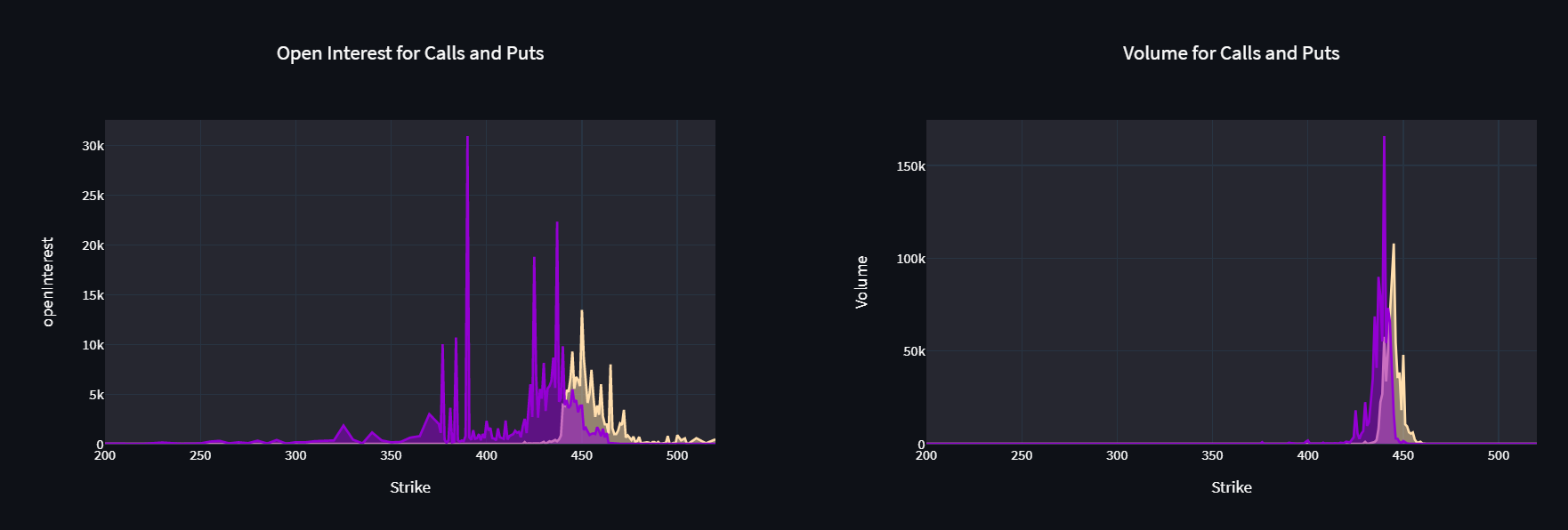

OI and Volume for SPY

The same goes for Tech and Semis they are all shorted to fuk as well.

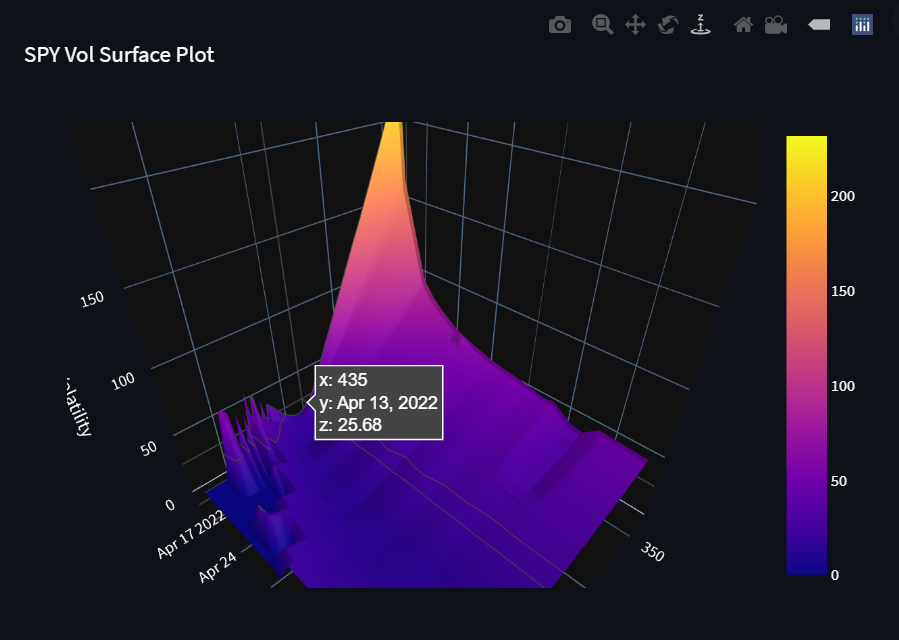

Vol surface plot for SPY puts

The IV for puts is around 25% greater than calls furthering the case for a massive bear rally in the next two days.

TLDR: Another face-ripping bear market rally incoming, BEARS R FUK BUY THE DIP

POSITIONS: 30 APR 14 445Cs going to add a lot more when/if we dip on Wednesday

https://www.reddit.com/r/wallstreetbets/comments/u2erj4/everyone_is_short_the_market_heres_why_you/

If this helps, based on the technicals right now, SPY is reversing. 1 hour is now above the 8 and 21 EMA, RSI is curving upwards and we’re above the huge level of 440. This is bullish and if this above is true, calls are probably free money for now

I read this to this morning part of my thesis as well. I did some research it seems large negative gamma appears during heavy put demand. It looks like the desire to hedge the cpi and general red days increased demand for puts. So it looks like dealers are hedging with the trend amplify it.

Looking at the chart if negative gamma started gaining on Monday it’s possible that if it’s hedges are unwound combined with low trading volume to the holiday it’s possible we come right back up to Monday’s open. But it’s also risky because negative gamma goes both way if something negative comes out over night we could come right back down to Wednesday open.

Still overall seems like a coin toss to where the Market heads this month and the next.

Watching to take puts near 4500 Spx area for about a week out unless we see huge bullish action above that point. The reasoning is I believe this recent rally to be caused the vix options expiration pushing down volatility sparking a rally because of an options Greek called vanna. (Article below) but basically my understanding from my reasearch is with the market being put dominated as implied volatility gets crushed the dominate put delta declines causing mms to want to buy stocks and futures because with less likely hood that puts are itm the less they need to be hedged. There is risk associated with tesla earnings benign bullish af but I like puts as a swing here personally for the reason I believe the rally to be an isolated event due to vix opex and not a true move due to the strength of cooperate America or the economy.

Just going to throw this up here. Basically my prediction for the week is that we see some heavy put selling coming into fomc and and after it. With vix at this higher level people are going to want to sell that volatility which will cause the vol to come down which will cause prices to come down which will cause mms to unwind hedges and prices to come back up. Also put demand will go down and price for puts is already much higher, Big money is already hedged for this weeks fomc so not feeling like we will see much more put buying.

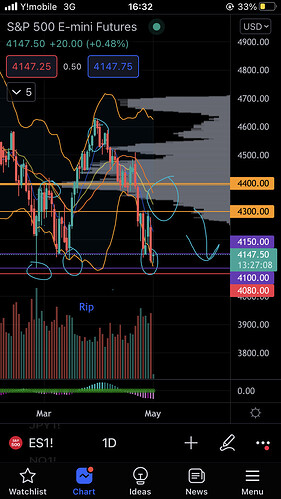

This pattern has manifested itself after Russian invasion climax, and the latest fomc my expectation barring a 0.75 bps hike is that we see a short cover rally to around 4400 and complete this head and shoulders pattern.

If this were to come true I would enter any long term short plays, 2023/2024 puts or short longer term micro es futures at this price.

A visual representation of what I’m thinking. Obviously this is just one opinion but just throwing it out there to add to your analysis if your forming a s&p swing play. May get clowned for this one but I think it has a shot.

Mimir Play Tracking Enabled: Bullish positions are currently not suggested because the trend is down. Waiting for trend reversal to signal a buy-in.

AUTOMATED MARKET ALERT: There are high impact market events tomorrow that could impact the trajectory of SPY, consider cutting positions end of day.

10:00AM - ISM Manufacturing PMI JUN

Strong Confirmed Sell Alert on 3m Timeframe for SPY

A Normal Sell Signal has Turned Strong on 3m Timeframe for SPY. Consider Dropping Calls

Potential Sell-Side Exit Point on 3m Timeframe for SPY

Strong Confirmed Buy Alert on 3m Timeframe for SPY

Potential Buy-Side Exit Point on 3m Timeframe for SPY

Strong Confirmed Sell Alert on 3m Timeframe for SPY

A Normal Sell Signal has Turned Strong on 3m Timeframe for SPY. Consider Dropping Calls.

Strong Confirmed Buy Alert on 3m Timeframe for SPY

Strong Confirmed Sell Alert on 3m Timeframe for SPY