fosngkowntwetasdgag

TLDR: I think that the pullback has started, but I’m expecting that SPY will have some green days for me to enter some swing puts.

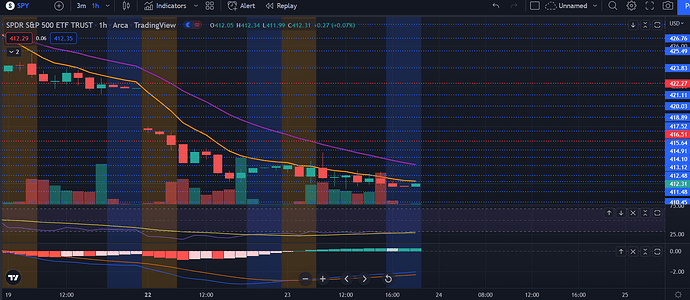

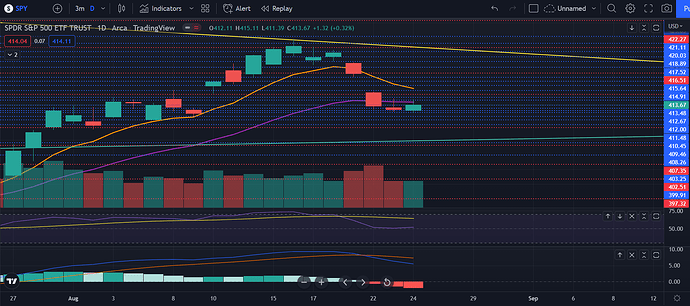

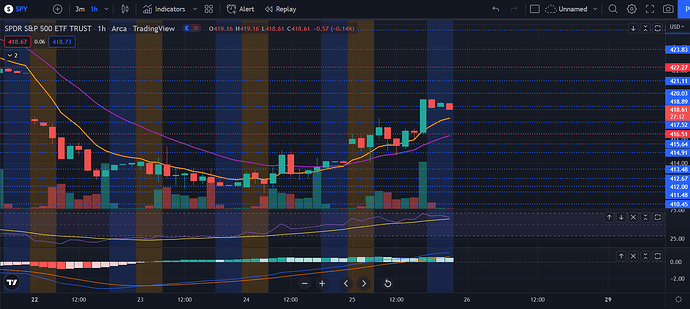

SPY on the hourly is looking berry bearish. On the indicator that I have right now (Nadarya-Watson Envelope), it typically signals the extremes on either side. When SPY breaks the lines or near the lines, it’s typically a sign to exit that position or be careful for a reversal. Also looking at the RSI, it’s formed a bullish divergence and is at extremes. These combinations lead me to think that we will have some kind of backtest before we trend lower. But yeah price action is bearish so Kevin and House can get their raging boners out.

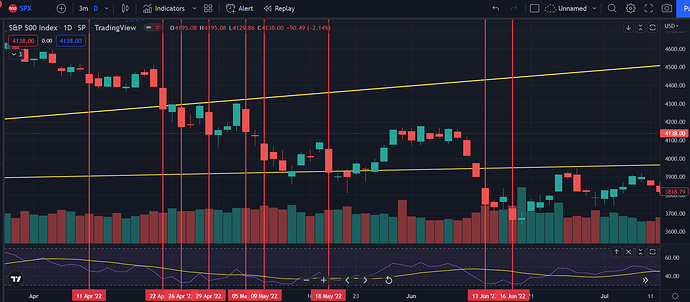

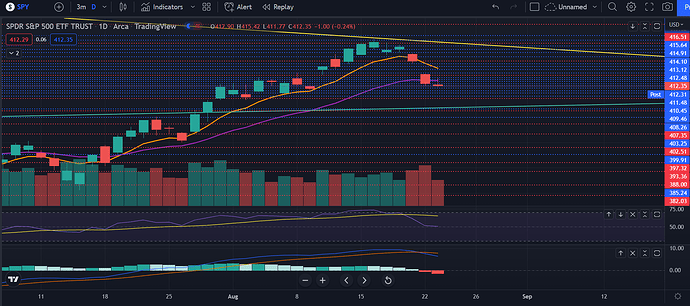

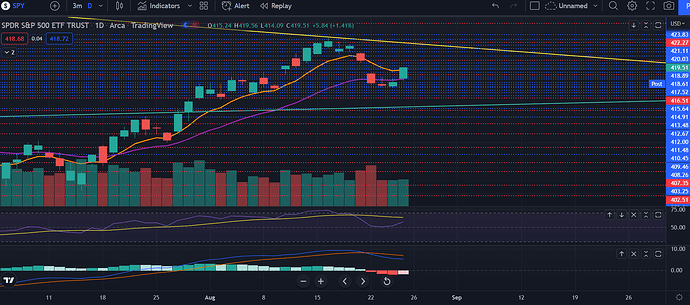

On the daily it seems like we’ve confirmed the downtrend. We broke the 21 EMA and have had rising volume on these sell days. What I’m looking for the next few days is some low volume green days to get us out of overextended area and a better entry for puts. I’m looking at 416-7 as my first area and then 422 as my next if SPY pushes up that high. Another reason why I expect a push up is because the RSI is at the 50 level and that sometimes leads to a bounce in the markets. Overall though, a confirmed downtrend and looking for the lower high to form to swing puts.

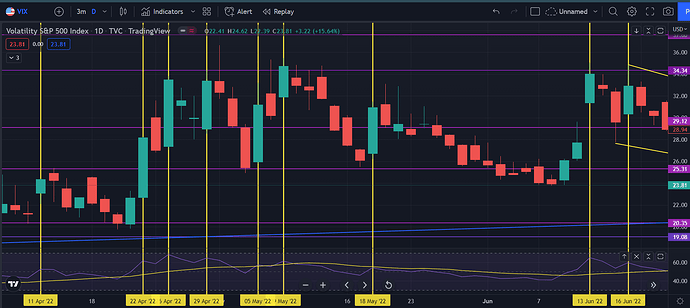

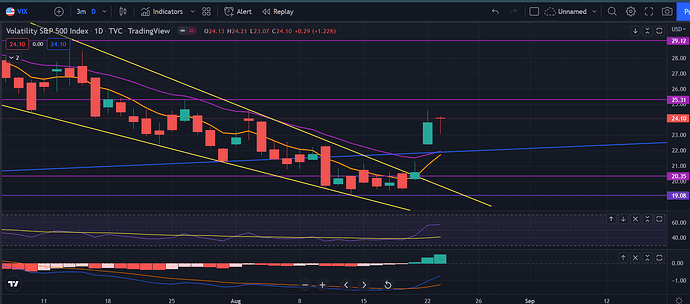

VIX is another reason why I expect a green day in the upcoming days. In the 2 days following a VIX of 10% greater move, it has led to some big rallies. I’ll post that chart at the bottom. Anyways, it seems like VIX has finally broken out and we are going to look at some volatile and red markets. Makes sense since September is weak and Jackson Hole meeting is this week.

Another reason why I expect a green day in an overall down trend is because of the dollar. The dollar has broken out heavily and that is bearish as hell for stocks. We are near the same resistance area at the last top and are forming a bearish divergence. I expect some pullback on the dollar or consolidation before it starts to trend back up and stocks to make the move lower.

Overall, because I didn’t enter puts last week, I’m waiting for another entry for spy puts. I’m still longer term bullish for SPY, but right now, I think we have some red months coming up.

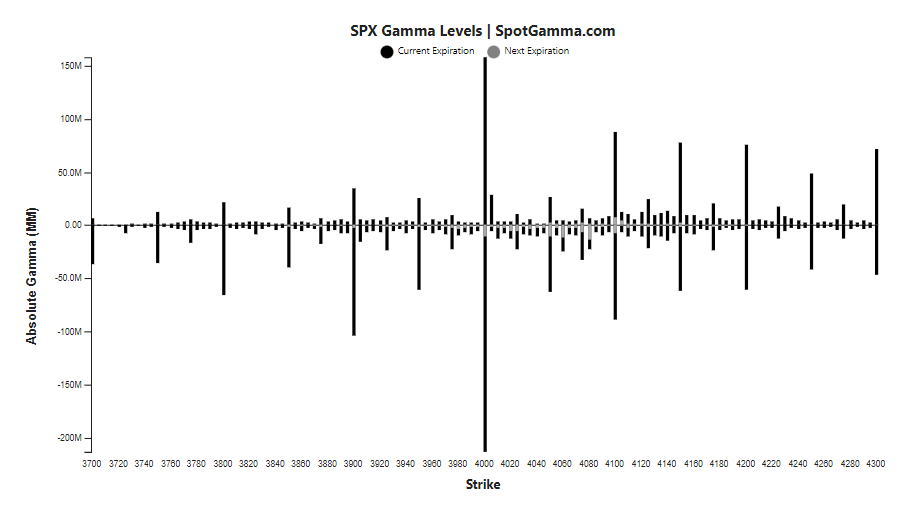

VIX STUFF

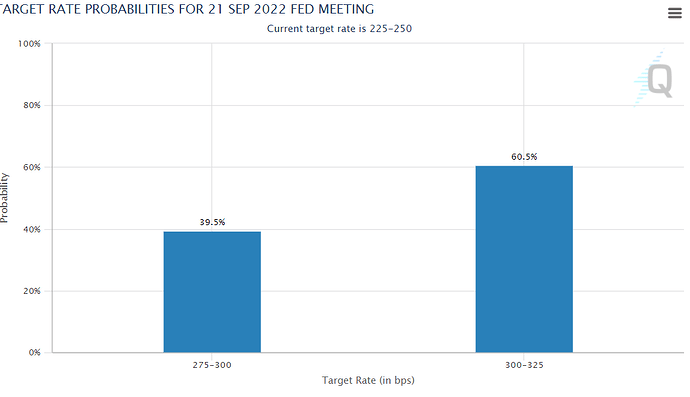

Days that VIX has risen over 10% in a day:

4/11, 4/22, 4/26, 4/29, 5/5, 5/9, 5/18, 6/13, and 6/16. Now let’s look at these dates on SPY/ SPX

4/11 - After one red day, had a rally of 3.17% since then - although it was choppy.

4/22 - The next day had a high to low of 2.37% and was green, although the markets shat afterwards

4/26 - The next day had high volatility, but from the next day’s low to the peak rally, it was 3.34%

4/29 - The next day had high volatility, but from the next day’s low to the peak rally, it was 6.14%

5/5 - Again the day had high volatility but the markets continued on lower

5/9 - The market was up higher, but didn’t bottom until 3 days later (-3.22%), then rallied 6% from low to peak

5/18 - The market bottomed 2 days later (-3%) and rallied 9.6% from low to peak.

6/13 - The market bottomed the next day and rallied 3.61% afterwards

6/16 - The market bottomed the next day and rallied 8.5% from low to peak.

Of course, you’re not going to get the exact lows and highs, but it does show that VIX being up over 10% in a day usually leads to a volatile next day and then usually bottoms within 2 days leading to a good rally. So based on this, I’m probably going to get a call tomorrow and hold. This method has a 7/9 chance of a bottom forming within 2 days and leading to a rally (technically 6/9 since one time it bottomed 3 days later but whatever)