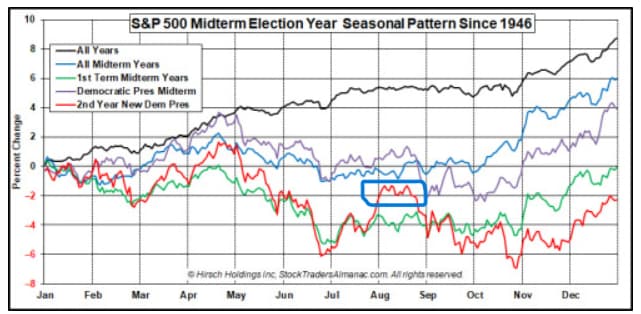

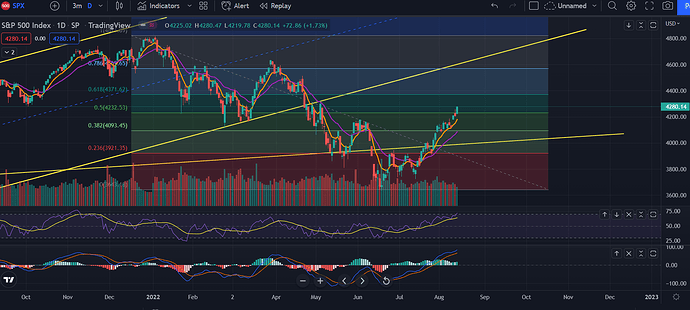

I’m back. I also don’t know rn if June was the bottom, but we’ll see. I do think there will be another big move down to enter, so I’ll be watching that.

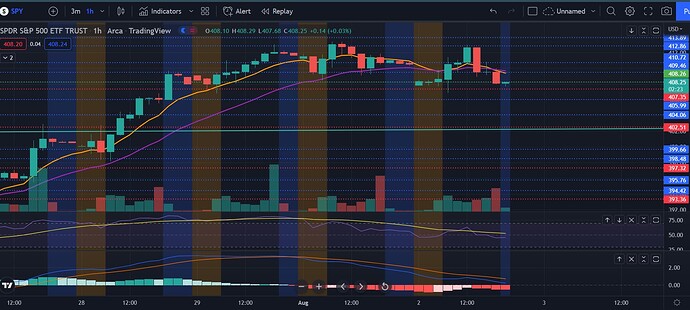

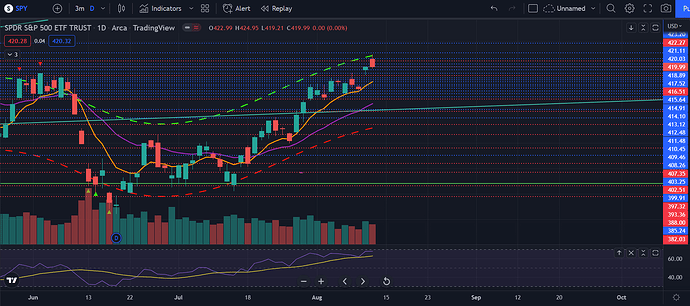

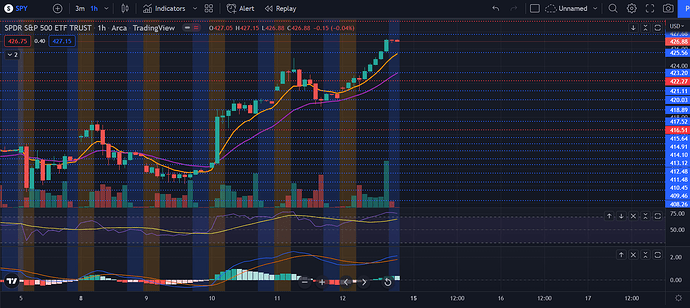

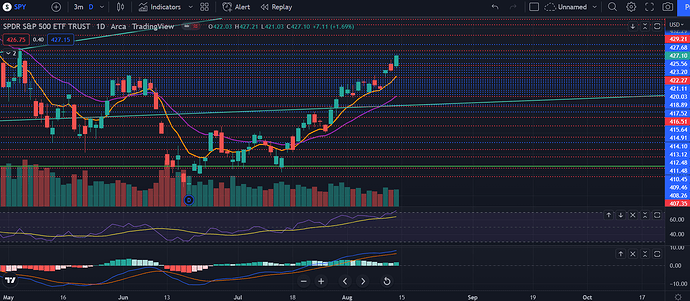

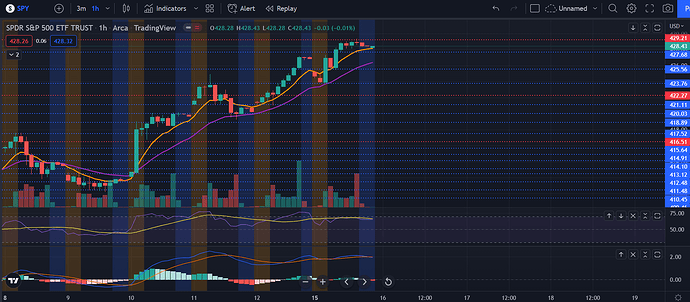

SPY on the hourly is looking bearish and looking like it wants to roll over. It broke the 21 EMA, tried to get above and failed. The MACD is continuing to show red bars, although it’s above the 0 line, which could mean that this is just a pullback until we go to 416 level. RSI is now below 50 and the MA, which is bearish. Also there’s a double top looking at the 413 level, which is also bearish.

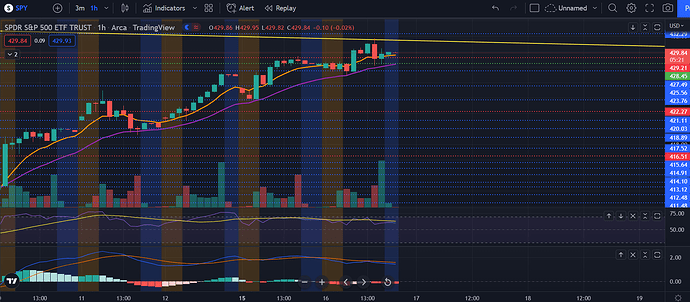

On the daily, we are still above the 8 EMA and trending up. This could just be a minor pullback until we hit the major level of 416, which was the top of the last big rally and the March bottom. It also looks like a bull flag, so it could be just waiting for a move upwards. The RSI also has bounced off the MA during this rally, so it could be that we pullback a little more start to move back up.

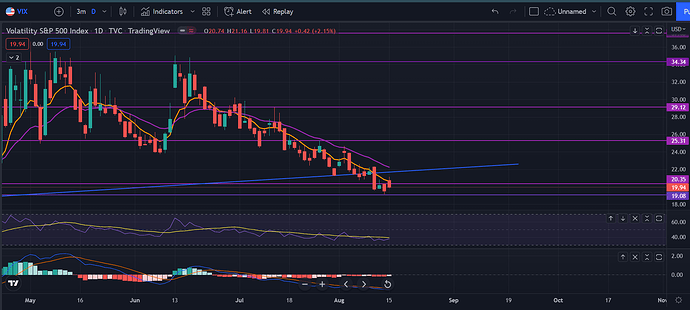

VIX bounced perfectly off the trendline since November. It’s still on a downtrend, but it’s looking like it’s trying to break out of it. If volatility returns, it could be a sign for another big move down. VIX is making it look like markets will move down again, but until it breaks above 25, I won’t be 100% for it.

The 10 year yields moved up a lot today. Idk if it was because of fed speaking or something, but this could put more pressure on the markets to move down. Although the 10 year looks like a head and shoulders and just testing the neckline before moving down again. Who knows.

The dollar started to move back up today. If this continues to track up, markets are going to go down. But so far, dollar is still on a small scale downtrend and until we continue to move upwards, it’s too early to start chanting spy to 0.

PCC doesn’t show much other than it’s in the middle.

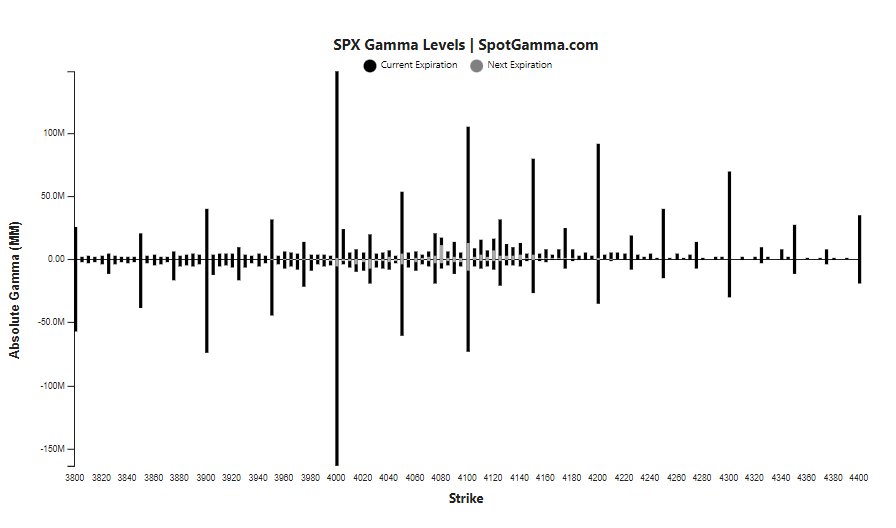

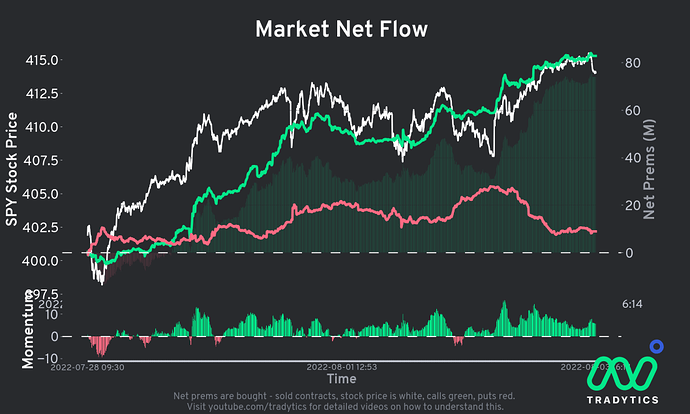

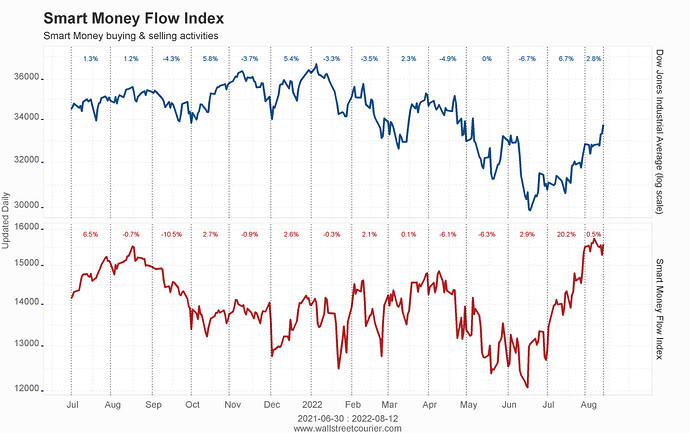

Overall, I think this does seem like a pullback before we move higher because there is no big level here to cause this shit down. I expect us to get the big rejection at 416, but we’ll see. Volume profile shows little volume here so it’s hard for me to believe that we start to reject here, but market does what it wants. I am betting on a big move to the downside to either confirm the June bottom or make another leg lower. Overall, 50/50 for the upcoming week, but if I had the money, I would get monthly puts.