Mostly just Powell tomorrow that’ll really determine the direction so no point of TA. I am betting on a bearish reaction from the markets, but we’ll see

So calls :pepedetective:

Inverse Yong never fails

TLDR: Markets loved 2021 JPow. Fuck bears, but we’re at the big ass resistance line. We broke above in after hours, but we’ll see how we react tomorrow. PCE and then ISM numbers tomorrow which could change the sentiment real quick.

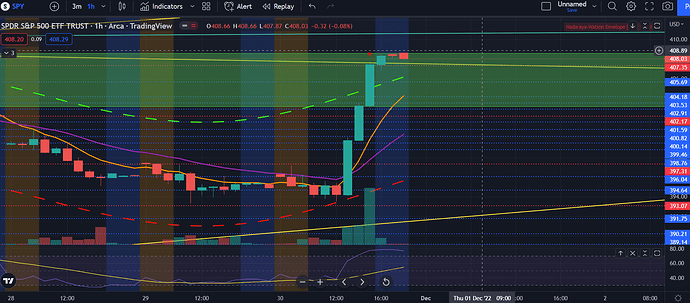

SPY on the hourly is very overextended to the upside. Wouldn’t be surprised if we flatline around here gathering more buyers or if we pullback to 403/402 for a retracement. Also the green box is the gap fill to the CPI reading 2 months ago. We filled the gap in AH, but I think we’ll fill it again during market hours tomorrow. We’ll see how we react afterwards.

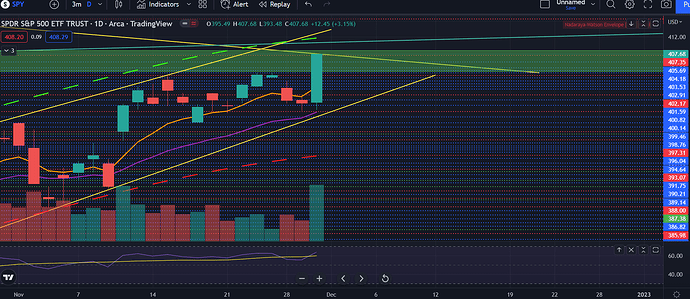

SPY on the daily is right at the downtrend line. Huge volume and looking strong. One thing that does worry me a little is that the MACD and the RSI both have a very slight bearish divergence, but we’ll see if those even matter. A break above this downtrend line will be huge, but honestly I’m skeptical. This downtrend line is something that everyone is looking at now. I think there’s a chance that we go up a little higher and then shit down to bull trap a fuck ton of people. JPow didn’t really say much that was super bullish to make this move this bullish imo. Fed is still going to raise rates and only gonna slow it down a little. Nothing really changed in the macro view, as Fed is still raising the terminal rates and said that it’s too early to think about stopping rates or reversing.

VIX is back at that 20 level. Could we see another top form on the markets here?

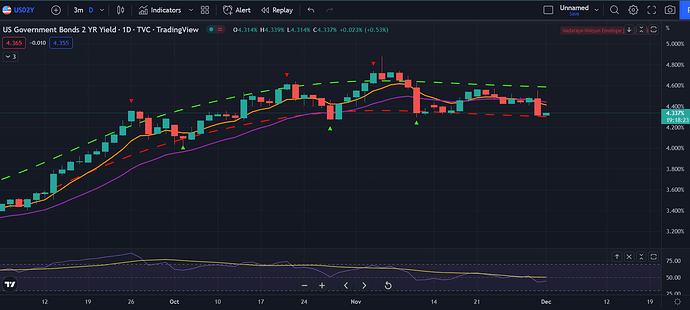

The 2 year yields have a perfect head and shoulders. If this continues to play out, then there’s a good chance that markets will continue to rally. Pivotal moments here for the yields and market as market is at the crucial resistance and 2 years look like they’re about to break lower.

The dollar is back at that big support level. We’ll see if the dollar breaks lower or bounces above again. So far looking like there’s a good chance that it’ll bounce as there’s a triple bullish divergence on the RSI and the dollar has been loving this level.

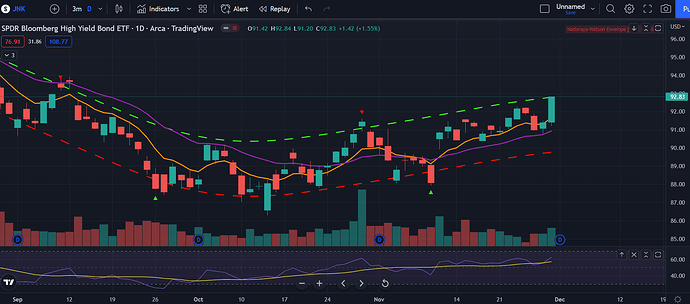

Now a good sign for the markets is that the junk bonds are also making higher highs confirming this move up. Interesting to see and possibly showing that there’s more in the tank to run.

Overall, markets are at critical levels and the rest of this week is going to show if there’s still a fuck ton more fuel in the tank to run up higher or if we start to reverse down. Fed is less hawkish than before, but still not bullish bullish imo. Good luck to everyone and hope everyone stays green.