Tl;dr - Need to keep an eye out on which way bond yields and USD goes to determine if the bottom is in. We’ll likely need this week to sort that out.

Overview

Thanks Yong!

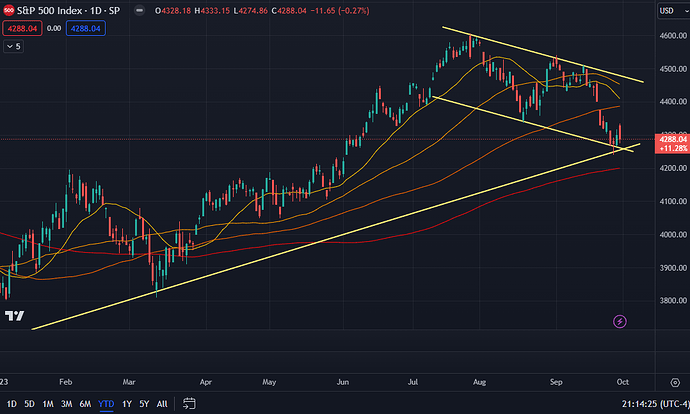

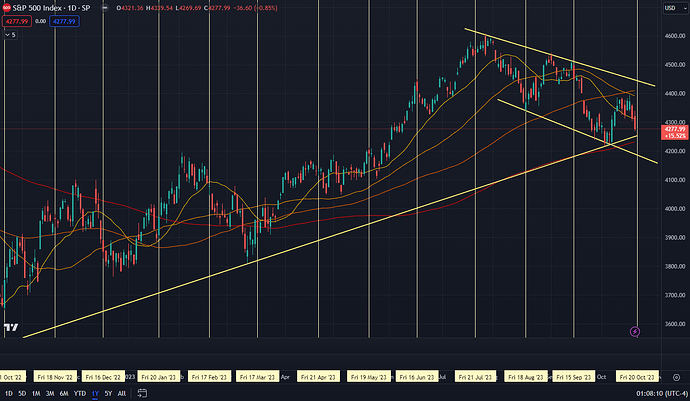

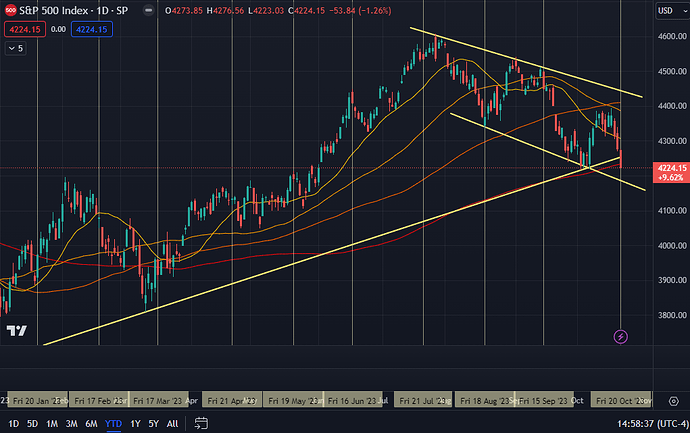

Indeed, it should feel like we’ve hit the bottom, but that’s not what it feels like. Considerations:

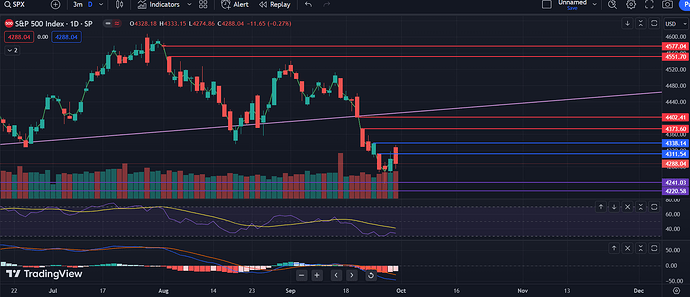

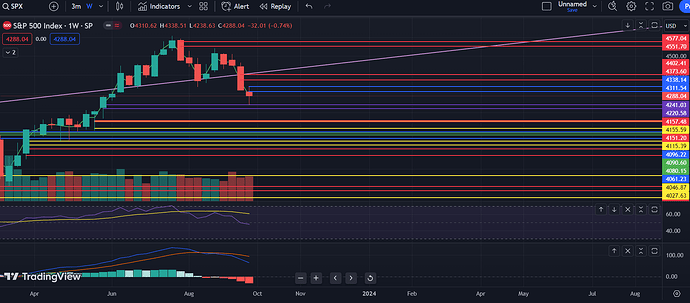

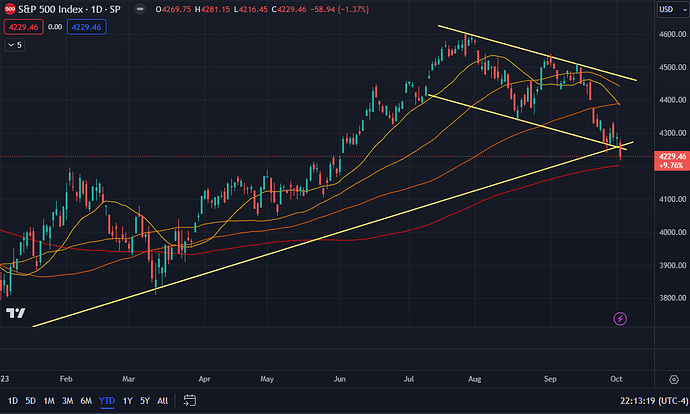

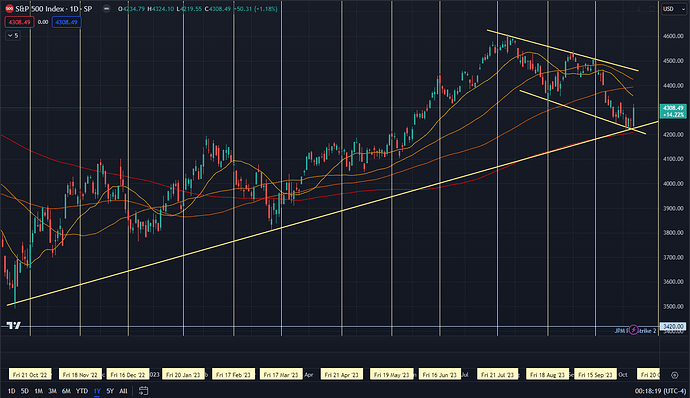

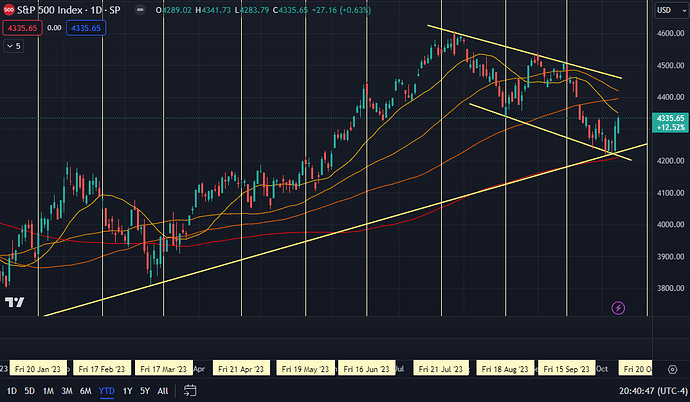

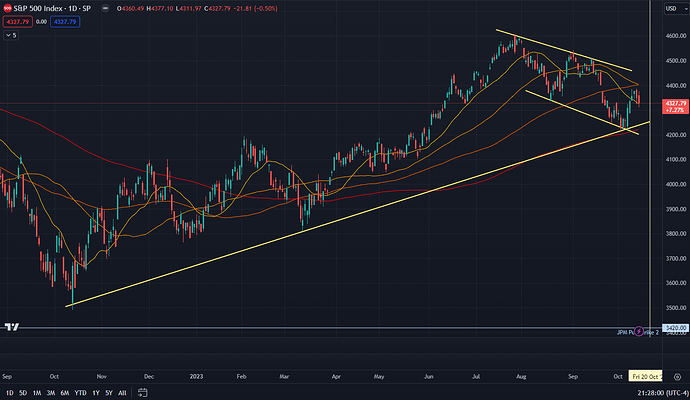

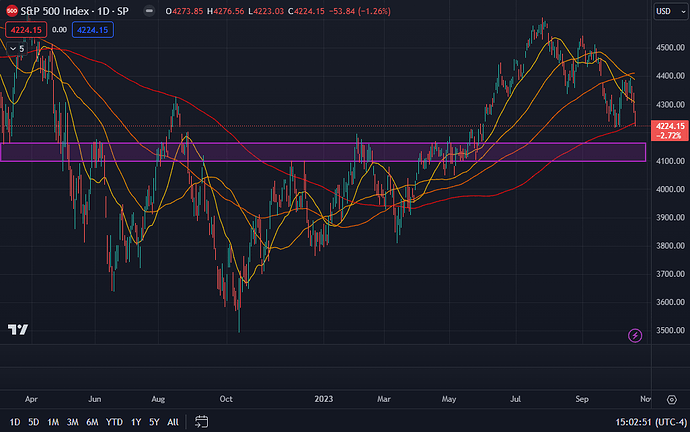

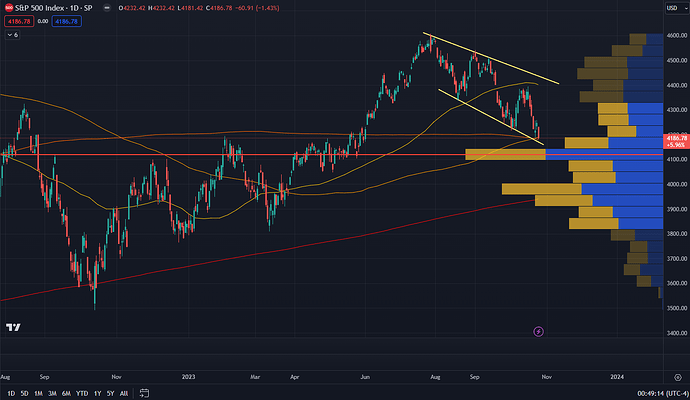

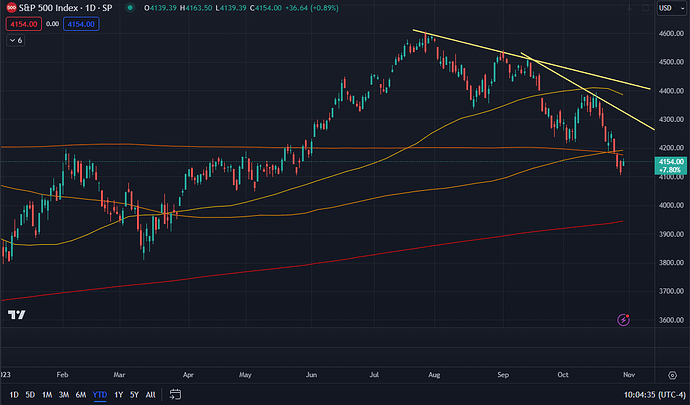

- We bounced solidly off of the MOAT (mother of all trendlines), which is bullish.

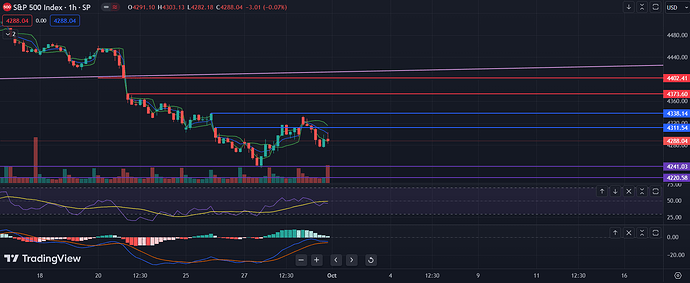

- We’re stuck below 20, 50 and 100SMA, which is bearish. There’s also the downward channel.

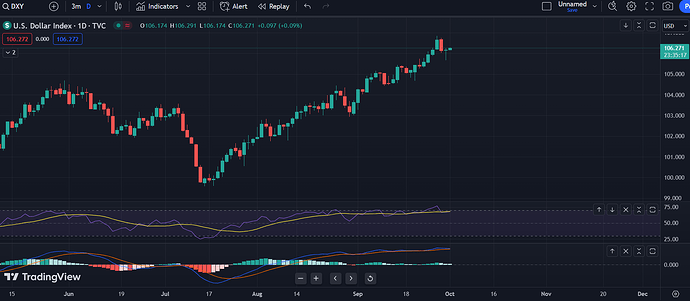

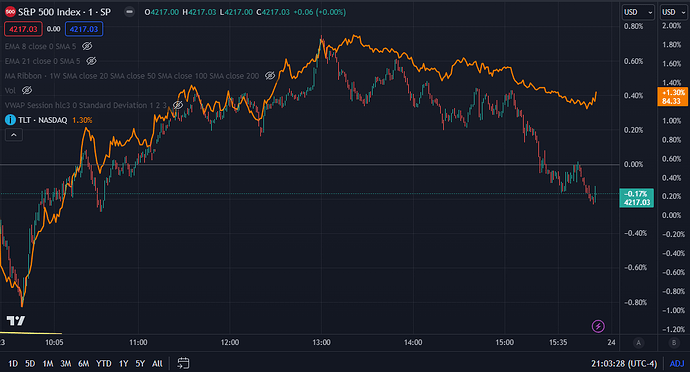

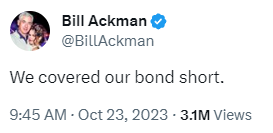

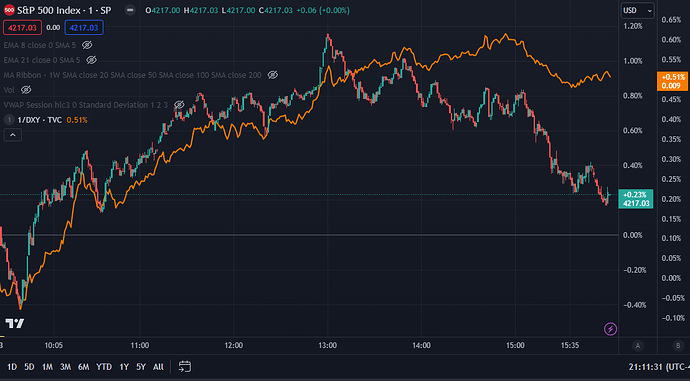

For now, the fate of the market seems to be strongly affected by bond yields and the USD. (Technically its yields that drives DXY, but internal responses can also affect the latter.) Both took a breather at the end of last week after roaring upward since FOMC. Since bond yields can’t go up forever, at least in one go, we can keep an eye out the lond end flattening to feel good about the bounce back.

Personally, I’d feel solidly good over the 4400 level, which is also where the 20/50/100 SMAs are.

It was also good to see IWM, the main street tickers, reject its lower trendline.

Structural Consideraions

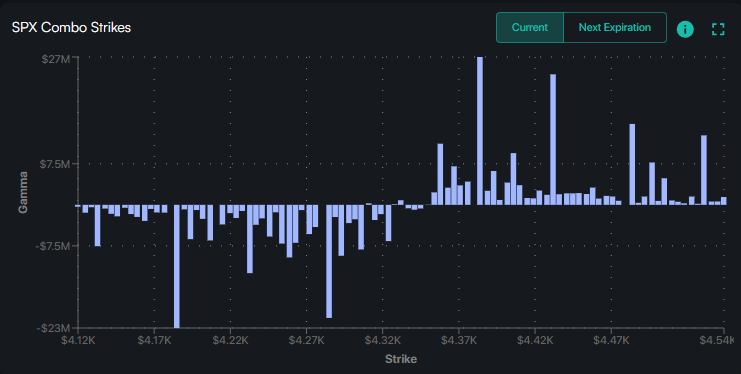

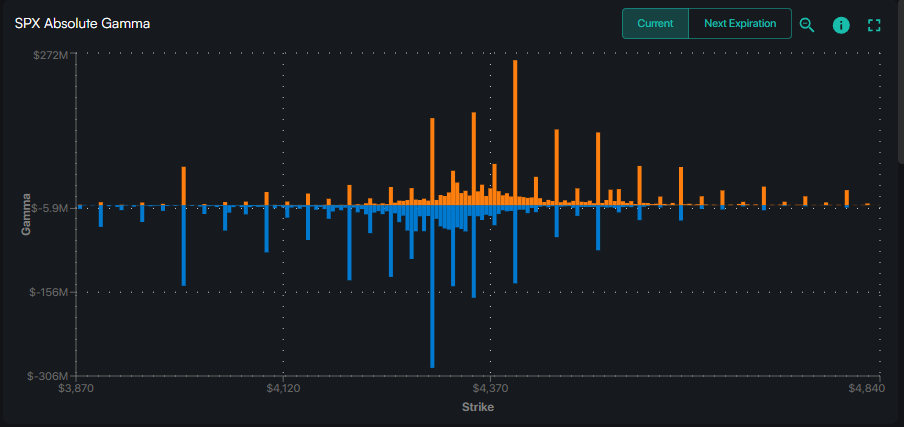

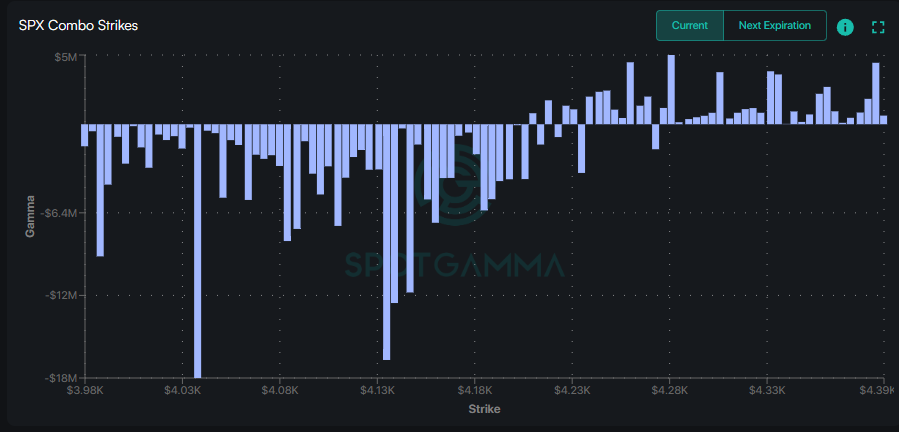

Vol trigger is 4350 and put wall (support) is at 4200. This puts where we closed (4288) somewhere between the two, suggesting that we can at least expect some volatility, as well as decisive moves in some direction or other. We have various macro metrics being published this week, culminating with Jobs numbers on Fri, so this first week of Oct can get toasty.

Oct opex related flows should really start taking hold from next week, so where we end up this week will be important. If we can end up over positive gamma territory by Fri, that would be great. The magnet stuff can start happening from there next week.

Market Indicators

Most other charts seem to suggest it is reasonable to expect that the bottom is in.

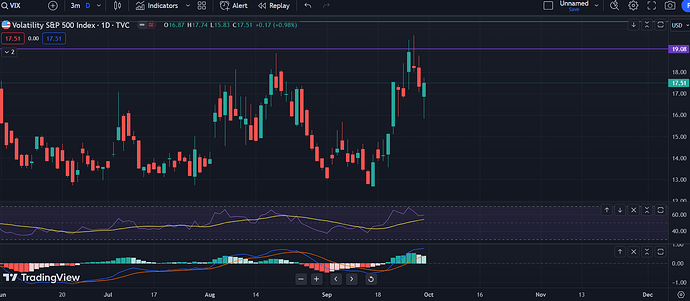

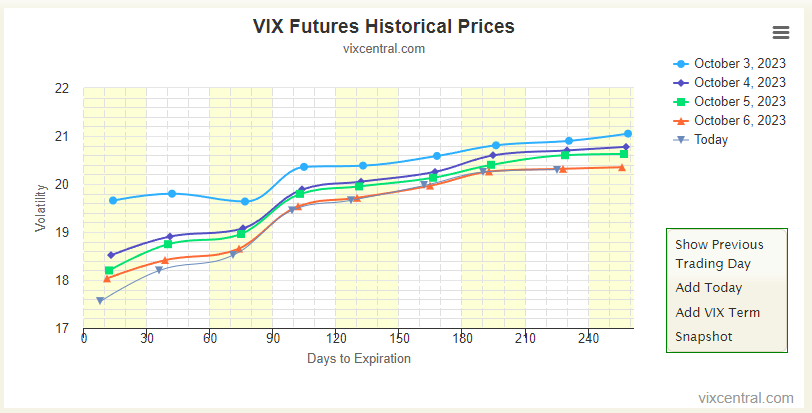

VIX never made it over 20, and is curling down already. Not much stress there.

The MOVE index, which is the bonds’ VIX, spiked last week (expected), but made a lower high. Again, not much stress.

The number of S&P tickers that were over its 50SMA was as low as it has gotten during recent lows.

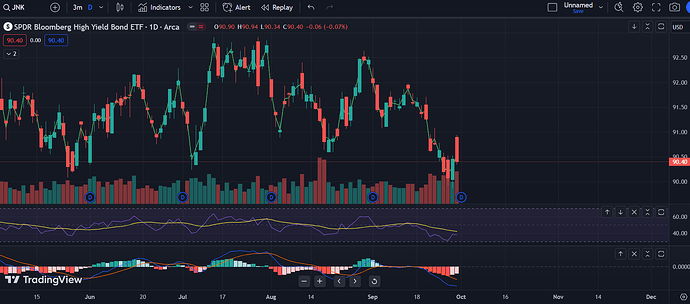

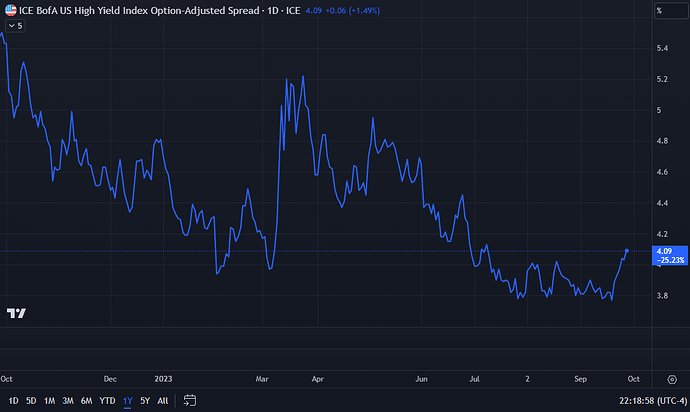

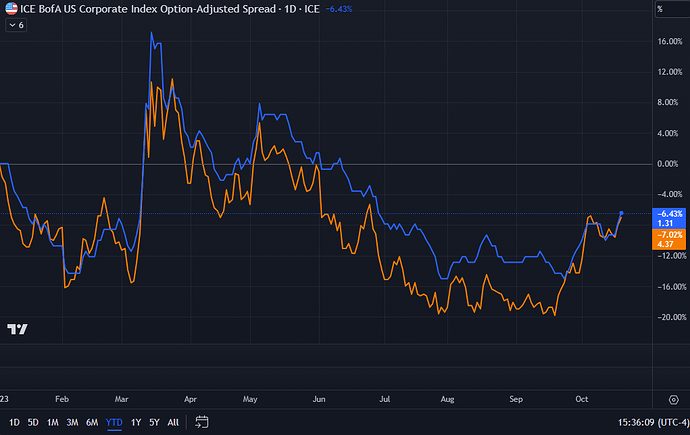

The only thing that gives me pause is the uptick in high yield (junk) bonds. But its nowhere near March, or earlier, so doesn’t seem too worrisome.

Sentiment Indicators

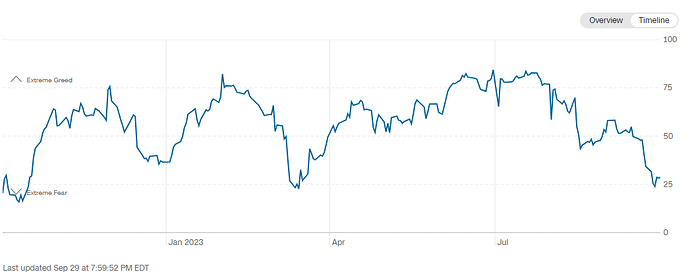

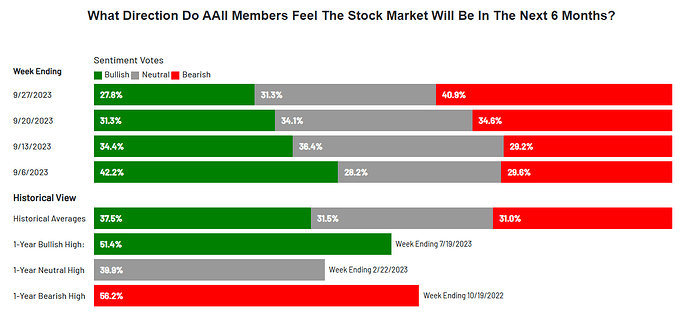

The Fear and Greed Index, and the AAII Investor Sentiment Survey both suggest significant deterioration of consumer sentiment, reaching previous lows. Which is great, as these often signal the bottom.

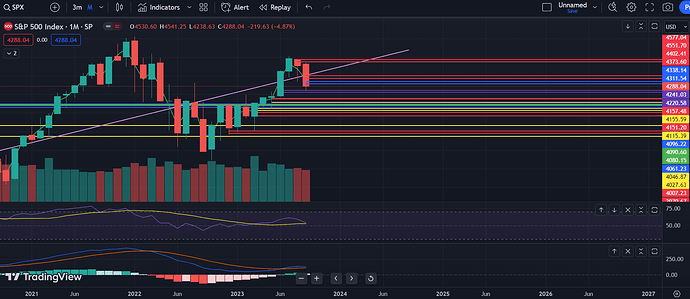

Big Picture

Based on the data presented above, it seems that we should be near the bottom. We might need a retest of a few things this week, but as long as they hold, feeling optimistic.

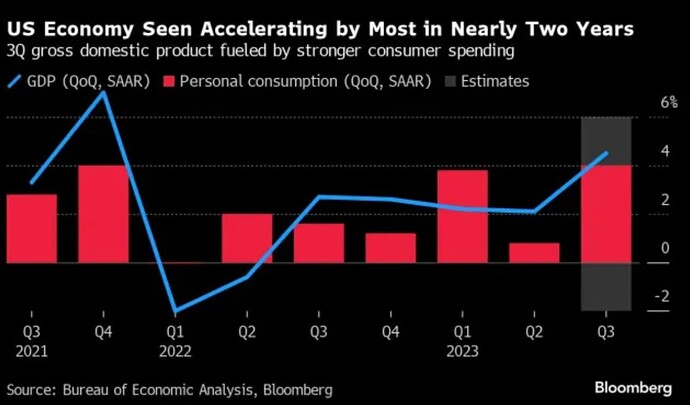

On a longer timeframe, we have earnings starting next week, and expectations are positive from it. There is the overhang of lots of bond selling and that will put some pressure on the markets, but it’s the fourth quarter, every fund manager wants their bonus, and negative performance is not good for that.

As noted above though, bonds still have the ability to unend all this, and if they do, it will be in a major way as we are already at a bottom, so let’s keep a close eye on that as we trade.

Good luck!