I’m back with my autistic trading

TLDR: I expect us to go to around the 405-410 area before having a good dip or the next leg lower because I think the market is rallying based off Fed pivot predictions, but the Fed isn’t pivoting, they’re just slowing rates but still raising rates. Plus we’re setting up bearish divergences and overextensions.

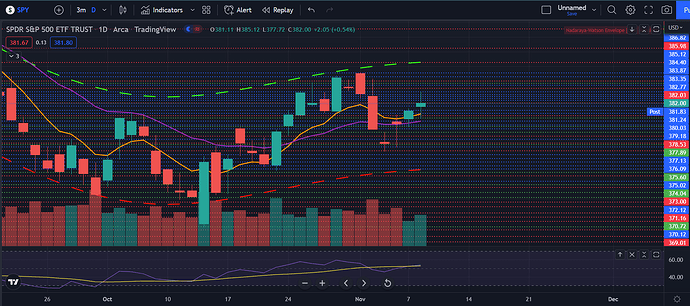

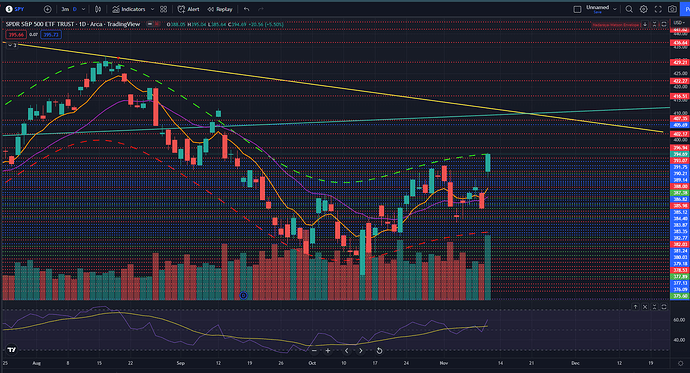

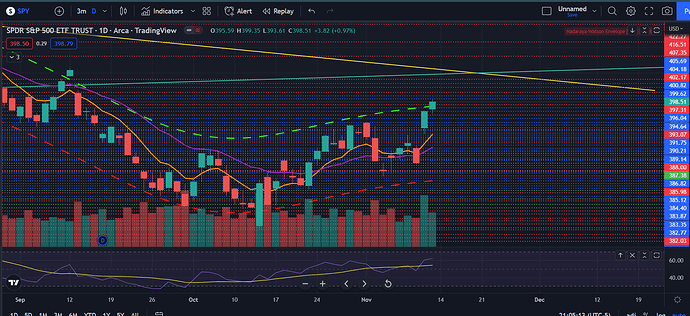

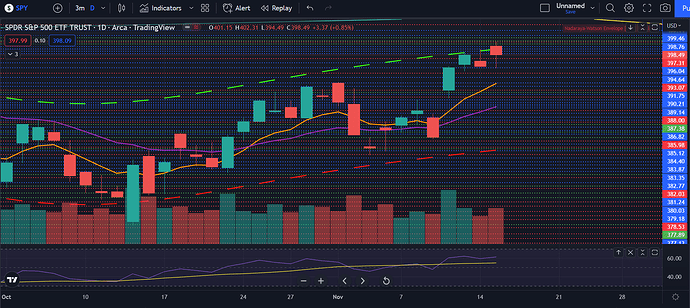

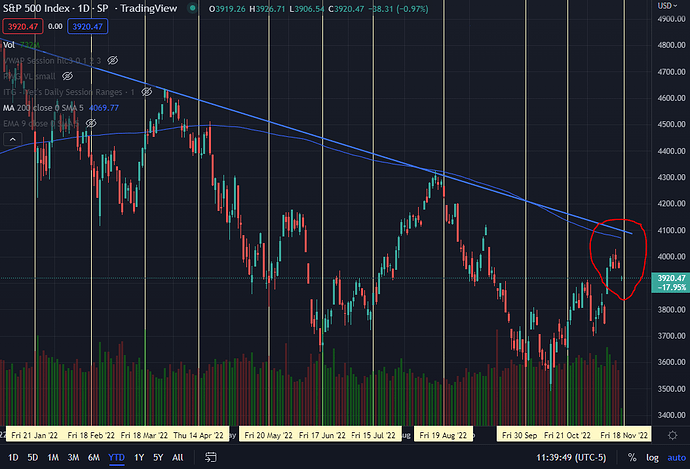

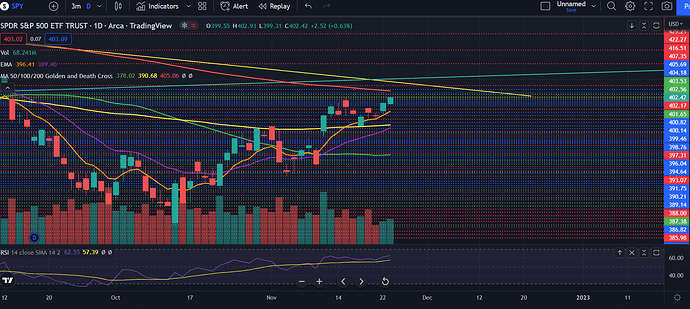

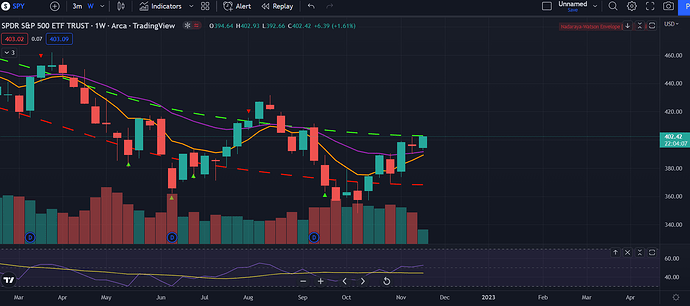

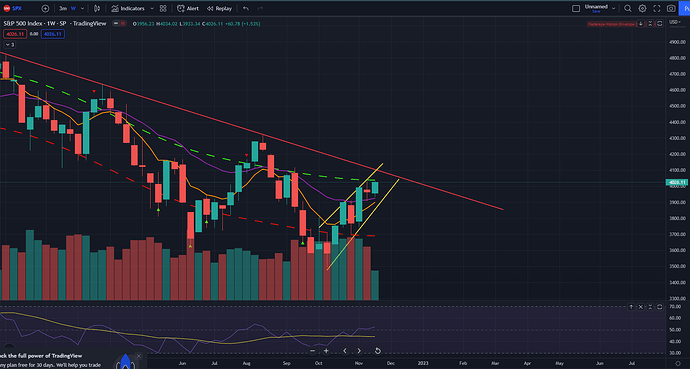

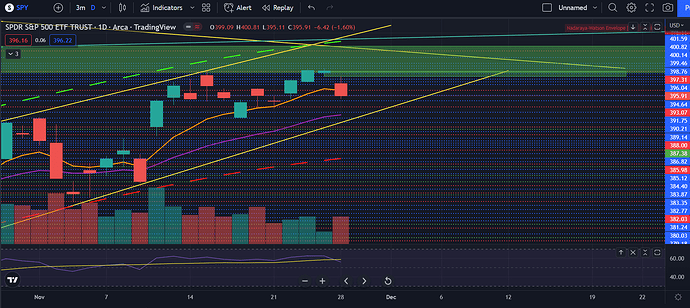

Looking at the SPY daily, we’re in a strong uptrend and bouncing off the 8 EMA. Volume has ben very low and trending up on low volume. Makes sense since this has been a holiday week, but because of the low volume, this doesn’t really convince me that this rally will continue on much longer. Also on the daily, we’re nearing the 200 MA and the major downtrend line this year. There is going to be lots of shorters there and bears looking to bring this shit back down. This is going to be a big inflection point to see whether we continue up or if we take a shitter back down. If we do break past the 200 MA and the downtrend line, I would have to imagine that technicals wouldn’t matter anymore and we’ll have a huge short squeeze to 440 at least. Tbh I don’t think that’ll happen, but we’ll see

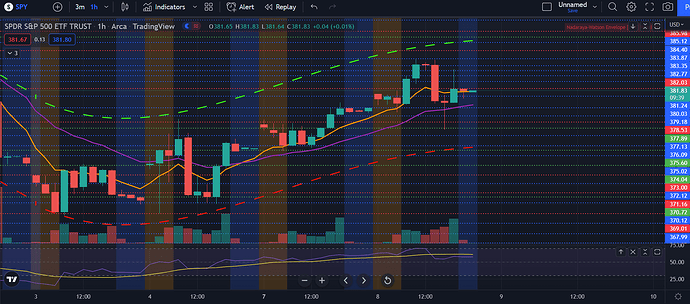

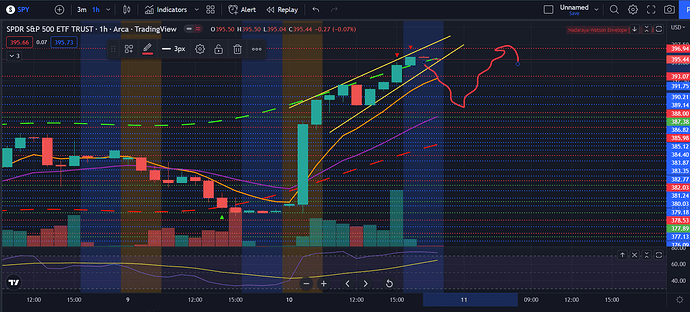

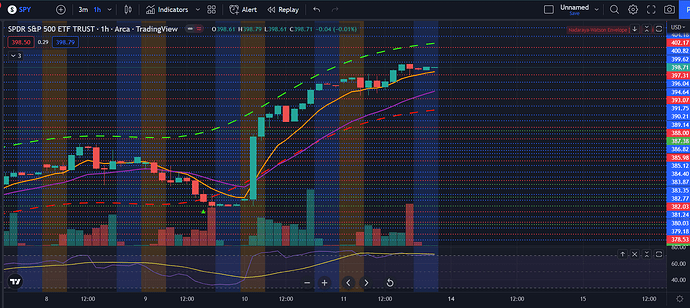

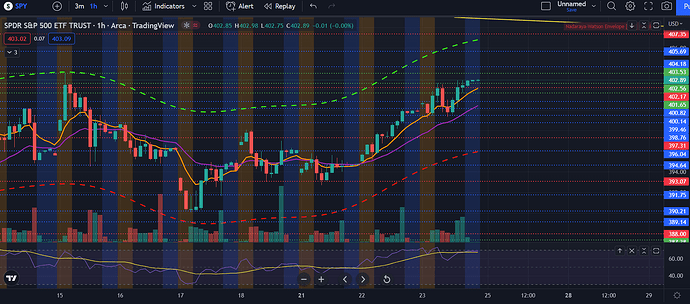

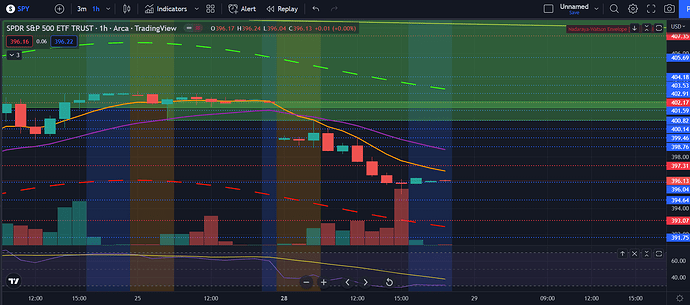

Now on the hourly, we’re forming a bearish divergence and in the overextended range on the RSI. We’re still bouncing off of the 8/21 EMAs and climbing up. I think that we’ll at most have a little dump to the 21 or 8 EMA again and then try to hit the 405-410 level which is the 200 MA and the downtrend line. I’m bullish for Friday, but leaning bearish for the weeks ahead.

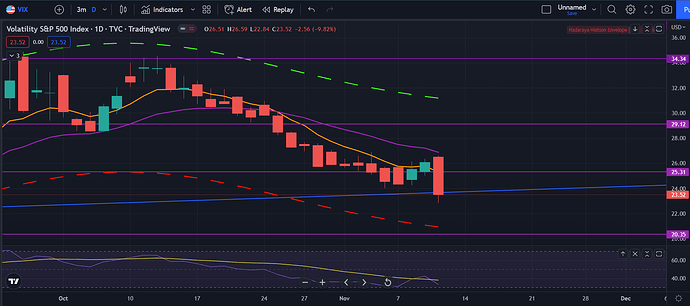

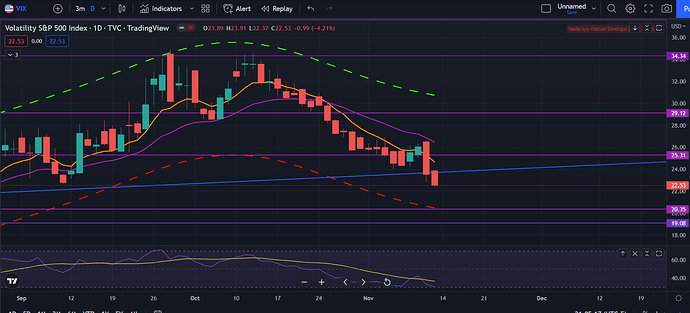

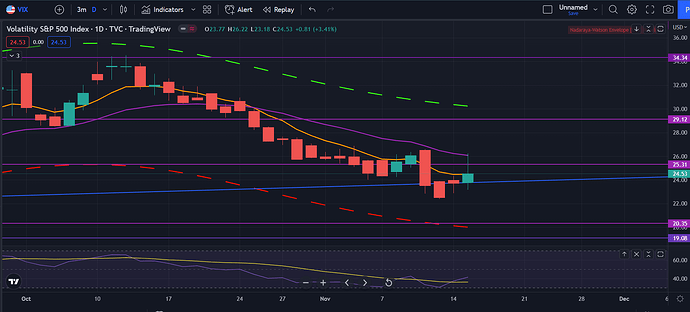

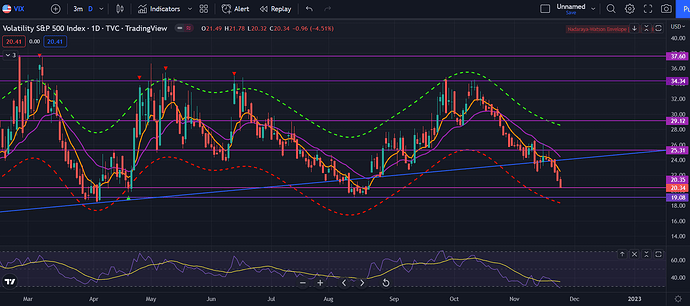

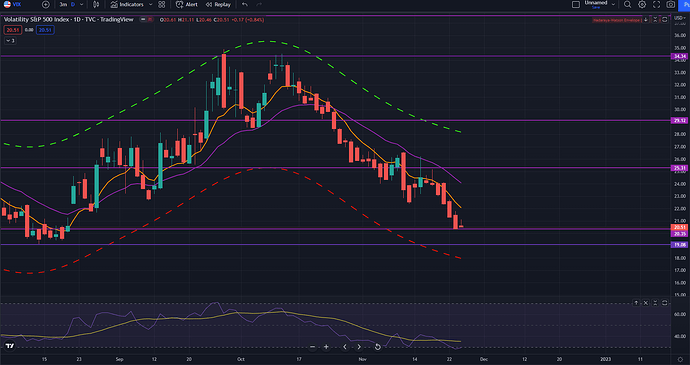

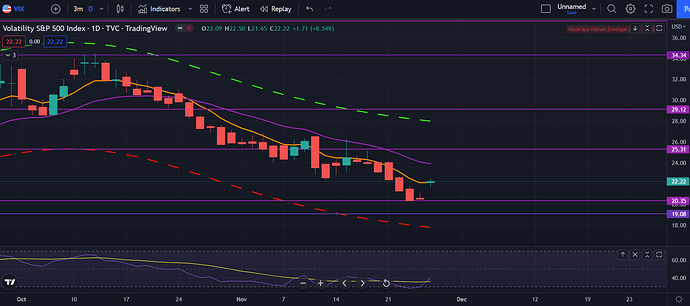

Looking at the VIX, we’re at the levels where markets typically top. Whether it’s just a pullback or the start of the next leg down, we don’t know, but VIX being at 19-20 is around when markets are starting to get overextended and due for a pullback.

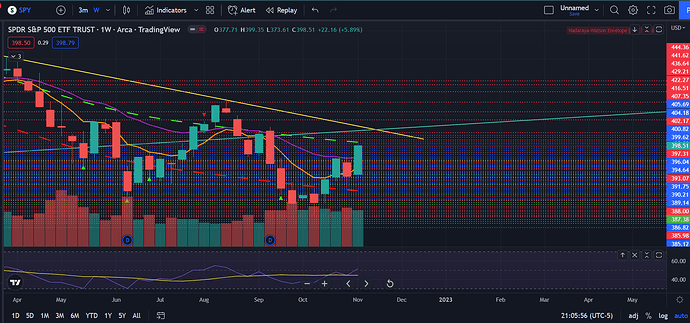

Also on the overextended narrative, look at the SPY weekly chart. We’re moving up on lower and lower volume - not good. Also we’re nearing the overextended levels on my chart and whenever we near these over extended levels, we typically tend to reverse here. We’ll see if this happens again.

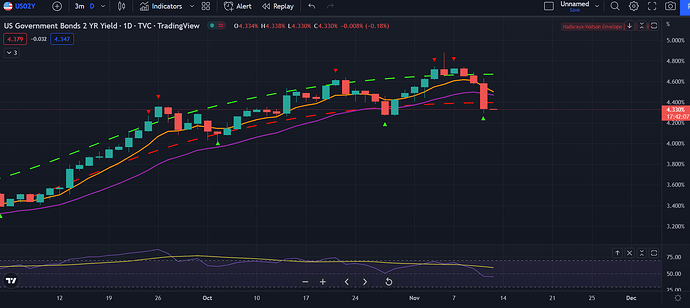

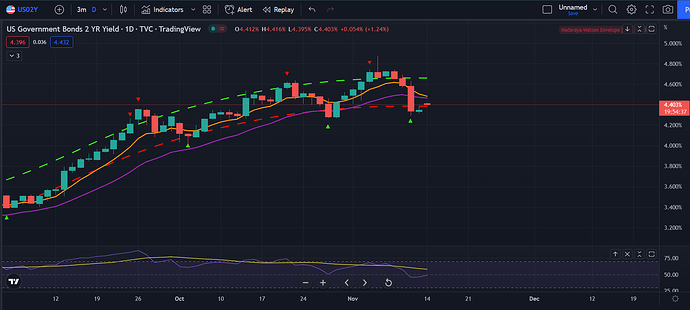

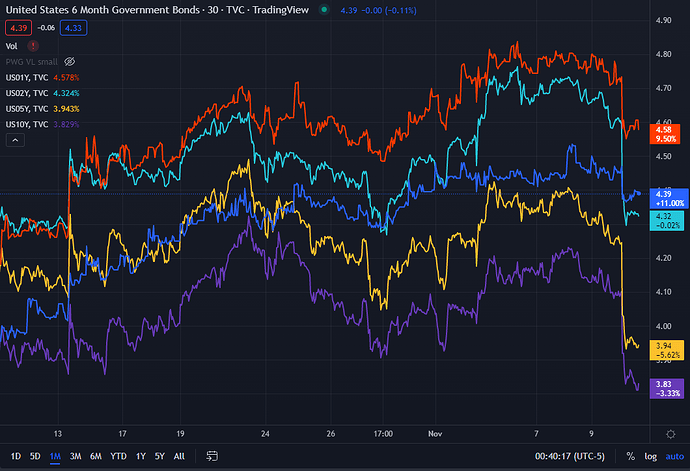

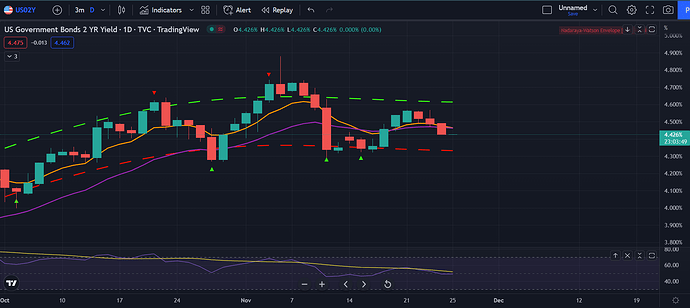

Now here are some more bullish signs. The 2 year yields seems to be forming a head and shoulder pattern. If this continues to play out, then there’s a chance that markets continue to rally and we get the huge short squeeze. This is looking bullish, but we still have to play out this pattern and have the 2 year yields roll below 4.32%. Until then, this is just a pattern that can be invalidated.

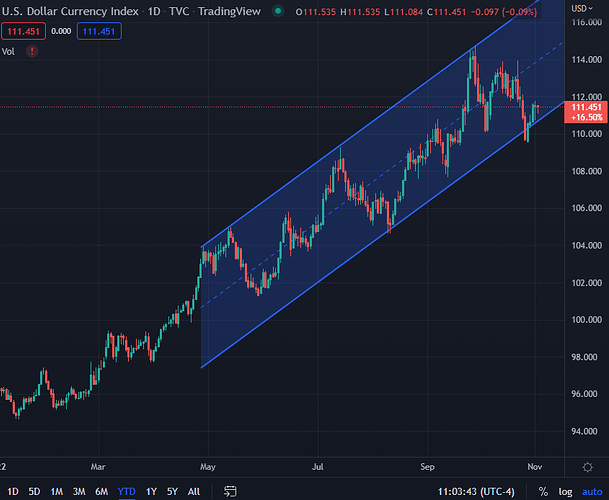

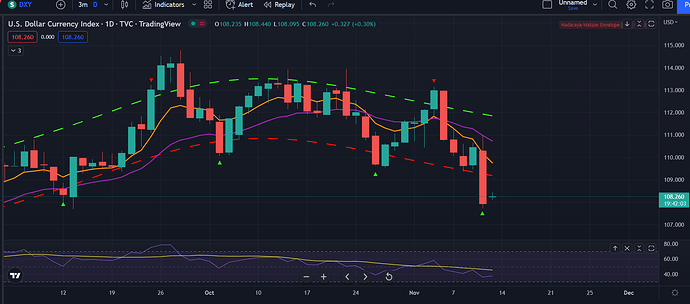

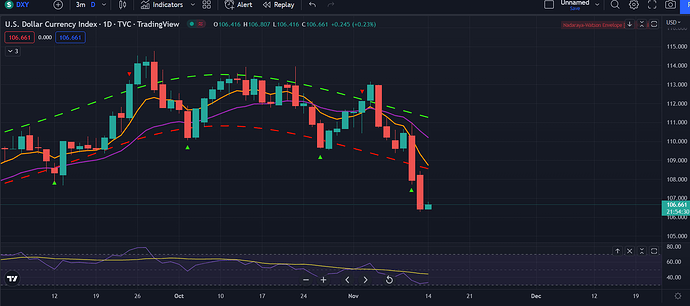

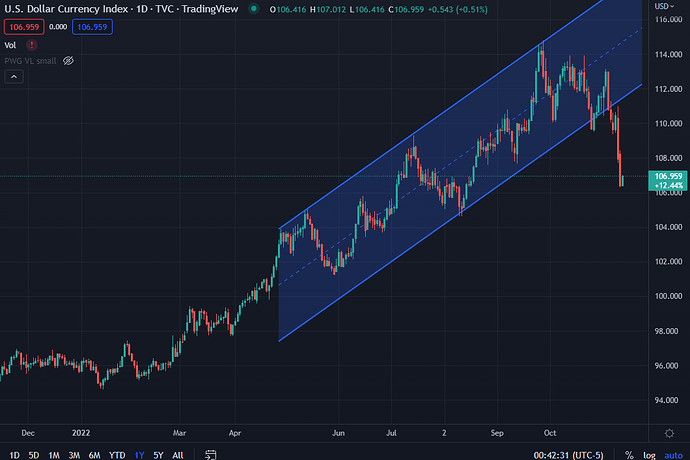

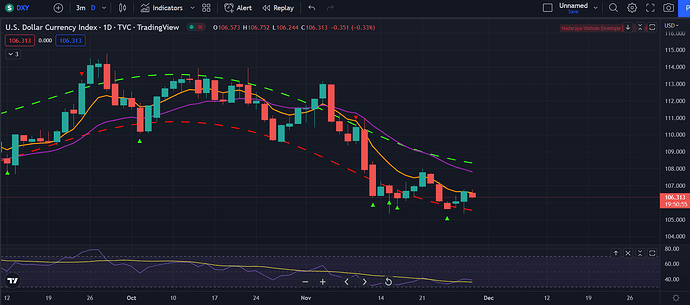

Now looking at the dollar, it’s taking a beat down, which is bullish for stocks. But something to watch for is how there seems to be a support formation here. There are multiple bounces around the area we’re at and bottom wicks. There’s also a bullish divergence on the RSI. I wouldn’t doubt that we start to bounce off here and put more pressure on the markets, pushing us into a pullback or a next leg down.

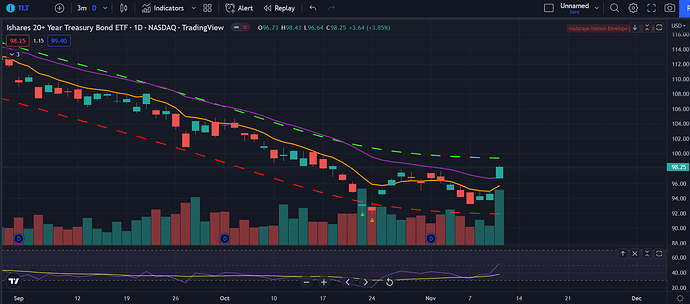

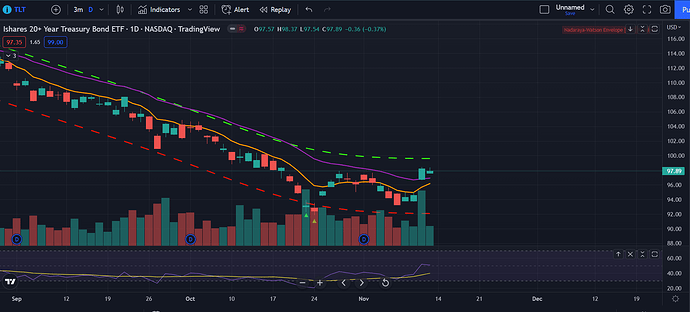

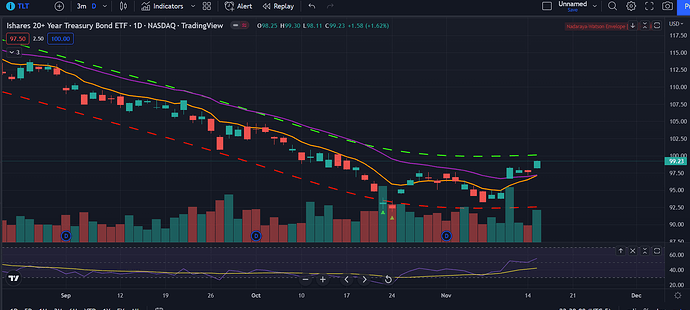

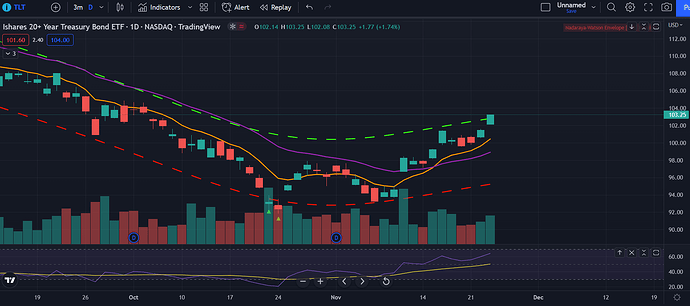

Now for more bullish signs. The bond market is starting to recover. This is a great sign, and potentially a sign that the bottom is in for now or we’re due for more room upwards. Either way, the fact that bonds are moving up are showing that buyers are getting more confident to take risks and buy equities. Good signs for bulls.

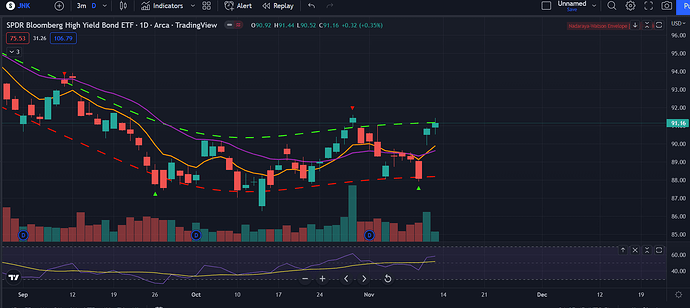

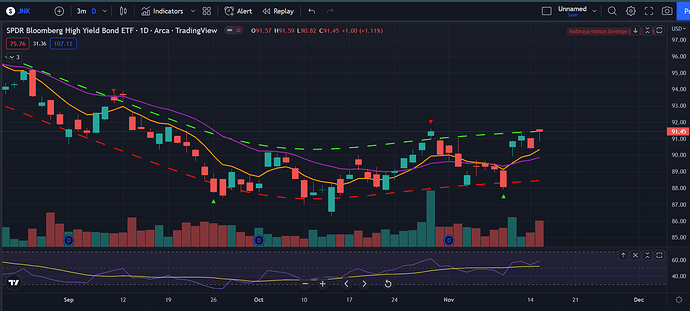

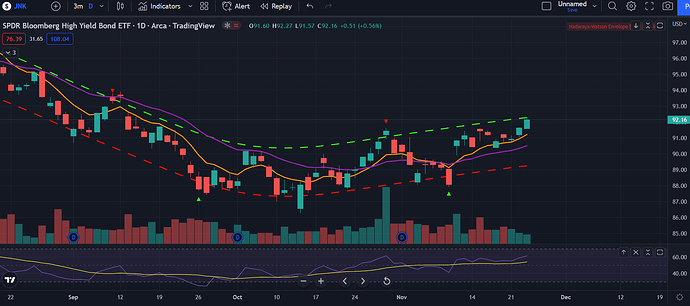

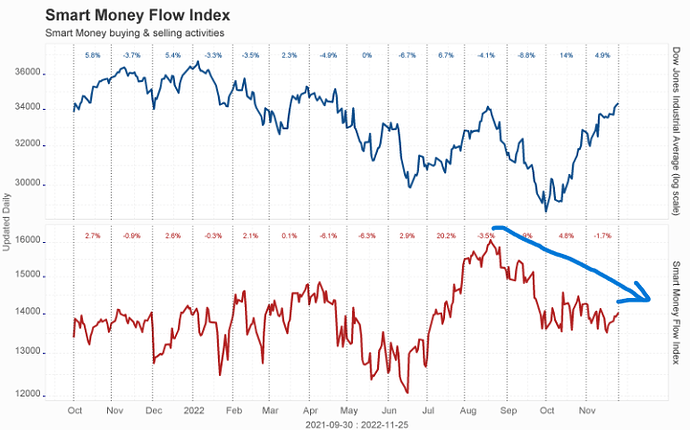

Junk bonds, which are like small caps and show the “health” of the market (imo), has been showing some red flags. Very low volume compared to regular bonds and rising on declining volume. Also it’s not going up as rapidly as the bonds, showing that we’re potentially looking at a bull trap. But the fact that we’re making higher highs is a promising sign that maybe the markets won’t go into a free fall right now.

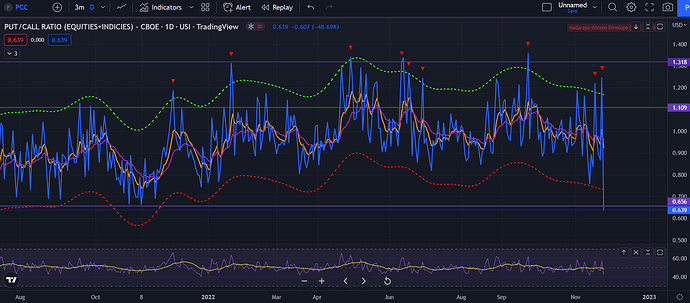

Now for some bearish shit. Looking at the put call ratio, we’re heavily extended to the call side. We haven’t seen this much money into calls all year. And typically, the PCC being at these levels have called tops. We’re at the level where we should be taking profits or entering shorts.

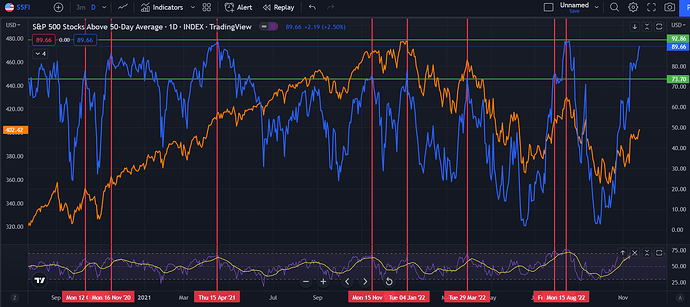

Again, looking at the S&P 500 percentage of stocks above their 50 day moving average, we can see that we’re at levels where markets tend to have a pullback or take a shitter down. This year, it’s been the next leg down. Will this change? I don’t know and maybe it’s just a pullback this time, but it’s showing that markets are becoming overextended to the upside and we should be looking for a pullback.

Overall, it does seem like markets may be providing signs that the bottom may be in for now and we have more room to move up. BUT there are signs everywhere showing that the markets are becoming overextended and due for a pullback. How deep this pullback will go will show us if the market has more room upwards or if this bear market rally is done. Look out for the levels at the 405-410 level because it seems like SPY is gravitating to that area for a huge move to either side. Good luck everyone and happy thanksgiving