TLDR: I expect a pullback around here to set up a higher low and then rally into end of year and possibly a little longer.

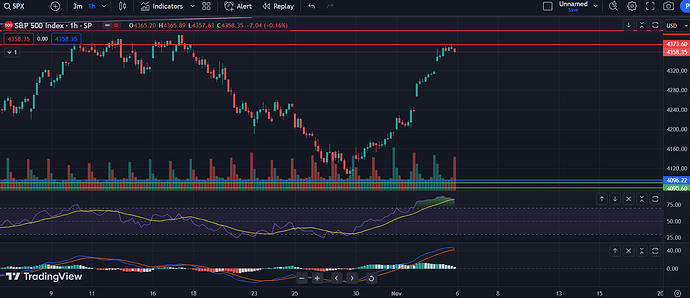

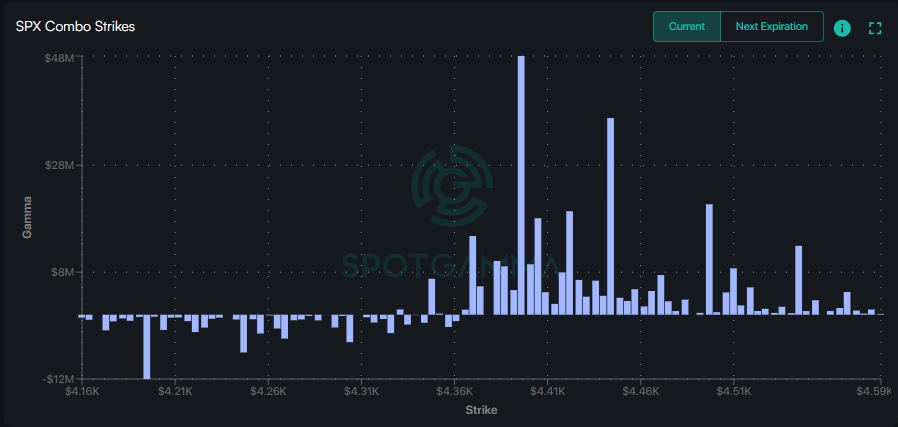

SPX stopped right at the gap fill. I expect markets to start to pullback around this level because this level is also resistance + a gap fill. Either we fill the gap and then pull back, or we start to pullback here. The RSI is very overextended and on lower timeframes like the 15 minute, we have a big bearish divergence. We haven’t pulled back at all with a ton of gaps below. I expect to get a pullback to fill some of these gaps and then keep on rallying. Seems like markets are happy with the Fed comments and expecting cuts now.

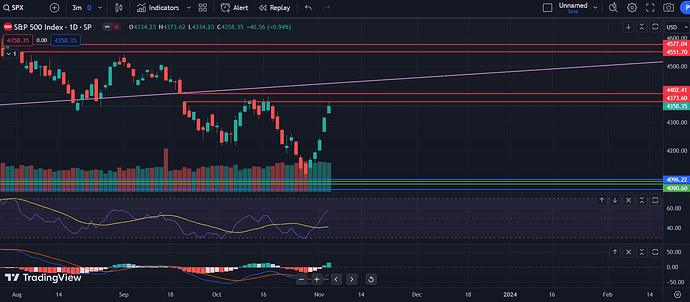

On the daily, we can see that we are at resistance and we have increasing big buy volume on this rally (using SPY). This shows this rally is strong. This is different from the 2022 bear rallies because we did see lower volume green days with not as much buy volume as these past few days. I’m expecting to set up an inverse head and shoulders and keep on rallying. There’s no news right now to cause a circuit breaker or us to just die from here.

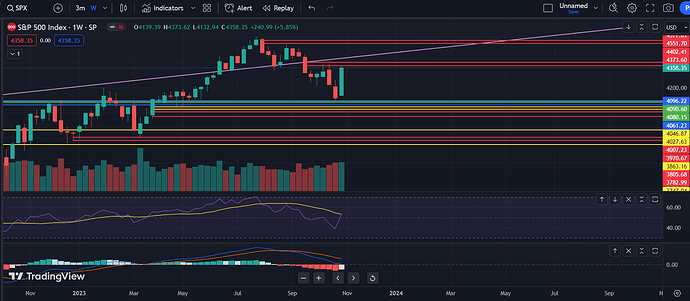

Weekly candle is insane and although we did close below the 50 RSI level on the weekly, we went straight back up. Maybe this is a fluke rally and we keep selling off and stay below the 50 level, but combined with the seasonal bullishness here and markets liking the Fed comments and how earnings aren’t horrible, I feel safer saying that we are going to rally.

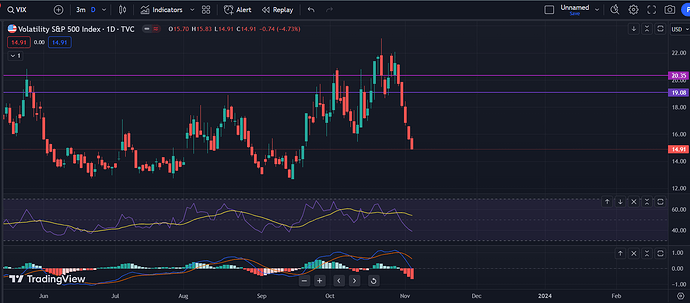

I also like how the VIX is dying off here. It gives me more confidence that markets aren’t gonna keep selling off because the volatility is lowering, showing that markets don’t expect much more of this selling.

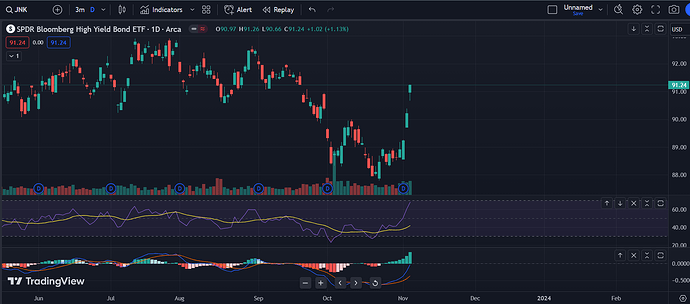

Another sign that I see that makes me think that we’re going to keep rallying is that JNK is up huge. This is a good sign because bond markets have been calling the real direction for the last 2 years. If shit bonds like these are rallying hard, then I expect markets to be risk on and start following like this and rally hard.

Overall, I see lots of signs that we’re going to set up a higher low and then rally into the end of year and let the bulls party until the bubble finally bursts and then recession comes to let bears party.