TLDR: We may have seen a local bottom around here and may be trapped in the 410-430 range until FOMC

Looking at the 1 hour on SPY, we can see that the 8 and 21 EMA showed a false reversal. We are back below both and looking bearish, esp breaking below 415. Something to note is that the RSI still isn’t making a new low even after being the lowest it’s been all week. This is bullish, although this is just one sign out of the ten bearish signs. Something to note, the risk reward in the short term here for puts isn’t amazing.

SPY on the daily is also bearish. Full candle close as the new low and looking like a break out of the trading channel. Something to note again is that the RSI is showing a higher high even tho the price is much lower. The pric is also pretty diverged from the EMA and we could see a return to average soon as we did yesterday. Sell volume was still big and a pretty clear sign of bad news bears. This just seems like a lower high and a lower low so be careful placing long term calls here.

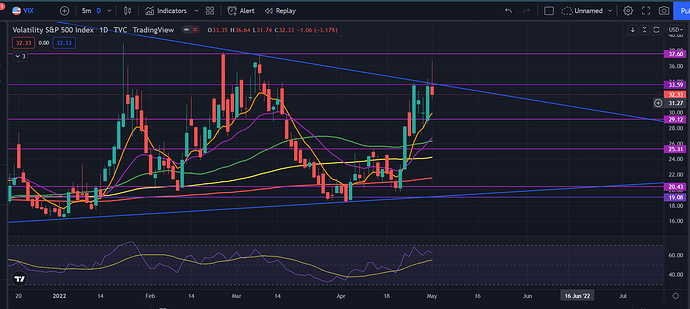

The VIX is following the downtrend line very well. Bounced off of it again and possibly showing the bottom here for a bit. We might get a relief rally tomorrow again looking at the VIX, but it can always just break out and make a new trend.

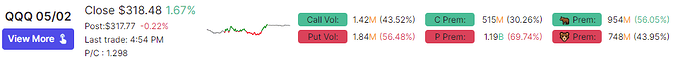

Put call ratio is also hella elevated and last time it was this high, it showed the bottom the next day. So maybe on Monday we make a new low and then rally for a bit. Who knows. But this level of puts in the market typically means that a local bottom is soon.

Overall, there is no reason to be bullish longer term right now. It’s sell all rips, but you have to time those. Don’t just fomo into puts. Markets rarely go straight up or down. Look for signs of local bottoms and tops and play the trend and look for confirmations. Right now, I think we’re near a bottom to bounce off of, but with this market, who knows. I personally think that we rally after fomc like the last time because we’ll have confirmation of the direction, but we’ll see