Tl;dr - let volatility be our guiding star this week.

At least the first few days of next week will likely be affected by the ongoing Israeli-Palestinian conflict. Far be it from me to attempt to predict a direction, but what I’ll be looking at is how volatility moves over the coming days.

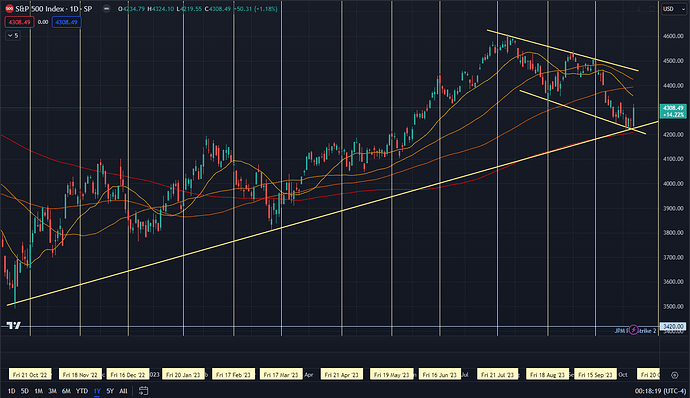

If vol does increase enough, along with a dip back into negative gamma territory, MMs may help markets fall quite a bit. Note that we are two weeks out from monthly opex, so those flow effects become important again. It wouldn’t be the worst thing in the world to revisit the 200 SMA (around SPX 4206) properly. As one market commentator put it, “We didn’t really test the levels… we barely kissed it. It’s like how you kiss your aunt. I need to see at least some tongue!” Of course, vol increase will eventually dissipate, providing us with vanna tailwind. Along with the charm flows happening as we get closer to opex.

This is all to say that a day or three red days will only be pulling the beachball down so that it can do what it does when it is released - pop back up.

This likely only applies if vol increases, but there is no expansion of the scope of the conflict. If Iran gets pulled in, oil will likely spike, and then all bets are off.

At the other end of the spectrum… markets don’t pay too much heed to the conflict, and vol slowly evaporates. To state the obvious, markets will slowly climb, then.