Hello friends, looking around I’m starting to form the opinion we will see a small relief rally following fomc and march opex.

Reason number 1.) Clarity after fomc is over the path of rate hikes will be much more clear then they currently are with war inflation and all these opinions and analysts on rate hikes markets hate uncertainty.

Reason number 2.) people sitting on cash a huge sell off in bonds stock commodities alike even bit coin selling off the money isn’t going anywhere that means people are sitting on it. I’m betting if spy starts getting some upwards momentum all that cash is going to come out of the woodworks.

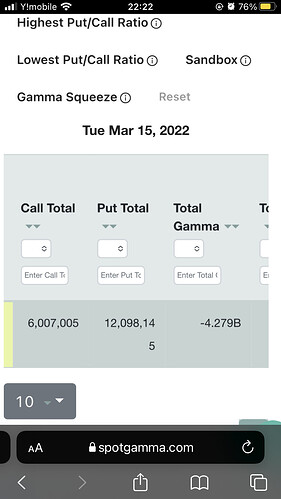

Reason 3.) large put oi on spy options.

Spy options have about 2X the number of puts as calls and a lot of those are in the money meaning the market makers have short positions to hedge these puts that they can unwind after this options expiration.

The combination of these things I think will spark a big rally to the upside as market makers unwind there hedges people gain confidence after rate hike plan is layed out and finally all this cash sitting on the side lines ready to fomo in at a sign of a rally.

Risk associated with this play is that fed says f it and does a 50bps hike. For protection against this I’m going to hedge with some treasury puts again.

Also something to note is with taking calls if a rally occurs vix will come day and calls will get iv crushed so I will also take some vix puts to counteract this as well. Obviously this runs the risk of being double wrong and getting screwed twice but these puts will be part of the overall total of money I’m willing to put in this play.

I will be playing this I was praying for a spx 4100 to enter but that may not occur and I might have to settle for a less ideal entry.

Also intend to trade t bonds around this to hedge and possibly profit on inverses correlations if they come up, bonds seem to be following soy right now.